- UAE’s F9 Capital and South Africa’s QGC form a JV to invest USD 1 bn in critical minerals mining. (Investment Watch)

- KSA’s Al Bashayer explores an EGP 1 bn investment in Egyptian waste management project. (Investment Watch)

- Egypt is eyeing USD 700 mn worth of green bonds in 2024 + up to USD 5 bn in issuances in the pipeline. (Debt Watch)

- China’s Trina Solar will set up a PV manufacturing base in the UAE. (Green Manufacturing)

- Oman’s Nama Water will explore the feasibility of wastewater sludge WtE project. (Waste to Energy)

- Egypt and Honeywell to partner on local SAF production? (Also on Our Radar)

- Saudi Arabia and South Korea set to sign a comprehensive clean hydrogen agreement that will manage each step of the value chain. (What We’re Tracking Today)

- Loss and damage fund talks fail to agree on recommendations ahead of COP28. (What We’re Tracking Today)

Monday, 23 October 2023

UAE’s F9 Capital and South Africa’s QGC form a JV to invest USD 1 bn in critical minerals mining

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends. It’s shaping up to be a busy week with some significant investment updates emerging from the USE and Egypt and smattering of stories from across the region.

THE BIG CLIMATE STORY- Abu Dhabi-based investor F9 Capital Management and South Africa’s Q Global Commodities are partnering to invest USD 1 bn in African mines producing minerals necessary for the energy transition

^^ We have the details on this story and more in the news well, below.

THE BIG CLIMATE STORY OUTSIDE THE REGION- China tightens export controls for EV-critical graphite: The Chinese government said on Friday it will begin imposing export curbs on graphite — a mineral essential for electric vehicle (EV) battery production — starting 1 December, 2023 in a bid to protect its ‘national security.’ Starting December, the country’s commerce ministry will begin requiring exporters to apply for export permits for certain graphite products. The curbs are expected to escalate trade tensions with the US, which began talks with the EU in March on a transatlantic bargain on minerals in a bid to counter Chinese dominance in the mining and EV sectors. China now processes more than 70% of the world’s graphite, and refines more than 90% of the mineral into the material used in EV battery anodes. Along with graphite, China processes more than half the world’s lithium, about two-thirds of its cobalt, and about one-third of the global supply of nickel.

The news made headlines in the international press over the weekend: Reuters | Bloomberg | Financial Times | CNBC | CNN

OVER IN COPLAND- Loss and damage fund talks fail to agree on recommendations ahead of COP28: The fourth — and what was meant to be the last — meeting of the COP27 Transitional Committee (TC) in Aswan failed to reach an agreement on who should fund the Loss and Damage Fund, where it should be based, and who would be eligible for support, the Financial Times reported on Saturday. The TC members were set to meet over three days — which was extended to four after it was clear no consensus was in sight — to agree on the recommendations the committee would put forth in the upcoming COP28 for the operationalization of the fund. They have decided to schedule another two-day meeting in Abu Dhabi on 3 November in a “last-ditch attempt” to bridge the differences, head of Global Political Strategy at Climate Action Network International (CAN) Harjeet Singh said.

The west are insisting Saudi + China contribute to the fund: While developed countries led by the US were responsible for the vast majority of historical greenhouse gas emissions behind global warming, they were not prepared to shoulder the responsibility of funding, special climate envoy to Barbados and a member of the transition committee Avinash Persaud told FT. Developed countries said they want heavy emitters like China and Saudi Arabia to put money into the fund, arguing that “the world has significantly changed in 30 years and those two are now wealthy enough to provide such aid,” Bloomberg writes.

And are pushing for the fund to be hosted by the World Bank: The G77 developing economies bloc plus China considered walking out of the talks earlier this week over a key dispute over the role of the World Bank in hosting the fund, FT reports. While developed countries see the World Bank as well-placed given its global outreach, its move to boost its commitment to funding climate goals, and its experience with similar financial bodies (such as the Green Climate Fund), developing countries would rather create a standalone facility under the remit of the UN. “The World Bank is not the institution that can best respond, that can best comply with what we’re looking for for this fund,” the Cuban chair of the G77 negotiating group told Bloomberg. The Loss and Damage Corporation also mentioned concerns over the Bank’s heavy emphasis on loans and debt in its approach, as well as the control that the US and other developed countries have on its decision making.

The COP28 presidency may be feeling the heat: If the members of the 24-person transition committee negotiating the global loss and damage fund “cannot reach common ground at the final gathering in Abu Dhabi next month, we are destined for very rocky negotiations in Dubai,” senior adviser in the global climate programme and the finance center at the World Resources Institute Preety Bhandari told FT.

WATCH THIS SPACE #1- KSA expected to ink an agreement with South Korea on clean hydrogen: South Korea’s President Yoon Suk Yeol landed in Riyadh yesterday to attend a bilateral investment forum that will reportedly see Saudi Arabia sign 51 agreements with the country worth USD 15.6 bn across several sectors including clean hydrogen production, Yonhap reports. South Korea and the kingdom are expected to sign off on a joint “hydrogen oasis cooperation initiative,” which aims to establish committees managing each step of the clean hydrogen value chain from production to storage and distribution, and facilitate partnership agreements between developers from both countries. Both countries' statistics agencies are also expected to ink a knowledge transfer agreement on “material on statistical production” of clean hydrogen, the news agency notes. In November last year, Saudi Arabia’s Public Investment Fund signed a USD 6.5 bn agreement with Korea Electric Power Corp (Kepco) and four other South Korean firms to build a hydrogen and ammonia production plant in KSA which is expected to have an annual generational capacity of 1.2 mn tons.

WATCH THIS SPACE #2- Hyundai and Kia eye 20% of MENA’s EV market by 2030: Hyundai Motor Company and Kia are targeting 550k of combined annual unit sales in the Middle East by 2030, snapping up 20% of the regional market, Korea Economic Daily reported on Friday. Hyundai Motors aims to sell 350k units by 2032 and Kia is targeting 210k unit sales by 2030. Hyundai also aims to double its portfolio by releasing six new EV models and Kia will nearly triple its EV lineup from the current four up to 11 models by 2027. The group is eyeing KSA's EV market as the biggest in the region, KED adds.

REMEMBER- Hyundai announced in September that it is planning to ink a formal agreement with Saudi Arabia to set up an EV assembly plant in the country. KSA also signed an MoU with Hyundai Motor Company for the construction of an EV and internal combustion engine manufacturing plant in January. Kia also debuted its EVs dedicated to the regional market earlier this month, two of which are expected to hit the market by 4Q 2023.

WATCH THIS SPACE #3- The global shipping industry is missing the emissions target: The world’s shipping industry is on course to miss the International Maritime Organization’s (IMO) target of having zero-emission fuels comprise 5% of its energy mix by 2030, according to a new report (pdf) presented during the Global Maritime Forum summit last week. The global pipeline of planned zero-emission fuel projects to power the IMO’s shipping industry decarbonization target would only meet a quarter of the sector’s 2030 target, the assessment notes. The report warns the global scale of zero-emission maritime vessels is inadequate to meet revised IMO targets of aiming for a net-zero mix of fuels by the end of the decade, noting that as of the end of last year there were a meager 24 ships adept at running of zero-emissions fuels, with another 144 in pipeline orders.

REMEMBER- Earlier this month, UNCTAD voiced concern over the aging of the global shipping fleet, saying that more than half of the world’s fleet is over 15 years old, leaving ship owners facing the challenge of renewing the fleet without clarity regarding alternative fuels, green technology and regulatory regimes to guide ship owners and ports. Decarbonizing the world’s shipping industry would require an additional USD 8 bn to USD 28 bn annually by 2050. IMO member countries gave the green light to a revised greenhouse gas strategy last July that outlines a net zero emissions goal for the shipping industry by mid century.

|

***

YOU’RE READING ENTERPRISE CLIMATE, the essential MENA publication for senior execs who care about the world’s most important industry. We’re out Monday through Thursday by 5am Cairo / 5am Riyadh / 6am UAE.

EXPLORE MORE OF ENTERPRISE ON THE WEB — tap or click here to read EnterpriseAM, EnterprisePM, and The Weekend Edition on our powerful new website packed with reader-friendly features.

Were you forwarded this email? Get your own subscription without charge here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

CIRCLE YOUR CALENDAR-

Saudi Arabia will host the Future Investment Initiative from Tuesday, 24 October to Thursday, 26 October in Riyadh. The three-day event will bring together state leaders, policymakers, executives, academics, NGOs, entrepreneurs, and scientists to host panels on how to scale green technologies, mining, AI’s role in the energy revolution, and how geoeconomics will impact critical minerals, the program (pdf) outlines.

Tunisia will host the International Fair of Energy Transition from Wednesday, 25 October to Friday, 27 October in Tunis. The event will host global stakeholders in the energy sector and will focus on promoting financing energy transition and discussing the challenges of renewables, energy efficiency and storage, and electric mobility.

Cairo Water Week is taking place from Sunday, 29 October to Thursday, 2 November. This year’s event will focus on global green developments in the water sector with sessions discussing the development of scientific solutions, practical tools, policies, and concrete measures to overcome today’s water challenges. The five-day event is organized by Egypt’s Ministry of Water Resources and Irrigation, in partnership with the EU and FAO.

India will host the International Solar Alliance from Monday, 30 October to Thursday, 2 November in New Delhi. Some 96 member countries will participate and discuss mobilizing funds to accelerate solar deployments, the universalization of energy access through solar mini-grids, and diversifying manufacturing and supply chains for solar energy production.

The UAE will host the Forbes Middle East Sustainability Leaders Summit from Wednesday, 1 November to Saturday, 3 November in Abu Dhabi. The summit will gather international leaders in sustainability, technology, finance, and policy to drive green strategies globally. The agenda includes sessions on climate-smart cities, green mobility, sustainable finance, and sustainable tourism. The summit is expected to set the tone for international and regional dialogue and decision-making, including COP28 which will kick off in late November.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

INVESTMENT WATCH

UAE’s F9 Capital and South Africa’s QGC form a JV to invest USD 1 bn in critical minerals mining

UAE’s F9 Capital is eyeing Africa’s critical minerals: Abu Dhabi-based investor F9 Capital Management and South Africa’s Q Global Commodities (QGC) are partnering to invest USD 1 bn in African mines producing minerals necessary for the energy transition, Bloomberg reported on Friday.

The details: The venture will see F9 and QGC develop mines in eastern and southern Africa for lithium, nickel, and cobalt, Bloomberg notes. An energy transition fund run by F9 would hold a 30% stake from the assets its investment fund would generate. QGC has stakes in metal deposits in South Africa, Botswana, Zambia, Tanzania, and Namibia.

What they said: “We wanted to make sure that our reserves and projects were exactly where they needed to be so we could get to the next stage,” QGS owner Quinton Van der Burgh told Bloomberg. “That pulling the trigger means investing in plants, infrastructure and developing our logistical arms.”

IPO plans in the making: The new joint venture is eyeing a listing on the UAE or Canada’s stock exchange, Van der Burgh said.

INVESTMENT WATCH

KSA’s Al Bashayer explores an EGP 1 bn investment in Egyptian waste management project

A new EGP 1 bn waste recycling project for Egypt? Egyptian Trade and Industry Minister Ahmed Samir met with KSA-based firm Al Bashayer Company to review the company’s plan to invest EGP 1 bn (USD 32.4 mn) in establishing a waste repurposing plant in Egypt, according to a statement released on Friday.

Part of a wider plan: Al Bashayer says it will leverage the know-how of an undisclosed German-based firm to upscale waste recycling operations in Egypt and plans to bring in more German-based developers to boost Egypt’s circular economy sector, the statement notes. Al Bashayer said its German partner would also look to invest in Egypt’s low-carbon energy sector, and Egypt’s trade ministry proposed the country’s industrial zone in Sadat City as a potential development hotspot.

IN OTHER EGYPT NEWS- Egypt and China signed a debt-swapping MoU on the sidelines of the Belt and Road Forum in Beijing last week and confirmed China's interest in funding development projects in the country’s agritech and renewable energy sectors, according to a separate statement. China did not clarify the type of financing it would earmark for Egypt-based projects in both industries.

Loan extensions are also in play: Egypt’s International Cooperation Ministry also confirmed during the bilateral meeting with the Chinese government that the China International Development Cooperation Agency (CIDCA) would extend concessional loans to fund the third and fourth phases of Egypt’s planned electric light rail train system, without detailing the value or tenor of the planned soft financing programs, the statement notes. Egyptian media reported earlier this month that China’s Eximbank would lend Egypt USD 400 mn for the third phase of the project.

DEBT WATCH

Egypt is eyeing USD 700 mn worth of green bonds in 2024 + up to USD 5 bn in issuances in the pipeline

The Egyptian government is reportedly considering issuing green bonds worth USD 700 mn next year, Al Borsa reported on Thursday, citing sources it says have knowledge of the matter. The issuance, which is still under study, will be carried out by an Electricity Ministry-affiliated body and the proceeds will be used to fund an unnamed green project, either by the private sector or through a public-private partnership (PPP), according to the news outlet.

Who’s involved? The International Finance Corporation (IFC) will act as an advisor to the offering and may also subscribe to the issuance itself, Al Borsa reported. It was reported that The Organization for Economic Cooperation and Development (OECD) will support the issuance, but the exact details of how the issuance will be guaranteed were not laid out.

I see your USD 700 mn, and raise you USD 5 bn: The Madbouly government is planning to bring in USD 3-5 bn from sovereign green issuances over the next five years, a government official told Enterprise.

In the meantime, a new framework is in the works for sustainable bonds: Egypt is working with the OECD to work out a framework for issuing green, blue, infrastructure, and other sustainable bonds on behalf of government entities, the source told us. The new regulations that will allow government entities to sell bonds tied to sustainability projects should be out in time for a green bond issuance set to happen next year, the source added.

This wouldn’t be Egypt’s first green bond sale: Egypt closed its second green bond issuance earlier this month with a CNY 3.5 bn (USD 478.7 mn) trove of Panda bonds. In 2020, our maiden green bond issuance brought in USD 750 mn and was almost 5x oversubscribed, attracting some USD 3.7 bn worth of orders for the bonds, pointing to growing appetites for climate-friendly securities worldwide.

GREEN MANUFACTURING

China’s Trina Solar will set up a PV manufacturing base in the UAE

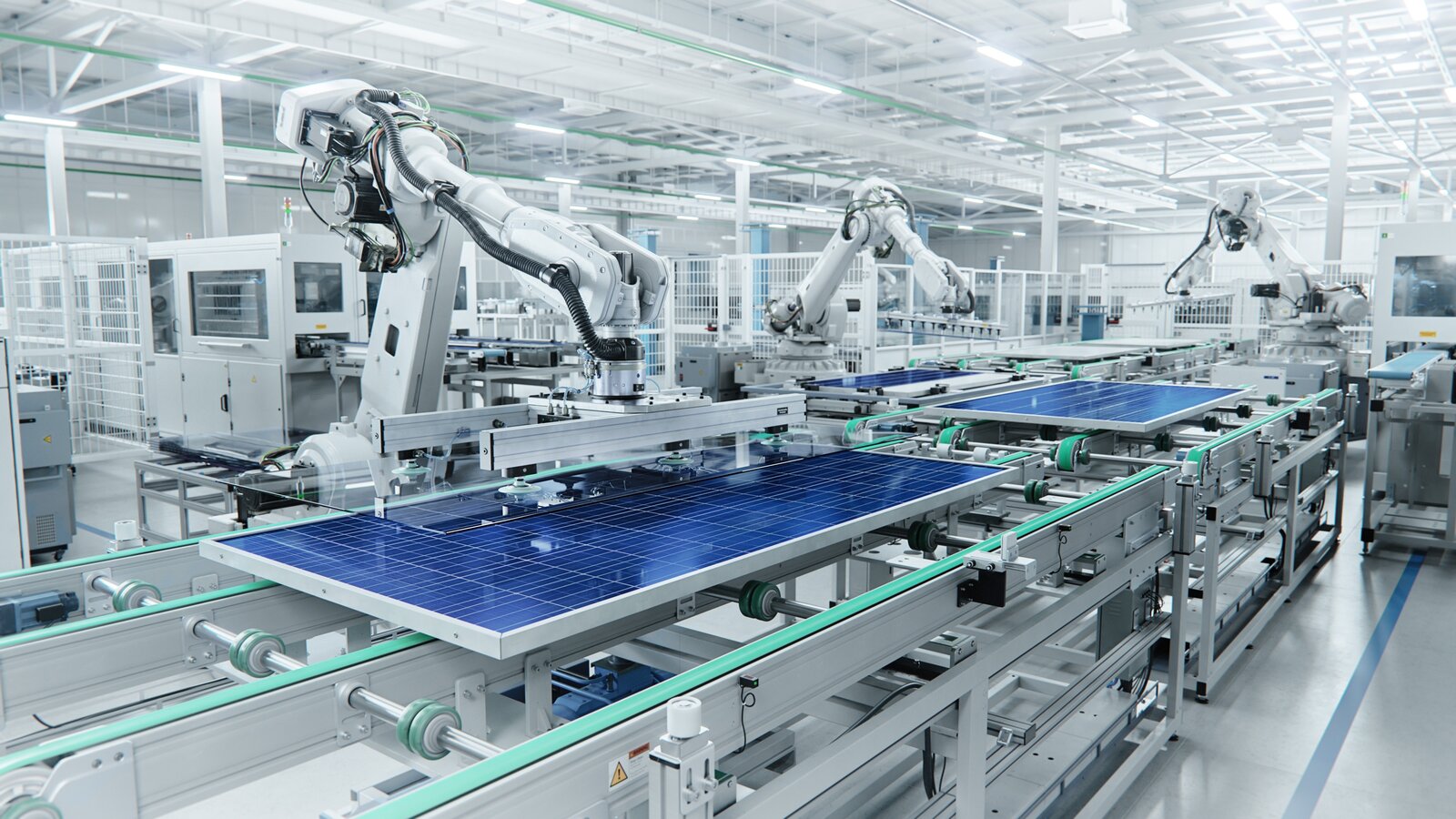

China’s Trina building solar panel manufacturing base in UAE: Chinese giant solar panel maker Trina Solar has signed an MoU with the UAE’s AD Ports and China-based investment firm Jiangsu Provincial Overseas Cooperation and Investment (JOCIC) to build a large-scale PV manufacturing base in the Khalifa Economic Zones Abu Dhabi (Kezad), English-language Chinese news outlet Yicai Global reported on Thursday. No financial details or a timeline for the project were disclosed.

The details: The facility — which will be built in three phases — will have an annual production capacity of approximately 50k tons of high-purity polysilicon, 30 GWs of crystalline silicon wafers, and 5 GWs of photovoltaic modules. Trina Solar will send representatives to the UAE to conduct field research and draw up feasibility studies and business investment plans, the news outlet reports.

REMEMBER- Trina Solar has supply agreements across the region: Trina Solar supplied the 45.5 MW solar station powering Saudi Arabia’s Jubail 3A water desalination plant with 700 watt PV modules last August. The firm delivered 800 MW of solar modules to Abu Dhabi’s 2 GW Al Dhafra solar plant in July. Back in March, the PV maker signed a five-year partnership and distribution agreement with Yemen’s Al Rabei for panels to generate some 500 MW of solar power.

About JOCIC: JOCIC is a Chinese state-owned company that was established in 2017 to fully manage, operate, and develop the China-UAE Industrial Capacity Cooperation Demonstration Zone, according to its website. Its founding came two years after China signed an agreement with the UAE to launch the China-UAE demonstration zone. JOCIC is a JV between China Jiangsu International, the China National Nuclear Corporation, and four of China’s national development zones.

WASTE TO ENERGY

Oman’s Nama Water will explore the feasibility of wastewater sludge WtE project

Nama Water is studying a new waste-to-energy initiative: Oman's national water utility company Nama Water is studying the feasibility of producing biogas from wastewater sludge as a promising waste-to-energy (WtE) initiative, Oman Daily Observer reported on Thursday. The feasibility study will explore and determine the financial and technical aspects of using anaerobic digestion tech to produce biogas from sewage sludge, Nama Water's Chief Process Engineer Intisar al Sulaimi said.

More sludge available: Nama is also developing a management strategy to identify sewage treatment plants suited for anaerobic digestion tech, aiming to complete the framework by the end of the year, Al Sulaimi said.

Oman’s casting a wide net on WtE: The feasibility study follows other initiatives in the same vein which are looking at generating energy using biofuels such as used cooking oil, municipal waste, biomass, and developing sustainable aviation fuel (SAF) from agri-oils.

And the sultanate believes it has huge potential for growth: Oman is capitalizing on its USD 1 bn WtE potential and already has several WtE projects underway. Its Sharjah plant has the capacity to process 300k tons of waste annually while generating 30 MW of clean energy. The Sultanate also finalized another feasibility study with Be'ah in April for a new plant with a capacity of 4.5k tons of municipal waste which is set to slash the carbon footprint of landfills by 50 mn tons in 35 years. Oman's Wakud is also setting up a fish-waste recycling facility and a vegetable and fruit waste-to-biogas plant, with work expected to begin by 2H 2024.

DEBT WATCH

International Finance Corporation is allocating 35% of USD 125 mn loan to green SMEs in Turkey

Fresh IFC financing for Turkey’s green sector: The International Finance Corporation (IFC) will invest USD 125 mn in Diversified Payment Rights (DPR) to Turkey’s state-owned bank Yapı Kredi, with at least 35% of the funds earmarked for SMEs focused on energy efficiency and renewables, according to a statement published last week.

Turkey is big on DPRs, but what exactly are they? DPRs are future flow securitizations, a debt instrument that allows a company or bank to borrow funds by promising to pay back using money they can reasonably expect to make at a future date. It is collateralized by a bank’s existing and future rights to receive foreign-currency payments into their accounts with correspondent banks abroad, global capital market consultant FitchRatings explains, adding that for Turkish banks these payments often relate to exports, capital flows, tourism or remittances. “DPRs are beneficial for providing emerging-market banks with access to foreign-currency funding in the international capital markets on attractive terms,” the global consultant added.

Yapi Kredi is working on securing backing for Turkey’s green transition: In October 2022, IFC provided a USD 120 mn blue and green loan to Yapı Kredi's leasing subsidiary, Yapı Kredi Leasing. The multilateral bank said it will use half of the proceeds to invest in blue projects — such as clean water, water efficiency, wastewater treatment, marine and ocean economy activities and water pollution prevention — while the other half for green projects including energy-efficient equipment, EVs, charging infrastructure, green construction, and renewable energy. In the same month, the EBRD also provided a EUR 50 mn on-lending facility to Yapı Kredi Leasing to support renewables and energy saving projects.

CLIMATE DIPLOMACY

Saudi signs MoUs with Indonesia and Singapore for renewables cooperation

KSA wants to partner up with Indonesia on renewables: Indonesia’s President Joko Widodo concluded a state visit where he discussed increasing bilateral cooperation in the renewable energy sector with KSA’s Crown Prince Mohammed bin Salman, the Saudi Press Agency reported on Friday. Both countries are currently reviewing potential investments across the solar, wind, and geothermal energy sectors, SPA notes. Indonesia has set out a target of sourcing 23% of its energy needs from renewables by 2025 under wider plans to become carbon-neutral by 2060.

Saudi ties: Acwa Power signed an MoU with Indonesia’s state-owned electricity company, PT Perusahaan Listrik Negara to develop a 4 GW battery storage facility and a hydroelectric-powered green hydrogen production facility last November. The two sides said at the time they would begin studies to determine feasibility of also establishing a 600-800 MW pumped storage hydroelectricity facility in Indonesia.

ALSO- KSA and Singapore ink clean energy roadmap: The governments of Saudi Arabia signed on Saturday a roadmap agreement to strengthen cooperation in the renewables, clean hydrogen, and carbon capture and storage sectors, the Saudi Press Agency reports. The new roadmap agreement — which builds on a bilateral MoU signed in 2021 — will facilitate commercial cooperation, as well as knowledge-transfer and research and development in the low-carbon and green technologies sector, SPA notes. The roadmap will also support policy exchange between both sides, helping establish standards, accreditations, and regulatory frameworks for new clean energy technologies.

Singapore is active in the region’s green energy sector: Singapore’s Sembcorp Utilities was among the selected to develop Oman’s 500 MW Manah 2 PV plant. Singapore’s sovereign fund GIC and French hydrogen investor Hy24 also invested USD 115 mn in InterContinental Energy's green hydrogen expansion plans in the Middle East and Australia. Singapore-based carbon trading exchange AirCarbon Exchange also launched the UAE Carbon Alliance with the UAE Independent Climate Change Accelerators in June to set up a framework for carbon markets.

OTHER DIPLO STORIES WORTH KNOWING ABOUT THIS MORNING-

- Oman and KSA team up on nuclear energy: Oman’s Environment Authority and Saudi Arabia’s Nuclear and Radiological Regulatory Commission have signed a knowledge-transfer agreement in a bid to promote best practices in the atomic energy sector and safeguard against radiation-related environmental hazards. (Oman News Agency)

ALSO ON OUR RADAR

STARTUPS-

Neo Mobility completes seed funding round: Dubai-based all-electric last-mile logistics and mobility company Neo Mobility has raised USD 10 mn in a seed funding round from green financing firms Delta Corp Holdings and Pyse Sustainability Fund among others, according to a statement released on Friday. The investment will allow Neo to scale up its operations to 5k two-wheeler and four-wheeler EVs in the UAE by 2025. "The seed fund represents an exciting milestone in our journey, accelerating the transition to eco-conscious last-mile logistics," said Neo CEO Abhishek Shah in the statement.

SUSTAINABLE AVIATION FUEL-

Egypt and Honeywell to partner on local SAF production? Egypt’s Oil Minister Tarek El Molla met with a delegation from US-based conglomerate Honeywell in Cairo to explore the possibility of establishing a local SAF production plant in the country, according to a statement released on Friday. Egypt’s government is looking to establish the SAF production company under the umbrella of the Egyptian Petrochemicals Holding Company in a bid to establish production plants with a capacity of 120k tons of SAF annually, the statement reads. Feasibility studies have been carried out for the proposed SAF production facility, expected to be located near the Alexandria National Refining & Petrochemical Company production plants in Alexandria, according to the statement.

REMEMBER- Honeywell recently debuted new SAF production tech: Honeywell unveiled green hydrogen-powered SAF production tech last May, which the company says can slash greenhouse gas emissions by 88% in comparison with conventional jet fuel. The new technology will combine green hydrogen and carbon dioxide captured from industrial smokestacks to produce lower-carbon methanol, which can be turned into fuels including SAFs.

GREEN FINANCE-

Egypt eyes Brics’ development bank for renewables + green hydrogen funding: Egypt is looking to get funding for its renewables green hydrogen and green ammonia projects in its Suez Canal Economic Zone from the Brics’ New Development Bank, according to a statement released on Thursday. Prime Minister Mostafa Madbouly confirmed that a plan is being prepared to determine aspects of cooperation with the bloc and its affiliated bank.

ELECTRIC VEHICLES-

Electromin and Quantron AG roll out Saudi’s largest fleet of all-electric trucks: Saudi Arabia-based motor vehicle manufacturing company Electromin has rolled out KSA’s largest fleet of all-electric trucks to date in partnership with German automaker Quantron AG, according to a statement released last week. Electromin has deployed 50 of the German company’s Qargo 4 light truck EVs, which have a 200 km tested driving range and are designed to upscale last mile delivery operations in urban areas. The EVs pack an 81 KW battery and have a 1.9k kg payload capacity, according to the company. The EVs have been prepped for deployment in collaboration with KSA-based corporations including Pepsico and Red Sea Global, the Saudi Gazette notes.

Electromin has been readying KSA’s EV infrastructure: The company revealed plans to establish KSA’s first ultra-fast direct current (DC) charging networks for EVs last July. The company already has over 100 alternating current (AC) charging chargers in the kingdom and its new addition of DC networks will enable it to cater to both B2B and B2C user segments.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- Tunisia launches solar thermal-powered desal plant: Tunisia’s Solartech Sud has inaugurated a pilot desalination plant powered by solar thermal energy to supply water to an oil mill in the southeastern town of Zarzis. (TAP)

- Egypt pushes forward on its 3 GW electricity interconnector with KSA: Egypt’s New and Renewable Energy Agency (NREA) has completed installation of the electricity transmission towers imported from India for its planned USD 1.8 bn, 3 GW electricity interconnection with Saudi Arabia, noting it plans to kick off operations on the project’s power stations in Badr and Sakakin by May 2025. (Youm 7)

- JinkoSolar will supply Acwa with 3.8 GW panels: China’s JinkoSolar will supply Acwa Power with 3.8 GW worth of panels for its 2.3 GW Ar Rass 2 project and the 1.5 GW Al Kahfah solar farm. (Statement)

- ADIO and NWTN collaborate on smart EVs: UAE’s NWTN has signed an agreement with The Abu Dhabi Investment Office to use the emirate’s smart and autonomous vehicles industry's Yas Island testing zone. (Statement)

- UM6P concludes Climate Launchpad competition: Mohamed VI Polytechnic University (UM6P) concluded its third edition of Climate Launchpad competition for green tech and business ideas. The winners included agritech startups Deepleaf and Jodoor. (Morocco World News)

AROUND THE WORLD

Tesla's disappointing 3Q warns of a slow EV market: Tesla's slowing growth during 3Q 2023, along with its shares dropping 9.3% on Thursday and then 4.4% again on Friday, signal rough times for the EV industry, Bloomberg reported on Friday. “We see a warning from the ‘gold standard’ of EVs having a ripple effect across the industry,” long-time EV investor Adam Jonas told the news outlet.

Price cuts alone aren't helping: Cutting car prices is only doing so much to raise demand, Tesla CEO Elon Musk told Bloomberg, blaming the low demand on rising interest rates in the US. Other EV manufacturers could see more trouble as they are already behind Tesla in the EV market, according to BloombergNEF analysis. The struggle to see a high-profit margin is also affected by "the significant pay hikes" for unionized workers at the EV factories, Jonas said.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- China announces new regulations for VCM: China set new standards for its national voluntary carbon credits market (VCM), noting that emission reductions projects inaugurated before the country’s announcement of its nationally determined contribution in 2020 will not be eligible to generate new carbon offset credits. (Bloomberg)

- The US invests USD 3.5 bn in its grid: The US is earmarking USD 3.5 bn in investments to upgrade the US power grid and connect transmission systems with power from renewable sources. The funding, which covers 58 projects in 44 states, is part of President Joe Biden's 2021 bipartisan infrastructure law. (Reuters)

- Denmark and the Netherlands backing South Africa’s coal phaseout: The governments of Denmark and the Netherlands have joined Canada, Spain, and Switzerland on the South Africa-focused Just Energy Transition Partnership, which has mobilized USD 8.5 bn to help the world’s largest coal-dependant country curb reliance on the heavily carbon emitting source. In June, the Netherlands and Denmark said they would set up a USD 1 bn fund to invest in green hydrogen projects in South Africa. (Statement)

CLIMATE IN THE NEWS

US startup says it can fully decarbonize the cement industry: California-based climate tech startup Brimstone Energy is using magnesium rich-calcium silicate rocks instead of carbon-heavy limestone in a bid to decarbonize the global construction industry and manufacture carbon-negative alternatives as durable as Portland cement, CNBC writes. The global cement production sector accounts for 8% of the world’s total annual carbon emissions, with 60% of its carbon footprint attributable to limestone usage, Brimstone notes.

Brimstone’s approach — one carbon-capturing rock to rule them all: Portland cement — the world’s most commonly used type of concrete material — is produced using a mix of limestones and minerals which generate 825–890 kg of CO2 per ton when heated. Brimstone uses calcium silicate — which is more abundant than limestone — and absorbs carbon from the atmosphere, rendering it carbon-negative. The company’s patented construction materials received certification last July for being as “chemically and physically identical” as Portland.

They already have backing: Bill Gates-backed investment firm Breakthrough Energy Ventures, which is financing the firm alongside Amazon’s Climate Pledge Fund, says Brimstone’s tech presents a “multi tn USD” offer to decarbonize the cement sector given the industry’s infrastructure readiness to adopt the technology. The company has raised USD 60 mn in funding to date, including USD 500k from the US government.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- Has solar energy proliferation reached an “irreversible tipping point”? Solar made up the majority of global power generation in 2050 in 72% of energy-simulations models run by a UK study on 70 global regions to forecast how 22 different energy sources are likely to be deployed through 2060. The extent of the predicted solar expansion is so high that the world has already reached an “irreversible tipping point,” where even a slowdown in policies would not stand in the way of the sector’s domination. (Bloomberg)

CALENDAR

OCTOBER 2023

24-26 October (Thursday-Saturday): Future Investment Initiative, Riyadh, KSA.

25-26 October (Friday-Saturday): Offshore & Floating Wind Europe 2023, London, United Kingdom.

25-27 October (Wednesday – Friday): International Fair of Energy Transition, Tunis, Tunisia.

29 October-2 November (Sunday-Thursday): Cairo Water Week, Cairo, Egypt

29 -31 October (Sunday-Tuesday): Egypt Energy Conference, Egypt International Exhibition Centre, Cairo, Egypt.

30 October – 2 November (Monday-Thursday): International Solar Alliance Assembly, New Delhi, India.

30 October – 1 November (Monday-Wednesday) ISWA 2023 World Congress: Global action towards a net-zero future, Muscat, Oman.

31 October-2 November (Tuesday-Thursday): Financial Times’ Energy Transition Summit, London, UK.

31 October-2 November (Tuesday-Thursday): World Hydropower Congress, Bali, Indonesia.

NOVEMBER 2023

1-3 November (Wednesday-Friday): Forbes Middle East Sustainability Leaders Summit 2023, Abu Dhabi, UAE.

7-8 November (Tuesday-Wednesday): ADIA Lab Symposium on Climate Change and Health Sciences, Abu Dhabi, UAE.

7-8 November (Tuesday-Wednesday): The 2023 US Algeria Energy Forum, Washington DC, USA.

9-10 November (Thursday-Friday): International Renewable Energy Agency Investment Forum, Uruguay.

9-15 November (Thursday-Wednesday): Intra-African Trade Fair 2023, Cairo, Egypt.

11-13 November (Saturday-Monday): GCC-Türkiye Economic Forum, Istanbul, Turkey.

15-17 November (Wednesday-Friday): WETEX and Dubai Solar Show, Dubai, UAE.

15-18 November (Wednesday-Saturday): DEWA’s First MENA Solar Conference, Dubai, UAE.

20-24 November (Monday-Friday) International Civil Aviation Organisation’s Aviation and Alternative Fuels conference, Dubai, UAE.

27-30 November (Monday-Thursday) Abu Dhabi Finance Week (ADFW), Abu Dhabi, UAE.

28-29 November (Tuesday-Wednesday): World Green Economy Summit (WGES), Dubai, UAE.

30 November – 12 December (Thursday-Tuesday): Conference of the Parties (COP 28), Dubai, UAE.

DECEMBER 2023

4 December (Monday): Saudi Green Initiative Forum, Dubai, UAE.

4 December (Monday): Abu Dhabi Sustainability Week (ADSW) summit, Dubai, UAE.

4-7 December (Monday-Thursday): International Conference on Global Warming, Ras Al Khaimah, UAE.

6-7 December (Wednesday-Thursday): Reuters’ Energy Transition MENA conference, Dubai, UAE.

8 December (Friday): Youth for Sustainability Forum (Y4S), Dubai, UAE.

12-14 December (Tuesday-Thursday): Green Hydrogen Summit Oman, Oman Convention and Exhibition Center, Muscat, Oman.

18-20 December (Monday-Wednesday): Saudi Arabia Smart Grid Conference, Hilton Riyadh Hotel & Residences, Riyadh, Saudi Arabia.

JANUARY 2024

9-11 January (Tuesday-Thursday): Future Minerals Forum, Riyadh, Saudi Arabia.

FEBRUARY 2024

26-28 February (Monday-Wednesday): Management and Sustainability of Water Resources, Dubai, UAE.

MARCH 2024

4-6 March (Monday-Wednesday): International Conference on Sand and Dust Storms in the Arabian Peninsula, Riyadh, Saudi Arabia.

APRIL 2024

16-18 April (Tuesday-Thursday): World Future Energy Summit, Abu Dhabi, UAE.

23-25 April (Tuesday-Thursday): Connecting Green Hydrogen MENA, Dubai, UAE.

MAY 2024

19-21 May (Sunday-Tuesday): Saudi Energy Convention, Riyadh, KSA.

JUNE 2024

5 June (Wednesday): World Environment Day, Saudi Arabia.

OCTOBER 2024

10-12 October (Tuesday-Thursday): Autonomous E-Mobility Forum, Doha, Qatar.

DECEMBER 2024

2-13 December (Monday-Friday): Conference of the Parties (COP16) to the United Nation Convention to Combat Desertification, Riyadh, KSA.

EVENTS WITH NO SET DATE

2023

Mid-2023: Oman set to sign contracts for green hydrogen projects.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

2024

12-14 February (Monday-Wednesday): Sustainable Aviation Futures MENA Congress, Dubai, UAE.

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

2025

International Union for Conservation of Nature World Conservation Congress, Abu Dhabi, UAE.

UAE to have over 1k EV charging stations installed.

2026

UITP Global Public Transport Summit, Dubai, UAE.

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2050

Tunisia’s carbon neutrality target.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.