- Japanese power company Jera wants to partner with Taqa on decarbonization projects. (Renewables)

- UAE’s Brooge Energy and Siemens ink agreement on green hydrogen production. (Green Hydrogen)

- Fertiglobe and Tabreed had a good 2022. (Earnings Watch)

- Raad Esmat Al Saady to replace Acwa Power CEO “Paddy” Padmanathan. (Moves)

- How MENA is harnessing data to accelerate climate action. (Greentech Corner)

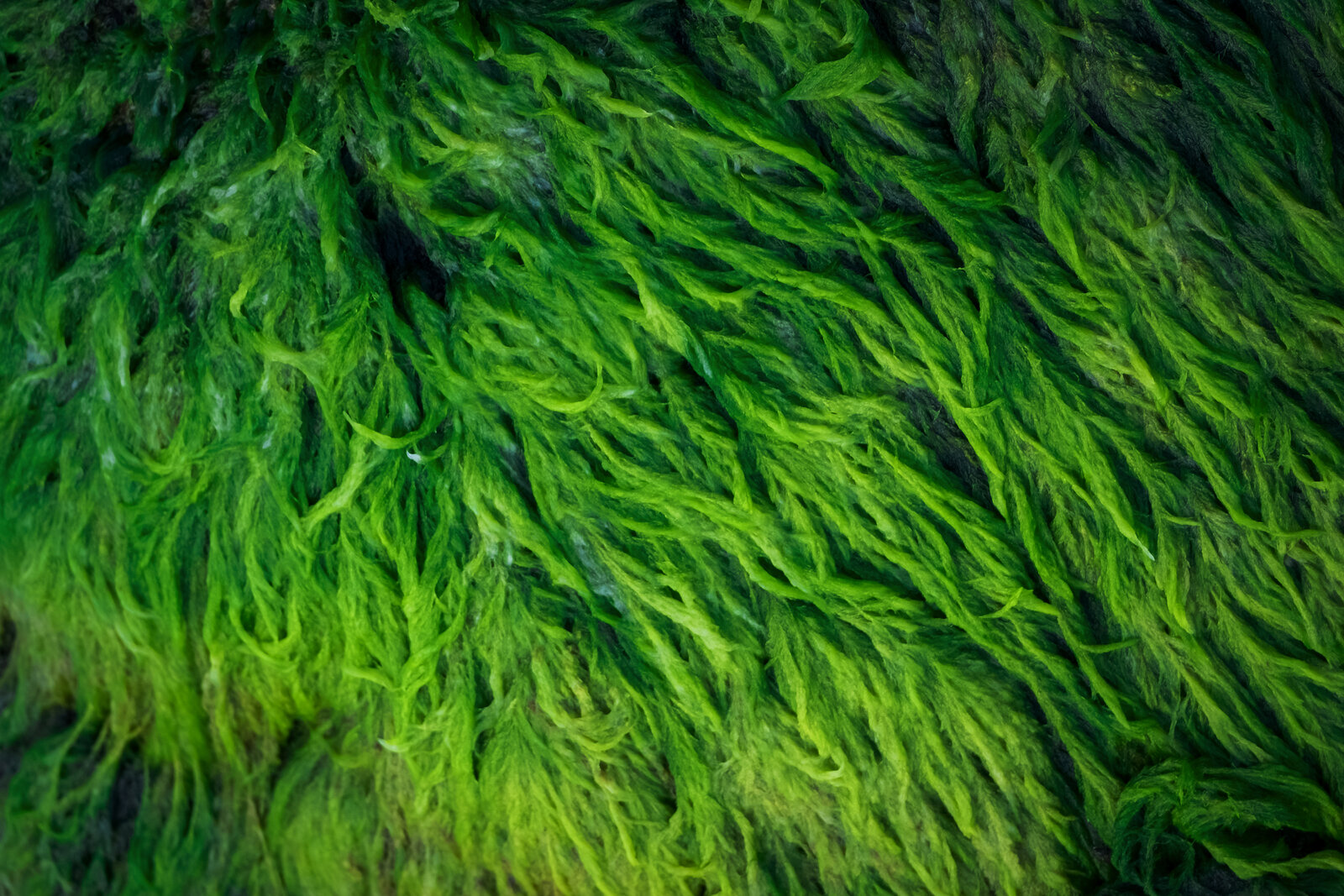

- How some sustainable fashion is so green, it literally grows in ponds. (On Your Way Out)

Thursday, 16 February 2023

Japan’s Jera wants to partner with Taqa on decarbonization projects

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends. We’re closing out the week strong with a hefty issue covering some new renewables agreements and earnings reports from key regional players. Let’s roll.

THE BIG CLIMATE STORY- Japanese power generation company Jera has inked an agreement with Taqa to jointly explore the feasibility of decarbonization projects in MENA, while UAE-headquartered Brooge Energy signed an agreement with Siemens Energy to build a green hydrogen facility in Abu Dhabi.

^^We have chapter and verse on these stories and more in the news well below.

THE BIG CLIMATE STORY OUTSIDE THE REGION-

We knew Antarctica’s “Doomsday Glacier” was melting. We’ve just learned that warm water entering its weaker parts is speeding the process up. The climate change-induced melting of Antarctica’s Thwaites Glacier, the so-called Doomsday Glacier, is being accelerated by warmer water seeping into the glacier’s weak spots, according to studies published yesterday in the journal Nature. Research started in 2019 saw US and British scientists send an underwater robot down a 600-meter hole made in Thwaites, allowing them to study the glacier from previously inaccessible places. They used sensors to collect data from key areas — including where the glacier’s ice meets the ocean — ultimately discovering that warmer water was flowing into the structure’s crevasses and exacerbating the instability caused by already-warming temperatures.

What could this mean? Irreversible collapse and huge sea level rise: The total collapse of Thwaites — which spans an area roughly the size of Florida — could cause a sea level rise of half a meter, which would have devastating consequences for the world’s coastal areas and potentially cause mass migration. But because Thwaites is essentially a stabilizing force for nearby glaciers, its collapse could also trigger a further three meter rise in global sea levels, the research found.

The story is attracting widespread coverage: Guardian | New York Times | NBC | CNN | AP | BBC | Reuters

IN COP LAND- COP28 needs to deliver on action, USD and an inclusive energy transition, say key stakeholders: COP28 President Sultan Al Jaber plans to “lay out a roadmap for COP28 that is inclusive, results-oriented and far from business as usual,” he said at the World Government Summit (WGS), which ran from Monday-Wednesday in Dubai, Reuters reported. Al Jaber called for “a major course correction” to slash emissions and keep the Paris Agreement goal of limiting the global temperature increase to 1.5°C within sight. “Keeping 1.5 alive is a top priority and it will cut across everything I do,” Al Jaber separately told Reuters in an interview.

As expected, climate finance is on everyone’s mind: COP28 should offer the chance “to zero in on what has been an elusive target,” noted IMF Managing Director Kristalina Georgieva in an interview with the National on the sidelines of the WGS. This includes the need to provide climate finance to emerging markets and developing countries, she added. Capital is essential to make the loss and damage fund — agreed upon at COP27 — “real and operational,” noted Al Jaber. Though the agreement to establish the fund was a big W, many details still need to be ironed out before it gets off the ground, we noted last month.

The role of DFIs remains under the microscope: Among COP28’s key aims is determining how to raise funds to address the region’s climate change-induced challenges — including desertification, coastal erosion, and air pollution, World Bank Vice President for MENA Ferid Belhaj told Wam on the sidelines of WGS. But “real reform” of multilateral banks and international financial institutions is needed to spur concessional financing, reduce risk, and draw more funds from the private sector, said Al Jaber. This echoes key messages from COP27, but could also reignite last year’s debate around DFI reform that centered particularly on the World Bank.

WATCH THIS SPACE- The European Parliament has approved a law to ban the sale of carbon-emitting petrol and diesel vehicles by 2035, France 24 reports. The law — passed in October — will allow carmakers to adapt their plants to EV production during the interval before it is enforced. EVs make up only 12% of new cars being sold in Europe, the outlet reports. While some dubbed the law “a historic vote for the ecological transition,” conservative MPs objected to the bill pointing to concerns about the 600k individuals whose employment is at risk in Germany alone if carbon-emitting petrol and diesel cars are phased out.

|

***

YOU’RE READING ENTERPRISE CLIMATE, the essential regional publication for senior execs who care about the world’s most important industry. Enterprise Climate covers everything from finance and tech to regulation, products and policy across the Middle East and North Africa. In a nod to the growing geographical ambitions of companies in our corner of the world, we also include an overview of the big trends and data points in nearby countries, including Africa and southern Europe.

Enterprise Climate is published at 4am CLT / 5am Riyadh / 6am UAE Monday through Thursday by Enterprise, the folks who bring you Enterprise Egypt, your essential 6am and 3pm read on business, finance, policy and economy in Egypt and emerging markets.

Subscribe to Enterprise Climate here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

CLIMATE DIPLOMACY- Libya explores renewables agreements: French ambassador to Libya Mostafa Mihrajeon met with Chairman of Libya’s National Oil Corporation Ferhat Bengdara to discuss bilateral cooperation on renewables and oil, according to a tweet from Mihrajeon. Details of which projects are being targeted by France were not disclosed.

Background: Libya established the Renewable Energy Authority of Libya (REAoL) in 2007 with a target to generate 10% of its energy needs from renewables by 2020, with the bulk of its energy requirements coming from wind. REAoL’s Tawergha solar project was handed over to a consortium of Germany’s GTG Holding Company and the Fraunhofer Institute for Solar Energy Systems earlier this month. The project will have an installed peak capacity of 1 MW and acts as a pilot project for future developments.

Israel, Egypt strengthen ties on energy: Egyptian Minister of Electricity and Renewable Energy Mohamed Shaker and Israeli Minister of Energy Israel Katz discussed investments in renewable energy and regional connectivity in Cairo, according to a tweet by Katz earlier this week.

COME TO OUR NEXT ENTERPRISE FORUM-

We’re excited to unveil our next C-level event in Cairo: The Enterprise Exports & FDI Forum, where we will take a deep dive into two of the most critical topics affecting our community.

Interested to learn more about how Egypt is planning on drumming up foreign direct investment (FDI) for all these green hydrogen, solar and wind agreements? Exports and FDI have never been more important to Egypt’s economy — or its businesses — than in the wake of the float of the EGP and the country’s positioning as a regional renewable energy hub. We think there’s a unique chance to build an export-led economy that makes Egypt a magnet for FDI and all the benefits that will come with it.

Want to join the conversation? Drop us a line on events@enterprisemea.com.

CIRCLE YOUR CALENDAR-

The UAE will host the World Environment, Social and Governance Summit from next Tuesday, 21 February to Thursday, 23 February in Dubai. The summit will host discussions on reducing carbon emissions and the urgency to incorporate ESG. Stakeholders from various fields will address the financial and strategic implementation of ESG.

Egypt will host the CSR Forum from 2-5 March at Somabay, Hurghada. The event aims to further discussions put forth during COP27 and boost private and public sector cooperation on climate action. You can register for the event here.

The Arabia CSR Awards is accepting applications until Friday, 30 June. The awardwinners will be announced during a ceremony on Wednesday, 4 October.

The first MENA Solar Conference is accepting applications from published researchers specialized in PV technology until Sunday, 30 April. The Dubai Electricity and Water Authority will be hosting the conference from 15 to 18 November, in conjunction with the Water, Energy, Technology, and Environment Exhibition and the Dubai Solar Show 2023. Researchers can submit their papers here.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

RENEWABLES

Jera wants to partner with Taqa on decarbonization projects

Japan’s Jera, UAE’s Taqa to explore renewables development: Japan’s power generation company Jera signed an MoU with Abu Dhabi National Energy Company (Taqa) to jointly explore the feasibility of low-carbon thermal energy, ammonia, and green hydrogen production projects in MENA, according to a company statement. The timeline and financials were not disclosed, nor were the countries both companies are eyeing for potential investments.

Not Japan’s first foray into MENA renewables: Jera signed an MoU with Mubadala-owned renewables firm Masdar in January to explore joint hydrogen production potential. Adnoc CEO — and newly-appointed COP28 President — Sultan Al Jaber also signed an agreement in the same month for bilateral cooperation on decarbonization technology with Japan’s Minister of Economy, Trade and Industry, Yasutoshi Nishimura.

Taqa is drumming up capital to fuel expansion plans: The company revealed plans to issue “several USD hundred mn” of green bonds in 2023 for specific projects earlier this week. Taqa aims to sell bonds, acquire assets, and expand in both its core industries — power generation and desalination — and nascent sectors like renewable energy, in line with its overall growth strategy.

GREEN HYDROGEN

Siemens and Brooge Energy will partner on green hydrogen production in the UAE

UAE-headquartered Brooge Energy inked an agreement with Siemens Energy to build a solar-powered green hydrogen facility in Abu Dhabi, Wam reports. The timeframe and price tag of the project have not been disclosed.

Siemens is keen on boosting MENA’s green hydrogen production capacity: Egypt’s Electricity and Renewable Energy Minister Mohamed Shaker met with Siemens Energy’s Egypt Managing Director Layla El Hares to explore potential cooperation on green hydrogen and renewable energy generation capacities earlier this month. Siemens Gamesa — a subsidiary of Siemens Energy — is a major player in Egypt’s wind energy sector, and is involved in the Ras Ghareb, West Bakr, and Gabal El Zeit projects in the Gulf of Suez.

And has SAF production in its sights: Siemens energy partnered with Masdar, Marubeni, and TotalEnergies in January to obtain licenses certifying the feasibility of producing sustainable aviation fuel from methanol gas.

About Brooge Energy Limited: Nasdaq-listed Brooge Energy is the parent company of Fujairah-based oil and services firm Brooge Petroleum and Gas Investment Company FZE, and has had plans, since August, to provide consulting services for a potential green hydrogen facility in the UAE, according to a company statement.

EARNINGS WATCH

Fertiglobe had a good 2022, despite a drop in 4Q bottom line + Tabreed’s 2022 income and revenue rise as it continues regional expansion drive

Fertiglobe reports slimmer 4Q 2022 bottom line, but annual net income and revenue are up: Fertiglobe — a UAE-headquartered urea and ammonia exporter and MENA’s largest producer of nitrogen fertilizers — reported a 48% y-o-y decline in adjusted net income attributable to shareholders in 4Q 2022 to USD 172 mn, according to the company's earnings release (pdf). 4Q 2022 revenue also dipped 11% y-o-y to USD 1.1 bn, off the back of lower urea prices, along with plant turnarounds — scheduled stoppage of some or all of their operations — in the UAE and Egypt, according to the earnings. On a full-year basis, Fertiglobe’s 2022 adjusted net income rose 75% y-o-y to USD 1.29 bn, up from USD 703 mn in 2021. The company saw a 52% y-o-y increase in revenue to USD 5 bn in 2022, up from USD 3.3 bn in 2021.

No more turnarounds for UAE, Egypt facilities in 2023: The 4Q plant turnarounds in the UAE and Egypt were among several turnarounds completed by Fertiglobe in 2022 — but no turnarounds are planned at those facilities in 2023, Fertiglobe CEO Ahmed El Hoshy said.

What’s in the pipeline: The company is “currently evaluating the engineering and technology choices” for the 100 MW electrolyzer plant it’s developing in Egypt with Scatec and Orascom Construction, “which will leverage our existing ammonia production and global distribution infrastructure,” El Hoshy said. This follows Fertiglobe’s recent commissioning of phase one of the USD 135 mn green hydrogen plant, which will produce up to 15k tons of green hydrogen a year as feedstock for some 90k tons of green ammonia.

Blue ammonia production is on the way: Fertiglobe has “made progress” with a blue ammonia project unveiled in late-2021 that will see it partner with Ta’ziz — a joint venture between Adnoc and ADQ — GS Energy and Mitsui to construct a facility to produce some 1 mn tons of blue ammonia a year, the earnings noted. The Shareholders’ Agreement for the project was signed in January and the EPC contract has been signed as well, with the project set to be financed by a mix of debt and equity.

Looking ahead, current low nitrogen prices will be offset by tight supply and anticipated high demand. Fertiglobe has “a good order book” going into 1Q 2023, El Hoshy said. Though global nitrogen pricing has been “weaker” in recent months, this has made nitrogen fertilizers more affordable for end-users, he added. Nitrogen demand is expected to recover to support the replenishing of low global grain stocks, while supply is likely to remain tight from 2023-2027. All of this is helping to keep the market healthy in the medium-long term, El Hoshy added. El Hoshy expects to see an uptick in demand for Fertiglobe’s industrial business, “supportive of ammonia primarily” — spurred by recovery in China, lower energy prices, and an improved global growth outlook.

UAE’s Tabreed sees an uptick in 2022 net income and revenue: Abu Dhabi-headquartered National Central Cooling Company (Tabreed) saw its net income attributable to shareholders rise 3% y-o-y in 2022 to AED 600.2 mn (USD 163 mn), according to the company’s earnings release. Tabreed’s revenue increased 13% y-o-y in 2022 to AED 2.22 bn (USD 600 mn).

Tabreed increased its total connection capacity to over 1.2 mn refrigeration tons (RT) in 2022, adding some 34k RT of new connections in the UAE, some 19k RT in Oman and 500 RT in Bahrain throughout the year, according to the earnings release.

2022 saw it expand its MENA market: Tabreed acquired a seventh district cooling plant in Oman in January, nearly doubling its concession capacity in the country. The company announced a partnership with Gascool and Marakez for Real Estate Investment in February to provide district cooling services to D5M mall in Cairo’s New Katameya and it signed a long-term BOO agreement with Egyptians for Healthcare Services Company in September for a district energy plant that will provide cooling and heating services to Cairo healthcare city project CapitalMed.

What they said: “Our medium and long-term strategy is being rolled out, with the company entering additional territories and increasing awareness through close alignment with governments, legislators, and developers, who understand how vital our services are in the drive to net zero,” Tabreed CEO Khalid Abdulla Al Marzooqi said.

GREENTECH CORNER

MENA is making strides in using data to drive work on climate

How MENA is harnessing data to accelerate climate action: The Global Covenant of Mayors for Climate & Energy — a data-driven alliance of some 11.5k cities including 181 MENA cities — announced last week that signatory cities can apply to a newly-launched knowledge exchange program by 8 March. The program will provide 20 member cities with financial and organizational support — and facilitate an expert exchange — to help spur their climate action plans. The alliance shows how knowledge and data can be collected, organized and shared to both communicate the climate crisis and measure progress, allowing online platforms to aggregate data to direct climate activity.

Using data platforms to inform climate action: KSA’s Data & Artificial Intelligence Authority and the Environment, Water and Agriculture Ministry announced a partnership with Google Cloud and Climate Engine in September to launch an AI-based observation program to measure the effects of water on vegetation and agriculture, using Google Earth Engine’s data, satellite imagery and climate-focused insights. Google Earth and Climate Engine will create a platform showcasing existing water and agriculture studies, and Saudi scientists will use it to develop localized case studies using data and AI. The program will ultimately focus on environmental protection, pollution monitoring, sustainable agriculture, climate and nature protection, and water and food security.

In Egypt, the focus so far is on agriculture: Egypt has several apps at different stages of development that collect and organize data, targeting an increase in agricultural productivity or helping farmers receive better returns on their produce. This helps mitigate the fallout from climate change — including unpredictable weather and dwindling harvests. VAIS — a deep-tech app currently under development — will collect and use satellite imagery to alert smallholder farmers to everything from insect infestations to diseases, or the impact of inclement weather on plants.

UAE platform The Surpluss also aims to maximize resource use: The Surpluss — recently developed and launched in the UAE — aims to divert waste from landfills and help companies become more climate-aware by providing a space for manufacturers, service providers, and other businesses to share surplus materials, production waste, and knowledge.

Globally, analytics platforms can use data to tell a big-picture story: ClimateOS, an integrated platform designed to show cities the full impact of their emission reduction activities, is helping to connect emissions, climate activity and economics at a broad level, The Guardian reports. The platform helps decision-makers understand which activities are the biggest drivers of emissions and plot out the cost and impact of the different actions they could take to reduce them.

How exactly does it work? The platform displays a range of activities that fall under different “building blocks”: Transport, industry, agriculture, energy, and others. It uses data-crunching and analytics to quantify the impact of shifting to a lower-emission alternative, while continuing to fulfill the underlying purpose of each activity. This could include transport fleets running on low-emissions fuel, large-scale substitution of energy-efficient equipment in industrial or agricultural operations, or a higher proportion of commuters walking or cycling to work.

It shows how climate action makes financial sense: ClimateOS quantifies the costs and potential benefits of particular climate actions, so cities can demonstrate to private investors and public funding bodies where climate investment could have a long-term financial payoff, The Guardian notes. It allows governments and businesses to assess the trade-off, for example, between the capital cost of investing in sustainable heating or cooling systems versus the costs saved by the improved health of residents or the reduced maintenance of inefficient equipment.

The platform’s user base is rapidly growing — especially in Europe: ClimateOS is currently used by over 50 cities in eight countries, according to The Guardian. Over 40 of these are in Europe, ClimateView shows.

Could it have a role to play in MENA? The platform doesn’t yet have users in MENA, but its potential role in helping the region slash its soaring emissions is clear. Globally, cities account for over 70% of CO2 emissions, according to a 2022 World Bank report. And as of 2021, some 65% of MENA’s total population lived in urban areas — well up from the global average of 55%. While MENA’s overall greenhouse gas footprint is comparatively low, it’s growing rapidly, with emissions set to more than triple by 2060 under a “business as usual” scenario. The region is also home to some of the world’s highest per capita emitters: Qatar, Kuwait, the UAE, Bahrain and KSA.

World Bank recommendations would suggest so: “The climate battle for the planet will be won or lost in cities,” the World Bank notes. In its MENA Climate Roadmap 2021-2025 (pdf), it notes the importance of climate-smart spatial planning and targeted investment as a way to achieve net-zero emissions.

MOVES

Raad Esmat Al Saady to replace Acwa Power CEO “Paddy” Padmanathan

Raad Esmat Al Saady (LinkedIn) has been appointed as Acwa Power’s vice chairman and managing director, succeeding Suntharesan “Paddy” Padmanathan (LinkedIn), who stepped down from his position as vice chairman, the company said in a Tadawul disclosure yesterday. Padmanathan will continue to serve as executive board member. Al Saady previously served as chairman of Saudi Airlines’ audit, risk and compliance committee, chairman of Saudi General Authority of Foreign Trade’s executive committee, and chairman of the Northern Region Cement company.

ALSO ON OUR RADAR

Tadweer, LanzaTech collaborate on a waste-to-energy facility: US-based carbon recycling company LanzaTech signed an MoU with the Abu Dhabi Waste Management Company (Tadweer) for a partnership agreement that would see both firms explore the possibility of establishing a waste to sustainable aviation fuels conversion plant, according to Wam. The planned conversion facility could also see carbon waste used to produce fabric materials and other applications, the news agency notes

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- Orascom Development Egypt will pay USD 39 mn to settle environmental fines levied by Egypt’s Environment Ministry in 2021 when the company was fined for allegedly causing environmental damage while constructing the Red Sea resort town of El Gouna. (EGX disclosure)

- Dubai’s Roads and Transport Authority — in partnership with food delivery startup Talabat and Dubai’s Integrated Economic Zones Authority — announced the launch of their net zero autonomous food delivery pilot project which will see three robot-driven ‘talabots’ serve a gated community in Dubai’s Silicon Oasis. (Wam)

ON YOUR WAY OUT

This fashion is so green, it literally grows in ponds

Sustainable fashion startups are turning to algae-based dyes and inks to combat the use of fossil fuel-based dyes, Bloomberg reports. Algae is less water-intensive than materials typically used in garments and has the added benefit of sucking CO2 from the air, possibly making it a climate-positive material.

Algae-based materials are gaining traction in the region: Israeli startup Algaeing makes algae-based dyes and inks for the fashion industry and is developing algae-based yarn, according to their website. Algaeing’s solar powered vertical farms produce algae in just three weeks — compared to the c. 180 days it takes to grow cotton, Bloomberg reports. The company has raised USD 5 mn from investors to-date and is looking to raise an additional USD 15 mn early next year, the business information service adds.

Fashion produces 10% of the planet’s CO2 emissions: The environmental footprint of fast fashion is not just a product of how the clothes are made or how the quickly discarded clothes fill up landfills. Polyester is made from fossil fuels, and some dyes are derived from crude oil. Manufacturers are increasingly responding to pressure from changing consumer habits and ESG investing to reduce their environmental footprint. In 2019, Swedish fast fashion giant H&M jumped on the bandwagon, announcing their target of sourcing 100% of their products from recycled or sustainably sourced materials by the end of the decade.

CALENDAR

FEBRUARY 2023

21-23 February (Tuesday-Thursday): World Environment, Social and Governance (ESG) Summit, Dubai, UAE.

MARCH 2023

7-9 March (Tuesday-Thursday: Middle East Energy Exhibition, Dubai World Trade Center, Dubai, UAE.

14-16 March (Tuesday-Thursday): Arab Aviation Summit (AAS), Al Hamra International Exhibition & Conference Centre, Ras al Khaimah, UAE.

15-19 March (Wednesday-Sunday): Qatar International Agricultural and Environmental Exhibition, Doha, Qatar.

22-24 March (Wednesday-Friday): K.ey – The Energy Transition Expo, Rimini Expo Centre, Emilia-Romagna, Italy.

22-24 March (Wednesday-Friday): UN 2023 Water Conference, New York, NY, United States.

APRIL 2023

6 April (Thursday): Arabia CSR Awards 2022 Clinic (online).

MAY 2023

1-4 May (Monday-Thursday): Arabian Travel Market, Dubai, UAE.

2-7 May (Tuesday-Sunday): Salon International de l’Agriculture au Maroc (SIAM), Meknes, Morocco.

16-18 May (Tuesday-Thursday): Seatrade Maritime Logistics Middle East, Dubai, UAE.

29-31 May (Monday-Wednesday): Electric Vehicle Innovation Summit, Abu Dhabi, UAE.

JUNE 2023

Bloomberg New Economy Gateway Africa Conference, Marrakesh, Morocco.

1-3 June (Thursday-Saturday): Envirotec and Energie Expo, Tunis, Tunisia.

13-14 June (Tuesday- Wednesday) The Arab Green Summit, Palazzo Versace Dubai, Dubai, UAE.

SEPTEMBER 2023

Chariot Limited and Total Eren’s feasibility study on a 10 GW green hydrogen plant in Mauritania to be completed.

OCTOBER 2023

2-4 October (Monday-Wednesday): WETEX and Dubai Solar Show, Dubai, UAE.

4 October (Wednesday): Arabia CSR Gala Awarding Ceremony, UAE.

NOVEMBER 2023

30 November – 12 December: Conference of the Parties (COP 28), Dubai, UAE.

EVENTS WITH NO SET DATE

End-2022

KSA’s Neom wants to tender three concrete water reservoir projects to up its water storage capacity by 6 mn liters.

2023

Early 2023: Egypt’s KarmSolar to launch KarmCharge, the company’s EV charging venture.

1Q2023: Oman will award two blocks of land for green hydrogen projects in Duqm, Oman.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

4Q2023: Oman to award four blocks of land for green hydrogen projects in Thumrait, Oman.

2024

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

First 1.5 GW phase of Morocco’s Xlinks solar and wind energy project to be operational.

2025

Second 1.5 GW phase of Morocco’s Xlinks solar and wind energy project to be operational.

UAE to have over 1k EV charging stations installed.

2026

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

Iraq’s Mass Group Holding wants to invest EUR 1 bn on its thermal plant Mintia in Romania to have 62% of run on renewable energy, while expanding its energy capacity to at least 1.29k MWh.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.