- Over 90% of our readers in Egypt are planning to buy an EV. (Enterprise Reader Poll)

- UAE’s Empower announces price range for its debut on DFM. (IPO Watch)

- Egypt lands USD 2 bn loan to shore up food security. (Climate Finance)

- Jordan’s SMEs in line for USD 10 mn in green financing. (Climate Finance)

- More renewable energy for Egypt + UAE expands solar capacity. (Renewables)

- The climate crisis is costing businesses bns of lost staff hours — and heat-related deaths are spiraling. (The Cost to Business)

- Emperor penguins get protections under the endangered species act. (On Your Way Out)

Tuesday, 1 November 2022

Climate finance gets a push

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends. We have a stacked issue for you this morning, with a little bit of everything from capital markets updates to a slew of financing news.

THE BIG CLIMATE STORY- It’s a big day for climate finance in the region: Egypt landed a USD 2 bn loan to shore up its food security, while Jordan received USD 10 mn in green financing for on-lending to SMEs specialized in climate change adaptation and mitigation tech and services.

MEANWHILE- The UAE’s Empower is out with an indicative price range ahead of its debut on the DFM on 16 November.

AND- We have the results of our Enterprise Reader Survey on the appetite for electric vehicles in Egypt, which has promising results.

^^ We have all the details in our news well below.

THE COUNTDOWN TO COP (5 days to go)–

Egypt’s Suez Canal Authority (SCA) will announce incentives for hydrogen-powered ships during COP27, SCA head Osama Rabea said during an interview with Egyptian talk show Haza Al Sabah. (watch, runtime 00:01:16). The incentives will include reduced tariffs aiming to accelerate the transition from fossil fuels. LNG-powered ships will also be eligible for the tariff reductions, Rabea says.

The UK’s left-leaning Guardian is ramping up pressure on developed and developing countries alike in the final days before COP. You can expect this to become a media pile-on any day now.

The US is under-investing in climate, over-investing in hydrocarbons in Africa: The US has poured USD 9 bn into oil and gas projects on the continent since the Paris Agreement in 2015 despite commitments to stop investments in fossil fuels, the Guardian reports. Only USD 682 mn have been invested in renewables like solar and wind over the same time period, despite Africa’s immense solar potential.

Swedish climate activist Greta Thunberg will not be attending COP27, saying global leaders use the conference as a chance for “greenwashing,” the newspaper adds. The annual climate conferences are unlikely to yield any significant transformation or “change the whole system,” but they do have potential “as a [chance] to mobilize,” the young activist said at her book signing in London.

Greenpeace lands in Egypt: A Greenpeace sailing ship docked in Hurghada this week in what organizers said was a bid to raise awareness about climate change ahead of COP27, the organization announced in a statement (pdf) yesterday. Greenpeace is interesting in drawing attention to climate finance and the debate about loss and damage compensation for developing economies.

KEY COP DATES-

- World leaders’ summit: 7-8 November (more details here)

- Finance day: 9 November

- Decarbonization day: 11 November

- Adaptation and agriculture day: 12 November

- Water day: 14 November

- Energy day: 15 November

Detailed schedule: Download as a pdf here or check out the website here.

COP27 app for attendees: App Store and the Google Play Store.

HAPPENING TODAY-

In Abu Dhabi: Day two of Adipec kicks off, gathering some 40 ministers from around the world including the UAE, Kuwait, Bahrain, and Egypt. Discussions will partly focus on the transition toward carbon neutrality. Hosted by Adnoc, Adipec bills itself as “the world's most influential gathering for energy industry professionals.” The event will run through this Thursday, 3 November. Tap or click here to register.

In Amman: It’s the final day of the International Investment Forum for Renewable Energy and Energy Efficiency in MENA. Organized by the Arab Renewable Energy Commission, the three-day event tackles renewable energy, energy efficiency, smart cities and grids, green hydrogen and sustainability.

In Cairo: The three-day Egypt Energy Conference is also on its last day. The event includes three smaller conferences on power generation, transmission, and distribution; sustainability and clean energy; and PPP, foreign investment, and energy funding. Some 120 startups and global exhibiting companies will attend the conference, according to organizers. You can register for the event here.

THE GREAT DEBATE- “The world demands maximum energy production with minimum emissions,” Adnoc CEO Sultan Al-Jaber told attendees at the Abu Dhabi International Petroleum Exhibition and Conference yesterday, Arab News reports. Al-Jaber said zeroing out investment in hydrocarbon exploration and production could lead to a loss of 5 mn barrels of oil per day annually, extending the energy shock experienced of this past year.

The UAE and KSA are not ready to give up on fossil fuels yet with senior officials from both countries arguing for continued fossil fuel investment, saying that current renewables capacity cannot meet growing demand, as we reported previously.

In parallel, Adnoc is pushing ahead talks with other big hydrocarbon players about a green future: Adnoc Chairman Sheikh Khaled bin Mohamed bin Zayed Al Nahyan met with the CEOs of London-headquartered oil company BP and Japanese oil firm Inpex to discuss energy security and accelerating the energy transition, WAM reports. The talks touched on ways to drive more cooperation in lower carbon energy solutions and expanding partnerships for renewables and hydrogen projects, WAM notes.

|

***

YOU’RE READING ENTERPRISE CLIMATE, the essential regional publication for senior execs who care about the world’s most important industry. Enterprise Climate covers everything from finance and tech to regulation, products and policy across the Middle East and North Africa. In a nod to the growing geographical ambitions of companies in our corner of the world, we also include an overview of the big trends and data points in nearby countries, including Africa and southern Europe.

Enterprise Climate is published at 4am CLT / 5am Riyadh / 6am UAE Monday through Thursday by Enterprise, the folks who bring you Enterprise Egypt, your essential 6am and 3pm read on business, finance, policy and economy in Egypt and emerging markets.

Subscribe to Enterprise Climate here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

WHAT CLIMATE IS COSTING BUSINESS-

The climate crisis has increased heat-related deaths and the spread of infectious disease, according to a report (pdf) published last week by medical journal The Lancet. Produced by nearly 100 experts from 51 institutions across the globe, the report finds heat-related deaths in the most vulnerable — babies under a year old and adults over 65 — have increased by 68% over the last four years compared with 2000-2004.

Extreme heat has slashed productivity with some 470 bn labor hours lost globally in 2021 alone — bringing estimated economic losses of USD 700 bn and contributing to growing food insecurity and hunger. The transmission of infectious diseases — including malaria and dengue fever — has also seen a sizable increase in the past decade, compared with the 1950s.

MEANWHILE- Morocco and Egypt are among the worst regionally for children’s exposure to climate and environmental shocks, according to the UNICEF Children’s Climate Risk Index (pdf). The two countries have the highest levels of exposure to heat waves in the region, while Jordan had the lowest regional exposure. In Egypt, temperatures rose 0.53°C on average every 10 years over the past 30 years, the report says.

CIRCLE YOUR CALENDAR-

The Hawkamah Annual Conference (Building Investor Confidence Through Governance) will kick off on Tuesday, 15 November in Dubai. The conference will address governance from the perspective of investors including expectations and interaction with boards as well as the role of regulators and companies in preparing for IPOs to attract the right investors.

Saudi Arabia’s Education Ministry will host the Global Conference on Sustainable Partnerships on Wednesday, 23 November to Thursday, 24 November in Riyadh, bringing together ministers and senior officials from the private and public sectors. The conference will focus on transforming innovations and scientific research to achieve integration between universities, research, development and the innovation sector.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

POLL

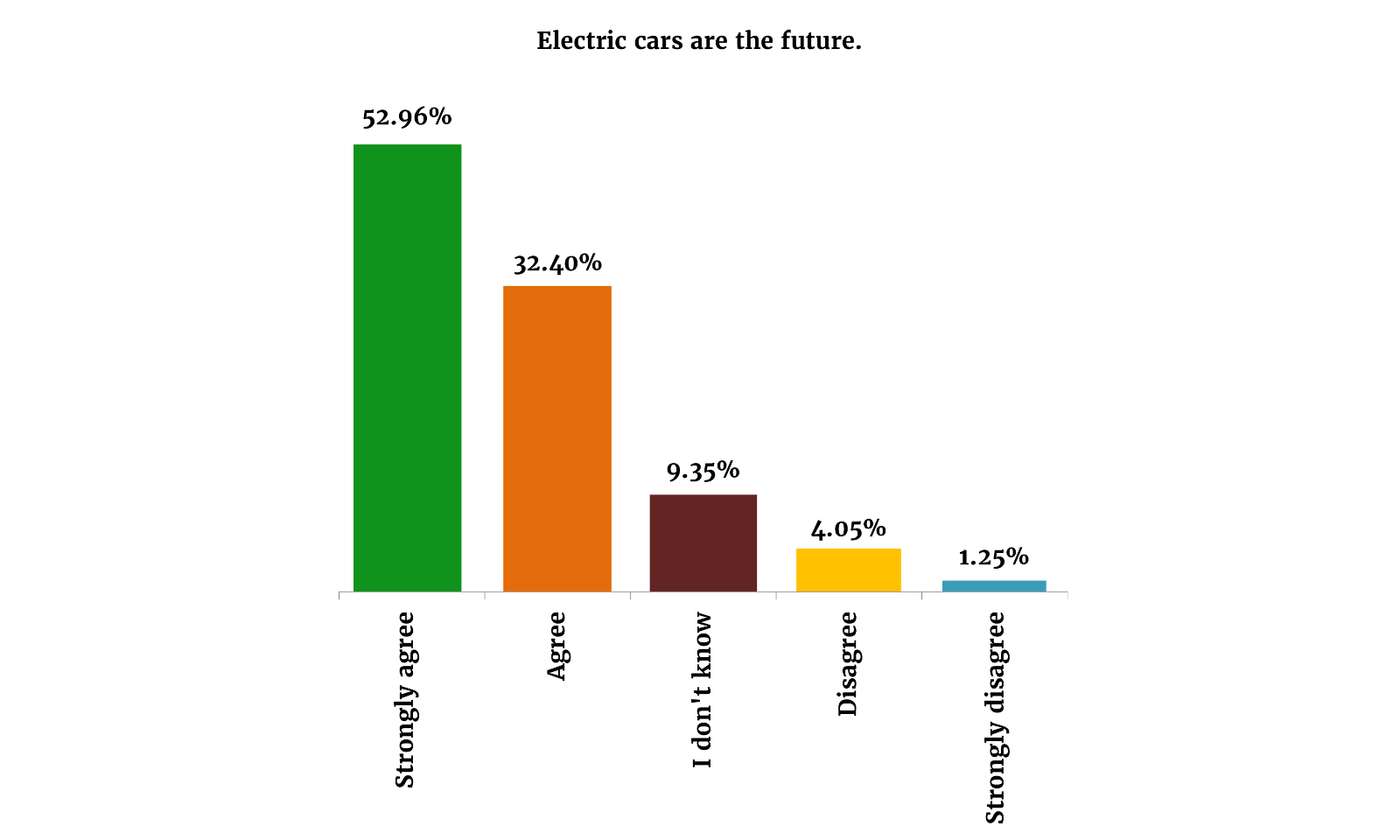

Egyptian consumers are bullish on EVs, with 1 in 5 looking to buy an EV in the next year

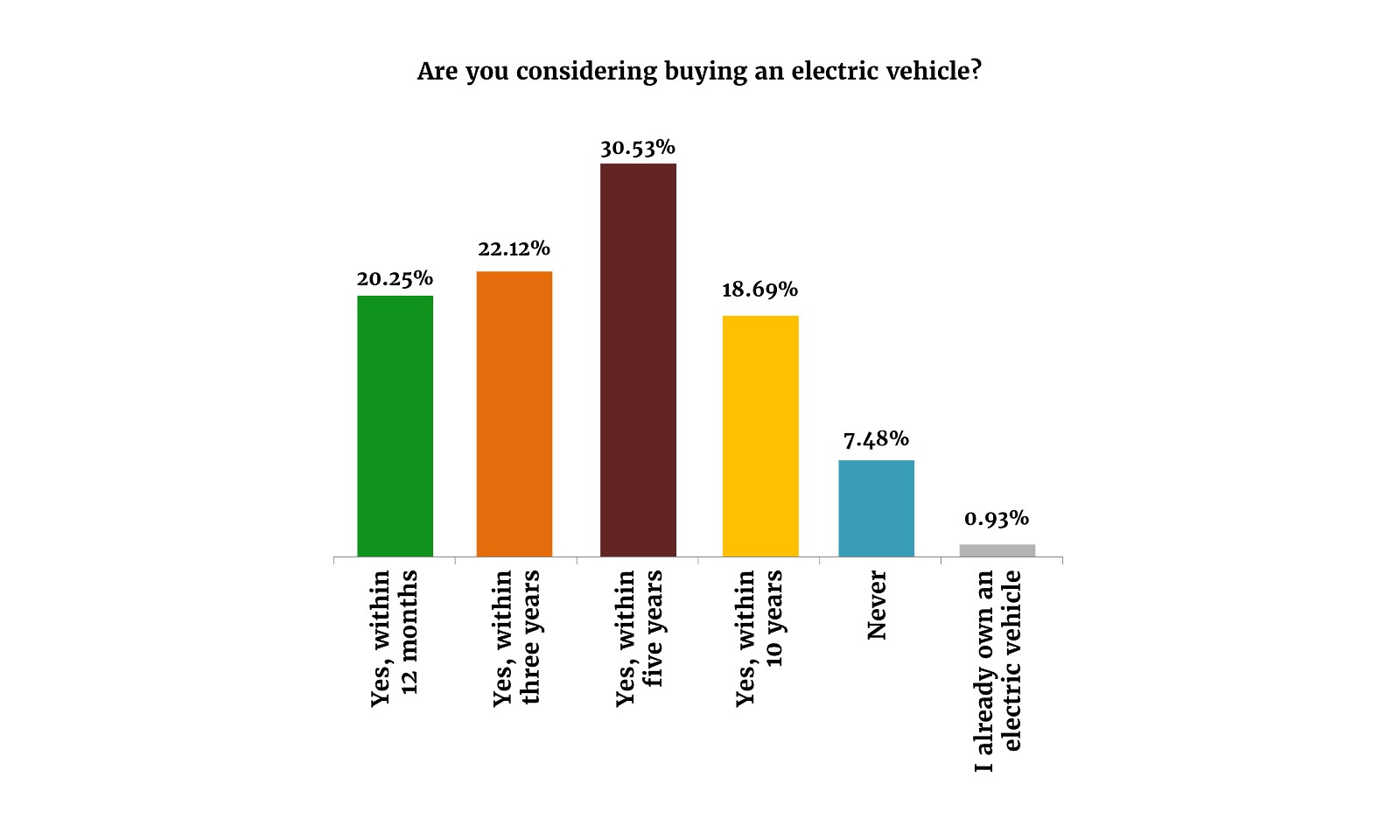

Egypt’s EV industry still has a long way to go — but you folks seem eager for the transition: As Egypt begins to make strides in developing a local electric vehicle industry and the infrastructure to power it, Enterprise readers are excited: 90% of you are planning to buy a EV within the the next 10 years — and one in five respondents said they’ll make a purchase in the next 12 months.

Before we get into it, what’s the current state of the country’s EV industry? Egypt’s industry is still nascent, with its first locally manufactured EV expected sometime next year — and that is only after a protracted search for a partner with which state-owned El Nasr Automotive can produce the EVs ends. On the infrastructure side, the government is still working on plans to establish a nationwide charging network — with our friends at renewable energy player Infinity working to set up 6k vehicle charging points at 3k stations across the country. In other efforts to advance the industry, Egypt’s House of Representatives just gave its final approval to a bill that will establish a new regulatory body to set policy for auto assembly in the country, including EVs, and provide financial incentives for manufacturers.

Meanwhile: EVs enter the country with zero customs duties. They’re not supported by full authorized aftersales service operation, but we’re aware of at least two importers with stock of Tesla and Volkswagen EVs for sale in the capital city.

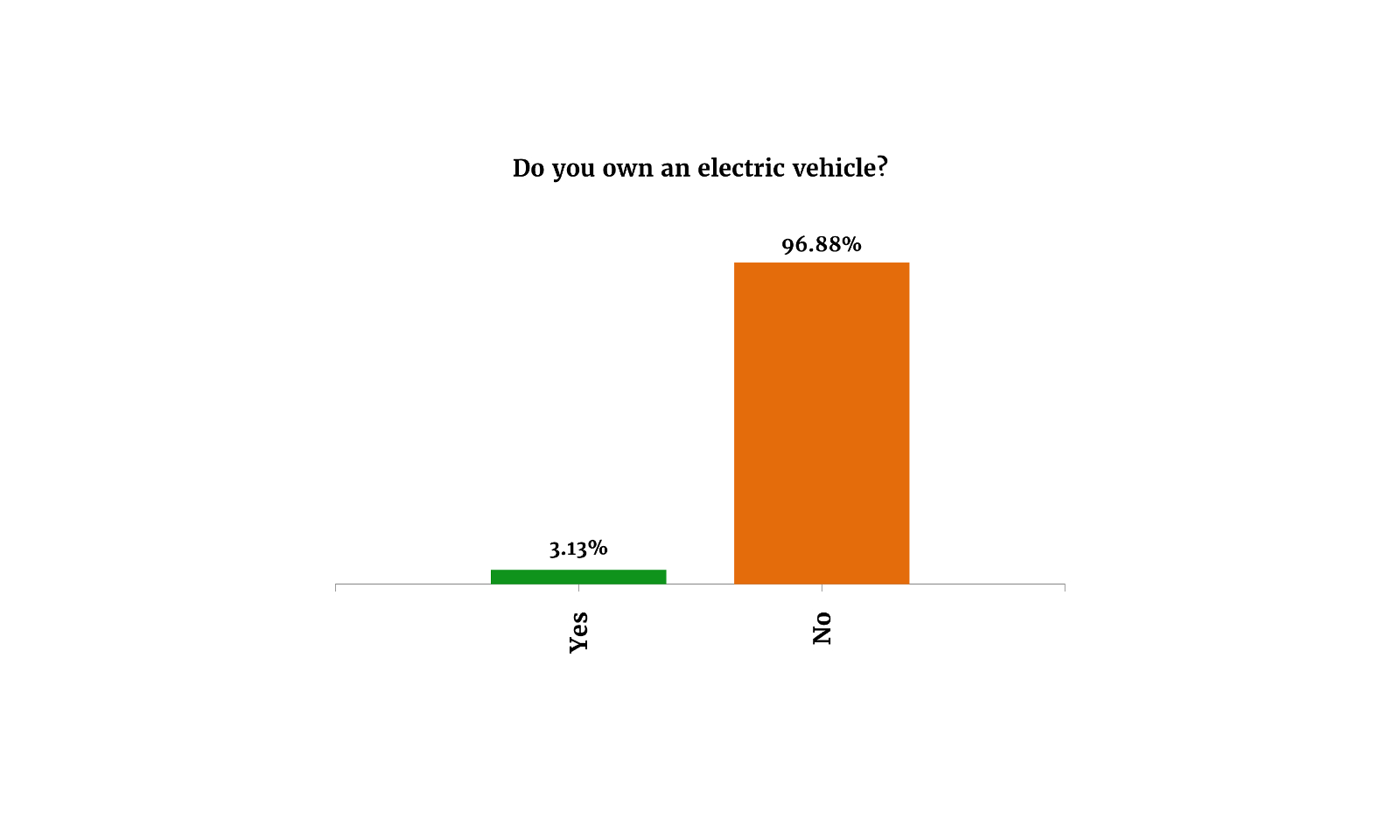

Only a handful of you own an electric car: A whopping 96.9% of you do not own an electric car, but some 20.6% know someone who does, indicating a small but budding trend.

More than 90% of you intend to buy an electric car at some point over the next decade. Some 20.2% of you intend to buy one in the next year, around 22.1% could go for one within three years, while 30.5% are considering buying one in five years, and another 18.7% said they would buy one after ten years.

Only 7.4% of you have ruled it out for good, citing reasons including a lack of charging infrastructure and doubts over the actual “greenness” of the industry.

The law of big numbers: Respondents to our poll in Enterprise Climate and EnterpriseAM are, by definition, at the top of the wealth pyramid — EVs are in no danger of going “mass” anytime soon. But think of it in these terms: If at least 5% of the population can afford to buy an EV (likely an underestimation, in our view), that means the addressable market for the vehicles in Egypt is roughly the same size as the entire population of Denmark, Ireland, Finland or Norway. And thanks to under-motorization and the continued growth of the middle class, the Egyptian passenger car market in 2021 was nearly 2x the size of Ireland’s.

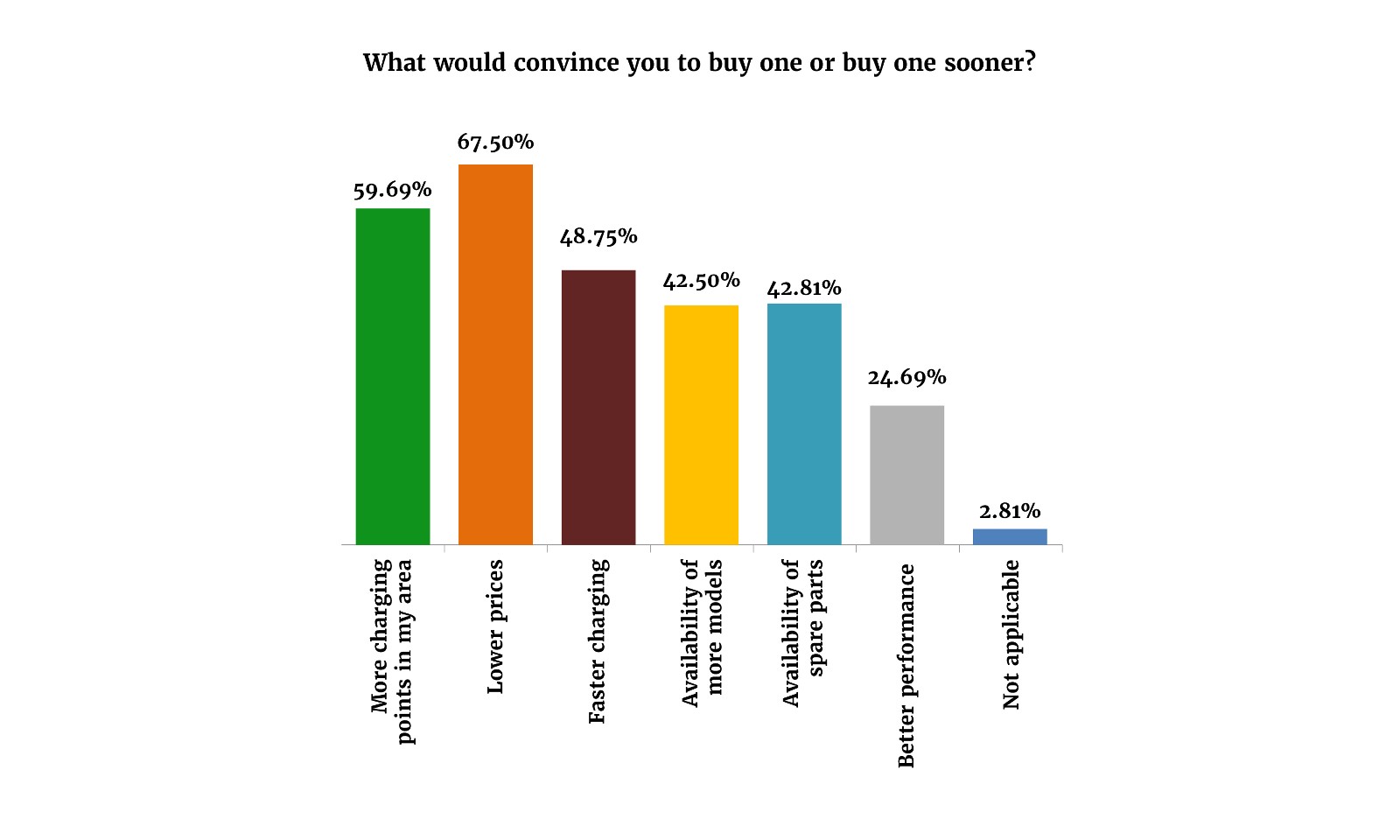

What could motivate you to hop on the EV bandwagon sooner? More than two thirds of you (67.5%) would choose to buy an electric car if they were cheaper, and some 59.7% want there to be more charging points in their area before they make the switch. About 48.8% percent want electric cars to charge faster, while 42.5% are hoping for more models to become available in the market. Around 42.8% want there to be more spare parts available for EVs, and a quarter of you care about better performance.

If you do make the switch, a majority of you (55.8%) would go for a hybrid car over a fully electric one, with most saying they want the extra cushion of a combustion engine in case there are no EV charging stations around. Both hybrid and fully electric cars are much more popular among you lot than a natgas- or dual-fuel-run car, with just 3.8% of respondents choosing it over the other two options.

In fact, most of you seem to dislike natgas-run cars, with three quarters of respondents saying they would stick with a gasoline-run car over a natgas-run or dual-fuel one if they were not able to buy an EV.

Why do you dislike natgas-powered cars? Loss of trunk space, where the CNG cylinder goes.

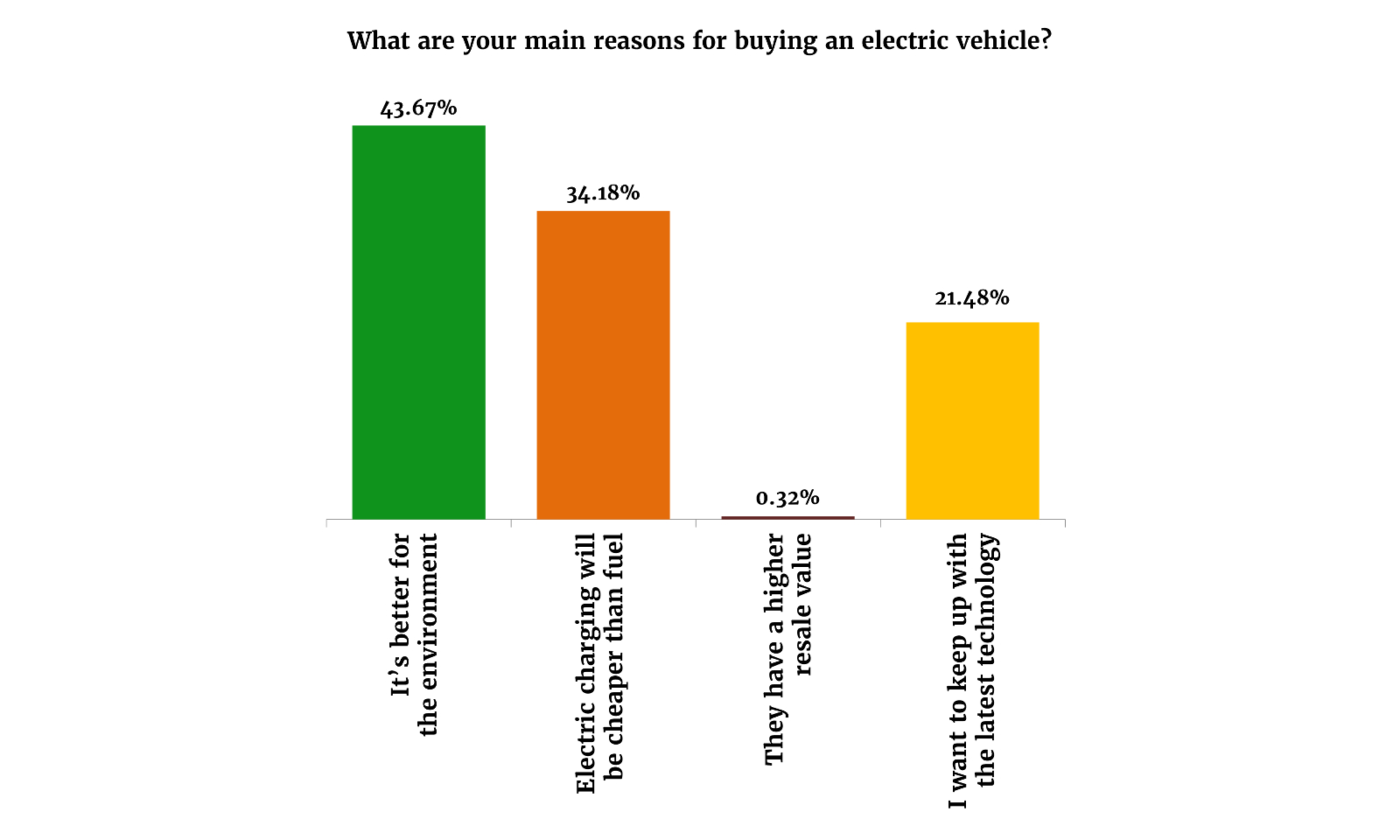

But you are an environmentally conscious lot: Some 43.7% of you say you would buy an electric car for their environmental benefits. More than 34% had look at the money, saying they would go the EV route so they could save on fuel. Only 21.8% would choose to buy an EV to stay up to date with the latest technology, while an even smaller minority would choose an electric car for its resale value.

A wide majority of you (85.4%) believes electric vehicles are the future. That’s much more than the 5.3% of you that don’t see EVs dominating the automotive industry in the coming years.

Plenty of you have your eyes on a Tesla: Some 24% said they would opt for a Tesla if they chose to buy an electric car. Other EV makers getting interest were Mercedes, BMW, Volvo, Volkswagen, and Toyota. Many survey takers were unaware of the options available in the local market, while others said they are waiting for more models to drop.

A handful of you just don’t plan on owning cars at all in a few years, choosing instead to opt for Uber or rentals. A number of you also think owning a regular car — let alone an electric one — at this point is just too expensive, while others are holding out hope for an improvement in public transport infrastructure down the line.

IPO WATCH

UAE’s Empower announces price range for its IPO

The Emirates Central Cooling Systems Corporation (Empower) has priced its initial public offering at AED 1.31-1.33 per share, according to the company’s price range release (pdf). The transaction will see 10% — or some 1 bn ordinary shares — of the company sold on the Dubai Financial Market (DFM). The indicative price range values the company, pre-offering, at between AED 13.1 bn and 13.3 bn (USD 3.5-3.6 bn)

Who’s selling? Majority shareholder Dubai Electricity and Water Authority (DEWA) is contributing 7 percentage points of their stake and Emirates Power Investment (a Dubai Holding subsidiary) is offering 3 percentage points. Following the offering, DEWA will hold a 63% stake and Emirates Power’s stake will be 27%.

Who’s buying? UAE Strategic Investment Fund, Shamal Holding, and Abu Dhabi Pension Fund are set to become key investors in the IPO with a commitment of up to AED 335 mn, according to Empower’s price range release.

The timeline: The subscription period kicked off yesterday and will close next Monday, 7 November for UAE retail investors and Tuesday, 8 November for other qualified investors. Following the bookbuilding process, the final offer price will be set next Wednesday, 9 November. The company’s shares are expected to begin trading on the DFM on 16 November, according to the statement.

Empower is one of 10 state-owned firms to list as part of the Dubai government’s privatization program, as we reported previously.

ADVISORS- Empower appointed Merrill Lynch, Citigroup and Emirates NBD as joint global coordinators on its IPO, with our friends at EFG Hermes acting as joint bookrunner. Moelis and Emirates NBD are acting as financial advisers. Emirates NBD is the lead receiving bank for the transaction, while our friends at Mashreq Bank are receiving bank alongside Abu Dhabi Islamic Bank, Ajman Bank, Commercial Bank of Dubai, Dubai Islamic Bank, Emirates Islamic Bank, First Abu Dhabi Bank, MBank, and Sharjah Islamic Bank.

CLIMATE FINANCE

Egypt lands USD 2 bn loan to shore up food security

Egypt will receive USD 2 bn to boost food security: The UN’s International Fund for Agricultural Development (IFAD) is providing Egypt with a USD 2 bn loan to boost investment in food, energy, and water, Bloomberg reports. The funds will be provided to the Egyptian government until 2030.

Where is the money going? The funds will be disbursed through a new program — the Nexus of Water, Food and Energy (NWFE) — that’s set to be unveiled at COP27. IFAD will “lead coordination” of the food part of the program, which is set to target “production, food storage and food transportation” and will connect markets with “smallholder” farmers, Bloomberg cited IFAD President Alvario Lario as saying in an interview last week. The European Bank for Reconstruction and Development (EBRD) will oversee the energy part of the program and the African Development Bank (AfDB) will oversee water, Bloomberg added. The EBRD is pledging USD 1 bn to the private sector to support bringing 10 GW of renewable energy online, and another USD 300 mn in concessional or IFI financing to support the grid, EBRD Egypt head Khalid Hamza told EnterpriseAM in October.

The funds will target small-scale, rural farmers in Egypt, Bloomberg noted. Small-scale farmers currently receive only 1.7% of global climate finance, though they produce one-third of the world’s food, it added, citing IFAD.

Background: NWFE is the mechanism by which Egypt’s International Cooperation Ministry will promote its pipeline of low-carbon projects to investors, EnterpriseAM reported in August. It got props from US climate envoy John Kerry for having “the potential to attract bns in investments from donor governments, philanthropy, development finance institutions and the private sector.”

IN CONTEXT- Climate change has hit Egypt’s agriculture sector hard recently: Egypt’s olive production fell by some 60-80% last season thanks to an unusually warm 2020-2021 winter, while the long 2021-2022 winter adversely affected the crop’s pollination and pruning process, local farmers told EnterpriseAM. Mango production took a 40% hit last year on the back of a Ramadan heatwave, though it recovered in 2022. Egypt’s dairy industry has been hit by climate change-induced extreme heat — which affects the growth, milk production, and reproductive rates of cattle, and growing conditions for livestock feed. And even honey production has taken a knock, with one local farmer estimating that it fell to about half its usual rate this year.

ON A WIDER SCALE- Global farming productivity is expected to decline by some 15% globally by 2050 due to rising temperatures and weather instability, according to the UN Food and Agriculture Organization.

CLIMATE FINANCE

Green finance for Jordan’s SMEs, courtesy of the EBRD, EU and GCF

Jordan’s SMEs in line for USD 10 mn in EBRD-led climate financing: The European Bank for Reconstruction and Development (EBRD) and the Green Climate Fund (GCF) are providing a USD 10 mn loan to Jordan’s Cairo Amman Bank (CAB) to on-lend to SMEs working on climate change adaptation and mitigation tech and services, according to a statement (pdf) issued by the EBRD yesterday.

The details: The USD 10 mn package — of which USD 2.5 mn is being co-financed by the GCF — will also include a technical cooperation package funded by the EBRD, EU, and GCF to provide support on tech usage to integrate climate change adaptation and mitigation. It will also advise on where and how to direct investment. The EU will also provide unspecified investment incentives, the statement says.

BACKGROUND- This is the third loan provided to Jordan by the EBRD, EU and GCF under the Green Economy Financing Facility, the EBRD confirmed to Enterprise Climate. It’s the first facility being provided to CAB under the GCF-GEFF Regional Framework in Jordan, the statement notes.

IN CONTEXT- It’s part of a raft of recent regional loans for on-lending to climate-focused SMEs. The EBRD signed an agreement with Jordan’s Bank al Etihad to provide a USD 10 mn GEFF, with USD 500k of co-financing from the GCF in August this year. Morocco’s Bank of Africa – BMCE Group recently secured EUR 13 mn in loans to use for on-lending to SMEs, with EUR 9.75 mn of this funding coming from the EBRD and EUR 3.25 mn from the GCF, and the EU providing a separate EUR 1.43 mn grant. Last year, the EBRD greenlit a USD 25 mn loan to the National Bank of Kuwait Egypt in April, a USD 50 mn loan to QNB AlAhli in June, and a USD 100 mn facility to Egypt’s Banque Misr in November.

RENEWABLES

OC-led consortium kicks of work on Egypt wind farm + other renewables updates from the region

We have a smattering of renewables stories from the region, including a new 45 GWh solar plant for a cement plant in Egypt’s Suez, the expansion of solar capacity at the UAE’s Al Maktoum Solar Park, and the kick-off of a wind farm project in Egypt’s Ras Ghareb.

OC-led consortium kicks off work on 500 MW wind farm in Egypt: A consortium of EGX- and Nasdaq Dubai-listed Orascom Construction, Japan’s Toyota Tsusho, and France’s Engie broke ground yesterday on a 500 MW wind farm in Egypt’s Ras Ghareb, according to a statement from the country’s cabinet. The consortium will develop, construct, and operate the wind farm under a 20-year contract. Implementation is expected to take 30 months, Orascom Construction said in a statement (pdf) last October.

SUEZ CEMENT INKS SOLAR PACT

Suez Cement Group of Companies (SCGC) and Intro Power and Utilities signed an EGP 350 mn (USD 14.48 mn) power purchase agreement (PPA) for a new solar plant, SCGC announced yesterday. The solar facility will supply the HeidelbergCement subsidiary’s Suez plant with nearly 45 GWh of solar energy, accounting for 20% of the plant’s power supply and offsetting approximately 22k tons of CO2 emissions annually.

The details: Construction of the new solar plant will begin next year and is expected to come online in 1H 2023. It will be connected to the Egyptian national grid by 2H 2023 and is expected to supply renewable energy for the Suez plant through to 2043. The plant will be developed, managed, operated and maintained by Intro Group.

Reducing emissions: “This step toward using more affordable and cleaner energy will help us significantly reduce power costs and bring us closer to our 2030 target of reducing net CO2 emissions to 400kg/t corresponding to a reduction of 47% compared with the base year 1990,” SCGC Managing Director Mohamed Hegazy said in the statement.

In context: Cement generates the most carbon emissions per USD of revenue globally with 6.9 kg of CO2 released — 5x more than steel — according to findings (pdf) by the World Cement Association during its annual conference. MENA cement producers account for nearly 7% of the global cement output.

DEWA ADDS 300 MW OF PV CAPACITY

ALSO- UAE’s Dubai Water and Electricity Authority added 300 MW of photovoltaic solar energy to Al Maktoum Solar Park’s phase 5 in 2022, the Government of Dubai announced yesterday. The latest addition upgrades phase 5’s production capacity to 600 MW — two thirds of the 900 MW planned to come online by 2023. The Solar Park will have a production capacity of 5 GW by 2030.

ON YOUR WAY OUT

Emperor penguins get protection under the US Endangered Species Act: Their longevity on our planet is becoming increasingly untenable as global warming accelerates the rate of sea ice melting in Antarctica, but now the shuffling flightless birds will receive protections under the US Endangered Species Act, the US Fish and Wildlife Service says.

Danger in Antarctica: The US Fish and Wildlife Service currently lists the birds as a “threatened” species due to rapid sea ice loss. Early thawing of sea ice — where the penguins search for food, breed, and evade predators — can cause severe declines in colonies, according to a study published in Global Change Biology. Up to 70% of emperor penguin colonies in Antarctica could die out by 2050 under current energy system trends and policies, the study warns.

CALENDAR

NOVEMBER

31 October-3 November (Monday-Thursday): ADIPEC, Abu Dhabi National Exhibition Centre, Abu Dhabi, UAE.

1 November (Tuesday) at 12pm: Mohammed Bin Rashid Al Maktoum Solar Park EOI submission deadline, UAE.

15 November (Tuesday): Hawkamah Annual Conference (Building Investor Confidence Through Governance), Dubai, UAE.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

23-24 November (Wednesday-Thursday): Global Conference on Sustainable Partnerships, The Ritz-Carlton, Riyadh, Saudi Arabia.

Deadline of bid submissions for the Ras Mohaisen – Baha – Makkah Independent Water Transmission Pipeline in Saudi Arabia.

COP27 sub-events:

7-8 November (Monday-Tuesday): Terra Carta Action Forum organized by the Prince of Wales’ Sustainable Markets Initiative.

UNFCCC’s capacity building hub.

7 November (Monday): Saudi Arabia’s Middle East Green Initiative event.

8 November ( Tuesday): COP27 Leaders’ Event: Accelerating Adaptation in Africa.

10 November (Thursday): ClimaTech Run competition’s pitching day.

11-12 November (Friday-Saturday): Saudi Green Initiative event.

DECEMBER

13-15 December (Tuesday-Thursday): International Renewable Energy Congress, Hammamet, Tunisia.

15 December (Thursday): The UN’s 15th meeting of the Conference of the Parties to the Convention on Biological Diversity (COP15), Montreal, Canada.

JANUARY 2023

13 January (Friday): The International Renewable Energy Agency’s Youth Forum, Abu Dhabi, UAE.

14-21 January (Saturday-Saturday): Abu Dhabi Sustainability Week takes place in the UAE.

16-18 January (Monday-Wednesday): EcoWASTE, Abu Dhabi National Exhibition Center (ADNEC), UAE.

16-18 January (Monday-Wednesday): World Future Energy Summit, Abu Dhabi National Exhibition Center (ADNEC), UAE.

January 2023: Bid submission deadline for green hydrogen projects to Hydrogen Oman (Hydrom).

FEBRUARY 2023

6-8 February (Monday-Wednesday): Saudi International Marine Exhibition and Conference, Hilton Riyadh, Saudi Arabia.

The second edition of The Arab Green Summit (TAGS), Dubai, UAE.

MARCH 2023

15-19 March (Wednesday-Sunday): Qatar International Agricultural and Environmental Exhibition, Doha, Qatar.

JUNE 2023

1-3 June (Thursday-Saturday): Envirotec and Energie Expo, UTICA, Tunis, Tunisia.

SEPTEMBER 2023

Chariot Limited and Total Eren’s feasibility study on a 10 GW green hydrogen plant in Mauritania to be completed.

OCTOBER 2023

2-4 October (Monday-Wednesday): WETEX and Dubai Solar Show, Dubai World Trade Centre, Dubai, United Arab Emirates.

NOVEMBER 2023

6-17 November (Monday-Friday): The UAE will host COP28.

EVENTS WITH NO SET DATE

End-2022

KSA’s Neom wants to tender three concrete water reservoir projects to up its water storage capacity by 6 mn liters.

2023

Early 2023: Egypt’s KarmSolar to launch KarmCharge, the company’s EV charging venture.

1Q2023: Oman will award two blocks of land for green hydrogen projects in Duqm, Oman.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

4Q2023: Oman to award four blocks of land for green hydrogen projects in Thumrait, Oman.

2024

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

First 1.5 GW phase of Morocco’s Xlinks solar and wind energy project to be operational.

2025

Second 1.5 GW phase of Morocco’s Xlinks solar and wind energy project to be operational.

UAE to have over 1k EV charging stations installed.

2026

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

Iraq’s Mass Group Holding wants to invest EUR 1 bn on its thermal plant Mintia in Romania to have 62% of run on renewable energy, while expanding its energy capacity to at least 1.29k MWh.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.