- South Korea’s CEVO + UAE’s Masari-Atlantis agree to set up EUR 100 mn EV factory. (Electric Vehicles)

- Zero Carbon Ventures closes USD 5 mn seed round. (Startup Watch)

- NYU Abu Dhabi develops self-cleaning membranes for desalination tech. (Green Tech)

- An initiative to support the decarbonization of heavy-emitting industries will be launched at COP28. (What We’re Tracking Today)

- EgyptSat Auto gets golden license for EV manufacturing. (Also on Our Radar)

- The UK is set to be getting renewable energy exported from Egypt. (What We’re Tracking Today)

- Total is investing USD 300 mn in a JV with Adani Green. (What We’re Tracking Today)

- The world’s first hydrogen validation facility comes online, courtesy of Mitsubishi. (Around the World)

Monday, 25 September 2023

CEVO + Masari-Atlantis are setting up an EV factory in Dubai

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people. We have a reasonably busy issue to kick off a new week, giving us a little bit of everything. Let’s jump in.

THE BIG CLIMATE STORY- UAE-based Masari-Atlantis and South Korea’s CEVO Mobility signed an investment contract to invest EUR 100 mn in a new electric vehicle factory in Dubai next year, with plans to produce 20k vehicles per year.

HAPPENING TODAY- Egypt will host the annual meetings of the Asian Infrastructure Investment Bank today in Sharm El Sheikh. The meetings, AIIB’s first in Africa, aim to showcase potential investments in Egypt and attract financing for green initiatives in renewables, sustainable transportation, communication, internet infrastructure, and water resources.

THE BIG CLIMATE STORY OUTSIDE THE REGION- The EU is backing Spain’s new Euro 7 vehicle emissions proposal: EU countries largely showed support for new regulations on non-carbon tailpipe emissions — particulate matter from brakes and tires — proposed by the Spanish government, backing a watered down version of the bloc’s initial Euro 7 draft, which was put forward by the EU Commission earlier in November and followed the EU’s initial Euro 1 set of regulations published in 1992. The new Spanish draft, which bloc members were due to make a final decision on yesterday during a ministerial meeting, will be later debated with the EU Commission and Parliament before final approval. The new proposal would extend the Euro 7’s initial implementation date of 1 July 2025 for cars and vans to 30 months from the initial two-year deadline. Eight EU countries — including France, the Czech Republic, and Italy — voiced concern back in May against strict limits on non CO2-tailpipe emissions, citing concerns that strong restrictions on combustion engine vehicles would divert investments away from EVs.

REMEMBER- The EU plans to ban the sale of fossil fuel-powered cars entirely by 2035: In November last year, the EU announced plans to slash car emissions by 55% compared with 2021 levels by 2030, before ultimately banning the sale of petrol and diesel engines by 2035, but final approval for the target has been delayed several times. Back in March the bloc began talks with Europe’s largest automaking country Germany on legislation allowing the sale and manufacture of combustion engine vehicles beyond the bloc’s previously agreed termination date provided they run on e-fuels, after the country postponed an EU vote to phase them out in February. Germany — which generates some EUR 411 bn per annum from auto sales — is lobbying for a flexible approach that would not see an outright prohibition of fuel-powered cars. On Saturday, German e-fuels maker Lühmann Gruppe announced plans to take the EU to court for its planned combustion engine phase out by 2035, noting the bloc’s plan is unrealistic and “driven by ideology, not facts.”

The story grabbed headlines in the international press over the weekend: Bloomberg | Reuters | Deutsche Welle

OVER IN COPLAND- Decarbonization of heavy industries is getting some backing at COP: A cross-sectoral initiative to support the decarbonization of heavy-emitting industries such as steel, iron, and cement will be launched during COP28 in the UAE later this year, Director General of the UN climate summit Majid Al Suwaidi said during the UN General Assembly (UNGA) meetings in New York last week, according to a statement. The initiative will facilitate the rollout of key enablers to develop the decarbonization industry, including financing, policymaking, technology, and collaboration, Al Suwaidi added.

And so are our favorite tree friends, the mangroves: A high-level Mangroves Ministerial will be held during COP, bringing together mangrove-hosting countries to build partnerships and plan for scaling up mangrove conservation and restoration, the presidency said in a statement on X, citing comments by UAE’s Climate Change and Environment Minister Mariam Al Mheiri at the UNGA. The ministerial will “focus on accelerating finance, policy and technology to meet the Mangrove Breakthrough global target of restoring and protecting 15 mn hectares of mangroves by 2030,” Al Mheiri added.

COP28 President Delegate Sultan Al Jaber made an appearance at UNGA’s Climate Ambition Summit: “Climate change won't be solved through agreement alone. It can only truly be addressed through action,” Al Jaber said in opening statements at the UNGA’s Climate Ambition Summit in New York. Referring to the latest data from the Global Stocktake, Al Jaber said that “the numbers are straightforward: 22 gigatons. That's the amount of greenhouse gas emissions we need to cut in the next seven years to keep 1.5°C within reach.”

And later urged countries to agree on loss and damage fund: Al Jaber urged nations to agree on how to operate a loss and damage climate fund to compensate developing countries for the damage caused by climate change, The National reports. Al Jaber made the remarks in his opening remarks during a consultation on funding arrangements held at the UN on Friday. Developing countries have proposed that the fund would have USD 100 bn by 2030, but the leaders could not agree on which states would pay and how the money would be disbursed. The details were left to be worked out in the highly anticipated COP28. A transitional committee set up during COP27 has already met three times to discuss the details of the loss and damage fund. It is scheduled to convene again next month in Aswan, Egypt.

Reactions and recommendations: Some EU countries are concerned that the fund could be misused as a “global ATM facility” accessed by countries that do not need it. The fund should target countries that are particularly vulnerable to the adverse effects of climate change, executive vice president of the UN Green Deal Maros Sefcovic recommended, according to the National. It should also hold the “countries that are historically responsible for GHG emissions” accountable, a representative from Tunisia said during the discussion. Organizers are hoping to reach an agreement before COP28, sources at the French Energy Ministry told the National.

WATCH THIS SPACE #1- Egypt to ship renewable power to the UK: The UK is set to be one of the beneficiaries of planned electricity interconnections between Europe and Egypt, which will export power generated from wind and solar plants, The Telegram reported on Friday. Egypt is expected to generate about 10 GW of power from wind farms near the Suez Canal, which will be transmitted via a 966 km subsea cable in the Mediterranean to Greece, the news outlet added. “About a third of the power will be used in Greece and the rest will be exported to the rest of Europe,” director of renewables and power at Norway-based energy consultancy Rystad Carlos Diaz told The Telegram.

BACKGROUND- Egypt and Greece have been working on a plan to add 9.5 GW of renewable power generation capacity in Egypt for export to Greece for which Infinity Power is exploring supplying renewables. It is unclear how the 9.5 GW plan will fit in the 3 GW Greece-Egypt Interconnector announced prior, raising the prospect that additional infrastructure will need to be built. Additionally, Norway’s Scatec signed an MoU to study an Egypt-Europe electricity interconnection project in July, and Belgian company Jan De Nul discussed potential collaborations in the electricity interconnection projects between Egypt and Europe in May.

WATCH THIS SPACE #2- We have a figure for Masdar’s next green bond issuance: Renewables giant Masdar is planning to issue USD 750 mn-1 bn in green bonds within six to nine months after closing its USD 750 mn debut bond sale earlier this year, CFO Niall Hannigan tells Bloomberg. The planned issuance is part of Masdar’s USD 3 bn push to grow its global portfolio to 100 GW of capacity by 2030, the output from which will be directed towards “the greenest projects” including solar, wind, and renewable power transmission.

WATCH THIS SPACE #3- Total will invest USD 300 mn in a JV with Adani Green: French oil giant TotalEnergies will invest USD 300 mn to form a joint venture with Adani Green on a renewable energy project, according to a statement. The project will have the capacity of around 1 GW of electricity from solar and wind power in India. Adani Green will contribute assets to the venture. “This will help deliver our vision to have 45 GW renewable energy capacity by 2030,” Adani Group Chairman Gautam Adani said in the statement.

TotalEnergies has a history with Adani: TotalEnergies is the second largest shareholder of Adani Green with a 20% stake since 2021. It also acquired a 50% interest in some of Adani Green’s solar farms in a USD 2.5 bn transaction that was among the largest foreign investments in India. This is also the two companies' first deal since fraud allegations were made against Adani earlier this year, battering investor confidence.

REMEMBER- The Qatar Investment Authority reportedly also bought shares worth USD 500 mn in Adani Green Energy last month, representing some 3% of Adani’s green energy arm, providing a lifeline for the company after facing fraud allegations earlier this year.

WATCH THIS SPACE #4- Hyundai likely to solidify plans for KSA-based EV assembly plant next month: In an upcoming October visit headed by the company’s chairman, Hyundai Motor Company is planning to ink a formal agreement with Saudi Arabia to set up an EV assembly plant in the kingdom, Korea Economic Daily reported. According to a preliminary agreement signed earlier this year, the project will send semi-finished electric vehicles and parts to Saudi Arabia for assembly and sale in the local market, the outlet added.

REMEMBER- In January, Saudi Arabia signed an MoU with Hyundai Motor Company for the construction of an EV and internal combustion engine manufacturing plant. Automaker Hyundai Kefico — a subsidiary of Hyundai — signed a KRW 250 bn (c. USD 196 mn) agreement in July to supply spare parts to Saudi Arabia’s first EV manufacturing company Ceer.

China’s Jinko Power secures BOO contract for 400 MW PV farm in KSA’s Al Jowf: A consortium led by Chinese renewables developer Jinko Power has nabbed a USD 315 mn build-own-operate (BOO) contract for a 400 MW solar energy plant in KSA’s northern Al Jowf province after submitting the most competitive Levelized Cost of Energy bid to the Saudi government, YICAI reports, citing a company statement. The plant would have a 450 MW peak power capacity, generating up to 1.2 bn KWh (1.2 mn MWh) of clean energy annually. The company did not reveal when it would break ground on the project, but said construction would be completed in 21 months, the solar payback period — the time it takes developers to make back initial solar investment — will be around 14 years, and that it will retain operating rights for the plant for 30 years.

The financing: The company said it plans to raise some USD 137 mn from senior unsecured CNY-denominated green bonds with less tenors below three years to finance its overseas projects and repay existing debts, but did not specify if its upcoming KSA project would be funded through the note issuance.

A strong MENA renewables portfolio: Jinko Power’s regional renewables assets include the UAE’s 2 GW Al Dhafra solar park, Oman’s 500 MW Manah 2 PV plant, and KSA’s 300 MW Saad solar energy project. The company has also been shortlisted to develop the 1.1 GW Al Henakiyah and 400 MW Tabrajal solar parks in KSA, and submitted bids to The Emirates Water and Electricity Company (Ewec) to develop the UAE’s 1.5 GW Al Ajban solar IPP project. Earlier this month, a JV between the company and Singapore’s Sembcorp Utilities secured approval for its share capital to be listed on the Third Market of the Muscat Stock Exchange.

Banque Misr launching green investment fund: State-owned Egyptian bank Banque Misr reportedly plans to establish a green investment fund in 1Q 2024, Daily News Egypt reports, citing sources it says have knowledge of the matter. The fund will focus on investing in companies that adhere to environmental, social, and governance (ESG) standards, particularly those listed on the EGX. The bank is awaiting approval from the Central Bank of Egypt and is set to align its investment strategy with S&P global’s sustainability index. The size of the fund is yet to be announced.

What’s a green investment fund? Green investment funds are mutual funds that finance companies that show a commitment to incorporating ESG into their operational fabric — a standard that is increasingly demanded by investors and consumers around the world.

REMEMBER– Just last week, Banque Misr was among a coalition of local lenders extending EGP 30 bn in financing for green hydrogen projects to Egypt’s SCZone. The bank is increasingly bolstering its green lending portfolio.

|

***

YOU’RE READING ENTERPRISE CLIMATE, the essential MENA publication for senior execs who care about the world’s most important industry. We’re out Monday through Thursday by 5am Cairo / 5am Riyadh / 6am UAE.

EXPLORE MORE OF ENTERPRISE ON THE WEB — tap or click here to read EnterpriseAM, EnterprisePM, and The Weekend Edition on our powerful new website packed with reader-friendly features.

Were you forwarded this email? Get your own subscription without charge here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

CIRCLE YOUR CALENDAR- Algeria will host its International Fair on Environment and Renewable Energy (Sieera) from Wednesday, 27 September through Friday, 29 September at Algiers’ Exhibition Palace. The conference will see local and international exhibitors debut their green tech offerings, and will include workshops and talks centered on accelerating the transition to clean energy sources with a focus on the role climate and green tech-focused startups and SMEs can play to create a net-zero pathway. The guest of honor for this year’s addition will be South Korea, and Sieera aims to capitalize on the country’s green tech know-how and capabilities to facilitate knowledge transfer and collaboration agreements between the developers of both countries.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

ELECTRIC VEHICLES

South Korea’s CEVO + UAE’s Masari-Atlantis agree to set up EUR 100 mn EV factory

CEVO, Masari-Atlantis are investing EUR 100 mn in an EV factory in Dubai: UAE-based Masari-Atlantis and South Korea’s CEVO Mobility signed an investment contract on Thursday to invest EUR 100 mn in a new electric vehicle factory in Dubai next year, Gulf Today reports.

In detail: CEVO and Masari-Atlantis plan to produce 20k electric vehicles per year at the factory, which will span 200k sqm. The first EV from the new factory is expected to be produced in 2024, according to Gulf Today. The two companies also agreed on an EV development plan to produce four-seater vehicles, including trucks, commercial vehicles for urban logistics and delivery markets, and custom-order sports cars in Dubai.

Who’s who: Masari-Atlantis is a joint venture between British Columbia-based investment firm Masari and Dubai-based Atlantis Wide and Petro Trading, according to Gulf Today. CEVO Mobility specializes in micro-electric vehicles and currently leads the South Korean micro-EV market.

The UAE EV market is booming: Dubai is setting its sights on having 42k electric cars on its roads by 2030, with the UAE’s EV market expected to grow at a CAGR of around 28.5% during the 2023-28 period, according to a market research report. Annual EV car sales in the Middle East, including the UAE, is currently at 3-4 mn units, Gulf Today says.

IN OTHER EV NEWS-

Saudi Arabia has granted EV manufacturer Lucid Motors an operating license for its manufacturing unit in the King Abdullah Economic City (KAEC) in Rabigh, west of the Kingdom, Asharq Al Awsat reports. Lucid — which is backed by Saudi’s Public Investment Fund (PIF) — broke ground on the factory last year, with intentions to diversify the national automotive sector by granting building permits to build the Lucid factory in the KAEC special economic zone. The facility in Saudi is estimated to be about 1.35 mn sq meters and occupies about 31% of the total area allocated to the automotive industry in the KAEC Special Economic Zone.

REMEMBER- Saudi is looking to convert 30% of the vehicles in Riyadh into electric cars to achieve its 2030 Vision.

ALSO- LG Chem and China's Huayou Group partner up for LFP in Morocco: LG Chem and Youshan plan to build a Lithium-Phosphate-Iron (LFP) cathode material plant and lithium conversion plant in Morocco, according to a statement. The two companies are expected to produce 50k metric tons of LFP cathode materials a year — which allows them to produce more affordable EV’s from 2026. This is enough to be installed in 500k electric vehicles that have 50 KWH capacity and a 350-km range. The two companies plan to build four facilities, including an LFP cathode material plant and a lithium conversion plant in Morocco, while also building a high-pressure acid leaching (HPAL) plant, a precursor plant, and a nickel processing plant in Indonesia.

STARTUP WATCH

Zero Carbon Ventures closes USD 5 mn seed round

Zero Carbon Ventures bags USD 5 in seed funding: UAE-based Zero Carbon Ventures, which is dedicated to bringing carbon-reducing technologies to the region, has raised USD 5 mn in seed funding from Dubai ruling family member Sheikh Ahmed bin Mana, the company said in a statement on Thursday. The Emirati businessman was also appointed as Zero Carbon’s strategic investor and chairman of the board of directors.

Where the money’s going: The funds will help the company deliver decarbonization projects and accelerate its efforts towards global sustainability initiatives on a wider scale, the statement read.

More on Zero Carbon: Founded in 2022, the company signed a preliminary pact with Masdar City in October of last year to collaborate on CO2-reducing tech in the UAE’s capital. It has since been investing and applying innovative tech across four key areas: waste, water, energy, and materials. The company has offices in Masdar City and Abu Dhabi Global Market and is backed by British climate tech-firm Levidian, according to the company website.

Sponsoring carbon capture: One of their current projects involves tackling the issue of methane emitted from landfills by capturing the gas before it escapes into the atmosphere and repurposing it to valuable commodities, according to their website.

REMEMBER– Zero Carbon also signed an MoU in September with Egypt’s Green Planet for a pilot project focused on the treatment and transformation of organic waste into income-generating products.

GREEN TECH

NYU Abu Dhabi develops self-cleaning membranes for desalination tech

NYU Abu Dhabi develops self-cleaning membranes for desalination tech: A team of researcher at the New York University (NYU) branch in Abu Dhabi has developed new autonomous membranes designed to clean desalination technologies in a bid to accelerate sustainable potable water production efforts, according to a statement out on Wednesday.

What is membrane desalination? Membrane desalination operations involve extracting salt and minerals from water solutions through porous layers to extend the life cycles of desalination plants. Membrane desalination is prone to fouling, and is the “major culprit to elevated operating costs,” due to the deterioration of permeate flux — the liquid flowing through desal membranes, increasing pressure and resulting in frequent, costly chemical cleaning, which shortens membranes’ lifespans.

The new tech: The NYU Abu Dhabi team has developed a hybrid membrane by utilizing stimuli-responsive materials — substances that react to the presence of or changes in external stimuli, such as light, temperature, and electricity — and thermo salient organic crystals embedded in polymers to enable controlled membrane deformation through pressurized self-modulation of pore sizes to minimize salt leakages in response to changes in temperature. “The crystals on the surface of the membrane respond to short-term increase in temperature, which activates the membrane to effectively remove the deposited contaminants from its surface,” the university notes. NYU concluded a study noting that the process increased the flow of desalinated water by more than 43% compared to conventional osmotic distillation operations, and significantly extended the membrane’s operational lifecycle.

Why does this matter for the region? The MENA region is the most water-scarce region in the world, according to the Public Reference Bureau. Some 6.3% of the global population lives in the region, but MENA only has 1.4% of the world’s renewable freshwater sources. As global warming exacerbates desertification globally, the MENA region is upping its desalination projects and is looking to conserve water to withstand the effects of climate change. Seawater desalination projects currently provide more than 90% of all daily water requirements in the GCC region. The GCC region produces approximately 40% of the total desalinated water in the world, according to the MENA Desalination Market report by Ventures Onsite. Membrane desalination provides a lifeline for coastal communities in our neck of the woods to meet local demands, the research note in the statement.

CLIMATE DIPLOMACY

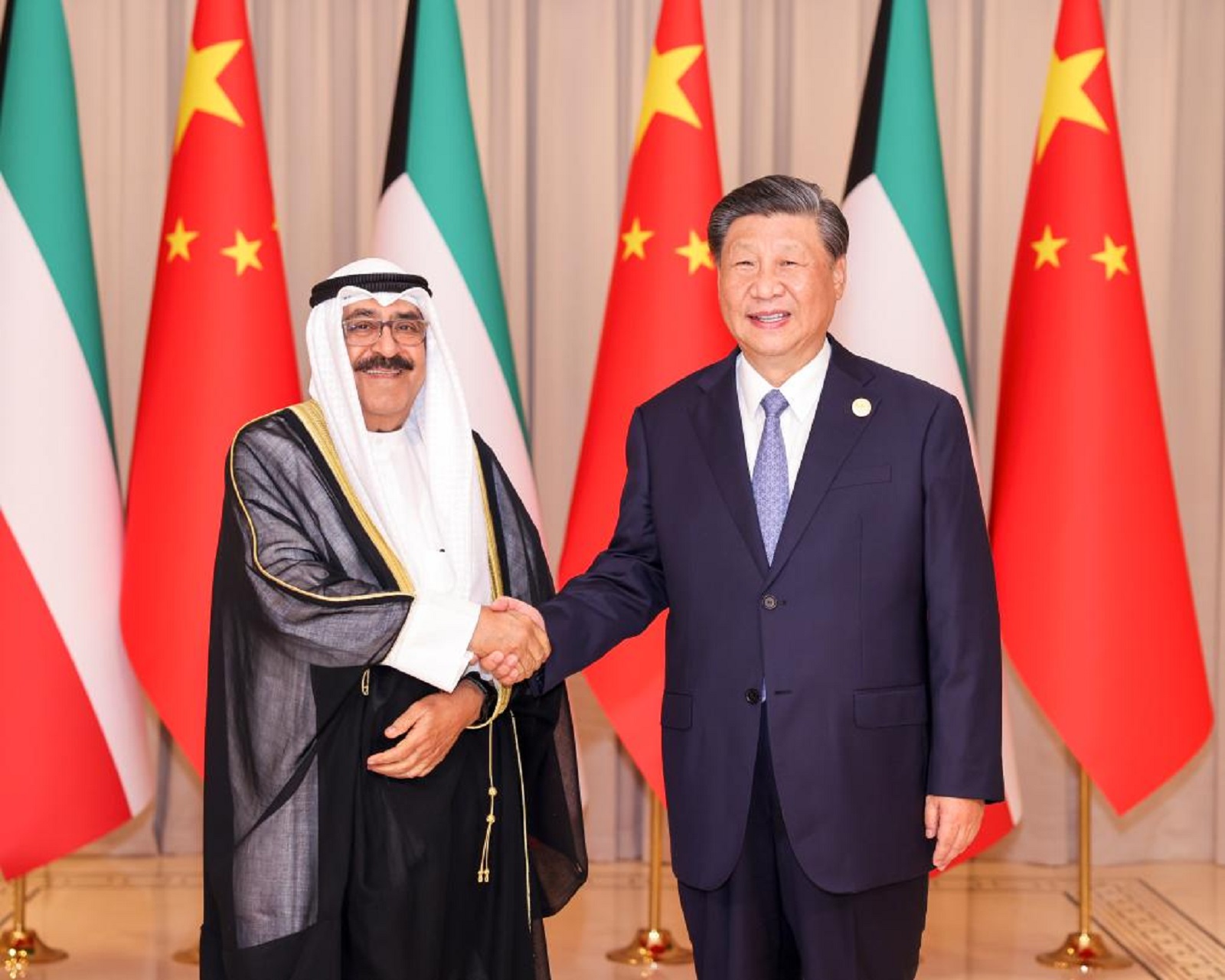

Kuwait and China partner on newables, smart city development, and low-carbon recycling + UAE and Indonesia look at smart cities, renewables, and food security. Plus: Egypt wants to work with Czech Republic on green fuels

Kuwait and China sign agreements to boost collaboration on renewables, smart cities, and low-carbon recycling: Kuwaiti Crown Prince Mishal Al Ahmad Al Sabah signed on Saturday MoUs with the Chinese government in renewable energy, smart city construction, water treatment, and low-carbon recycling, according to the Kuwait News Agency. Kuwait’s Electricity, Water, and Renewable Energy Minister Jassem Al Ostad signed a pact with China’s national energy department to establish power systems and grid infrastructure supporting the Arab country’s transition to renewables. Al Sabah also signed an MoU with China’s state-owned National Development and Reformation Commission to set up a low-carbon green recycling system as well as infrastructure for water treatment solutions in Kuwait. Kuwait announced last November during COP27 that it plans to become carbon-neutral by 2060, and has set out a target to push down by 7.4% its expected business-as-usual (BAU) emissions — 11 mn metric tons of CO2 equivalent — by 2030.

UAE and Indonesia want to team up on smart city development, renewables, and food security: UAE Energy and Infrastructure Minister Suhail Al Mazrouei met with Indonesia's President Joko Widodo on the sidelines of the UAE-Indonesia Business Forum in Jakarta to discuss increasing cooperation in smart and green cities, renewables, and food security, according to Wam. Mazrouei spotlighted potential cooperation in developing Indonesia’s new green capital Nusuantra on Borneo, which is set to become operational by 2045 in line with the country’s efforts to attain carbon neutrality by 2060. Widodo plans to reserve 70% of the new capital’s landmass as green areas in a bid to upscale national reforestation efforts. Mazrouei noted both the state and UAE private developer’s interest in helping establish various port infrastructure in Nusuantra, as well as setting up renewables projects in the country, and helping support Indonesia’s food security efforts. Indonesia has set out a target of sourcing 23% of its energy needs from renewables by 2025.

The UAE has already established a foothold in the country’s clean energy sector: Back in 2020, UAE state-owned renewable energy giant Masdar signed a power purchase agreement with Indonesia’s state-owned electricity company for the 145 MW floating solar power plant the Emirati firm had developed in the South Asian country. Earlier in February, Masdar acquired shares in the geothermal unit of Indonesian government-owned geothermal utility Pertamina, which controls 82% of Indonesia's installed geothermal energy capacity, and manages 13 geothermal energy projects generating 1.87 GW of electricity.

Egypt’s SCZone wants to partner with the Czech Republic on green fuels: The head of Egypt’s Suez Canal Economic Zone Walid Gamal El Din met last week with a delegation of Czech green hydrogen developers to explore increasing Egypt’s green fuel production and export capacities to the EU market, according to a cabinet statement on Wednesday. The SCZone head also met with representatives from the Czech Hydrogen Technology Platform (Hytep) as part of national targets to expand green methanol, ammonia, and hydrogen generation capacities. The Czech Republic unveiled its hydrogen strategy in 2021, setting out a target to produce 990 tonnes of hydrogen per year by 2025 as part of national targets to become carbon neutral by 2040. Earlier last week, SCZone officials similarly met with executives from Shell to discuss potential partnership agreements to accelerate the port’s green fuel storage and production capacity.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- Tunisia + UK discuss renewables cooperation: Tunisia’s Economy and Planning Minister Samir Said met with UK Trade Commissioner John Humphrey in Tunis on Friday to discuss potential partnerships in the Tunisian and African renewables sector, particularly capitalizing on UK green tech capabilities to support climate-focused SMEs and startups. (TAP)

- UAE + Israel talk cooperation in waste management: The UAE’s Climate Change and Environment Minister Mariam Al Mheiri met with Israeli counterpart Idit Silman to discuss partnership opportunities in waste management as well as climate action collaboration ahead of COP28 in Dubai in December. (Statement)

- Egypt, Jordan, Iraq look at renewables cooperation: The foreign ministers of Egypt, Jordan, and Iraq met in New York on Saturday to explore collaboration opportunities in renewable power and trilateral electricity interconnection. (Statement)

ALSO ON OUR RADAR

EgyptSat Auto lands golden license to locally manufacture EVs: The Egyptian Cabinet has granted a golden license to private company EgyptSat Auto to build and operate a EGP 300 mn EV production plant in 10th of Ramadan City, according to a statement on Wednesday. The 50k sqm factory is set to start producing electric passenger cars, buses, motorcycles, and charging stations by the end of 2024, and is expected to create 500 jobs, the statement read.

Golden license? A golden license effectively serves as one single approval covering everything from project establishment, including land allocation and building licensing, through to project operation and management. Check out our explainer on it here.

This isn’t the first we’re hearing of EV incentives: Last year, Egyptian Prime Minister Moustafa Madbouly launched a national strategy to support the emerging industry. The Egyptian Automotive Industry Development Program (AIDP) encourages EV localization with the aim of enhancing the country’s existing assembly and manufacturing capabilities, and of encouraging new investment into the sector.

Egypt’s state-owned Banqe du Caire is teaming up with the International Finance Corporation (IFC) to develop a new climate finance framework, according to an IFC statement. The framework is designed to help protect Banque du Caire from climate risk, promote green investment options and accelerate the decarbonization of Egypt’s economy. This comes in line with the Egyptian government’s Nationally Determined Contributions (NDCs), which hope to see GHG emissions reduced by 37% within the next seven years.

About the partnership: IFC will conduct an internal assessment of Banque du Caire’s operations, which will include reviewing its portfolio of existing climate finance assets and screening its portfolio against climate risk, with the aim of transforming the lender’s current finance strategy into an actionable climate-friendly workplan, the statement read.

Oman signs 2 MoUs to explore geological hydrogen: Oman’s Energy and Minerals Ministry signed two MoUs with Eden GeoPower and Earth Sciences Consultancy Centre to facilitate scientific discussions on conducting preliminary studies on exploring geological white hydrogen and identifying sites for conducting experimental research, Oman News Agency reports. Oman is among the countries to have found deposits of geological hydrogen this year. The gas can be found in abundance in layers of continental and oceanic crusts, geysers, and hydrothermal systems and can supply vast amounts of net zero energy.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- FAB partners with UAE’s Blue Carbon to boost investments in carbon offsetting: Dubai-based carbon management company Blue Carbon has signed an MoU with First Abu Dhabi Bank (FAB) to facilitate financing of carbon reduction initiatives including managing carbon credits. Blue Carbon currently has operations in Africa and Asia. (Statement)

- GV Investments to launch ready-made factories initiative in Egypt’s Tarboul: Egyptian industrial developer GV Investments has set aside an area of 500k sqm to build ready-made industrial complexes for medium and small-sized projects in Tarboul City, the largest sustainable industrial city in Egypt. (Zawya)

- UAE to increase investment in DR Congo’s green energy mining: Abu Dhabi-based Primera Group will increase its investment in mining important green-energy minerals including copper and cobalt in DR Congo — the world’s biggest cobalt producer — after starting a gold venture with the government in January. (Bloomberg)

- Abu Dhabi is exploring more green collaboration with France and Germany: A delegation from Abu Dhabi’s energy department met with a number of high-ranking government officials and stakeholders in France and Germany’s energy sectors to discuss green partnerships and knowledge exchange for the energy transition. (Wam)

- ENOWA trials using helicopters instead of carbon-heavy equipment: NEOM’s water and electricity subsidiary, ENOWA, installed high-voltage transmission line towers by airlifting individual tower components using helicopters to the NEOM mountains and assembling them at the tower base, eliminating the need for carbon-intensive trucks, cranes, and heavy equipment. (Statement)

AROUND THE WORLD

Mitsubishi kicks off operations on world’s first hydrogen validation facility: Japan’s Mitsubishi Heavy Industries began full-scale operations on the world’s first fully fledged hydrogen certification facility, according to a company statement out on Wednesday. The validation body — named Takasago Hydrogen Park — aims to certify equipment validation of hydrogen production and power generation technologies, as well as ensure full hydrogen reliance for gas turbines. The park will also support the expansion of the hydrogen sector with the introduction of new low-carbon fuel generation technologies, the company notes. Hydrogen certification aside, the park also brought online the world’s largest alkaline electrolyzer plant in Hyogo Prefecture in west central Japan, which boasts a 1.1k normal cubic meter per hour capacity (Nm3/h), equivalent to 100 kg of pure pressurized hydrogen production volume per hour. The green fuels the plant will produce will be stored at the park’s 39k Nm3 hydrogen depot. The hydrogen the company produces will be verified as 100% renewables powered at Mitsubishi’s T-Point combined cycle power plant facility using the company’s 450 MW Power Jac gas turbine, with plans to validate hydrogen co-firing at the facility by the end of 2023, and later validating 100% of hydrogen firing of its H-25 gas turbine by next year.

More hydrogen certification facilities to come: Mitsubishi Power is also developing solid oxide electrolysis cells (SOEC), anion exchange membrane (AEM) water electrolyzers, and turquoise-hydrogen production tech with no carbon generation owing to methane decomposition operations that transform the gas into hydrogen and solid carbon, according to the statement. “The company plans to conduct verification and validation in these areas sequentially. After developing these fundamental technologies for products based on its proprietary technologies at the Nagasaki Carbon Neutral Park, Mitsubishi Power plans to carry out hydrogen production validation of these technologies at the Takasago Hydrogen Park with the aim of achieving commercialization,” the company said.

Exxon steers toward carbon capture and away from EV charging: ExxonMobil is developing direct air capture (DAC) technologies in its plans for a net-zero future, Senior VP of Exxon’s Low Carbon Solutions Matthew Crocker tells Reuters. The oil company will not invest in EV charging stations as “it’s not an area in which the company can bring significant competitive advantage,” Crocker said. DAC “would link very closely to our [carbon capture and storage] business where we are going to have large geologic storage and the capability to capture CO2,” he added. Exxon’s energy transition focuses on reducing CO2 emissions, hydrogen, and biofuels rather than investing in renewables. CCS and reducing emissions account for Exxon's USD 17 bn low-carbon business through 2022-2027. The company has been working with renewables experts like FuelCell Energy to develop its carbon capture program.

Kenya and Britain’s GBM ink agreement for construction of USD 3 bn dam: Kenya has signed a project development agreement with British construction firm GBM to carry out a feasibility study for the construction of a USD 3 bn dam with the potential to generate up to 1 GW of electricity, according to a National Irrigation Authority statement. The agreement gives GBM permission to set up bases and begin preparations at the project site, and comes ahead of the signing of a final contract, as well as financial close and concession agreements. The dam will be constructed under a public-private partnership.

Project profile: Upon completion, the mega dam, dubbed High Grand Falls, is expected to be the second largest in Africa, with its reservoir covering over 165 sq km with a water volume of about 5.6 bn cbm to irrigate 400k acres of land, the authority said.

IFC secures USD 3.5 bn from 13 ins. providers to expand development finance: The International Finance Corporation (IFC) inked a USD 3.5 bn credit ins. policy with 13 global ins. companies under its Managed Co-lending Portfolio Program (MCPP), the IFC in a statement on Thursday. The policy will help IFC increase access to finance for MSMEs, including women owned businesses as well as climate-friendly firms in emerging markets across the world.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- ADB and KEITI to team up on low-carbon, climate-resilient tech: The African Development Bank (ADB) and the Korea Environmental Industry and Technology Institute (KEITTI) are dedicating USD 13 bn to support investment in low-carbon and climate-resilient technologies in a number of African countries. (Statement)

- UK minister defends gov’t approach to net zero: The UK is taking a “pragmatic and proportional approach” to facing climate change without impacting British citizens’ income, British Interior Minister Suella Braverman said, while denying claims that the government is not fulfilling its net zero commitments. (The Guardian)

- US’ EPA invites bids for USD 4.6 bn grants to help lower greenhouse gas emissions: The US’ Environmental Protection Agency (EPA) is offering USD 4.6 bn-worth of grants — funded through US President Joe Biden’s Inflation Reduction Act — to governments across the country to finance climate action projects. (Reuters)

CLIMATE IN THE NEWS

Airports are feeling the heat: Airports around the world have recently begun to adopt new designs and procedures to accommodate operational challenges caused by climate change, such as extreme heat, drenching, and temperature fluctuations, Bloomberg reports. These designs include using heat-resistant materials for construction, relocating electrical equipment to rooftops, reinforcing runways, and enhancing air conditioning systems to combat climate change. In Amsterdam, Schiphol Airport has elevated and sloped its runways to ensure proper drainage during intense rainfall, while Nice Airport in France had to decrease its industrial water usage due to the limited supply of water. The number of airports vulnerable to flooding is expected to double along the North Sea coast, where the effects of sea level rise are more severe, between 2030 and 2080, according to a study (pdf).

Some MENA airports didn't get the memo yet: MENA is one of the world's most vulnerable regions in terms of climate due to its degraded marine and coastal ecosystems, rising summer temperatures, encroaching desertification, scarcity of freshwater, and increased air pollution, according to the World Bank. Dubai’s airport so far is resilient enough to handle its climate, as its runway is made up of combinations of asphalt that can withstand scorching temperatures, while Iraq’s airport, unprepared, had to shut down airports and public buildings after being hit by a sandstorm last year.

Ethanol groups slam EPA over claims the biofuel has “minimal climate benefits”: An advisory board to the US Environmental Protection Agency (EPA) is under fire from the ethanol and corn industries for a draft report concluding that using corn-starch ethanol as fuel has little climate benefit, Reuters reported on Friday. The report, which was discussed in a public meeting by the advisory board on Thursday in Washington DC, found that there is “a reasonable chance there are minimal or no climate benefits from substituting corn-ethanol for gasoline or diesel,” a conclusion that has drawn criticism from industry experts.

The counter-argument: “We adamantly disagree,” said Geoff Cooper, CEO of the Renewable Fuels Association, citing stats by the Department of Energy’s Argonne National Laboratory saying that ethanol is 44% lower in emissions than gasoline.

The report will be revised…: The full board voted to accept the draft report pending revisions. Some suggested revisions include softening the report’s language and clarifying uncertainties in the scientific literature.

…but the debate remains unsettled: Biofuel lobbyist Chris Bliley argued that the draft comment “cherry picks certain data from a few anti-ethanol critics,” whereas others maintained that new studies suggest ethanol may be less climate-friendly than previously thought.

CALENDAR

SEPTEMBER 2023

26-27 September (Tuesday-Wednesday): GCC-Iraq Business Forum, Sharjah, UAE.

28 September (Thursday): International Energy Agency Critical Minerals and Clean Energy Summit, Paris, France.

Chariot Limited and Total Eren’s feasibility study on a 10 GW green hydrogen plant in Mauritania is to be completed.

Egypt set to launch alliance to shore up climate financing in developing countries.

OCTOBER 2023

2-5 October (Monday-Thursday): ADIPEC Decarbonization Accelerator, Abu Dhabi, UAE.

4 October (Wednesday): Arabia CSR Gala Awarding Ceremony, UAE.

4-5 October (Wednesday-Thursday): Future Sustainability Forum, Dubai, UAE.

8-10 October (Sunday-Tuesday): Saudi Green Building Forum, Riyadh, Saudi Arabia.

10-11 October (Tuesday-Wednesday): Green Energy Africa Summit, Cape Town International Convention Centre 2, Cape Town, South Africa.

8-12 October (Sunday-Thursday): MENA Climate Week, Riyadh, Saudi Arabia.

9-15 October (Monday-Sunday): World Bank/IMF 2023 Annual Meetings, Marrakech, Morocco.

10-12 October (Tuesday-Thursday): Autonomous E-Mobility Forum, Doha, Qatar.

16-17 October (Monday-Tuesday): Duqm Economic Forum, Duqm, Oman.

16-18 October (Monday-Wednesday): Climate Week, Rome, Italy.

16-20 October (Monday-Friday): UNCTAD World Investment Forum, Abu Dhabi, UAE.

18-20 October (Wednesday-Friday): Morocco and Belgium business meeting on green hydrogen, Tangiers, Morocco.

17-18 October (Tuesday- Wednesday): Critical Minerals Africa Summit, Cape Town, South Africa.

17-19 October (Tuesday-Thursday): Energy Intelligence Forum, London, UK.

17-20 October (Tuesday-Friday): Fourth meeting of the COP27 Transitional Committee, Aswan, Egypt.

25-26 October (Friday-Saturday): Offshore & Floating Wind Europe 2023, London, United Kingdom.

29 October-2 November (Sunday-Thursday): Cairo Water Week, Cairo, Egypt

31 October-2 November (Tuesday-Thursday): Financial Times’ Energy Transition Summit, London, UK.

31 October-2 November (Tuesday-Thursday): World Hydropower Congress, Bali, Indonesia.

NOVEMBER 2023

1-3 November (Wednesday-Friday): Forbes Middle East Sustainability Leaders Summit 2023, Abu Dhabi, UAE.

7-8 November (Tuesday-Wednesday): ADIA Lab Symposium on Climate Change and Health Sciences, Abu Dhabi, UAE.

7-8 November (Tuesday-Wednesday): The 2023 US Algeria Energy Forum, Washington DC, USA.

9-10 November (Thursday-Friday): International Renewable Energy Agency Investment Forum, Uruguay.

9-15 November (Thursday-Wednesday): Intra-African Trade Fair 2023, Cairo, Egypt.

15-17 November (Wednesday-Friday): WETEX and Dubai Solar Show, Dubai, UAE.

15-18 November (Wednesday-Saturday): DEWA’s First MENA Solar Conference, Dubai, UAE.

20-24 November (Monday-Friday) International Civil Aviation Organisation’s Aviation and Alternative Fuels conference, Dubai, UAE.

27-30 November (Monday-Thursday) Abu Dhabi Finance Week (ADFW), Abu Dhabi, UAE.

28-29 November (Tuesday-Wednesday): World Green Economy Summit (WGES), Dubai, UAE.

30 November – 12 December (Thursday-Tuesday): Conference of the Parties (COP 28), Dubai, UAE.

DECEMBER 2023

4 December (Monday): Saudi Green Initiative Forum, Dubai, UAE.

4 December (Monday): Abu Dhabi Sustainability Week (ADSW) summit, Dubai, UAE.

8 December (Friday): Youth for Sustainability Forum (Y4S), Dubai, UAE.

12-14 December (Tuesday-Thursday): Green Hydrogen Summit Oman, Oman Convention and Exhibition Center, Muscat, Oman.

18-20 December (Monday-Wednesday): Saudi Arabia Smart Grid Conference, Hilton Riyadh Hotel & Residences, Riyadh, Saudi Arabia.

JANUARY 2024

9-11 January (Tuesday-Thursday): Future Minerals Forum, Riyadh, Saudi Arabia.

FEBRUARY 2024

26-28 February (Monday-Wednesday): Management and Sustainability of Water Resources, Dubai, UAE.

MARCH 2024

4-6 March (Monday-Wednesday): International Conference on Sand and Dust Storms in the Arabian Peninsula, Riyadh, Saudi Arabia.

APRIL 2024

16-18 April (Tuesday-Thursday): World Future Energy Summit, Abu Dhabi, UAE.

23-25 April (Tuesday-Thursday): Connecting Green Hydrogen MENA, Dubai, UAE.

JUNE 2024

5 June (Wednesday): World Environment Day, Saudi Arabia.

DECEMBER 2024

2-13 December (Monday-Friday): Conference of the Parties (COP16) to the United Nation Convention to Combat Desertification, Riyadh, KSA.

EVENTS WITH NO SET DATE

2023

Mid-2023: Oman set to sign contracts for green hydrogen projects.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

2024

12-14 February (Monday-Wednesday): Sustainable Aviation Futures MENA Congress, Dubai, UAE.

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

2025

International Union for Conservation of Nature World Conservation Congress, Abu Dhabi, UAE.

UAE to have over 1k EV charging stations installed.

2026

UITP Global Public Transport Summit, Dubai, UAE.

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2050

Tunisia’s carbon neutrality target.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.