Chinese battery giant CNGR is setting up a USD 2 bn battery plant in Morocco

Morocco tapped to host one of the world’s largest battery parts makers: Morocco-based pan-African investment fund Al Mada is teaming up with Chinese battery giant CNGR Advanced Material Company to build a MAD 20 bn (USD 2 bn) industrial base for battery parts production and recycling in Morocco, Bloomberg reported, citing a joint statement.

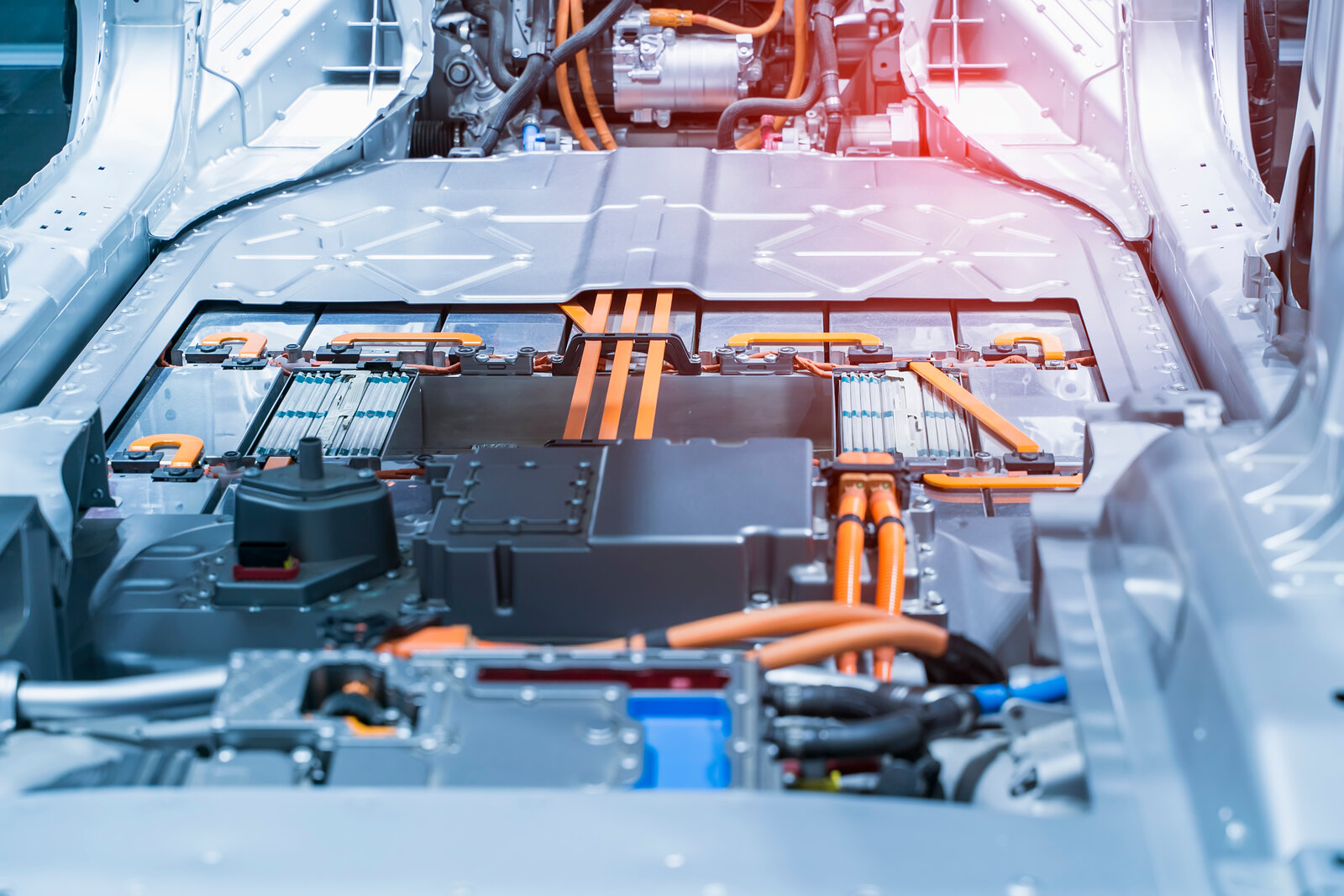

The details: Through an established JV, CNGR’s plant will produce precursor cathode active materials (pCAM) for lithium-ion batteries and lithium iron phosphate, as well as recycle black mass from used batteries, according to Argus. Construction at Jorf Lasfar port will start this year, with production planned to launch in phases with the first schedules in 4Q 2024, the news outlet writes. Once completed, the project will be able to provide battery CAM materials to over 1 mn EVs per year, with a designed capacity of 120k tons per year for pCAMs, 60k tons per year for lithium iron phosphate and 30k tons per year for black mass recycling. CNGR's subsidiary CNGR Morocco New Energy will hold a 50.03% stake in the JV, while Al Mada's subsidiary NGI will hold 49.97% of the JV’s share.

SOUNDSMART- CAMs are high purity chemicals that determine the performance, efficiency, reliability, cost, durability, and size of lithium-ion batteries, making it one of the most important components of the production process. Other than lithium iron phosphate — which will be produced at CNGR’s plant — the most common CAM materials used in lithium-ion batteries are lithium cobalt oxide, lithium manganese oxide, and lithium nickel manganese cobalt oxide. Its precursor material, pCAM, makes up about 60% of the monetary value of the cathode active material, which in turn contributes about 30% of the value of the final battery, CNGR Finland explains.

CNGR is eyeing Morocco’s minerals: The two firms are currently in talks with Morocco’s state-owned phosphates and fertilizer giant OCP Group to ensure a supply of the minerals needed for their battery production, Bloomberg writes. Morocco is a major global phosphate salt producer with its reserves accounting for 71% of the world's total reserves, according to Argus.

There is a growing demand of pCAMs: CNGR's ternary precursor production rose by 19% from the previous year to 105k tons from January to June, driven by growing demand from the EV and lithium-ion battery sectors, Argus writes.

This is not the first company interested in Morocco’s minerals: In August, Chinese battery minerals producer Zhejiang Huayou Cobalt said it had plans to invest MAD 200 bn (USD 20 bn) in establishing a plant in Morocco’s Laayoune-Sakia El Hamra region with an output of 6 mn cars annually. Earlier in June, Morocco signed an MoU with Chinese battery maker Gotion High Tech to set up a “gigafactory” with investments estimated at MAD 65 bn (c. USD 6.4 bn) in Bouknadel. Cars and their components have topped Morocco’s exports so far this year outperforming phosphate and fertilizer sales, Bloomberg said.

IN OTHER MOROCCO NEWS- Morocco and World Bank work to set up green hydrogen infrastructure: The Moroccan government — with help from the World Bank — will soon float a tender to select at least one private sector player for the development of green fuel transport and storage infrastructure within the country, Bloomberg quotes the country’s Energy Transition Minister Leila Benali as saying. The green hydrogen logistics strategy would bolster the country’s efforts to become a low-carbon energy exporter, Benali said, noting that the country’s gas interconnector with Europe would later be used for the transport of green fuels. Morocco also plans to use the planned Nigeria-EU gas pipeline to transport green hydrogen to the bloc while meeting demand in West African countries on the way, Benali says. Morocco’s green hydrogen advisory body Cluster Green H2 expects the country’s green hydrogen sector will be valued at some USD 3.4 bn by the end of the decade, and Morocco’s electrolyzer capacity could total up to 5 GW by 2030 before reaching 31-53 GW by 2050. “Once we have demonstrated the scalability of the sector, Cluster Green H2’s forecasts may be conservative,” Benali said.

REMEMBER– Morocco has another interconnector planned with the EU: UK-based renewables company Xlinks is also laying a 3.8k km high-voltage direct current (HVDC) subsea cable to eventually transport 3.6 GW of renewable energy — nearly 8% of the the UK’s current requirements — from a 10.5 GW solar and wind farm in Morocco’s Guelmim-Oued Noun region to Britain’s power grid in Devon.