- Egypt lines up USD 83 bn worth of green hydrogen and ammonia projects. (Green Fuel)

- In a first for Africa, GE and Hassan Allam show its possible to decarbonize existing gas-fired power generation infrastructure by running it on a mix of hydrogen and natural gas. (What We’re Tracking Today)

- US, Indonesia unveil “world’s largest” ever climate finance pact. (What We’re Tracking Today)

- A good first day for Empower’s IPO debut. (IPO Watch)

- COP27 President Sameh Shoukry is optimistic about delegates reaching an agreement. (COP Watch)

- Egypt’s SFE is reportedly snapping up 10% of Acwa’s Suez wind farm. (Investment Watch)

- KSA will develop cryogenic carbon capture tech. (On Our Radar)

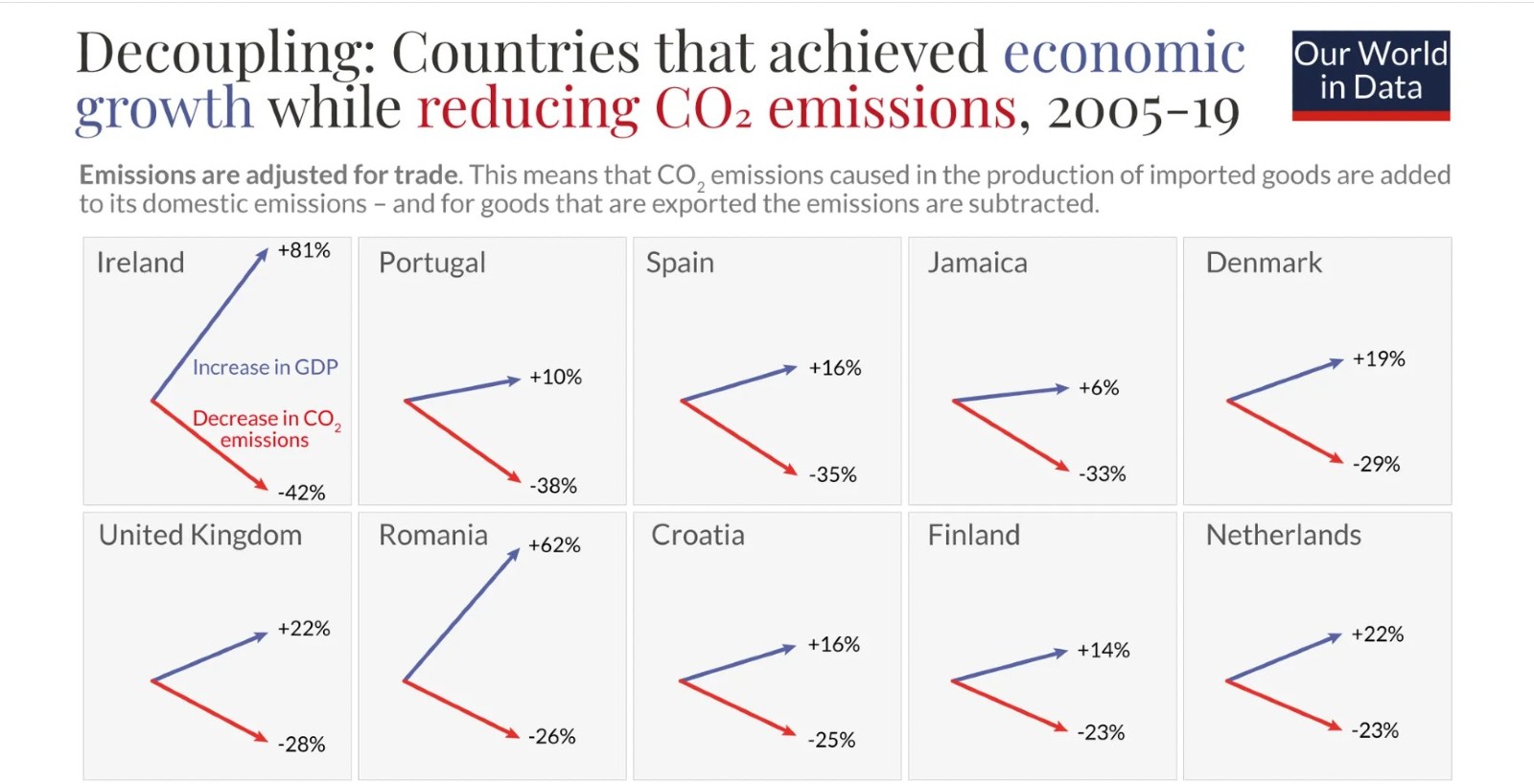

- 25 countries are slashing emissions and maintaining economic growth. (Image of the Day)

- Is the auto industry on a “collision course” with 1.5°C? (Danger Zone)

Wednesday, 16 November 2022

Why it’s a big deal that a power plant in Sharm is running on a hydrogen-natural gas fuel blend

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, nice people. It’s day 10 of the summit and all eyes are on the delegates hammering out details on a possible agreement in the run up to Friday.

THE BIG CLIMATE STORY? It’s largely the same as yesterday, really: Word on the street is that frustrations are rising, but COP27 President Sameh Shoukry is optimistic the summit will reach an agreement — although discussions could extend past Friday.

Shoukry told Bloomberg in a televised interview that climate finance is at the top of the agenda for negotiators with the aim of coming up with an agreement that “satisfies the interest of all parties, but also leads to greater ambition and climate action.”

^^We have the full story in the news well, below.

Speaking of climate finance- Look out for Egypt launching its voluntary carbon market through an alliance between the Sovereign Fund of Egypt and the private sector, according to Planning Minister Hala El Said (watch, runtime: 13:54).

MEANWHILE- It’s Biodiversity Day in Sharm, with sessions focusing on the impact of climate change on biodiversity, with a particular focus on oceans, endangered species, and coral reefs.

UP NEXT: Solutions day is tomorrow.

Detailed schedule: Download as a pdf here or check out the website here.

COP27 app for attendees: App Store and the Google Play Store.

LOTS OF ENERGY NEWS FROM COP-

WATCH THIS SPACE #1- GE, Hassan Allam Construction project shows we can use hydrogen to lower the carbon footprint of natural gas-fired power generation. In a first for Africa, the Sharm El Sheikh Power Plant is using hydrogen-natural gas blended fuel, according to a statement (pdf). The project is proof that hydrogen, while more difficult to transport and store than natural gas, can be used for on-site power generation.

Why this matters, part I- It proves gas turbines can be run with a lower carbon footprint, taking advantage of “the growth of variable renewables by providing on-demand electricity to

firm the grid.” The statement did not say how much the blend cut the plant’s carbon footprint.

Why this matters, part II- It’s also proof that it’s possible to start to decarbonize conventional generation capacity that’s already in place today: The GE-Hassan Allam project saw engineers adapt an already-installed GE LM6000 at the Egyptian Electricity Holding Company's Sharm plant to run on hydrogen-blended fuel, “highlighting that today’s gas power generation assets can be a destination technology, not just a bridging technology, as the world scales up the production of hydrogen,” the statement said.

Who’s responsible: The project was implemented in less than five months by the Egyptian Electricity Holding Company, GE, Hassan Allam Construction, and Pgesco.

|

WATCH THIS SPACE #2- Egypt has a low-carbon hydrogen strategy. Egypt announced its strategy for low-carbon hydrogen on the sidelines of COP27, a statement by the Oil Ministry said. Details on the strategy were scarce, but minister Tarek El Molla said that Egypt is home to key components for the industry that will allow it to shore up its energy security while cutting its environmental footprint.

WATCH THIS SPACE #3- Our friends at Actis have appetite for African energy: The emerging markets private equity giant could be pouring up to USD 300 mn annually into renewables in Africa, Lisa Pinsley, Actis’ head of energy in the Middle East and Africa, told Reuters. “We could be looking at investing USD 200 to USD 300 mn a year if the opportunity presents itself,” she said. Actis also has plans to invest in gas infrastructure and gas-fired power projects, she said, but stressed that the firm would not invest in any liquid fuel or oil and gas exploration and production projects in the continent.

WATCH THIS SPACE #4- Saudi oil company Aramco is earmarking “multiple bns of USD” to become a major blue hydrogen exporter and plans to begin start selling blue ammonia to Asia by 2027, Aramco CTO Ahmad Al Khowaiter told Bloomberg. Export discussions with Japan and South Korea are the ones “farthest along,” according to Al Khowaiter. Aramco had sent test cargoes totaling 40 tons of blue ammonia to Japan in September, according to a company statement.

From Sharm to the Grand Egyptian Museum — the business community will move the talk about a green transition ahead at the Enterprise Climate X Forum, which takes place at the Grand Egyptian Museum on Tuesday, 6 December 2022. We can think of no better place to discuss the world’s most important industry than in a world-class museum that stands as a testament to our nation’s ability to persevere (and innovate) for seven millennia. And it seems you can’t either, judging by the responses and statements of support we’ve been getting.

What’s the Enterprise Climate X Forum? It’s our first industry-specific conference, where CEOs, top execs, investors, bankers and development finance folks have the chance to talk about how to build a climate-centered business — and how to make sure your business continues to have access to the funds it needs to grow. You can learn more on our conference website here.

Some of the biggest names in business and finance are on board — are you? If you’re a C-suite exec, business owner, climate professional, DFI staff, investor or banker, please email us at climatexrsvp@enterprisemea.com to signal your interest, letting us know your name, title and where you work.

THE TWO BIG GLOBAL CLIMATE STORIES on this fine November morning:

#1- The presidents of the US and Indonesia unveiled the “world’s largest climate finance agreement” — a pact that will see the United States give the Southeast Asian nation USD 20 bn to have it “pivot away from coal,” Bloomberg reports. The agreement will see Indonesia cap emissions from both the power grid and for captive generation capacity supplying industrial plants and commit to having renewables account for more than a third of its generation capacity by 2030. US President Joe Biden and Indonesia’s Joko Widodo unveiled the agreement late yesterday.

#2- US, CHINA TO RESTART CLIMATE TALKS- US climate envoy John Kerry met yesterday with his Chinese counterpart Xie Zhenhua at COP in Sharm, raising hope for the resumption of climate talks between the world’s top polluters, AP reported. The two met for about 45 minutes, but said little of substance afterward. “We had a very good meeting,” Kerry said, adding that it was “much too early” to speak about the remaining differences. “But we’re gonna go to work,” he said. There was no comment by Chinese officials following the meeting.

The sit-down comes one day after US President Joe Biden and Chinese counterpart Xi Jinping agreed to “empower key senior officials to maintain communication and deepen constructive efforts” on transnational challenges, including climate change, global economic stability, and global food security, according to a White House readout.

MEANWHILE- “World’s largest floating offshore wind farm” begins production: Power production from the Hywind Tampen floating offshore wind farm began earlier this week, Norwegian energy firm Equinor announced. Seven of eleven turbines at the wind farm are set to come on stream this year, with the last four turbines slated to be installed next year. Once completed, the mega wind farm will have a system capacity of 88 MW and deliver energy to offshore oil and gas infrastructure.

***

YOU’RE READING ENTERPRISE CLIMATE, the essential MENA publication for senior execs who care about the world’s most important industry. We’re out Monday through Thursday at 4am Cairo / 5am Riyadh / 6am UAE.

Were you forwarded this email? Get your own subscription without charge here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

THE DANGER ZONE-

#1- Is the auto industry on a “collision course” with 1.5°C? The world’s biggest manufacturers of combustion engine vehicles are on track to overshoot the carbon emission budget that’s required to meet the goal of limiting global warming to 1.5°C by 2050, according to a report (pdf) by NGO Greenpeace. The research — based on sales projections from automotive giants Toyota, GM Volkswagen, and Hyundai / Kia — found that, at its current trajectory, the industry will sell nearly double the number of cars the planet could handle by 2040 if we are to meet the goal of limiting global warming to 1.5°C, the outfit said in a statement.

#2- As the global population ballooned past 8 bn yesterday, the UN issued stark warnings on dwindling resources on their website. The population will increase by another 2.4 bn by the 2080s, according to UN projections — with the most growth in sub-Saharan Africa, where countries are also among the “most vulnerable to climate change and most in need of climate finance,” Reuters reports.

CHART OF THE DAY- Conscientious decoupling: With some 80% of the world’s energy still powered by fossil fuels, increases in CO2 emissions are generally viewed as a necessary evil for economic development, prosperity and poverty reduction — but over 30 countries successfully managed to slash emissions while maintaining economic growth, according to Vox citing Our World in Data. This chart tracked 25 of these countries between 2005 and 2019 to show “absolute decoupling” — when environmental pressures are stable or decreasing while economic prosperity is growing. These “are not just per capita measures; we’re talking about total emissions and total economies here,” the news outlet notes.

How have countries managed this “absolute uncoupling”? New tech lowering the price of renewables, regulations on air pollution, and carbon pricing were key steps, Vox reports.

CIRCLE YOUR CALENDAR-

Saudi Arabia’s Education Ministry will host the Global Conference on Sustainable Partnerships on Wednesday, 23 November to Thursday, 24 November in Riyadh, bringing together ministers and senior officials from the private and public sectors.

UAE will host The Big 5 Global Construction Impact Summit on Wednesday, 7 December at the Dubai World Trade Centre, bringing more than 2k exhibitors from 60 countries, as well as regional and global construction industry leaders together to discuss ways to meet local and global net zero and waste reduction targets.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

ENERGY

Egypt signs framework agreements for green hydrogen + ammonia plants worth USD 83 bn

Another step forward to becoming a global green energy hub: Egypt has signed framework agreements with international power companies to construct nine green hydrogen and ammonia facilities in the Suez Canal Economic Zone, the cabinet announced in a series of statements (here, here and here) yesterday. The facilities would collectively produce up to 7.6 mn tons of green ammonia and 2.7 mn tons of hydrogen a year when fully operational, putting Egypt on the road to becoming a regional hub for green hydrogen.

Caveat: These aren’t final agreements. The documents signed yesterday are framework agreements and are not binding commitments. The companies will continue to study the projects before coming to a final investment decision in the coming months, after which they would begin lining up financing.

If they all go ahead, a lot of money is heading our way: As much as USD 83 bn could be invested across the nine projects, cabinet said.

The players lining up to get involved in Egypt’s green hydrogen plans:

#1- ReNew Power and El Sewedy Electric signed an agreement for an USD 8 bn project that will produce 220k tons of green hydrogen and 1.1 mn tons of ammonia a year, ReNew and cabinet said. The company said it will undertake further studies and will make a final investment decision in the next 12-16 months. If it goes ahead, it expects to begin commissioning the pilot phase in 2026.

#2- UK power producer Globeleq inked an agreement to build a 2 mn-ton green hydrogen facility. The Africa-focused company had signed an early agreement in August for the plant.

#3- Saudi company Alfanar signed one for its 500k-ton green ammonia facility. Alfanar earlier this year signed a USD 3.5 bn MoU with several Egyptian organizations to build the facility that will produce ammonia from 100k tons of green hydrogen every year.

#4- Masdar, Hassan Allam, and Infinity inked an agreement to establish a facility to produce up to 480k tons of green hydrogen a year.

#5- Australian energy producer Fortescue Future Industries signed an agreement to set up a green ammonia production facility with an annual production capacity of some 2 mn tons.

#6- Norway’s Scatec, Fertiglobe, Orascom Construction, and the SFE inked an agreement for the consortium’s 100 MW green ammonia facility in Ain Sokhna. The facility last week saw the commissioning of its first phase. Once the plant is fully developed, it will produce up to 15k tons of green hydrogen as feedstock for as much as 90k tons of ammonia per year.

#7- Al Nowais subsidiary AMEA Power’s put pen to paper for a 390k-ton per-year green ammonia plant and could be up and running by the end of 2025 at its 500 MW green hydrogen plant in Ain Sokhna.

#8- French energy producer TotalEren and SME investor Enara Capital signed an agreement for a 300k-ton green ammonia facility in Ain Sokhna. TotalEren and Enara first signed an MoU with Egypt back in May that stipulated the facility would initially produce 300k tons of ammonia each year.

#9- EDF Renewables and Egyptian firm ZeroWaste inked an agreement with the SCZone for a USD 3 bn facility that is slated to produce some 350k tons of green ammonia for ships. Construction of the plant is expected to begin in 2024, with operations slated to begin in 2026.

Becoming a green hydrogen hub doesn’t happen overnight: It’s going to take until the middle of the next decade until all these facilities are fully operational, according to Planning Minister Hala El Said (watch, runtime: 13:54).

Egypt wants to be a key player in the global hydrogen market: A host of companies have been conducting feasibility studies for green hydrogen and ammonia projects this year after signing MoUs worth bns of USD. The biggest project was an agreement with Maersk to work on a huge USD 15 bn facility capable of producing 3 mn tons of fuel a year, which the two sides are expected to finalize at COP27.

EBRD LENDS A HAND ON H2-

The European Bank for Reconstruction and Development will provide a USD 80 mn loan to Fertiglobe-Scatec-OC-SFE ammonia plant, which will be the country’s first integrated green hydrogen plant, it said in a statement. The loan comes nearly a week after the companies began commissioning the first phase of the 100 MW green hydrogen plant.

Where the funds are going: It will be used to acquire and build a 100 MW electrolyser facility powered by renewable energy. Upon completion, the facility will deliver up to 15k tons of green hydrogen annually.

IN REGIONAL GREEN FUEL NEWS-

Denmark’s Maersk is exploring green methanol in Jordan: The Jordanian Energy Ministry yesterday signed an MoU with Danish shipping giant AP Moller-Maersk to produce green methanol in Jordan using desalinated water and renewable energy, Attaqa reports. Maersk will conduct feasibility studies first, but the project could become a major source of green fuel for the shipping company’s maritime shipping fleet.

Correction: 16 November, 2022

A previous version of this story incorrectly said Norway’s Scatec, Fertiglobe, and Orascom Construction signed the final agreements for their 100 MW Ain Sokhna facility and included incorrect figures on the facility’s final capacity.

IPO WATCH

A good first day for Empower’s DFM debut

Emirates Central Cooling Systems Corp. (Empower) saw its shares rise 2.23% in its first day of trading on the Dubai Financial Market (DFM) under the ticker EMPOWER, according to market data. Empower’s shares closed at AED 1.36 after debuting at AED 1.33.

REFRESHER- The company sold a 20% stake (2 bn shares) in its IPO, with 85% of the offering (1.7 bn shares) placed with institutional investors in a private placement and the remaining 15% tranche (300 mn shares) sold to retail investors, according to the company’s prospectus (pdf).

Appetite was strong going in: The retail portion of Empower’s IPO closed more than 49x oversubscribed last week, while the offering to institutional orders was 46x oversubscribed. Empower had completed its bookbuilding at AED 2.6 bn (USD 724 mn), setting a final price of AED 1.33 per share at the top of the price range. “The huge success of the privatization program so far shows that Dubai is well on its way to achieve the vision of the wise leadership to increase the total volume of its stock markets to AED 3 tn,” Empower Chairman Saeed Mohammed Al Tayer said in a company statement. This is DFM’s fourth public offering this year.

Who bought in? Some 12.6% of the private placement shares were placed with the UAE Strategic Investment Fund, Shamal Holding, and the Abu Dhabi Pension Fund. Some 5% was reserved to offer to the Emirates Investment Authority, and a further 5% to the Pensions and Social Security Fund of Local Military Personnel.

Who was selling? Majority shareholder Dubai Electricity and Water Authority contributed 14 percentage points of their stake and Emirates Power Investment (a Dubai Holding subsidiary) is offering 6 percentage points. Following the offering, DEWA will hold a 56% stake and Emirates Power’s stake will be 24%, according to the disclosure.

ADVISORS- Empower appointed Merrill Lynch, Citigroup and Emirates NBD as joint global coordinators on its IPO, with our friends at EFG Hermes acting as joint bookrunner. Moelis and Emirates NBD are acting as financial advisers. Emirates NBD is the lead receiving bank for the transaction, while our friends at Mashreq Bank are receiving banks alongside Abu Dhabi Islamic Bank, Ajman Bank, Commercial Bank of Dubai, Dubai Islamic Bank, Emirates Islamic Bank, First Abu Dhabi Bank, MBank, and Sharjah Islamic Bank.

EARNINGS WATCH- Empower reported AED 300.3 mn in net income in 3Q 2022, rising 10.8% y-o-y, according to a financial statement (pdf) the company also released yesterday. The company’s revenues rose 12.9% y-o-y during the quarter to AED 918.8 mn. On a nine-month basis, Empower’s bottom line rose 10.9% y-o-y to AED 732.0 mn on revenues of AED 2.1 bn, up 14.7% y-o-y.

COP WATCH

Egypt’s Shoukry is optimistic about delegates reaching an agreement

Will we see an agreement hammered out by Friday? COP27 President and Egyptian Foreign Minister Sameh Shoukry is “optimistic” that COP27 will yield an agreement on loss and damage, he told Bloomberg in an interview yesterday (watch, runtime: 11:07). Shoukry reiterated that loss and damage, how to plug climate finance gaps to keep the 1.5°C warming threshold within reach, and ensuring climate change action is “comprehensive and just” are all key to negotiations.

Climate finance is topping the COP27 negotiation agenda, with a target to address all the issues identified as important by the COP delegates — including mitigation, adaptation, finance, and loss and damage — in a way that’s equitable and “satisfies the interest of all parties, but also leads to greater ambition and climate action,” Shoukry told Bloomberg. That process could extend beyond Friday, he added.

Big polluters must play a major role in climate financing: The COP Presidency is “looking forward” to continued US contributions to help make up current shortfalls in the USD 100 bn previously pledged, along with other past commitments, Shoukry said, but stopped short of placing the same degree of responsibility on major emitters China and India.

IS A FOSSIL FUEL PHASE-OUT PLEDGE ON THE CARDS?

Negotiations on a proposal by India to “phase down” all fossil fuels are gaining momentum with backing from the EU, small island states, and the UK nearly locked in, Bloomberg reports, citing sources familiar with the matter. Some — including the UK and the EU — have reportedly been pushing for tougher “phase out” language to be included in the first draft of the COP27 Egyptian presidency’s cover decision which is expected this week, the sources said.

The caveat: Some Gulf and African countries, including Saudi Arabia and the UAE, are unlikely to be on board with a fossil fuel phase-out. Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman explicitly said in a Bloomberg interview last week that the world needs all kinds of energy and it is more about emissions mitigation, while UAE President Mohammed bin Zayed Al Nahyan defended the country’s plans to continue its role as oil supplier “as long as the world is in need of oil and gas.”

CHINA COULD DERAIL COAL PHASE OUT EFFORTS

The good news? The world is on track to phase out coal: Over three quarters of coal-fired electricity generation capacity in the OECD and EU is on track to close by 2030, according to a report (pdf) by the Powering Past Coal Alliance. The scale of new coal power plants globally has also “collapsed by the same amount since 2015,” as rich countries stick to their pledges to phase out coal despite the energy crunch resulting from Russia’s war in Ukraine.

The bad news? China could “counteract” the gains: Despite China’s renewable energy ambitions, it has continued an expansion of coal power plants, the report says. Climate envoy Xei Zhenhua says pumping up coal-fired power capacity allows the country to maintain the stability of its power grid. China accounts for about two-thirds of the 300 GW of new coal power capacity planned globally, the report showed.

EU PLANS TO RAMP UP CLIMATE TARGETS

The EU has pledged to upgrade its emissions targets by at least 2% before next year’s COP28 as it looks to counter claims of backtracking on commitments due to the ongoing energy crisis, EU climate chief Frans Timmermans said during a speech at the summit. The bloc will not reverse course on its climate targets — which at 55% currently stands as one of the most ambitious targets among major emitters — Timmermans said.

Calls for “doubling” adaptation finance: “The EU is ready to make progress on the global goal on adaptation,” the climate chief said during his speech. He called on the summit’s attendees to “collectively double” adaptation finance, while pointing the finger at multilateral banks to get the ball rolling on “tns” to developing countries.

IN OTHER COP NEWS-

The European Investment Bank (EIB) will lend the UN’s International Fund for Agricultural Development (IFAD) EUR 500 mn to onlend to small-scale farmers, according to an EIB statement. The funds will help small-scale farmers with climate change adaptation and provide them with support to face global fuel and fertilizer crises that are compounding food shortages, the statement notes. EUR 150 mn will be immediately available, while the remaining EUR 350 mn is expected to be disbursed over the coming two years.

The World Bank is back in the hot seat: Climate-focused reform of the World Bank could and should be done within a year to end its “[tacit] support” of “fossil fuel colonialism,” former US Vice President and climate campaigner Al Gore told the Guardian in an interview at COP27. The World Bank and other multilateral development banks need to completely refocus on de-risking renewables projects in emerging markets and providing access to more private capital to help spur the energy transition, he added.

Egypt’s Electricity Minister Mohamed Shaker launched the Africa Just and Affordable Energy Transition Initiative (pdf) at COP27 yesterday, according to a cabinet statement. The initiative entails making the green transition of African countries financially viable, give 300 mn people access to clean cooking fuels and technologies, and upping the share of renewable energy by 25 percentage points by 2027, in order to build a power sector based on renewable energy sources by 2063.

KUDOS-

UAE tech and telecom giant e& and Ericsson will work together to reduce energy usage and build more efficient networks, according to a press release. The three-year MoU will see e& focus on implementing energy saving strategies, network performance and e-waste recycling.

INVESTMENT WATCH

Egypt’s wealth fund could acquire 10% of ACWA’s 1.1-GW wind farm

SFE could invest in ACWA, Hassan Allam wind farm: The Sovereign Fund of Egypt (SFE) could acquire a minority stake in ACWA Power’s planned 1.1-GW wind farm in the Gulf of Suez. The wealth fund is considering making an investment in the facility under the terms of an MoU signed with the Saudi renewables developer yesterday, which could see it “potentially acquire up to 10%” of the USD 1.5 bn project, the SFE said in a statement (pdf). That would see the fund invest up to USD 150 mn in the project, according to our math. A final agreement will be announced “soon,” three sources familiar with the matter told Bloomberg Asharq yesterday.

The second sovereign fund to the party: News of the SFE’s potential buy-in comes a week after the Oman Investment Authority inked an MoU with ACWA to acquire a 10% stake in the wind farm. The SFE would also buy its stake from ACWA, which currently owns 75% of the project, while Hassan Allam Holding is set to retain its 25% stake, according to Asharq.

More finance in the pipeline? The European Bank for Reconstruction and Development (EBRD) is eyeing a potential investment in the Suez farm, Harry Boyd-Carpenter, the EBRD’s managing director for climate strategy and delivery, told EnterpriseAM earlier this week. Some 70-75% of the wind farm will be financed through loans, while the remainder will be self-financed, Asharq quotes its sources as saying. The project is expected to reach financial close by 4Q 2024.

REFRESHER- ACWA and Hassan Allam Holding signed a 25-year power purchase agreement (PPA) with the Egyptian Electricity Transmission Company (EETC) in June to develop the project under a build-own-operate framework. The project is expected to begin commercial operations by the end of 2026.

EARNINGS WATCH

Tabreed reports 3Q2022 results

The UAE’s National Central Cooling Company (Tabreed) reported AED 159.3 mn in net income after non-controlling interest in 3Q 2022, up 3.2% y-o-y, according to the company’s financial statement (pdf). Revenues for the quarter rose 14.8% y-o-y to AED 683.8 mn. Tabreed’s 9M 2022 net income after non-controlling interest rose 3% y-o-y to AED 399.6 mn on revenues of AED 1.7 bn, up 13.3% y-o-y.

ALSO ON OUR RADAR

KSA will develop cryogenic carbon capture tech: Saudi Arabia's King Abdullah University of Science and Technology’s (KAUST) signed an agreement with the Saudi Electricity Company to co-develop cryogenic carbon capture plants in KSA’s 605 MW integrated solar combined cycle power plant Green Duba, according to a company statement.

What is cryogenic carbon capture? The process sees cooling mechanisms freeze CO2 to -140°C transforming the gas into solid carbon without passing through the liquid phase, according to research by the US National Energy Technology Laboratory. Cryogenic projects are 30-50% less energy intensive than current CO2 capture tech and can cut carbon capture costs by nearly 50% compared to traditional CO2 absorption methods, according to research by the University of Brighton.

UK-based water tech company Hydro Industries is considering building two wastewater treatment facilities in Egypt, according to a statement from Egypt’s Port Said Governorate. The plants would be located at the South Port Said industrial zone to treat some 50 tons of industrial wastewater daily. Hydro Industries would be granted a 50-year contract to operate the facilities, which would be constructed within 18 months of finalizing the agreement.

Jordan-based solar panel manufacturing company Philadelphia Solar is entering a JV with US solar tech company Translucent Energy, according to a company statement. The Jordanian outfit will bring its Tier 1 PV panels to US markets and the companies plan to complete a 1.2 GW solar panel manufacturing plant in the US by 4Q 2024.

ON YOUR WAY OUT

The Amazon rainforest comes to Dubai: Italian architect Stefano Boeri presented his Vertical Forest Dubai skyscraper project during COP27, according to a statement. The project would see the external faces of a 190 meter high skyscraper and another 150-meter-high tower covered in 2.6 k trees and 27k shrubs. The buildings will house hydroponic gardens and greenhouse systems with facades made of PV panels to generate some 5.1 kwH of energy to power the towers’ water cycles. The buildings will also have hydrogen batteries to store the clean energy produced by the photovoltaic panels, the statement notes.

CALENDAR

NOVEMBER

7-18 November (Monday-Friday): Egypt hosts COP27 in Sharm El Sheikh.

15 November (Tuesday): Hawkamah Annual Conference (Building Investor Confidence Through Governance), Dubai, UAE.

23-24 November (Wednesday-Thursday): Global Conference on Sustainable Partnerships, The Ritz-Carlton, Riyadh, Saudi Arabia.

Deadline of bid submissions for the Ras Mohaisen – Baha – Makkah Independent Water Transmission Pipeline in Saudi Arabia.

COP27 sub-events:

UNFCCC’s capacity building hub.

10 November (Thursday): ClimaTech Run competition’s pitching day.

11-12 November (Friday-Saturday): Saudi Green Initiative event.

DECEMBER

7 December (Wednesday): The Big 5 Global Construction Impact Summit, Dubai World Trade Center, Dubai, UAE.

13-15 December (Tuesday-Thursday): International Renewable Energy Congress, Hammamet, Tunisia.

15 December (Thursday): The UN’s 15th meeting of the Conference of the Parties to the Convention on Biological Diversity (COP15), Montreal, Canada.

JANUARY 2023

10-12 January (Tuesday-Thursday): The Future Minerals Forum, Riyadh, Saudi Arabia.

13 January (Friday): The International Renewable Energy Agency’s Youth Forum, Abu Dhabi, UAE.

14-21 January (Saturday-Saturday): Abu Dhabi Sustainability Week, Abu Dhabi, UAE.

16-18 January (Monday-Wednesday): EcoWASTE, Abu Dhabi National Exhibition Center (ADNEC), UAE.

16-18 January (Monday-Wednesday): World Future Energy Summit, Abu Dhabi National Exhibition Center (ADNEC), UAE.

January 2023: Bid submission deadline for green hydrogen projects to Hydrogen Oman (Hydrom).

FEBRUARY 2023

6-8 February (Monday-Wednesday): Saudi International Marine Exhibition and Conference, Hilton Riyadh, Saudi Arabia.

21-22 February (Tuesday-Wednesday): The Arab Green Summit, Dubai, UAE.

21-23 February (Tuesday-Thursday): World Environment, Social and Governance (ESG) Summit, Dubai, UAE.

MARCH 2023

15-19 March (Wednesday-Sunday): Qatar International Agricultural and Environmental Exhibition, Doha, Qatar.

JUNE 2023

1-3 June (Thursday-Saturday): Envirotec and Energie Expo, UTICA, Tunis, Tunisia.

SEPTEMBER 2023

Chariot Limited and Total Eren’s feasibility study on a 10 GW green hydrogen plant in Mauritania to be completed.

OCTOBER 2023

2-4 October (Monday-Wednesday): WETEX and Dubai Solar Show, Dubai World Trade Centre, Dubai, United Arab Emirates.

NOVEMBER 2023

6-17 November (Monday-Friday): The UAE will host COP28.

EVENTS WITH NO SET DATE

End-2022

KSA’s Neom wants to tender three concrete water reservoir projects to up its water storage capacity by 6 mn liters.

2023

Early 2023: Egypt’s KarmSolar to launch KarmCharge, the company’s EV charging venture.

1Q2023: Oman will award two blocks of land for green hydrogen projects in Duqm, Oman.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

4Q2023: Oman to award four blocks of land for green hydrogen projects in Thumrait, Oman.

2024

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

First 1.5 GW phase of Morocco’s Xlinks solar and wind energy project to be operational.

2025

Second 1.5 GW phase of Morocco’s Xlinks solar and wind energy project to be operational.

UAE to have over 1k EV charging stations installed.

2026

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

Iraq’s Mass Group Holding wants to invest EUR 1 bn on its thermal plant Mintia in Romania to have 62% of run on renewable energy, while expanding its energy capacity to at least 1.29k MWh.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.