- Schneider Electric’s Sebastien Riez talks efficiency, EVs and inflation. (CEO Poll)

- Cadillac EVs will land in Egypt by 2023, Al Mansour looks to local assembly. (Electric Vehicles)

- Egypt launches a guide for “Just Financing”. (COP Watch)

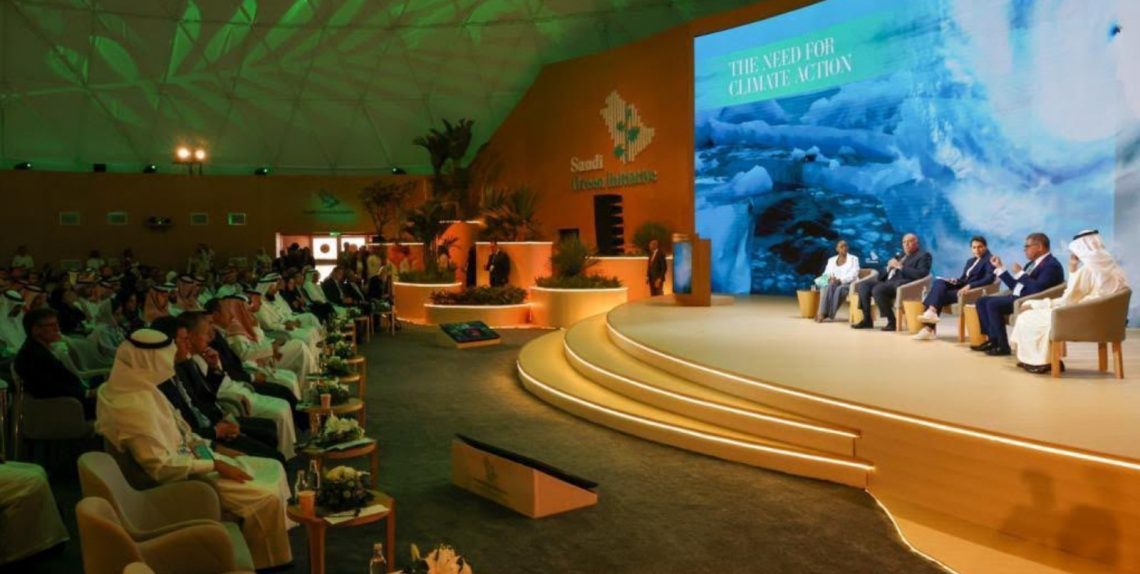

- Saudi Arabia makes really big splash at SGI. (COP Watch)

- Biden pledges USD 250 mn to support adaptation fund. (COP Watch)

- UAE and Japan ink agreement on green ammonia for export. (On Our Radar)

- Is Brazil angling to host an upcoming COP? (Watch This Space)

- 45 mn people in 37 countries are at risk of famine. (Danger Zone)

Monday, 14 November 2022

Egypt’s “Just Financing” guidebook is here

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, ladies and gentlemen, welcome to week two of COP27. It’s day eight of the summit, and we have a roundup of all the news you may have missed over the weekend (or on your very well-earned ‘day off’ yesterday).

THE BIG CLIMATE STORY: Saudi Arabia came in hot with a slew of pledges at its Saudi Green Initiative Forum at COP27 over the weekend in a bid to position itself as more than just the world’s top oil exporter. The kingdom has some 13 renewable energy projects in the pipeline worth a combined USD 9 bn.

Soundbit of the morning: “The world is hoping to crucify us. We want people to match us, and we want to make sure people put their money where their mouths are,” Saudi Energy Minister Prince Abdulaziz bin Salman told Reuters.

^^ We have the full rundown of what went down on Day 5 through to Day 7 — and what to look out for over the next few days — in the news well, below.

** MEANWHILE- WE HAVE A BIG ANNOUNCEMENT of our own to make:

Our Enterprise Climate X Forum is happening at the brand new Grand Egyptian Museum: We are delighted to finally reveal that the Enterprise Climate X Forum is taking place at the Grand Egyptian Museum on Tuesday, 6 December 2022..

What’s the Enterprise Climate X Forum? It’s our first industry-specific conference, where CEOs, top execs, investors, bankers and development finance folks have the chance to talk about how to build a climate-centered business — and how to make sure your business continues to have access to the funds it needs to grow.

Some of the biggest names in business and finance are on board — are you? If you’re a C-suite exec, business owner, climate professional, DFI staff, investor or banker, please email us at climatexrsvp@enterprisemea.com to signal your interest, letting us know your name, title and where you work.

Who’s on board? The Enterprise Climate X Forum is taking place with the generous support of our friends, including:

- Banking partners: HSBC | Mashreq | Attijariwafa Bank

- Telecom partner: Etisalat by e&

- Event partners: Hassan Allam Utilities | Infinity

HAPPENING TODAY-

It’s Water Day at COP 27, with sessions on sustainable water resource management, water scarcity, drought, cross boundary cooperation, and the improvement of early warning systems. We’re expecting the official launch of the Aware (Action for water adaptation and resilience) initiative, in partnership with the World Meteorological Organization.

The next big things to look out for: Energy Day on Wednesday and Solutions Day on Friday.

REMEMBER- The key issues at play (loss and damage, emission reduction targets etc.) are being negotiated by government delegations over the next week so we’ll likely have to wait until 18 November for a final agreement to come out of COP27.

Also at COP27: Egypt’s first smart, sustainable city: Egypt’s Housing Ministry showcased Palm Hills Developments’ real estate project Badya at its COP27 pavilion, as the country’s first smart, sustainable city, according to a ministry statement.

Detailed schedule: Download as a pdf here or check out the website here.

COP27 app for attendees: App Store and the Google Play Store.

|

WATCH THIS SPACE #1- Brazil is angling to host an upcoming COP, Reuters reports citing unnamed sources. Brazilian President-elect Luiz Inacia Lula da Silva will reportedly announce an overhaul of Brazil’s environmental policies — including a new national climate authority overseeing all climate action work by ministries and agencies — at COP27 this week. Lula, who will take office in January, made climate a cornerstone of his campaign in the runup to his reelection last month.

WATCH THIS SPACE #2- The World Bank Group plans to expand electrification across Sub-Saharan Africa: The World Bank, the IFC, and the Multilateral Investment Guarantee Agency launched an initiative to upscale distributed renewable energy projects in sub-Saharan Africa (SSA) by promoting public and private investment across the region, according to a statement. The initiative, the Distributed Access through Renewable Energy Scale-Up Platform, will use off-grid solar stations and mini-grids (among other infrastructure) to expand access to electricity.

SOUND SMART- Some 500 mn people across SSA will remain without electricity by 2030 if current renewables project levels are not expanded threefold, the group warns, reducing the region’s access to inclusive development.

***

YOU’RE READING ENTERPRISE CLIMATE, the essential regional publication for senior execs who care about the world’s most important industry. Enterprise Climate covers everything from finance and tech to regulation, products and policy across the Middle East and North Africa. In a nod to the growing geographical ambitions of companies in our corner of the world, we also include an overview of the big trends and data points in nearby countries, including Africa and southern Europe.

Enterprise Climate is published at 4am CLT / 5am Riyadh / 6am UAE Monday through Thursday by Enterprise, the folks who bring you Enterprise Egypt, your essential 6am and 3pm read on business, finance, policy and economy in Egypt and emerging markets.

Subscribe to Enterprise Climate here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

THE DANGER ZONE- 45 mn people in 37 countries are at risk of famine due to war and climate, according to a joint report (pdf) by the Food and Agriculture Organization (FAO) and the World Food Programme (WFP). Up to 205 mn people face acute food insecurity and need urgent assistance, driven mainly by the effects of conflict, climate conditions and weather shocks, economic shocks, and outbreaks of animal and plant pests. Ukraine’s prolonged conflict is also making food shortages worse, the report adds.

The Middle East and East Africa are especially at risk: The report identifies 17 countries and two regional clusters where food insecurity will worsen between now and January, largely due to climate change effects and increasing conflict, with 970k people expected to face catastrophic conditions this year if no action is taken. With the exception of Afghanistan and Pakistan, all of the hotspots identified in the report are in the Middle East and Africa. More than 50% of the population in South Sudan, Yemen, and Syria are in a crisis phase or worse.

CIRCLE YOUR CALENDAR-

The Hawkamah annual conference will kick off tomorrow in Dubai. The conference will address governance from the perspective of investors including expectations and interaction with boards as well as the role of regulators and companies in preparing for IPOs to attract the right investors.

Saudi Arabia’s Education Ministry will host the Global Conference on Sustainable Partnerships on Wednesday, 23 November to Thursday, 24 November in Riyadh, bringing together ministers and senior officials from the private and public sectors.

UAE will host The Big 5 Global Construction Impact Summit on Wednesday, 7 December at the Dubai World Trade Centre, bringing more than 2k exhibitors from 60 countries, as well as regional and global construction industry leaders together to discuss ways to meet local and global net zero and waste reduction targets.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

CLIMATE CEO POLL

The Enterprise Climate CEO Poll: Schneider Electric’s Sebastien Riez

Enterprise Climate CEO Poll- Sebastien Riez, Schneider Electric: With all eyes on Sharm El Sheikh as COP27 continues, Enterprise Climate and EnterpriseAM are presenting our inaugural Climate CEO Poll, a series of interviews with top CEOs to discuss key issues including climate finance, regulation, and the green economy.

Sebastien Riez (LinkedIn) is the Northeast Africa, and Levant Cluster President for Schneider Electric, a French multinational digital automation and energy management company. We talked to Riez about the MENA EV market, future investments in the region and the outcomes Schneider hopes to see from COP27.

Enterprise: Schneider Electric has made energy efficiency and decarbonization a cornerstone of your business. How much CAPEX does the company plan to invest in 2023 in this area of the business?

Sebastien Riez: Sustainability is a key priority for us, and we continue to invest in research and development to develop our products. To paint a picture, we’re allocating 5% of our global revenues — which came in at EUR 28.9 bn in 2021 — to R&D in the coming year.

E: Which areas of the green economy do you think the MENA region should be focusing on?

SR: Efficiency is the core, at the center of everything. Whatever the segment is, we can be more efficient. As Schneider, at our head office in Cairo, we use Schneider Electric technology to be more sustainable. Today, we are able to cut our energy bill by 50% using Schneider Electric solutions. We’ve also brought our solutions to several corporate clients like Carrefour Egypt, which asked for help to decrease its energy bill. We developed product solutions, which are currently being implemented in 44 sites including supermarkets and hypermarkets, bringing their total energy savings to 7%. Some sites have seen their energy savings reach as much as 25%.

We are also digitizing the electrical distribution grid — which always sees technical losses from the electricity distribution process — here in Egypt, utilizing Schneider Electric solutions. Thanks to that, we are able to optimize the efficiency of the grid and to make savings on electricity production because we are losing less. By losing less, we’re able to produce less, meaning we’re using fewer fossil resources and hereby reducing the carbon footprint. Sustainability is the consequence of being more efficient.

E: There are concerns that the MENA region will be unlivable if temperatures continue to rise by 2050. How much energy will we need to produce sustainably to be able to inhabit this part of the world?

SR: The more temperatures rise, the more energy we will need to cool down our environment, but if that energy source is not clean then we are making the situation worse and worse. It is super urgent to make sure the source of energy we are using is green. We need to look at energy efficiency, looking at how much of this energy we are producing is lost and how do we address that.

E: How do you view the MENA EV market?

SR: The EV market in the MENA region started late in comparison to Europe or some other part of the world. It is becoming a reality in the Middle East and in some countries in Africa. Schneider is supporting that front by supplying EV/EVlink chargers in Sharm El Sheikh in parallel with COP27 and in Cairo.

E: Where do you see the challenges for the region’s EV market?

SR: The challenge is to have the facility to manufacture those EVs so that we can feed the market. In parallel the challenge is to build the right infrastructure. If you have an EV but you don’t have the chargers around, you won’t be able to make the most of it. If you have the chargers but not the EV then you have the same problem. Those are two dimensions that need to be addressed together and they need to progress together at the same time. Globally speaking, we are more than ready to make the EV transition happen and to support the country.

E: How has Schneider Electric adapted to the high inflation, high interest rate environment along with ongoing supply chain disruptions?

SR: The current environment is super challenging, we had the pandemic and just after the pandemic we got the geopolitical situation that we’re facing today, resulting in a lot of consequences on the world, most notably inflation getting higher and higher, and large disturbances in supply chain. This is not easy to cope with, but here in Egypt we have the advantage that we are pretty localized — we have our own factory in Egypt and our own distribution center. We try to localize as much as we can — some of our products source 40-60% of their inputs from the local market — which helps us reduce the impact of all those disturbances. Being local helps mitigate part of the impact.

E: What outcomes, policies, or initiatives that would directly impact your business would you hope to see come out of COP27?

SR: If we manage to have a global framework, a global policy and more and more solutions with regard to energy efficiency and business sustainability that’s going to help speed up the process. If the regulatory framework is pushing and promoting sustainability, that can only help the business. This year in Sharm, we have all the stakeholders in the equation. Years back COP mostly brought together nations and NGOs but today you have added the dimension of the private sector.

Schneider Electric has helped our customers save more than 120 mn tons of CO2 since we began monitoring our impact on people and the planet with our sustainability barometer in 2005. We want to reach 800 tons by 2025 within the framework of our new program. We’ve given 30 mn people access to green energy since 2005 and we want to push that figure to 100 mn by 2025. By 2025, we also want to have 80% of our revenues coming from green business and have 50% of our products use green components.

ELECTRIC VEHICLES

Cadillac EVs will land in Egypt by 2023, Al Mansour will start assembly in Egypt

Electric Cadillacs are coming to Egypt: General Motors (GM) and Al Mansour Automotive will roll out Cadillac’s all-electric mid-size luxury SUV Lyriq in Egypt by the end of 2023, the two companies announced in a statement (pdf) last week. Five other Cadillac EVs are slated to hit the Egyptian market two years later, according to the statement.

Al Mansour Auto hopes to start assembling electric vehicles in Egypt within the coming year, and is close to finishing feasibility studies, Ankush Arora, CEO of Al Mansour Automotive told Bloomberg Asharq yesterday. Al Mansour chairman Mohamed Mansour told Bloomberg he intends to produce 15k EVs in Egypt over the next three years. Under an MoU signed last December, Al Mansour Auto and GM are looking at partnering up to produce EVs in Egypt.

The Lyriq is really popular in the West: It’s sold out for 2023 delivery in the United States, where GM is now accepting orders for 2024 delivery. It’s getting positive reviews from Car and Driver, Edmunds and Motor Trend.

What’s the current state of Egypt’s EV industry? The industry is still nascent, with its first locally manufactured EV expected sometime next year after a protracted search for a partner to work with El Nasr Automotive on producing EVs. The government is still working on plans to establish a nationwide charging network — with our friends at renewable energy player Infinity working to set up 6k vehicle charging points at 3k stations across the country. Egypt’s House of Representatives just gave its final approval to a bill that will establish a new regulatory body to set policy for auto assembly in the country, including EVs, and provide financial incentives for manufacturers.

REGIONALLY- Saudi Arabia’s Public Investment Fund (PIF) signed agreements with US-based luxury EV manufacturer Lucid Motors and Taiwan’s Foxconn on EVs to design, manufacture, and sell EVs in Saudi Arabia. The agreement with Foxconn would see both parties collaborate to set up Ceer, a joint venture created to design, manufacture, and sell EVs in Saudi Arabia by 2025. 80% of all EVs produced by US-based EV manufacturer Lucid Motors will be made in Saudi Arabia by 2030 with 155k EVs produced annually in Saudi Arabia by 2025.

Several auto companies are looking to set up shop in Morocco, given the country’s capacity to produce over 700k vehicles per year, and Turkey unveiled its first locally-produced EV last month with some 1 mn cars expected to be produced by the end of the decade.

COP WATCH — FINANCE

Egypt launches guide for “Just Financing,” ADGM wants a piece of the regional carbon market, and more…

Egypt launches guide to “Just Financing”: Egypt’s International Cooperation Ministry launched the Sharm El Sheikh Guidebook for Just Financing (pdf) late last week in a bid to unlock private-sector climate finance, according to a ministry statement, in part by helping create a pipeline of bankable climate-friendly projects. Policymakers, development finance institutions, private-sector players and banks all had input into the creation of the guidebook, the ministry said.

The key takeaways:

- Some USD 5.9 tn of the total USD 410 tn privately held global financial assets could provide the dry powder needed between now and 2030 to implement mitigation and adaptation measures in developing economies.

- The collective funds of multilateral development banks, if pooled for climate action, would make up only 4% of what’s needed — meaning every country in the world needs the private sector to invest in climate-related projects.

- Private capital often shies away from climate-friendly projects because of concerns about the risk-reward equation, so lowering risks associated with investing in climate projects is crucial, including mobilizing concessional capital.

- The framework outlines how to increase investment quality in developing nations by offering more equity and local currency debt — instead of hard currency debt — to increase debt sustainability.

- Governments need to work with other stakeholders to help identify and prioritize climate investment needs, along with existing technical and financial gaps to improve transparency and accountability in their planning, reporting and communication.

ADGM JOINS EGX, TADAWUL WITH CARBON MARKET PLANS

The UAE’s Abu Dhabi Global Market (ADGM) is set to launch a voluntary carbon market “in a matter of weeks,” head of sustainable finance Mercedes Vela Monserrate said, according to Bloomberg. The platform will be operated by Singapore-based digital exchange AirCarbon; several high-profile financial institutions and commodities firms will participate, Monserrate reportedly said.

Egypt and Saudi Arabia are doing the same: ADGM joins competitors from Egypt and Saudi Arabia in pushing into the market for the trading of voluntary carbon credits.

Are ADGM green bond issuances also in the works? ADGM is working with other UAE authorities to standardize and clarify requirements for ESG funding tools — like green bonds, Monserrate said. This could lead to the issuance of green bonds on the ADGM from 2023, she added.

ADGM also put forward a sustainable finance regulatory framework: The financial center published a proposed sustainable finance regulatory framework last week to support UAE’s net zero goals, according to a statement. The framework aims to build a sustainable finance hub to support the goals through investment funds, bonds, and managed portfolios.

USD 9 BN IN CLIMATE FINANCE-

The US-UAE Agriculture Innovation Mission for Climate (AIM for Climate) doubled its investment commitments to USD 8 bn and increased the scope of its partnerships since its COP26 launch, it announced in a statement (pdf) on Friday. The initiative aims to “significantly increase” investment and support for climate-smart agriculture and innovation in food systems from 2021-2025, its website notes.

IRENA closer to securing USD 1 bn for renewables: The International Renewable Energy Agency’s (IRENA) closed in on its USD 1 bn funding goal for its Energy Transition Accelerator Financing (ETAF) platform as three new partners joined, according to a statement. The Asian Infrastructure Investment Bank (AIIB), UAE’s Masdar, and reins. company Swiss Re all made commitments to contribute to renewable energy projects in developing markets through ETAF, which was launched at COP26 with USD 400 mn from anchor investor Abu Dhabi Fund for Development.

How much are we talking about? AIIB wants to deploy USD 300 mn, Masdar is potentially investing up to USD 200 mn, and reins. company Swiss Re will provide ins. solutions and risk insights to “help de-risk these critical investments,” the statement said.

The Inter-American Development Bank (IDB) is also weighing partnering up with ETAF and will aim to co-finance up to USD 100 mn of renewable energy and decarbonization tech projects in Latin America and the Caribbean, the statement noted.

EGYPT LINES UP ANOTHER USD 1.8 BN

Egypt raised another c.USD 1.8 bn for its energy transition in just a few days: The US and Europe pledged USD 550 mn to help Egypt decarbonize its power infrastructure and install new renewable energy capacity.

How it breaks down:

- Our friends at EBRD have committed USD 1.3 bn including “USD 1 bn of private renewable finance, USD 300 mn in sovereign finance and grants of USD 3 mn from its shareholder special fund,” the bank confirmed on Friday.

- The US and Germany agreed to provide over USD 250 mn for the energy pillar of Egypt’s newly-launched Nexus on Water, Food and Energy (NWFE) initiative, the two said (pdf) on Friday.

- More than USD 300 mn in grant and concessional finance will come from the European Commission, France, the Netherlands, Denmark, and the UK, as well as donors to the EBRD’s High Impact Partnership on Climate Action.

International partners want to help accelerate Egypt’s energy transition: Egypt has “agreed to quadruple [its] deployment rate and reflect that in a revised NDC,” US climate envoy John Kerry was quoted as saying in the EBRD statement. Egypt will submit a revised NDC by June 2023, and may also commit to a net-zero emissions target, while upping the use of zero-emission vehicles and sustainable public transport, EnterpriseAM reported yesterday.

The USD 1.8 bn figure doesn’t include whatever is earmarked for Egypt by the World Bank’s CIF from some USD 350 mn it has now put aside to invest in sustainable agriculture in emerging markets. Egypt is the only country in MENA participating in the first tranche of funding from CIF, with Kenya, Tanzania, the Dominican Republic and Fiji also listed as beneficiaries, according to a statement.

OTHER CLIMATE FINANCE NEWS-

Also worth knowing about this morning:

- Our friends at the UAE’s Mashreq Bank plans to increase its sustainable financing to USD 30 bn by 2030, senior executive VP Tarek El Nahas told Arab News, the outlet reported on Thursday.

- Move over Global Shield — there’s a new financing facility in town: More than 85 African ins. companies have joined forces to create The African Climate Risk Facility (ACRF) to underwrite USD 14 bn of cover for climate risk by 2030, according to a joint statement. ACRF will provide protection for 1.4 bn people on the continent against climate disasters like floods, droughts and tropical cyclones.

- USD 20 mn more green finance for Egypt from the EBRD: The EBRD and EU signed an agreement with QNB Al Ahli under the Green Economy Financing Facility to provide on-lending for youth-led green MSMEs, it said in a statement on Friday.

- USAID committed an initial USD 15 mn to an initiative designed to conserve Egypt’s Red Sea coast, with a target of raising another USD 35 from other donors and private businesses, it announced in a statement on Tuesday.

COP WATCH — AGREEMENTS

Saudi Arabia makes big splash with SGI

Saudi Arabia announces a slew of green agreements: The kingdom came out with some of the biggest renewable energy announcements at the Saudi Green Initiative Forum on the sidelines of COP27, as it looks to reposition itself for a post-oil world. “The world is hoping to crucify us,” Saudi Energy Minister Prince Abdulaziz bin Salman told Reuters. “We want people to match us, and we want to make sure people put their money where their mouths are,” he said.

Saudi Arabia currently has 13 renewable energy projects worth a combined USD 9 bn in the pipeline, the minister said, according to Al Arabiya. The projects — which include what could become the world’s largest green hydrogen plant — have a collective capacity of 11.3 GW, and will help reduce some 20 mn tons of carbon emissions a year, he said.

There’s more to come: “Next year, we will be finalizing the plans for developing 10 more renewable energy projects and connecting an additional 840 MW of solar PV power to our grid,” bin Salman said during his keynote speech (watch, runtime: 5:36).

Saudi Arabia is looking to source 50% of its energy from renewables by 2030. In the past year alone, Saudi Arabia managed to reduce emissions by about 1 mn tons, the minister said.

MASSIVE ARAMCO CARBON CAPTURE HUB

Aramco to build massive carbon capture and storage hub: Saudi Aramco signed an agreement to build one of the world’s largest carbon capture and storage hubs with the capacity to store up to 9 mn tons of carbon dioxide a year by 2027, the minister also announced on Thursday. “Don’t be very surprised if we achieve this net zero even before that period,” he said, referring to the kingdom’s plan to reach net-zero emissions by 2060. The story got attention in the foreign press: Reuters | Bloomberg.

The details: The facility, which will be located in Jubail, will get some 6 mn tons of CO2 from Aramco, with the rest to come from other industrial sources, the news outlets say. There were no details on the exact timeline or investments for the project.

This is big for Riyadh’s blue hydrogen ambitions: Saudi Aramco has long had plans to lead a future market for blue hydrogen, a form of zero-carbon fuel made through a process that captures its own carbon emissions.

SOUND SMART- Don’t know the different between green and blue hydrogen? Check out our explainer here.

MA’ADEN JUMPS ON CARBON CAPTURE BANDWAGON

Ma’aden is also jumping on the carbon capture bandwagon: Saudi mining company Ma’aden signed a 20-year agreement with industrial gas manufacturer Gulf Cryo to build and operate a carbon capture plant in its phosphate complex in Ras Al Khair, Saudi state news agency SPA reported. The plant will capture 300k metric tons of CO2 emissions a year from Ma’aden’s three ammonia plants, Zawya reported.

Where will the captured CO2 go? The CO2 will be used in the place of fossil fuels for industrial gas applications in Saudi Arabia. Some will be distributed to the International Maritime Industries, the largest shipyard in the MENA region, while the rest will be used in industrial applications such as enhanced oil recovery and water desalination.

EBRD + EGYPT GREEN STARTUPS

EBRD to support Egyptian startups from Smart Green Governorates initiative: The European Bank for Reconstruction and Development (EBRD) will provide support to six startups selected from Egypt’s Smart Green Governorates initiative, according to an Egyptian cabinet statement. The startups selected are: e-scooter startup Rabbit Mobility, clean energy startup NoorNation, power and water producer Engazaat, Banlastic, Kadet El Mostakbal and Archtech. The bank will provide the startups with technical support, training and business consulting services.

MOROCCO’S GREEN ENERGY EXPORT AMBITIONS

Morocco takes one big step towards green energy export ambitions: Morocco signed an MoU with France, Portugal, Spain and Germany to facilitate cross-border renewable corporate power purchase agreements and financial and technical cooperation, according to a statement (pdf). The agreement will see Morocco make regulatory and legislative amendments to support green energy cooperation between the five countries, including through granting the private sector access to the Moroccan electricity transmission grid, the statement said.

Morocco has big ambitions to become a key green energy exporter to Europe: Morocco plans to supply 8% of the UK’s electricity needs by exporting 3.6 GW of electricity via its 10.5 GW of solar and wind energy from just its Xlinks renewable energy project by 2030. Just a few weeks ago, the country signed an agreement with the EU to establish a “green partnership” that would see cooperation and “investment in green technology, renewable energy production, sustainable mobility, and clean production in industry.”

ALSO-

Worth knowing about this morning:

- Abu Dhabi’s Environment Agency (EAD) and the UAE’s Climate Change Ministry signed an MoU at COP27 with retailer Majid Al Futtaim to increase reliance on reusable plastic, WAM reported on Thursday.

- Egyptian President Abdel Fattah El Sisi called for a “legal, binding agreement” to help preserve its water security amid the ongoing Grand Ethiopian Renaissance Dam conflict with Ethiopia, according to a statement from the presidential spokesman.

- GORD signs MoUs with Qatar’s Doha Bank, Baladna: The Gulf Organization for Research and Development (GORD) signed two MoUs on Saturday — one with Qatar’s Doha Bank to boost green initiatives, and another with dairy firm Baladna Food Industries to support food security and decarbonization initiatives, QNA wrote.

- Microsoft will build a digital Government Emissions Accounting and Reporting Center of Excellence (GEAR COE) in Egypt to help authorities digitally record, measure and report on carbon emissions, according to a company statement (pdf).

- Upping cooperation on mining and green hydrogen was the key topic of discussion in a meeting between Egypt’s Oil Minister Tarek El Molla and Australia’s Environment and Climate Action Minister Reece Whitby. (Statement)

COP WATCH — PUBLIC POLICY

Biden pledges USD 250 mn to support adaptation fund, but pledges fall short

Biden warns “the very life of the planet” is at stake: US President Joe Biden doubled down on climate change warnings during his speech on Friday, saying that “the very life of the planet” is at stake, as he made new pledges that aim to support the world’s fight against climate change. The US doubled its pledge to its “adaptation fund” for poorer countries to USD 100 mn, and pledged a further USD 150 mn to support climate change efforts in Africa. Biden also promised the US will meet its emissions targets by 2030, after unveiling a plan to cut methane emissions from its oil and gas industry to 87% below 2005 levels by 2030.

But the pledges fall short of what developing countries need: Climate activists criticized Biden for failing to call wealthy nations for more climate change support for developing countries and for his “radio silence” on loss and damage finance, Reuters reports. “He announced a slew of new climate programs, but he couldn’t deliver what the developing world most wants — enough money to adapt to climate extremes,” one expert said. A recent report showed that developing countries will need USD 1 tn annually in external financing by the end of the decade to combat climate change.

Biden’s speech got a lot of play in the foreign press: Financial Times | WSJ | CNN | Washington Post | The Guardian | NYT.

TRACKING + COUNTING ALL THE THINGS-

UN unveils satellite-based system tracking methane emissions: The UN unveiled on Friday its Methane Alert and Response System (MARS) to help detect methane emissions, the UN Environment Program (UNEP) said in a statement. The system uses data from mapping satellites to identify methane hotspots and their sources, which the UNEP will use to notify governments and companies about the emissions “so that the responsible entity can take appropriate action.”

The UN and global standard setter the International Organization for Standardization published a set of net-zero guidelines (pdf) to crack down on greenwashing and allow companies and organizations to align on net-zero emissions plans. The guidelines act as a “single core reference text” that provides standards for a range of sectors, including automotive, oil and gas, aerospace and telecommunication. This comes after a UN report last week criticized companies, banks, and cities’ net-zero plans for being “rife with greenwashing.”

Countries accounting for half of the global economy have set out a year-long plan to cut industrial gas emissions, according to a United Nations Framework Convention on Climate Change (UNFCC) statement. Countries including the US, Germany, Japan, Canada, and Egypt have agreed on 25 “priority actions” to be unveiled at next year’s COP28 in the UAE to help cut emissions across power, transport, steel, hydrogen and agriculture.

OTHER HIGHLIGHTS FROM COP-

Egypt launched a program to “decarbonize existing oil and gas facilities” as part of a new private-public decarbonization coalition with engineering giant Bechtel, according to a statement from the COP27 Presidency (pdf). Egypt currently has 126 energy efficiency projects in action and has invested some USD 2.4 bn in decarbonization saving around 7 mn tons of CO2 per year, according to the statement.

The Cairo-headquartered East Mediterranean Gas Forum also launched a regional decarbonization initiative for the oil and gas industry, the COP27 Presidency statement says, without providing further information. The issue of gas decarbonization was on the forum’s radar last year.

The UAE unveiled 92 measures businesses can take to reduce emissions, according to a press release picked up by Zawya. The second edition of its “green business toolkit” outlines the measures — including electrifying vehicle fleets and replacing raw materials with low-carbon alternatives — to help guide companies towards developing a net-zero strategy.

ALSO ON OUR RADAR

Emirates National Oil Company Group (Enoc) and Japan’s IHI Corporation inked an MoU for green ammonia production and export in the UAE, according to a company statement on Thursday. This is the first time the Gulf country conducts a green ammonia feasibility study. The solar-powered project would produce renewable fuels at Enoc’s existing facilities. The companies are also looking into exporting the produced green ammonia to Japan and other Asian countries, as well as selling it locally to feed electricity or fuel ships.

ALSO- South Korea’s Doosan Enerbility was awarded a USD 1.2 mn contract to build a nuclear turbine island for Egypt’s Dabaa nuclear power plant, according to a company statement on Thursday. Korea Hydro and Nuclear Power had signed a contract in August to construct El Dabaa’s turbine island, and subcontracted the construction of the building to Doosan, the statement notes. Nuclear turbine islands house the units that convert thermal energy into electricity within nuclear plants.

Some 15 leading South Korean energy companies left the UAE with several renewable energy projects worth a combined USD 104 mn in the pipeline during the second edition of the Korea Energy Week UAE, Zawya reported on Friday. The countries are also looking to complete a comprehensive economic partnership agreement in the near future.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- German chemical producer BASF inked an MoU with Egypt’s El Sewedy Industrial Development for a 470k sqm green logistics hub in Sokhna 360 industrial city, according to a company statement on Thursday.

- The Amman Stock Exchange signed an agreement with the International Finance Corporation (IFC) to upskill its employees on climate action disclosure practices, according to a company statement picked up by Zawya.

- Egyptian real estate firms Misr Italia, Tatweer Misr, GV Developments, Paragon Developments and Redcon Construction signed MoUs with Schneider Electric to utilize its EcoStruxure offering and make their operations more energy efficient, according to a company statement (pdf).

CALENDAR

NOVEMBER

7-18 November (Monday-Friday): Egypt hosts COP27 in Sharm El Sheikh.

15 November (Tuesday): Hawkamah Annual Conference (Building Investor Confidence Through Governance), Dubai, UAE.

23-24 November (Wednesday-Thursday): Global Conference on Sustainable Partnerships, The Ritz-Carlton, Riyadh, Saudi Arabia.

Deadline of bid submissions for the Ras Mohaisen – Baha – Makkah Independent Water Transmission Pipeline in Saudi Arabia.

COP27 sub-events:

UNFCCC’s capacity building hub.

10 November (Thursday): ClimaTech Run competition’s pitching day.

11-12 November (Friday-Saturday): Saudi Green Initiative event.

DECEMBER

7 December (Wednesday): The Big 5 Global Construction Impact Summit, Dubai World Trade Center, Dubai, UAE.

13-15 December (Tuesday-Thursday): International Renewable Energy Congress, Hammamet, Tunisia.

15 December (Thursday): The UN’s 15th meeting of the Conference of the Parties to the Convention on Biological Diversity (COP15), Montreal, Canada.

JANUARY 2023

10-12 January (Tuesday-Thursday): The Future Minerals Forum, Riyadh, Saudi Arabia.

13 January (Friday): The International Renewable Energy Agency’s Youth Forum, Abu Dhabi, UAE.

14-21 January (Saturday-Saturday): Abu Dhabi Sustainability Week, Abu Dhabi, UAE.

16-18 January (Monday-Wednesday): EcoWASTE, Abu Dhabi National Exhibition Center (ADNEC), UAE.

16-18 January (Monday-Wednesday): World Future Energy Summit, Abu Dhabi National Exhibition Center (ADNEC), UAE.

January 2023: Bid submission deadline for green hydrogen projects to Hydrogen Oman (Hydrom).

FEBRUARY 2023

6-8 February (Monday-Wednesday): Saudi International Marine Exhibition and Conference, Hilton Riyadh, Saudi Arabia.

21-22 February (Tuesday-Wednesday): The Arab Green Summit, Dubai, UAE.

21-23 February (Tuesday-Thursday): World Environment, Social and Governance (ESG) Summit, Dubai, UAE.

MARCH 2023

15-19 March (Wednesday-Sunday): Qatar International Agricultural and Environmental Exhibition, Doha, Qatar.

JUNE 2023

1-3 June (Thursday-Saturday): Envirotec and Energie Expo, UTICA, Tunis, Tunisia.

SEPTEMBER 2023

Chariot Limited and Total Eren’s feasibility study on a 10 GW green hydrogen plant in Mauritania to be completed.

OCTOBER 2023

2-4 October (Monday-Wednesday): WETEX and Dubai Solar Show, Dubai World Trade Centre, Dubai, United Arab Emirates.

NOVEMBER 2023

6-17 November (Monday-Friday): The UAE will host COP28.

EVENTS WITH NO SET DATE

End-2022

KSA’s Neom wants to tender three concrete water reservoir projects to up its water storage capacity by 6 mn liters.

2023

Early 2023: Egypt’s KarmSolar to launch KarmCharge, the company’s EV charging venture.

1Q2023: Oman will award two blocks of land for green hydrogen projects in Duqm, Oman.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

4Q2023: Oman to award four blocks of land for green hydrogen projects in Thumrait, Oman.

2024

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

First 1.5 GW phase of Morocco’s Xlinks solar and wind energy project to be operational.

2025

Second 1.5 GW phase of Morocco’s Xlinks solar and wind energy project to be operational.

UAE to have over 1k EV charging stations installed.

2026

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

Iraq’s Mass Group Holding wants to invest EUR 1 bn on its thermal plant Mintia in Romania to have 62% of run on renewable energy, while expanding its energy capacity to at least 1.29k MWh.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.