- Masdar to develop a 500 MW floating solar park in Indonesia. (Solar)

- Taqa Morocco plans to earmark USD 320 mn to boost its clean energy portfolio. (Investment Watch)

- Oman’s biggest IPO on record begins subscription period. (IPO Watch)

- Amea Power reaches financial close on the 120 MW Kairouan solar plant in Tunisia. (Solar)

- Saudi Arabia eyes first nuclear power plant with tougher IAEA checks. (Nuclear)

- IEA says 1.5°C goal is within reach. (What We’re Tracking Today)

- UK’s BII has USD 1 bn in store for climate-related projects in India. (Around the World)

- Firefighters turn to AI to help scope out and extinguish climate-induced wildfires. (Climate in the News)

Wednesday, 27 September 2023

Masdar is developing a floating solar park in Indonesia

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends. We have a meaty issue for you this morning, with news across a range of sectors in our neck of the woods and on a global level.

THE BIG CLIMATE STORY- UAE state-owned renewable energy giant Masdar has signed an agreement with Indonesia’s utility company PLN Nusantara Power to develop a 500 MW floating solar photovoltaic plant (FPV) in Indonesia.

THE BIG CLIMATE STORY OUTSIDE THE REGION- Indonesia launches its carbon trading market: Indonesia’s President Joko Widodo formally kicked off operations on his country’s first voluntary carbon credits market yesterday as part of state plans to become carbon-neutral by 2060 and become a major global carbon allowances trading hub. The maiden carbon transactions yesterday — 13 carbon credits offsetting about 460k metric tonnes of CO2 equivalent — were priced at 69.6k IDR (c USD 4.49) per unit. Widodo said yesterday that the platform could potentially add some 3 tn IDR (c. USD 194 bn) to the country’s coffers once Indonesia sets emissions caps for industries beyond the power sector, and other companies with net-zero commitments can participate in the market. Banks, government-owned geothermal utility Pertamina, and mining companies were among the buyers yesterday.

The story got some coverage in the international press: Reuters | Bloomberg

ALSO JUMPING ON THE CARBON MARKET WAGON- India will fix carbon emission intensity benchmarks and reduction targets for four fossil fuel-powered sectors and start carbon trading by 2025, Reuters reports, citing unnamed government officials. The country will set reduction targets for three years for companies in iron and steel, cement, petrochemicals, and paper. The companies in these sectors, likely the first to trade on the Indian carbon market, will be able to buy and sell carbon credits by 2025 to meet their reduction targets. If companies exceed their target, they can sell carbon credits to others that have not met their goals.

AIIB announces climate action plan: The Asian Infrastructure Investment Bank (AIIB) announced its Climate Action Plan (pdf) plan during the bank’s annual meetings in Sharm El Sheikh, according to a statement. The plan will help AIIB reach its climate ambitions by 2030. “The Climate Action Plan demonstrates AIIB’s ambition to mobilize our capital, capacity, and convening power to help our members in their efforts to address climate change,” said AIIB President and Chairman of the Board Jin Liqun.

What will they do? The bank plans to tailor climate solutions to individual clients across Asia, taking into consideration members’ income levels and capacity to address climate change, focus on mitigation plans that offer co-benefits for biodiversity and nature conservation, strengthen financing partnerships to mobilize capital for climate projects, and promote innovation efforts in mitigation and adaptation. AIIB also plans to allocate around 50% of its annual financing approvals to climate finance by 2025.

AIIB is already on the climate front: AIIB issued the first Asian adaptation bonds earlier this year. Its cumulative climate finance portfolio hit USD 11.7 bn and has financed 107 projects with climate components, the statement reads.

WATCH THIS SPACE #1- IFC helping Egypt’s Kandil Steel develop decarbonization program with USD 25 mn loan: The International Finance Corporation (IFC) has signed off on a USD 25 mn loan to Egypt’s flat steel manufacturer Kandil Steel to support the company’s expansion plans and help it build a decarbonization roadmap, the multilateral lender said in a statement. The loan, approved preliminarily earlier this year, will “support the company’s operational and financial resilience” by funding working capital and enabling it to continue purchasing raw materials, the statement added. With the help of the IFC loan, the company aims to increase annual production by 60% to 800k tons by the end of 2024, said CEO Amr Kandil. The final decision on the loan was initially scheduled for June, and the companies did not disclose the reasons for the delay.

Kandil has high incentives to green its production as the EU moves forward with restricting imports of heavy emitting goods: The EU is planning to introduce a levy on the import of iron and steel by 2026 as part of its carbon border adjustment mechanism. Egypt, the UAE, and Saudi Arabia are among the top iron and steel exporting countries, making their transition to green steel crucial for remaining competitive in the global market. The Institute for Energy Economics and Financial Analysis released a report (pdf) last year outlining the region’s potential to lead the world in green steel production. The iron and steel sectors account for some 7-9% of all direct fossil fuel emissions worldwide.

About Kandil: Kandil is a key player in the local steel industry, ranking among Egypt’s 10 largest steel exporters, and currently shipping to more than 40 countries across the world, according to the statement. The company’s factories in Tenth of Ramadan City and Obour City have the capacity to produce 708k tons of steel a year, and it dominates the local market for galvanized steel products.

WATCH THIS SPACE #2- France calls for a firmer stance on phasing out fossil fuels: France says the EU should set dates by which fossil fuels should be phased out during the COP28 UN climate summit later this year, according to a document seen by Reuters. France is seeking a set timeline as it “would increase the pressure on countries that are reluctant to agree on a phase-out of fossil fuels,” the document read. France urged the EU to ensure emissions-capturing technologies do not delay efforts to phase out fossil fuels. It also cited the EU's Global stocktake report, which states that phasing out all unabated fossil fuels — ones that have no mechanisms to remove the bulk of their emissions — is essential to reach net zero emissions and reduce further climate change damage.

EU countries are split on phasing out fossil fuels: Some EU nations, including France, voiced concern against strict limits on non-CO2-tailpipe emissions. Spain proposed earlier this week a watered-down version of the bloc’s initial Euro 7 draft to extend its initial implementation date of 1 July 2025 for cars and vans to 30 months from the initial two-year deadline. The EU aims to finalize its COP28 negotiating position in mid-October.

Meanwhile, Paris is getting its own ducks in a row: French President Emmanuel Macron laid out a strategy on Monday that aims to meet the mutually-agreed EU target of cutting national greenhouse gas emissions by 55% by 2030 compared to 1990 levels. Under the plan, France will “act twice as fast” in the next seven years, he claimed, curbing emissions at a steeper 5% per year, compared to the 2% it has witnessed over the past five years — and lowering reliance on fossil fuels to 40% from 60%. The strategy includes producing 1 mn climate-friendly heat pumps, producing 1 mn EVs and having four battery plants fully operational, and decommissioning the country’s two remaining coal plants — which produce less than 1% of France’s total energy output — by 2027. France’s 50 most polluting industrial sites — which include the steel, cement, and chemical industries and contribute a total of 10% of France’s overall emissions — will also formally sign to cut emissions by 45% by 2030.

Critics of the roadmap say it’s not enough: Greenpeace France has pointed out that a more ambitious plan would have specified dates for completely phasing out oil and gas, the Associated Press reports, quoting a member of the European Parliament’s Greens alliance as saying “he made the exact same promise five years ago.”

This comes as France is set to host the International Energy Agency (IEA) summit on critical minerals and clean energy this week, which Japan’s Economy, Trade, and Industry Minister Yasutoshi Nishimura is scheduled to attend, Reuters reports. Japan, which faces resource shortages, is looking to strengthen its diplomatic ties as a means to secure metals needed for energy production, particularly batteries used in electric vehicles, as the country works towards a 2050 net carbon neutrality target.

WATCH THIS SPACE #3- IEA says 1.5°C goal is within reach: Reaching net zero emissions and maintaining global warming within the 1.5°C threshold is still within reach due to the growth of renewables and green investments, according to a new IEA report. The IEA's new Net Zero Roadmap, an update from the initial version from 2021, highlights the changes to the clean energy sector in the past two years and the record growth in solar power capacity and electric vehicle sales which are in line with the net zero goals, the report reads.

The new roadmap sets a clear path: “The pathway to 1.5°C has narrowed in the past two years, but clean energy technologies are keeping it open,” said IEA Executive Director Fatih Birol. The new report sees global renewable power capacity tripling by 2030, the annual rate of energy efficiency improvements doubling, and the energy sector methane emissions falling by 75%. It also calls for a significant increase in investment, especially in emerging and developing economies, where global clean energy spending rises from USD 1.8 tn in 2023 to USD 4.5 tn annually by the early 2030s.

|

***

YOU’RE READING ENTERPRISE CLIMATE, the essential MENA publication for senior execs who care about the world’s most important industry. We’re out Monday through Thursday by 5am Cairo / 5am Riyadh / 6am UAE.

EXPLORE MORE OF ENTERPRISE ON THE WEB — tap or click here to read EnterpriseAM, EnterprisePM, and The Weekend Edition on our powerful new website packed with reader-friendly features.

Were you forwarded this email? Get your own subscription without charge here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

CIRCLE YOUR CALENDAR-

Adnoc will host its annual Abu Dhabi International Petroleum Exhibition & Conference (Adipec) Decarbonization Accelerator from 2-5 October at the Abu Dhabi National Exhibition Centre, where more than 2k local and international oil and gas companies will be showcasing their ideas and perspectives for decarbonizing the industry. Four sector-specific areas — under the titles Decarbonisation, Maritime & Logistics, Digitalisation in Energy, and Manufacturing & Industrialisation — will be designated for networking and partnerships.

Dubai’s MENA Electric Vehicle show begins today at the Radisson RED in DSO’s Dubai Digital Park and wraps tomorrow. The event is connecting stakeholders in the global EV chain and will explore the socioeconomic significance of EV adoption, utilizing them for increased energy independence and economic diversification, governance, and policies pertaining to EVs, strategies for advancing sustainable infrastructure development, and the digital transformation within the e-mobility industry, according to Wam. This event will include key players in the industry such as Tesla, Al Futtaim Automotive, and Talabat, among others.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

SOLAR

Masdar to develop a 500 MW floating solar park in Indonesia

Masdar signs agreement to triple capacity of its Cirata floating solar PV power plant in Indonesia: UAE state-owned renewable energy giant Masdar has signed an agreement with Indonesia’s utility company PLN Nusantara Power to develop a 500 MW floating solar photovoltaic plant (FPV) in Indonesia, according to a company statement.

The details: The 500 MW project is the second phase of the floating Cirata solar plant for which Masdar signed a power purchase agreement back in 2020. The initial 145 MW phase of the project, which was South Asia’s first FPV plant at the time, is expected to come online later this year. The new solar farm follows a recent regulatory development allowing up to 20% of water coverage for renewable energy operations, the company notes. The company did not reveal the expected investment ticket for the upcoming phase, but the first stage is estimated to have a USD 145 mn price tag.

Masdar already has a foothold in Indonesia: Earlier in February, Masdar acquired shares in the geothermal unit of Indonesian government-owned geothermal utility Pertamina, which controls 82% of Indonesia's installed geothermal energy capacity, and manages 13 geothermal energy projects generating 1.87 GW of electricity.

And the UAE government just inked a new pact with Indonesia: UAE Energy and Infrastructure Minister Suhail Al Mazrouei met with Indonesia's President Joko Widodo on the sidelines of the UAE-Indonesia Business Forum in Jakarta last week to discuss increasing cooperation in smart and green cities, renewables, and food security. Mazrouei spotlighted potential cooperation in developing Indonesia’s new green capital Nusuantra on Borneo, which is set to become operational by 2045 in line with the country’s efforts to attain carbon neutrality by 2060. Widodo plans to reserve 70% of the new capital’s landmass as green areas to upscale national reforestation efforts. Mazrouei noted both the state and UAE private developer’s interest in helping establish port infrastructure in Nusuantra, as well as setting up renewables projects in the country and helping support Indonesia’s food security efforts. Indonesia has set out a target of sourcing 23% of its energy needs from renewables by 2025. Indonesia will need approximately USD 51.7 bn annually for climate mitigation efforts, according to the International Renewable Energy Agency.

INVESTMENT WATCH

Taqa Morocco plans to earmark USD 320 mn to boost its clean energy portfolio

Taqa Morocco to earmark USD 320 mn to boost its clean energy portfolio: Taqa Morocco — a subsidiary of Abu Dhabi National Energy Company (Taqa) — plans to allocate MAD 3.3 bn (c. USD 320 mn) to develop renewable energy projects in the country yielding an expected 200 MW by 2025, the company’s Vice President Amr Mohamedi told Bloomberg Asharq. This follows statements from Taqa CEO Majid Iraqui last March on the company’s ambitions to develop several wind power farms in the kingdom.

REMEMBER- Morocco has a lot of wind energy potential: In July, Nareva Enel Green Power (NEGP) — a JV between Morocco’s electricity company Nareva and Italian renewable energy developer Enel Green Power — kicked off operations on its 300 MW Boujdour wind farm in Morocco. Activation of the Boujdour wind farm brought the number of operational wind farms in the country to 17. The wind farm is part of NEGP’s 850 MW Integrated Wind Project (IWP), which seeks to deploy an additional 100 MW from the onshore Tiskrad wind farm in Laayoune and 270 MW from the Jbel Lahdid onshore wind farm in Essaouira.

Details on Taqa’s new plan: The company secured earlier this month MAD 6.6 bn from a number of local banks in a bid to refinance debts it incurred to fund its operations, and will use a chunk of the capital to expand its renewables production capacity and finance planned desalination projects by 4Q 2023, Mohamedi said, without providing details about the other renewables ventures. The company is planning to leverage its efficient renewable resources to fuel its green hydrogen export plans. Morocco is also looking to up its clean energy volumes in anticipation of the EU’s carbon border tax system and in preparation of its own planned emission caps model, Mohamedi noted.

REFRESHER- Morocco wants to position itself as an export hub for renewable energy and green hydrogen to Europe: Back in February, Spain extended a EUR 800 mn credit line to the kingdom and signed 19 MoUs including a renewable energy development agreement with the country. Other nations have also been showing interest in the country’s potential, with Germany signing with Morocco a partnership agreement in 2020 to build a 100 MW hydrogen plant in the country. Morocco and Portugal also signed an agreement to similarly develop green hydrogen plants in the country with plans to export the green fuels to the EU.

Taqa Morocco plans to invest USD 1.6 bn in renewable energy projects by 2030, Iraqui said back in March. Its renewables portfolio includes the 96 MW Noor Midelt solar generation plant, and includes other wind energy projects with a combined 100 MW volume in the country’s north, and 600 MW of clean energy farms in pre-development in the south.

Morocco has big renewables targets: Morocco wants renewable energy to account for 80% of its total power generation by 2050. The country plans to more than triple allocations for renewables projects to MAD 14 bn (c. USD 1.4 bn) between 2023-2027 as part of a target to have 50-52% of its energy come from renewables by 2030. Morocco’s installed capacity of renewables stood at more than 4 GW as of 2022.

IPO WATCH

Oman’s biggest IPO on record begins subscription period

Oman’s OQ Gas Networks kicks off subscription period for country’s biggest IPO listing: The subscription period for the retail and institutional portions of Omani state-owned natural gas network operator OQ Gas Networks’ (OQGN) IPO on the Muscat Stock Exchange (MSX) began yesterday, as per the IPO prospectus (pdf). OQGN is offering up to 49% of its total share capital, aiming to raise as much as OMR 297 mn (USD 771 mn). OQGN is the sole operator of Oman’s gas transportation system and was valued at OMR 606 mn (USD 1.6 bn) in the run up to the IPO. The offering will be the biggest listing for Oman on record.

The details: The institutional offering covers 40% of the shares on offer at a price range between OMR 0.131-0.14 per share (USD 0.34-0.36), while the retail offering covers another 30% of the offering. The retail offering prices shares at a disc. maximum of OMR 0.126 (USD 0.33) per share. The subscription period for the institutional offering closes on 9 October, while the retail subscription closes on 5 October. OQGN shares are expected to begin trading on the MSX on or around 24 October.

Who’s already bought in? The remaining 30% of shares is reserved for anchor investors — the Saudi Omani Investment Company, Falcon Investments, and Belgium-based Fluxys International — which have made “irrevocable commitments,” according to the prospectus. The Saudi Omani Investment Company is wholly owned by Saudi Arabia’s Public Investment Fund, while Falcon Investments is a subsidiary of the Qatar Investment Authority. Fluxys International is an independent energy infrastructure and utilities company that aims to develop low-carbon hydrogen and CO2 routes to import into Belgium and Europe. The three have agreed to buy shares at a price of OMR 0.14 (USD 0.36) per share, with each of the three snapping up 10% of the shares on offer.

Why is this important? Countries with an established gas network will have an advantage in hydrogen production and transport, as hydrogen could be blended into existing natural gas networks. Current research shows that hydrogen can be safely injected into the gas grid up to 5-10% volume, and is expected to reach 20% by the end of the decade. A gas supply that includes low-carbon hydrogen would lower CO2 emissions and help scale up production of hydrogen. The inclusion of Fluxys as a shareholder signals that the IPO will facilitate Oman’s plans to use its gas network for hydrogen transport.

Oman is banking on its existing gas infrastructures: OQGN’s growth strategy includes playing a vital role in the Gulf country’s energy transition by facilitating hydrogen and captured carbon transportation and storage. OQGN is working with Oman’s hydrogen development entity Hydrom on a common-use infrastructure scheme to accelerate the development of the necessary infrastructure for previously signed hydrogen projects, Hydrom Managing Director Abdulaziz Al Shidhani told The Energy Year in an interview in July. Nama Group for Electricity and Water are also working on the common infrastructure scheme which is being fast-tracked by the government with an estimated timeline of six to seven years to be completed.

Advisors: Oman’s biggest financial services provider, Bank Muscat, is issue manager, according to the prospectus. Bank Muscat, EFG Hermes, and AN International Bank are joint global coordinators. Collection agents for the IPO include Ahlibank, BankDhofar, Bank Muscat, Bank Nizwa, Horizons Capital Markets, EFG Hermes Oman, National Bank of Oman, Oman Arab Bank, Sohar International, Ubhar Capital, and United Securities.

SOLAR

Amea Power reaches financial close on the 120 MW Kairouan solar plant in Tunisia

UAE-based renewables developer Amea Power has achieved financial close on its planned USD 86 mn, 100 MW PV plant in Tunisia’s Kairouan, according to a company statement. The company expects to break ground on the project between December of this year and January 2024, Amea Power’s Senior Director of Business Development Hussein Matar told Enterprise Climate, and is looking to fully kick off operation on the solar farm by the summer of 2025.

The details: Amea Power has secured funding for the project, which will have a 120 MW peak production capacity and be built under a build, own, operate model, from the International Finance Corporation (IFC) and the African Development Bank (AFDB). The IFC will extend green loans to the Emirati firm totalling USD 26 mn, of which USD 13 mn will be in the form of concessional financing, and the AfDB has similarly committed to providing USD 26 mn for the plant. The project is expected to generate some 222 GWh of clean energy annually, powering some 43k households in the country, and offsetting an estimated 100k tons of CO2 annually once fully operational, the statement notes. Once operational, it is set to be the largest solar plant in the country, according to Amea Chairman Hussein Al Nowais.

What they said: The multilateral lenders are financing the project in a bid to upscale Tunisia’s climate adaptation efforts and help wean it off of fossil fuel imports, they said, noting that it is one of the world's most vulnerable countries to the effects of climate change. “This new project in Tunisia aligns with IFC's strategy to increase access to clean energy and support cross-border investments from the Gulf Cooperation Council countries to emerging markets,” the lender notes.

Background: Tunisia awarded the Kairouan PV plant to a consortium that includes AMEA Power and Chinese energy solutions provider TBEA Xinjiang New Energy Company earlier in 2019. AMEA Power was then awarded a concession and power purchase agreement in March 2022, and construction on the plant was set to begin at the end of 2022.

Tunisia has big solar ambitions: Tunisia has set a national strategy to develop solar plants with a combined capacity of 500 MW across the country, with a target to have clean energy sources comprise 35% of its electricity mix by 2030, and its unconditional emissions reduction target to slash 27% — 35 mn tons of CO2 —- by 2030 compared to 2010 levels, and ultimately become carbon-neutral by 2050. As part of the strategy, Tunisia is looking to build a 200 MW plant in Tataouine, a 100 MW plant in Gafsa, and two 50 MW plants in Tozeur and Sidi Bouzid. Amea Power — which has been making strides in the regional clean energy sector — plans to participate in future tender projects in the country, Matar told us.

NUCLEAR

Saudi Arabia eyes first nuclear power plant with tougher IAEA checks

KSA is all in on nuclear with tougher IAEA checks: Saudi Arabia is planning to set up its first nuclear power plant under a bid to advance its nascent nuclear program under monitoring by the International Atomic Energy Agency (IAEA), the country’s Energy Minister Prince Abdulaziz bin Salman Al Saud said in remarks (pdf) during the IAEA's annual General Conference in Vienna.

All for peaceful uses: The Saudi official said his country is working “to develop peaceful uses for nuclear energy across various fields through close cooperation” with the IAEA. These include the Saudi National Atomic Energy projects and its components, including building the country’s first nuclear energy power plant to meet sustainable development requirements outlined in its Vision 2030, he said.

And welcoming tougher IAEA checks: Saudi Arabia will allow international inspectors wider oversight of its nuclear activities through broader monitoring guidelines with the IAEA, according to the minister. Riyadh is also working closely with the IAEA “to leverage its expertise and the advisory services it provides in the field of implementing safeguards to develop the national infrastructure and human capabilities required to support this transition,” he added.

Wider monitoring to keep the haters away: Wider access by international inspectors to the kingdom’s nuclear activities would help abate worries by non-proliferation analysts who have expressed concern over the Gulf country’s plans without tougher IAEA checks. The worries come amid threats by Saudi Crown Prince Mohammed bin Salman that his country would develop nuclear weapons if rival Iran does.

And that’s not all: The Saudi minister signed the Junior Professionals Program Agreement with the IAEA’s Director General Rafael Gross, according to Asharq Al Awsat. The agreement should pave the way to train and develop human resources in several fields related to the IAEA’s technical aspects and beyond, according to the media outlet.

REMEMBER- The Chinese want in: Saudi Arabia is reportedly considering a Chinese offer to build a two-reactor 2.8 GW nuclear power plant in the country. The move is believed to be an attempt by Riyadh to pressure the Biden administration to ease its conditions for assisting the Gulf country in its nuclear energy ambitions. The talks are part of a plan by Saudi Arabia to award a contract for the facility by the end of the year and a longer term plan to build 16 reactors at an estimated cost of USD 80 bn to USD 100 bn by 2030.

MOVES

Saudi’s Ma’aden announces board reshuffle

Ma’aden puts fresh faces on its board: Ahmed Alhakbani (LinkedIn) and Manar Al Moneef (LinkedIn) have been tapped to join Saudi Arabia’s state-owned Mining company Ma’aden’s board of directors, effective 25 October, the company said in a disclosure to Tadawul yesterday. Alhakbani and Al Moneef are replacing Suliman bin Abdulrahman AlGwaiz and former Vice Chairman Abdulaziz bin Saleh AlJarbou.

CLIMATE DIPLOMACY

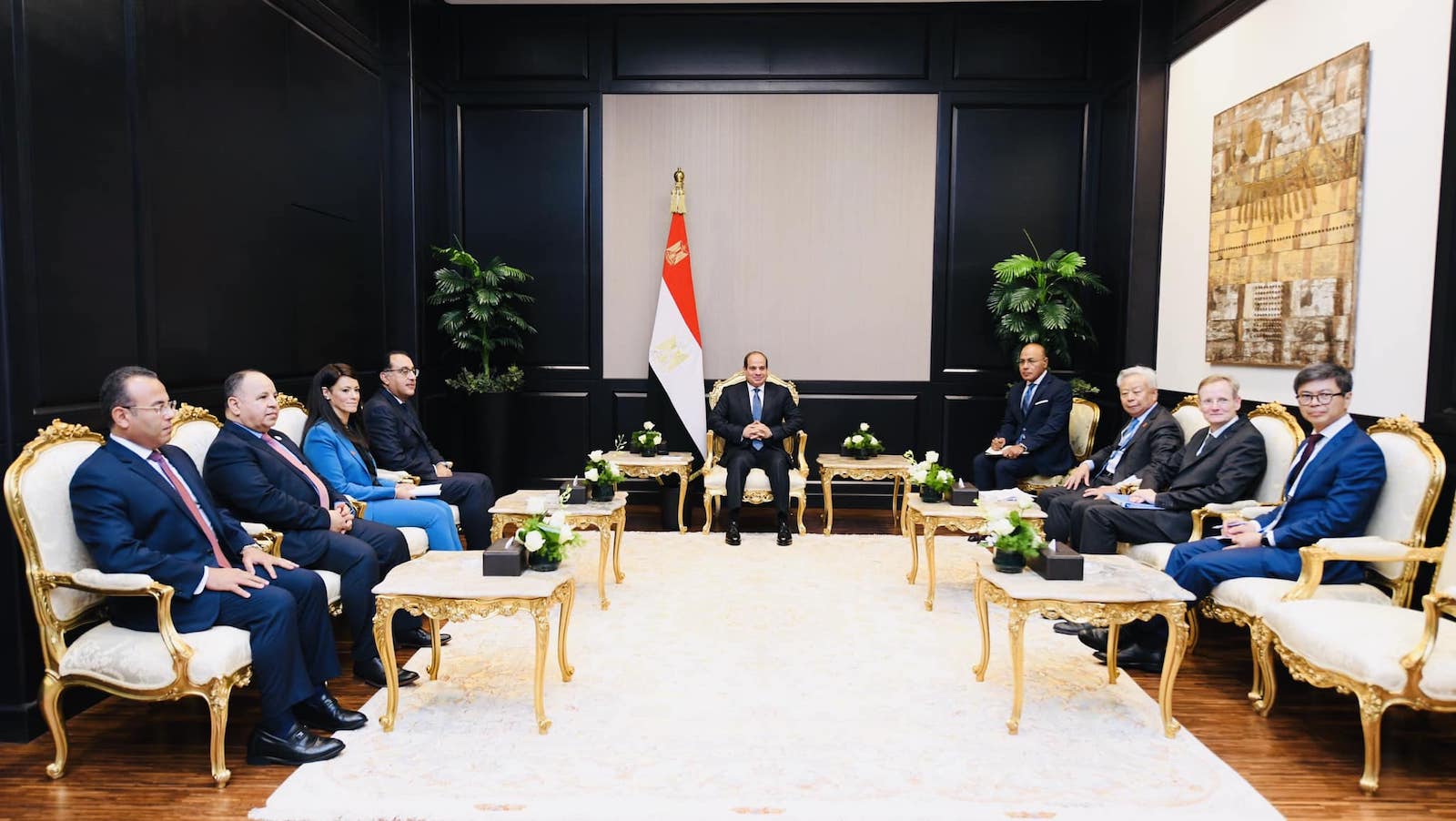

Egypt’s Sisi, AAIB President discuss cooperation in clean energy, green economy

Egypt’s Sisi, AAIB chief discuss cooperation: Egyptian President Abdel Fattah El Sisi discussed with Asian Infrastructure Investment Bank (AIIB) President Jin Liqun exploring cooperation in clean energy, transportation, and the transition to a green economy on the sidelines of the AIIB annual meetings in Sharm El Sheikh, according to an Egyptian presidency statement. El Sisi and Liqun also discussed ongoing efforts in international financing reforms and multilateral development banks’ role in bolstering the capacity of developing nations to address global economic challenges, according to the statement.

Israel, Masdar move forward on Jordan water-for-energy agreement: Israeli Energy Minister Israel Katz met with Masdar CEO Jameel Al Ramahi in Tel Aviv to advance a water-for-energy agreement with Jordan that was first floated by Israel and Jordan back in 2021, Reuters reports. The so-called “Project Prosperity” would see 600 MW of solar energy headed for Israel in exchange for 200 mn cubic meters of desalinated water for Jordan, with a signing expected at COP28 in Dubai.

ALSO ON OUR RADAR

A Moroccan pharma group is getting funds from EBRD for sustainability transition: The European Bank for Reconstruction and Development (EBRD) is loaning EUR 34.5 mn to H&S Holding subsidiary Dislog Group, a diversified industrial Moroccan group, according to an EBRD statement. A portion of the loan is earmarked for facilitating Dislog’s transition to sustainability, the statement says.

The breakdown: Divided into two tranches, EUR 24.5 mn will go towards Dislog’s acquisition of Steripharma, a local pharma manufacturer that provides affordable specialty generics medicines, while the remaining EUR 10 mn will finance the construction of a new green industrial building, a logistics platform, and PV solar panels to generate renewable power for the building.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- Infinity to charge BMW EVs in Egypt: Global Auto Group, BMW’s agent and importer in Egypt, signed an agreement with our friends at Infinity to charge electric BMWs at its charging stations. (Statement)

AROUND THE WORLD

The UK has big climate plans for India: British International Investment (BII) — the UK government’s development finance institution — is planning to pour in c. USD 1 bn in climate-related projects in India by 2026, BII’s CEO Nick O’Donohoe tells Reuters. “We are evaluating exciting businesses in sectors such as biofuels, circular economy … as part of the vision for the 2030 roadmap agreed between India and the UK,” O’Donohoe said. BII invested over USD 300 mn in climate finance last year in the South Asian country’s renewable energy, electric mobility, and sustainable agriculture sectors, he told the newswire. BII’s current portfolio in India currently stands at USD 2.2 bn with investments in more than 290 businesses, according to Reuters. Its latest venture in the country was a USD 250 mn commitment in Indian carmaker’s Mahindra and Mahindra’s new electric vehicle unit last year.

Australia is one step closer to becoming a renewable energy superpower: A future hydrogen hub in South Australia has secured funding commitments in a bid to bring the country closer to becoming a renewable energy superpower, according to a statement by the Australian prime minister’s office. Both the Albanese and Malinauskas governments have committed USD 100 mn to develop infrastructure at Port Bonython to help it become South Australia’s first large-scale export terminal for hydrogen. The port is also expected to be home to projects worth up to USD 13 bn and generate as much as 1.8 mn tons of hydrogen by 2030, the statement read.

ALSO- Households in Australia are close to adding 3 GW of rooftop solar capacity to the electricity grid this year, the Guardian reports, citing data from the Clean Energy Regulator. Some 1.4 GW of capacity from c. 160k rooftop systems was added to the grid in the first six months of the year. The new additions would bring the size of rooftop solar capacity to the grid close to the 2021 record of 3.2 GW, according to the regulator.

South Korea’s Posco may set up shop abroad in a “desperate” attempt to meet its corporate target to slash 30% of its emissions by 2035, with Australia among the countries Posco is considering, Senior Vice President for Posco’s Climate Action Strategy Kim Hee told Bloomberg. The company’s plans to reach net-zero targets by mid-century would require some 3.7 mn tonnes of green hydrogen, Kim said. The company — which has some 45 global subsidiaries and operations in over 16 countries aside from South Korea — plans to establish its green steel plants beyond its hometown due to non-competitive domestic levelized electricity costs. Although the move would be a “last resort” due to associated risks, “the fact that we may put this idea on the table shows how desperate we are in delivering our climate commitment,” Kim said.

Regional footprint and expected net-zero investment ticket: The company, which plans to fuel its green steel production targets from renewables-powered hydrogen, was awarded in June a USD 6.7 bn contract to set up what it described as the world’s largest green hydrogen plant in Oman’s Duqm, and later in July signed an agreement with KSA’s Acwa Power to jointly develop green hydrogen and its derivatives, in a bid to help decarbonize Posco Group’s power generation and steel manufacturing operations. The global steel industry accounts for about eight percent of global greenhouse gas emissions, generating around 1.85 tons of CO2 per steel ton, and Posco remains South Korea’s largest corporate emitter. The company estimates its carbon-neutrality ambitions would have a 40 tn KRW (USD 30 bn) price tag, and entail development of nine clean hydrogen production plants. Earlier in July, the company announced plans to allocate some USD 93 bn to scale its hydrogen, battery materials, and steel production sectors.

Kenya plans to break ground on its first nuclear power plant in 2027 as it pushes for zero carbon energy, CEO of the Nuclear Power and Energy Agency (NuPEA) Justus Wabuyabo tells the Business Daily. The agency plans to issue international tenders to construct the plant in either Kilifi or Kwale counties. The plant will have an expected capacity of 1 GW. “We will do the bidding stage, as anytime between 2026 and 2027 and start construction in 2027. Construction ranges six to 10 years so we are looking at 2034-35 to commission the first plant,” Wabuyabo added.

China may offer compensation to utilities with idle coal plants to support their green transition: China is considering compensating utility providers for the coal plants initially built to tackle persistent supply shortages, but are likely to become idle as the country transitions to renewables, Bloomberg reported, citing a draft of the plan of which it obtained a copy. The funds will be collected through fees for industrial and commercial consumers based on their power capacity and the rates they pay on their electricity, the news outlet added. If approved, consumers will begin to pay for the additional fee starting next year.

BACKGROUND- China has accelerated its construction of coal-fired power in recent years due to supply shortages and a need for backup generation to intermittent wind and solar. Despite the breakneck speed of China’s renewable power installations, coal still accounts for 59% of the country’s electricity.

IFC + Reserve Bank of Fiji to develop a green finance taxonomy: The International Finance Corporation (IFC) and the Reserve Bank of Fiji (RBF) will work together to implement a “green taxonomy” — a set of clear guidelines and parameters to help define green assets and projects, the IFC said in a statement. The move, the IFC and RBF say, will facilitate more climate financing from the private sector to such projects, as well as creating green jobs and avoiding greenwashing. The IFC will also help Fiji’s financial sector to implement ESG practices.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- Unusually heavy rains caused eight deaths in Mexico after the rains resulted in the flooding of a river in the Mexican state of Jalisco, destroying four houses and damaging 50 others. (Reuters)

- A major low-carbon iron ore facility in Brazil could be happening: Brazil’s top miner Vale has signed an agreement with Latin America’s largest commercial port Acu port to examine the possibility of setting up a low-carbon iron ore complex in Rio de Janeiro, according to company executives. (Reuters)

CLIMATE IN THE NEWS

Firefighters turn to AI to help scope out and extinguish climate-induced wildfires: The latest intel by The Global Forest Watch confirms that climate change is spurring an increase in wildfires, affecting twice as much tree cover in 2023 compared to observed levels over the past two decades. To help tackle the problem, green tech developers including San Francisco-based Pano AI are using artificial intelligence to aid firefighters in the battle against global warming-induced weather disasters, Bloomberg writes. Firefighters embed Pano AI’s panoramic cameras to capture real time snapshots of forest cover in a bid to detect early signs of impending wildfires, a fire chief in the US’ Oregon tells Bloomberg. The data the green tech collects is then analyzed by an AI algorithm programmed to detect signs of potential fires, minimizing reliance on human labor. On one occasion, Pano’s AI fire detection mechanism identified a wildfire outbreak that Schneider’s team failed to detect after hours of search efforts in forest cover, and proved effective on numerous other occasions, according to the fire comissioner. Pano AI has established more than 100 AI-enabled fire lookouts systems across six US states and Australia, and has raised a total of USD 45 mn to date.

Blended finance to support India's net zero path: Blended finance — the blending of concessional funds from official development assistance institutes with private funding to leverage funds and reduce risks — is essential to India's green energy transition as it can drive more investment into key climate projects, according to a new IFC report. The report stresses that blended finance can boost private sector investment in mitigation and adaptation projects.

India needs a massive investment boost to reach net zero goals: India aims to reduce the emissions intensity of its GDP by 45% by 2030, from the 2005 level, and attain 50 percent of its power capacity from renewable sources, according to a report by the Climate Policy Initiative. To reach this goal, India will need to significantly raise climate investments from USD 18 bn to USD 170 bn annually until 2030. The available investment for climate action in India is currently USD 44 bn.

Blended finance already adopted regionally: The UAE's initiative to commit USD 4.5 bn to help Africa advance clean energy projects is supported by blended finance solutions. The IFC also announced in March investing USD 50 mn of blended co-investments in Jordan Kuwait Bank’s planned five-year green bond issuance.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- Potential windfall taxes should be imposed on petrostates too: Calls to impose windfall taxes on private oil companies should be extended to petrol-producing countries, former UK prime minister Gordon Brown said. Levying a 3% windfall tax on the oil and gas export revenues of the biggest oil-producing countries would yield USD 25 bn a year, which can be used to help developing countries cope with the climate crisis. (The Guardian)

- Dubai Harbour introduces its first waste collection drone: Dubai Harbour has announced the introduction of its first Pixie Drone, which can identify and dispose of organic waste and non-organic waste from the water’s surface. The drone, manufactured by The Searial Cleaners, is approximately 1.62 meters long by 1.15 meters wide, making it smaller than other clean-up robots. (Statement)

CALENDAR

SEPTEMBER 2023

26-27 September (Tuesday-Wednesday): GCC-Iraq Business Forum, Sharjah, UAE.

27-29 September (Wednesday-Friday): Algeria’s International Exhibition for Renewable Energy and the Environment, Algiers, Algeria.

28 September (Thursday): International Energy Agency Critical Minerals and Clean Energy Summit, Paris, France.

Chariot Limited and Total Eren’s feasibility study on a 10 GW green hydrogen plant in Mauritania is to be completed.

Egypt set to launch alliance to shore up climate financing in developing countries.

OCTOBER 2023

2-5 October (Monday-Thursday): ADIPEC Decarbonization Accelerator, Abu Dhabi, UAE.

4 October (Wednesday): Arabia CSR Gala Awarding Ceremony, UAE.

4-5 October (Wednesday-Thursday): Future Sustainability Forum, Dubai, UAE.

8-10 October (Sunday-Tuesday): Saudi Green Building Forum, Riyadh, Saudi Arabia.

10-11 October (Tuesday-Wednesday): Green Energy Africa Summit, Cape Town International Convention Centre 2, Cape Town, South Africa.

8-12 October (Sunday-Thursday): MENA Climate Week, Riyadh, Saudi Arabia.

9-15 October (Monday-Sunday): World Bank/IMF 2023 Annual Meetings, Marrakech, Morocco.

10-12 October (Tuesday-Thursday): Autonomous E-Mobility Forum, Doha, Qatar.

16-17 October (Monday-Tuesday): Duqm Economic Forum, Duqm, Oman.

16-18 October (Monday-Wednesday): Climate Week, Rome, Italy.

16-20 October (Monday-Friday): UNCTAD World Investment Forum, Abu Dhabi, UAE.

18-20 October (Wednesday-Friday): Morocco and Belgium business meeting on green hydrogen, Tangiers, Morocco.

17-18 October (Tuesday- Wednesday): Critical Minerals Africa Summit, Cape Town, South Africa.

17-19 October (Tuesday-Thursday): Energy Intelligence Forum, London, UK.

17-20 October (Tuesday-Friday): Fourth meeting of the COP27 Transitional Committee, Aswan, Egypt.

25-26 October (Friday-Saturday): Offshore & Floating Wind Europe 2023, London, United Kingdom.

29 October-2 November (Sunday-Thursday): Cairo Water Week, Cairo, Egypt

30 October – 1 November (Monday-Wednesday) ISWA 2023 World Congress: Global action towards a net-zero future, Muscat, Oman.

31 October-2 November (Tuesday-Thursday): Financial Times’ Energy Transition Summit, London, UK.

31 October-2 November (Tuesday-Thursday): World Hydropower Congress, Bali, Indonesia.

NOVEMBER 2023

1-3 November (Wednesday-Friday): Forbes Middle East Sustainability Leaders Summit 2023, Abu Dhabi, UAE.

7-8 November (Tuesday-Wednesday): ADIA Lab Symposium on Climate Change and Health Sciences, Abu Dhabi, UAE.

7-8 November (Tuesday-Wednesday): The 2023 US Algeria Energy Forum, Washington DC, USA.

9-10 November (Thursday-Friday): International Renewable Energy Agency Investment Forum, Uruguay.

9-15 November (Thursday-Wednesday): Intra-African Trade Fair 2023, Cairo, Egypt.

11-13 November (Saturday-Monday): GCC-Türkiye Economic Forum, Istanbul, Turkey.

15-17 November (Wednesday-Friday): WETEX and Dubai Solar Show, Dubai, UAE.

15-18 November (Wednesday-Saturday): DEWA’s First MENA Solar Conference, Dubai, UAE.

20-24 November (Monday-Friday) International Civil Aviation Organisation’s Aviation and Alternative Fuels conference, Dubai, UAE.

27-30 November (Monday-Thursday) Abu Dhabi Finance Week (ADFW), Abu Dhabi, UAE.

28-29 November (Tuesday-Wednesday): World Green Economy Summit (WGES), Dubai, UAE.

30 November – 12 December (Thursday-Tuesday): Conference of the Parties (COP 28), Dubai, UAE.

DECEMBER 2023

4 December (Monday): Saudi Green Initiative Forum, Dubai, UAE.

4 December (Monday): Abu Dhabi Sustainability Week (ADSW) summit, Dubai, UAE.

8 December (Friday): Youth for Sustainability Forum (Y4S), Dubai, UAE.

12-14 December (Tuesday-Thursday): Green Hydrogen Summit Oman, Oman Convention and Exhibition Center, Muscat, Oman.

18-20 December (Monday-Wednesday): Saudi Arabia Smart Grid Conference, Hilton Riyadh Hotel & Residences, Riyadh, Saudi Arabia.

JANUARY 2024

9-11 January (Tuesday-Thursday): Future Minerals Forum, Riyadh, Saudi Arabia.

FEBRUARY 2024

26-28 February (Monday-Wednesday): Management and Sustainability of Water Resources, Dubai, UAE.

MARCH 2024

4-6 March (Monday-Wednesday): International Conference on Sand and Dust Storms in the Arabian Peninsula, Riyadh, Saudi Arabia.

APRIL 2024

16-18 April (Tuesday-Thursday): World Future Energy Summit, Abu Dhabi, UAE.

23-25 April (Tuesday-Thursday): Connecting Green Hydrogen MENA, Dubai, UAE.

MAY 2024

19-21 May (Sunday-Tuesday): Saudi Energy Convention, Riyadh, KSA.

JUNE 2024

5 June (Wednesday): World Environment Day, Saudi Arabia.

DECEMBER 2024

2-13 December (Monday-Friday): Conference of the Parties (COP16) to the United Nation Convention to Combat Desertification, Riyadh, KSA.

EVENTS WITH NO SET DATE

2023

Mid-2023: Oman set to sign contracts for green hydrogen projects.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

2024

12-14 February (Monday-Wednesday): Sustainable Aviation Futures MENA Congress, Dubai, UAE.

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

2025

International Union for Conservation of Nature World Conservation Congress, Abu Dhabi, UAE.

UAE to have over 1k EV charging stations installed.

2026

UITP Global Public Transport Summit, Dubai, UAE.

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2050

Tunisia’s carbon neutrality target.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.