- Chinese battery giant CNGR is setting up a USD 2 bn battery plant in Morocco. (Electric Vehicles)

- Abdul Latif Jameel-backed FRV will supply Amazon with solar energy from Spanish farms. (Solar)

- Egypt’s SCZone in talks with Shell on a green fuels partnership. (What We’re Tracking Today)

- Italy is turning to Algeria for cooperation in the renewables sector. (Climate Diplomacy)

- A new study finds human-caused climate change made Libya floods 10x more likely. (Danger Zone)

- Recycling aluminum cans could save 60 mn tons of CO2 per year by 2030. (Macro Picture)

- HSBC launches a USD 1 bn fund for climate startups. (Also on Our Radar)

- The world’s first “scientific health check” shows a majority of planetary boundaries have been broken. (Climate in the News)

Thursday, 21 September 2023

Chinese battery giant CNGR is setting up a USD 2 bn battery plant in Morocco

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, ladies and gents. We have a hefty issue with updates over the past couple of days to catch up on, let’s dive right in.

THE BIG CLIMATE STORY- Morocco-based pan-African investment fund Al Mada is partnering with Chinese battery giant CNGR Advanced Material Company to build a USD 2 bn industrial base for battery parts production and recycling in Morocco.

^^ We have more detail on this story and much more in the news well, below.

THE BIG CLIMATE STORY OUTSIDE THE REGION- Climate takes center stage at UN General Assembly ahead of COP28: Plans on emissions reduction, a fossil fuel phase out, and improved climate financing for the global south took center stage at the UN General Assembly (UNGA) earlier this week ahead of COP28. World leaders including US President Joe Biden highlighted the impact global warming has on both the global economy and vulnerable communities. “Record-breaking heat waves in the United States and China. Wildfires ravaging North America and southern Europe. A fifth year of drought in the Horn of Africa. Tragic, tragic flooding in Libya. Together these snapshots tell an urgent story of what awaits us if we fail to reduce our dependence on fossil fuels and begin to climate-proof the world,” Biden said. Current global climate action is falling “abysmally short” of meeting the Paris-agreed net-zero target and 1.5 C warming threshold, UN Secretary General Antonio Guterres warned at the UN meeting.

There were some notable no shows at the UN’s Climate Ambition Summit: The UN selected 34 states to lead the Climate Ambition Summit — which kicked off yesterday — in a bid to accelerate the transition away from fossil fuels, but China, the US, and the UAE were either excluded or showed no interest in spearheading talks on a fossil fuels phasedown. Notable participants in the UN chief’s planned climate talks include COP30 host Brazil, Canada, the EU, Pakistan, and South Africa, as well as non-member financial institutions including the World Bank and the International Monetary Fund. US Special Envoy on Climate Change John Kerry is expected to make an appearance, his office noted he will not be delivering a speech.

The news grabbed ink across the international outlets: Reuters | Bloomberg | Financial Times | The Guardian

WATCH THIS SPACE #1- Egypt’s SCZone in talks with Shell on a green fuels partnership: The head of Egypt’s Suez Canal Economic Zone (SCZone) Walid Gamal El Din met with executives from Shell to discuss potential partnership agreements to accelerate the port’s green fuel storage and production capacity, according to a statement. Egypt is looking to capitalize on progress made last month in the green hydrogen logistics sector, after Dutch-based chemicals producer OCI Global completed a six-hour refueling operation in East Port Said for the world’s first green methanol-powered ship. The SCZone has also begun talks with an unnamed Dutch developer to upscale its carbon capture capacity as part of its decarbonization targets, the statement notes. Earlier this month, Gamal El Din signed a letter of intent with Dutch-based developer Soluforce to establish a corridor facilitating the export of green fuels from Egypt to the Netherlands.

WATCH THIS SPACE #2- New EU regulations could hamper hydrogen industry growth: Europe’s nascent hydrogen industry is ready to fight the European Commission (EC) over a new set of regulations that businesses argue would hinder the clean fuel’s growth, Bloomberg reports. The proposed directives stipulate that third-party access to terminals must be “ensured”, meaning investors would have to make any and all spare supply of green hydrogen available for purchase on the market. In a bid to uphold fair competition, broad market access could be made mandatory.

The new rules could scare away investors: Plans by Germany-based Mabanaft to build an ammonia-to-hydrogen conversion facility at the German port of Hamburg by 2026 have been halted amid discussions with the EC, sources say. Mabanaft says that in order to secure bank financing, it would need to strike long-term contracts of around 20 years for all capacities. The developers are arguing that the EC’s regulations would severely hinder their output, profit-margins, and timeline, warding off investments and strangling decarbonization. The final design of the regulatory framework is still subject to change.

What does this mean for us? The new rules threaten to disrupt the clean fuel’s global transport chain, capping FDIs and exports from the UAE, Saudi, Egypt and Morocco. Just last year, Neom’s green hydrogen company inked an exclusive long-term agreement with Air Products last December to offtake 100% of the plant’s production and mark it for export to Hamburg’s port — which the proposed directives could impact.

WATCH THIS SPACE #3- Aramco and Exxon push back against IEA’s 2030 fossil fuel peak estimate: Despite promising predictions by the IEA last month that fossil fuel demand would peak within the next decade, Aramco Chief Amin Nasser and Exxon Mobil CEO Darren Woods are pushing back against the estimates, saying that demand for both oil, gas, and coal remain strong while calling for more investments into the carbon-intensive sources, CBC reported, noting statements made during the World Petroleum Congress this week. To create a net-zero pathway, more financing needs to be channeled toward power sources aside from renewables and green hydrogen, both of which will play a small role in meeting global energy needs, the oil companies said. A full dependency on low-carbon sources is proving unfeasible, according to Aramco. The notion of peak oil demand “is wilting under scrutiny because it is mostly being driven by policies, rather than the proven combination of markets, competitive economics and technology,” Reuters quotes Nasser as saying. The Saudi firm expects demand for oil to rise to 110 mn barrels per day by 2030, up 10 mn bpd from current levels.

KSA also took a shot at the IEA: Saudi Arabia's Energy Minister Abdulaziz bin Salman similarly called for more investments in hydrocarbons at the oil summit in Canada, and said the IEA has drifted from its role as “a forecaster and assessor of the market to one practicing political advocacy.”

WATCH THIS SPACE #4- Big emissions tax coming for the shipping industry in Europe: Ships sailing in and out of Europe could rack up a hefty emissions bill when the maritime industry joins the EU’s Emissions Trading System in January, Bloomberg reports. Shipping and maritime giants like MSC Mediterranean Shipping and AP Moller-Maersk may see a tab in the hundreds of mns of USD for carbon emissions.

About the system: Maritime vessels, which carry around 80% of world trade, emitted around 1 bn tons of CO2 into the atmosphere in 2018. The European Commission plans to cut emissions with a large-scale charge for international shipping. Ships carrying an average of 5k standard containers between Asia and Europe, which amounts to 40k tons of CO2 emissions, can see charges of around EUR 810k (USD 866.6k) assuming carbon prices are at EUR 90 a ton, the report notes.

In other emission cuts efforts: The program is expected to take a while to efficiently cut emissions, and methane and nitrous oxide emissions will be included in the system in coming years. The EU also has the 2025 FuelEU Maritime regulation that drives shippers toward clean fuels and caps annual greenhouse gasses emitted by shipping vessels.

THE DANGER ZONE- Climate change made Libya floods 10x more likely: The catastrophic flooding of Libya’s Derna city — which has left at least 4k dead and 9k missing according to UN recently revised figures — was made 50x more likely due to human-caused global heating, the Guardian reports, citing a study from the World Weather Attribution (WWA). Up to 50% more rainfall occurred due to human-caused climate change, the report concluded according to the new outlet, adding that the volume of rain that fell in Libya was “far outside that of previously recorded events.” The study found that in addition to increased CO2 emissions causing heavier rains and stronger floods, people were made more vulnerable to the rain due to a lack of adaptation planning such as building homes on floodplains, chopping down trees and not maintaining dams. The high death toll in Derna was a result of two poorly maintained aging dams bursting near the city, which washed away entire neighborhoods.

Our region should brace itself: “The Mediterranean is a hotspot of climate-change-fuelled hazards,” climate scientist at Imperial College London and co-author of the report Friederike Otto told the Guardian. Across the region, such extreme rain could now be expected at least once a decade, the news outlet added. The floods in the Mediterranean region mark a “breaking point” in atmosphering conditions, research director at the National Observatory of Athens and co-author of the report Vassiliki Kotroni said.

REMEMBER- Building early warning systems and resilient infrastructures will be an essential factor in adapting to the climate crises and minimizing human losses. You can read more about regional adaptation initiatives in preparation for extreme weathers in part two of our explainer on the El Nino climate phenomenon. A study published earlier this month showed that the continent as a whole is in need of a 10-fold increase in climate adaptation funding to USD 100 bn annually by 2030, which African leaders have submitted a proposal for ahead of COP28.

|

***

YOU’RE READING ENTERPRISE CLIMATE, the essential regional publication for senior execs who care about the world’s most important industry. Enterprise Climate covers everything from finance and tech to regulation, products and policy across the Middle East and North Africa. In a nod to the growing geographical ambitions of companies in our corner of the world, we also include an overview of the big trends and data points in nearby countries, including Africa and southern Europe.

Enterprise Climate is published by 5am CLT / 5am Riyadh / 6am UAE Monday through Thursday by Enterprise, the folks who bring you Enterprise Egypt, your essential 6am and 3pm read on business, finance, policy and economy in Egypt and emerging markets.

EXPLORE MORE OF ENTERPRISE ON THE WEB — tap or click here to read EnterpriseAM, EnterprisePM, and The Weekend Edition on our powerful new website packed with reader-friendly features.

Subscribe to Enterprise Climate here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

CIRCLE YOUR CALENDAR-

Saudi Arabia will host the MENA Climate Week from Sunday, 8 October to Thursday, 12 October in Riyadh. The four-day summit will discuss climate solutions ahead of COP28. It aims to provide a platform for policymakers, businesses, and others to exchange climate solutions as well as discuss obstacles and avenues in different regions. It considers four major systems-based tracks: energy systems and industry, cities, urban and rural settlements, infrastructure and transport, land, ocean, food and water, societies, health, livelihoods, and economies. You can register here.

The UAE will host the UNCTAD World Investment Forum from Monday, 16 October to Friday, 20 October in Abu Dhabi. This year’s theme focuses on sustainable investments, with a diverse range of climate financing sessions on promoting investments in the blue economy, agrifood systems, sustainable infrastructure, carbon markets, the circular economy, strategic minerals for decarbonization, and sustainable tourism. Some sessions will tackle reform of financial institutions needed to reach net zero, such as a session on integrating nature-related risk into capital markets and financing an equitable nature economy. Public sector investments and stock exchange action on climate disclosures will also be discussed.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

ELECTRIC VEHICLES

Chinese battery giant CNGR is setting up a USD 2 bn battery plant in Morocco

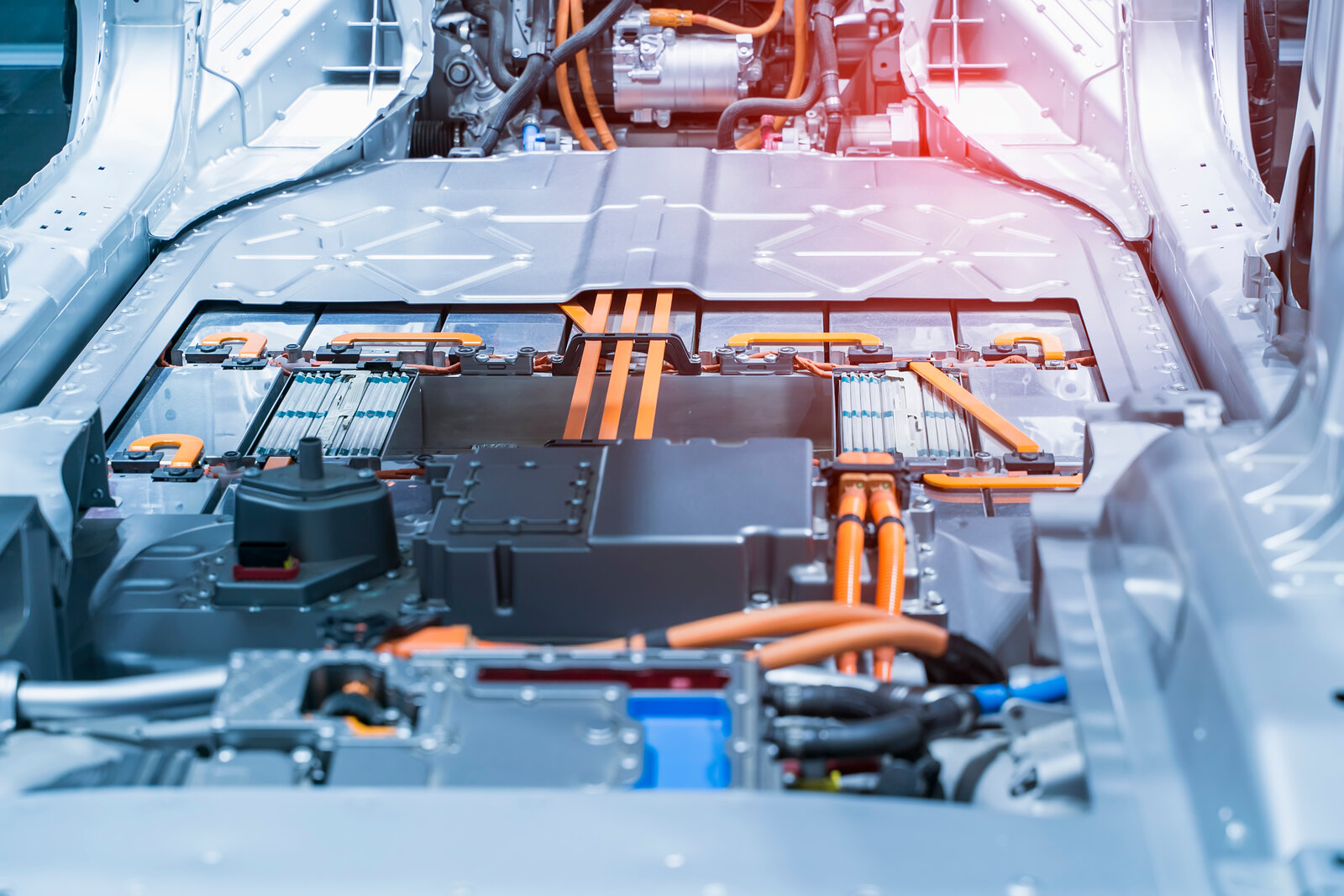

Morocco tapped to host one of the world’s largest battery parts makers: Morocco-based pan-African investment fund Al Mada is teaming up with Chinese battery giant CNGR Advanced Material Company to build a MAD 20 bn (USD 2 bn) industrial base for battery parts production and recycling in Morocco, Bloomberg reported, citing a joint statement.

The details: Through an established JV, CNGR’s plant will produce precursor cathode active materials (pCAM) for lithium-ion batteries and lithium iron phosphate, as well as recycle black mass from used batteries, according to Argus. Construction at Jorf Lasfar port will start this year, with production planned to launch in phases with the first schedules in 4Q 2024, the news outlet writes. Once completed, the project will be able to provide battery CAM materials to over 1 mn EVs per year, with a designed capacity of 120k tons per year for pCAMs, 60k tons per year for lithium iron phosphate and 30k tons per year for black mass recycling. CNGR's subsidiary CNGR Morocco New Energy will hold a 50.03% stake in the JV, while Al Mada's subsidiary NGI will hold 49.97% of the JV’s share.

SOUNDSMART- CAMs are high purity chemicals that determine the performance, efficiency, reliability, cost, durability, and size of lithium-ion batteries, making it one of the most important components of the production process. Other than lithium iron phosphate — which will be produced at CNGR’s plant — the most common CAM materials used in lithium-ion batteries are lithium cobalt oxide, lithium manganese oxide, and lithium nickel manganese cobalt oxide. Its precursor material, pCAM, makes up about 60% of the monetary value of the cathode active material, which in turn contributes about 30% of the value of the final battery, CNGR Finland explains.

CNGR is eyeing Morocco’s minerals: The two firms are currently in talks with Morocco’s state-owned phosphates and fertilizer giant OCP Group to ensure a supply of the minerals needed for their battery production, Bloomberg writes. Morocco is a major global phosphate salt producer with its reserves accounting for 71% of the world's total reserves, according to Argus.

There is a growing demand of pCAMs: CNGR's ternary precursor production rose by 19% from the previous year to 105k tons from January to June, driven by growing demand from the EV and lithium-ion battery sectors, Argus writes.

This is not the first company interested in Morocco’s minerals: In August, Chinese battery minerals producer Zhejiang Huayou Cobalt said it had plans to invest MAD 200 bn (USD 20 bn) in establishing a plant in Morocco’s Laayoune-Sakia El Hamra region with an output of 6 mn cars annually. Earlier in June, Morocco signed an MoU with Chinese battery maker Gotion High Tech to set up a “gigafactory” with investments estimated at MAD 65 bn (c. USD 6.4 bn) in Bouknadel. Cars and their components have topped Morocco’s exports so far this year outperforming phosphate and fertilizer sales, Bloomberg said.

IN OTHER MOROCCO NEWS- Morocco and World Bank work to set up green hydrogen infrastructure: The Moroccan government — with help from the World Bank — will soon float a tender to select at least one private sector player for the development of green fuel transport and storage infrastructure within the country, Bloomberg quotes the country’s Energy Transition Minister Leila Benali as saying. The green hydrogen logistics strategy would bolster the country’s efforts to become a low-carbon energy exporter, Benali said, noting that the country’s gas interconnector with Europe would later be used for the transport of green fuels. Morocco also plans to use the planned Nigeria-EU gas pipeline to transport green hydrogen to the bloc while meeting demand in West African countries on the way, Benali says. Morocco’s green hydrogen advisory body Cluster Green H2 expects the country’s green hydrogen sector will be valued at some USD 3.4 bn by the end of the decade, and Morocco’s electrolyzer capacity could total up to 5 GW by 2030 before reaching 31-53 GW by 2050. “Once we have demonstrated the scalability of the sector, Cluster Green H2’s forecasts may be conservative,” Benali said.

REMEMBER– Morocco has another interconnector planned with the EU: UK-based renewables company Xlinks is also laying a 3.8k km high-voltage direct current (HVDC) subsea cable to eventually transport 3.6 GW of renewable energy — nearly 8% of the the UK’s current requirements — from a 10.5 GW solar and wind farm in Morocco’s Guelmim-Oued Noun region to Britain’s power grid in Devon.

SOLAR

Abdul Latif Jameel-backed FRV will supply Amazon with solar energy from Spanish farms

FRV will provide Amazon with renewable energy: Abdul Latif Jameel-backed Fotowatio Renewable Ventures (FRV) have agreed to power Amazon’s operations with renewable energy from Spanish solar farms, according to a statement released on Tuesday. No financial details on the agreement were disclosed nor a timeline for when the agreement will be activated.

The details: FRV will power Amazon's operations with renewable energy from five solar projects in Spain. One of the farms is already operational and the remaining four are expected to operate in 2024, with an expected generation capacity of over 1.5 TWh. “This strategic collaboration with Amazon will enable us to continue contributing to the decarbonization of the electricity sector,” said Managing Director of FRV Iberia Fernando Salinas in the statement.

FRV has had a busy year: FRV has expanded its renewables operations massively this year. The company secured three new solar parks in New Zealand in a JV with Canadian asset management company Omers last month. FRV Australia and Genesis also agreed to acquire the 52 MW Lauriston solar farm earlier this year. The company also reached financial close on two battery energy storage (BESS) facilities in the UK with a combined power output of 133 MW in March.

MACRO PICTURE

Recycling aluminum cans could save 60 mn tons of CO2 per year by 2030

An effective global recycling system for aluminum beverage cans could save up to 60 mn tons of CO2 per annum globally by 2030, according to a study (pdf) by Roland Berger analyzing waste management schemes in six countries, including the UAE. The research assessed each country's collection infrastructure, recycling and landfill rates, used beverage can trade, raw material flows, and future targets. The five other countries in the study were South Korea, Vietnam, Cambodia, Thailand, and Australia, which, together with the UAE, represent 9% of the global can market. The study was commissioned by the International Aluminium Institute (IAI) and co-funded by Emirates Global Aluminium, Crown Holdings, Australian Aluminium Council, and Novelis.

The UAE had the lowest recovery rate: The UAE came in last in terms of the share of aluminum cans recovered, with only a 33% recovery rate. South Korea had the highest recovery rate at 96%, followed by Vietnam at 93%, Cambodia at 90%, Thailand at 86%, and Australia at 74%. Collectively, the six countries recycle 79% of all cans put on the market, according to one of the directors of forecasting at the IAI. The recovered cans are either recycled into cans once again, or used in the manufacturing of other products that require aluminum.

And is lacking policy incentives for effective collection: The study described the UAE’s recycling system as being in a transitional phase, where the collection infrastructure is largely developed but still lacks mandatory “extended producer responsibility” (EPR) strategies — making producers responsible for managing the disposal of products in the post-consumer stage — or “deposit return systems” (DRS) — offering financial incentives to consumers who return their used products. The other two types of systems identified were informal collection, and developed waste management, where the former relies on a high number of informal workers who collect the cans for income, and the latter depends on solid policies and complex infrastructure.

Recommendations to increase collection and recycling: The research identified some future actions to increase the rates of recycling, including deploying standardized dual-stream collection where consumers are incentivized to separate their waste; piloting semi-automatic basic and medium-sized sorting facilities; supporting a global trading platform for waste; and working with small-scale recyclers to improve recycling processes. With global consumption expected to increase by 50% between 2020 and 2030, these policies will be necessary to achieve global net zero emissions.

COFFEE WITH…

Coffee with: Mark Hoolwerf, Deputy Director at Port of Amsterdam

Coffee with: Mark Hoolwerf, Deputy Director at Port of Amsterdam: Hoolwerf (LinkedIn) serves as the International Deputy Director of Port of Amsterdam, the second largest port in the Netherlands and a hub that is eying green fuels imports from both Egypt and the UAE. Prior to serving as the Deputy Director, he acted as the Area Manager for four regions including the UK & Ireland, West Africa, North Africa, and Latin America.

The Port of Amsterdam has plans to import one mn tons of green hydrogen annually after 2030, has signed an agreement to establish a 500 MW green hydrogen plant in the Dutch capital’s port area, and has signed a spate of green fuels-focused agreements to establish hydrogen corridors to the EU both with regional developers, and foreign players, including with the Port of Bilbao.

We sat down for a brief chat with Hoolwerf on the sidelines of the Green Hydrogen Summit in Egypt last week to talk about green fuels generation potential in MENA, and discuss the Dutch government’s plans to source green hydrogen from the region given the EU bloc’s target to source 10 mn tons of low-carbon fuels by 2030.

Enterprise: Where do you see the green hydrogen sector going in Egypt, given the USD 83 bn worth of agreements signed during COP27 last November?

Mark Hoolwerf: I think the potential in Egypt is tremendous. The Port of Amsterdam is working with several companies in the region, including producers with planned projects as well as prospective producers in the early stages. Egypt is one of the countries with the highest potential to deliver cheap green fuels in comparison to some of the other countries that we are looking at, which is attributable to Egypt’s prime geographical position and proximity to export markets like the EU. Its efficient renewable energy resources; whether it be high solar radiation or high wind speeds, which is another important asset.

I think the name of the game is making sure that you can support and facilitate the ones that have the highest potential and show the largest commitment to actually get it off the ground.

E: What is Port of Amsterdam’s level of interest in MENA’s green hydrogen sector?

MH: We're very keen on ensuring the Port of Amsterdam has sufficient green fuel supplies to meet climate action targets, that’s why we are collaborating with producers in several countries. Our concern is on matching the cost of getting the hydrogen from countries like Egypt and the wider MENA region to the port of Amsterdam in a cost-effective manner and meeting what EU offtakers are willing and able to pay. In January, the Port of Amsterdam and Dutch firms SkyNRG, Evos Amsterdam, and Zenith Energy Terminals signed an agreement with the UAE’s Masdar to explore the possibilities of green fuel exports to Europe. The Dutch government has similar agreements with countries like Oman, and Saudi Arabia that focus on supporting the development of hydrogen corridors.

The Gulf is obviously one of the front runners, especially Saudi Arabia and the UAE. In North Africa, I think Egypt and Morocco have tremendous potential. Algeria is also showing promise.

E: What are your expectations for COP28? What outcomes are you hoping for?

MH: Usually what you see is a lot of promises and intentions basically being declared, but what we would like to see is those words translated to actual commitments. It’s a bit of a cliche answer, but it is definitely what we are hoping for, especially when it comes to hydrogen. Over the last couple of years, there have been a lot of MoUs without translation to concrete commercial agreements. Getting preliminary green hydrogen agreements off the drawing board and on the ground is very challenging, but that’s what I would like to see most.

CLIMATE DIPLOMACY

Italy is turning to Algeria for cooperation in the renewables sector

Italy is ready to increase cooperation with Algeria in the energy transition: Increased cooperation in renewables projects and an electric interconnection was at the top of the agenda in a Tuesday meeting between the head of Algeria’s state-owned gas firm Sonelgaz and Italy’s ambassador to Algeria Giovanni Polizzi, according to a statement. Polizzi expressed Italian companies' willingness to boost investments in the electricity and gas sector in Algeria, the statement added. The meeting was attended by other executives of Sonelgaz.

REMEMBER- Algeria has been struggling to grab investor attention: Algeria has recently been criticized for having an “inconsistent regulatory environment” by the US. In July, Spain decided to exclude Algeria from a European-wide hydrogen transport infrastructure with Morocco, despite previous proposals of a submarine natural gas pipeline between Algeria and Spain.

ALSO ON OUR RADAR

Morocco is dialing in on renewables + hydrogen research and training: The Moroccan Institute for Research in Solar Energy and New Energies (Iresen) has signed four different agreements to boost research and training in the renewable energy and green hydrogen fields, Morocco World News reports. The agreements were made on the sideline of the World Power-to-X Summit which is concluding today.

The details: The first agreement was signed with the Regional Council of Guelmim-Oued Noun province to boost research and sustainable development activities in renewables. The second was signed with Morocco’s Office for Vocational Training and Labor Promotion and the GreenH2 cluster — a national platform launched in 2021 to support the country's green hydrogen industry — to develop and implement specialized vocational training programs for Moroccan and African professionals in the green hydrogen value chain. Iresen also partnered with Chinese technology giant Huawei and international platform Green Energy Park to work together on renewables and storage research. The fourth agreement will see the Moroccan institute collaborating with the Arab region’s intergovernmental organization Regional Centre for Renewable Energy and Energy Efficiency to drive renewables research projects and partnerships. Green H2 also agreed to partner with Netherland’s Morocco-focused JV Eco-Stream to support the growth of its green hydrogen sector.

HSBC launches a USD 1 bn fund for climate startups: British banking group HSBC Holdings announced yesterday plans to launch a USD 1 bn startup fund to support companies working on advancing carbon capture, battery energy storage, EV charging, and sustainable food technologies around the world, according to a statement. The bank is specifically targeting early stage startups, noting that about 50% of global emissions reductions required to reach net zero by 2050 “will come from technologies that are currently at the demonstration or prototype phase.” The company has also announced a USD 100 mn investment in Bill Gates-backed venture capital firm Breakthrough Energy Catalyst in a bid to support green tech advancements. The USD 1 bn financing commitment follows the bank’s announcement of its Climate Tech Venture Capital strategy, which aims to similarly fund companies focused on developing net-zero technologies.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- Oman solar plant gets a green guarantee: Standard Chartered has issued its first green guarantee to China Energy Engineering Shanxi Electric Power Engineering Company for a solar power project in Oman. (Zawya)

- Qatar’s first electric car is also heading to Jordan: Qatar’s smart transport company EcoTransit will be releasing the Vim — which is manufactured in China — in Qatari markets within the next two months and will enter Jordanian markets soon. (Jordan News Agency)

- Fedex joins the EV bandwagon: The world’s largest express delivery company is adding three EVs to its UAE fleet in a bid to enhance sustainable logistic services. FedEx completed trials on EV maneovering in the UAE earlier this year. (Albayan)

- Jordan’s green hydrogen strategy is imminent: Jordan’s green hydrogen strategy is in the final stages of preparation, according to Secretary General of the Ministry of Energy and Mineral Resources Amani Al-Azzam. Jordan plans to reach 50% of electricity generated from renewables by 2030, by introducing new energy storage systems, smart meters, and improving the infrastructure that enables the transfer of electricity between neighboring countries. (Al Mamlaka)

AROUND THE WORLD

Norway's sovereign wealth fund is planning to invest in 1 GW of Spanish utility giant Iberdrola’s renewables plants in Spain and Portugal, Reuters reported this week, citing sources that spoke to Cinco Dias newspaper. The sovereign fund was initially negotiating to buy a 49% stake in a portfolio of onshore wind farms and solar power plants with a 500 MW capacity. This will be the second major investment the fund is making in Iberdrola this year, after it purchased 49% of a 1.3 GW portfolio of solar and wind farms in January for EUR 600 mn. Iberdrola has been raising cash to invest in new projects by selling stakes in more advanced ones. Norges Bank Investment Management operates the fund.

REMEMBER– UAE’s Masdar entered a similar agreement and acquired a 49% stake in Iberdrola’s EUR 1.6 bn Baltic Eagle offshore wind farm off the coast of Germany last July.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- USD 1 bn climate fund to be formed by major investors: Former US president Bill Clinton and co-founder of autonomous driving tech firm Mobileye Ziv Aviram are launching a USD 1 bn climate fund. Bn’aires Itai Lemberger and Robert Citrone — founders of Bow Wave Capital Management and Discovery Capital Management respectively — are also amongst the fund’s founders. (Bloomberg)

- Hyundai funds sustainable mobility development: Hyundai Motor Group will invest USD 12 bn in EV manufacturing and battery production after signing MoU with Georgia Tech to develop sustainable mobility and a hydrogen economy. (Statement)

CLIMATE IN THE NEWS

The first complete “scientific health check” reveals global systems are well beyond stable range: Six of the world’s nine planetary boundaries — the environmental thresholds within which ecosystems can self-regulate and humanity can safely operate — have been broken due to “human-caused pollution and destruction of the natural world,” The Guardian reported, citing a study (pdf) published in ScienceAdvances. Another two of the boundaries — air pollution and ocean acidification — are currently at risk of collapsing, while four biological boundaries — climate, biodiversity, land use, and biogeochemical cycles — are either at or close to the highest risk level. While air pollution is globally still within the boundary, the study showed that the boundary has been crossed in some regions such as South Asia and China. The assessment — which was based on 2k previous studies — concluded that Earth's systems have been thrown out of equilibrium, making future global environmental conditions uncertain, the study concluded.

When were the boundaries crossed? The boundary for biosphere integrity — which concerns the functioning of ecosystems — was broken in the late 1800s, while the boundary for land use — the loss of forest — was breached in the last century. In the late 1980s, the safe boundary for climate change was surpassed, while the freshwater boundary was exceeded in the early 1900s. Other boundaries include nitrogen and phosphorus flow and synthetic pollution, both of which have been broken due to excessive use of fertilizers.

Atmospheric ozone is the only boundary relatively intact: “The one boundary that is not threatened is atmospheric ozone, after action to phase out destructive chemicals in recent decades led to the ozone hole shrinking,” The Guardian explains.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- Antarctic sea-ice at record low levels: Sea-ice on the Antarctic Ocean’s surface has fallen well below any previously recorded level reaching 17 mn sq km, 1.5 mn sq km below the September average, satellite data shows. (BBC)

ON YOUR WAY OUT

Vertical farming is growing out of business: Vertical farming may be a solution to food scarcity in arid climates, but the tech required to build and operate a vertical farm is too capital-intensive to lock in investors leaving many agritech businesses in the red, Bloomberg reports. There’s a lot to be done agronomically in a vertical farm but financially crops like fruits and potatoes are not enough to sustain a business, says Gilles Dreyfus, CEO of Jungle, a French vertical farming startup.

The key to profit is in high-margin crops and premium products: Jungle’s success is in pursuing crops with fast-growing cycles that are more efficiently grown in a climate-controlled space like basil and lettuce. When grown outdoors, these crops can have up to four harvests a year but in a vertical farming climate, harvests can reach up to 14 cycles. The French startup also favors short-stature crops with the ability to grow at a higher density, leaving room for more crops. Selling premium products at a decent markup, like fragrant flowers to major perfume brands, is the real jackpot in turning a profit via vertical farming, Dreyfus says.

Could vertical farms feed the world? Dreyfus believes they can, comparing vertical farming’s progress to the early days of solar energy. The industry, which once routinely lost money, has increasingly become more profitable. Perfecting the technologies used in vertical farming and understanding its business could lure in investments as crops become more profitable, he adds.

The UAE is making headway on the agritech front: In collaboration with Italy’s Zero farms, Abu Dhabi-based investment and holding company ADQ started operations on its first ever vertical farming project last March. AgTech Park’s pilot phase spans a surface area of 1k sqm and will yield 10 tons of produce per annum when it comes online by the end of 3Q 2023. An expansion reaching 40k sqm is expected to produce more than 40 kilo tons of crops annually — roughly 6% of the country’s consumption.

CALENDAR

SEPTEMBER 2023

9-20 September (Saturday-Wednesday): 2023 Sustainable Development Goals Summit, New York, USA.

19-21 September (Tuesday-Thursday): World Power-to-X Summit, Marrakesh, Morocco.

26-27 September (Tuesday-Wednesday): GCC-Iraq Business Forum, Sharjah, UAE.

28 September (Thursday): International Energy Agency Critical Minerals and Clean Energy Summit, Paris, France.

Chariot Limited and Total Eren’s feasibility study on a 10 GW green hydrogen plant in Mauritania is to be completed.

Egypt set to launch alliance to shore up climate financing in developing countries

OCTOBER 2023

2-5 October (Monday-Thursday): ADIPEC Decarbonization Accelerator, Abu Dhabi, UAE.

4 October (Wednesday): Arabia CSR Gala Awarding Ceremony, UAE.

4-5 October (Wednesday-Thursday): Future Sustainability Forum, Dubai, UAE.

8-10 October (Sunday-Tuesday): Saudi Green Building Forum, Riyadh, Saudi Arabia.

10-11 October (Tuesday-Wednesday): Green Energy Africa Summit, Cape Town International Convention Centre 2, Cape Town, South Africa.

8-12 October (Sunday-Thursday): MENA Climate Week, Riyadh, Saudi Arabia.

9-15 October (Monday-Sunday): World Bank/IMF 2023 Annual Meetings, Marrakech, Morocco.

10-12 October (Tuesday-Thursday): Autonomous E-Mobility Forum, Doha, Qatar.

16-17 October (Monday-Tuesday): Duqm Economic Forum, Duqm, Oman.

16-18 October (Monday-Wednesday): Climate Week, Rome, Italy.

16-20 October (Monday-Friday): UNCTAD World Investment Forum, Abu Dhabi, UAE.

18-20 October (Wednesday-Friday): Morocco and Belgium business meeting on green hydrogen, Tangiers, Morocco.

17-18 October (Tuesday- Wednesday): Critical Minerals Africa Summit, Cape Town, South Africa.

17-20 October (Tuesday-Friday): Fourth meeting of the COP27 Transitional Committee, TBD.

25-26 October (Friday-Saturday): Offshore & Floating Wind Europe 2023, London, United Kingdom.

29 October- 2 November (Sunday-Thursday): Cairo Water Week, Cairo, Egypt

31 October – 2 November (Tuesday-Thursday): World Hydropower Congress, Bali, Indonesia.

NOVEMBER 2023

1-3 November (Wednesday-Friday): Forbes Middle East Sustainability Leaders Summit 2023, Abu Dhabi, UAE.

7-8 November (Tuesday-Wednesday): ADIA Lab Symposium on Climate Change and Health Sciences, Abu Dhabi, UAE.

7-8 November (Tuesday-Wednesday): The 2023 US Algeria Energy Forum, Washington DC, USA.

9-10 November (Thursday-Friday): International Renewable Energy Agency Investment Forum, Uruguay.

9-15 November (Thursday-Wednesday): Intra-African Trade Fair 2023, Cairo, Egypt.

15-17 November (Wednesday-Friday): WETEX and Dubai Solar Show, Dubai, UAE.

15-18 November (Wednesday-Saturday): DEWA’s First MENA Solar Conference, Dubai, UAE.

20-24 November (Monday-Friday) International Civil Aviation Organisation’s Aviation and Alternative Fuels conference, Dubai, UAE.

27-30 November (Monday-Thursday) Abu Dhabi Finance Week (ADFW), Abu Dhabi, UAE.

28-29 November (Tuesday-Wednesday): World Green Economy Summit (WGES), Dubai, UAE.

30 November – 12 December (Thursday-Tuesday): Conference of the Parties (COP 28), Dubai, UAE.

DECEMBER 2023

4 December (Monday): Saudi Green Initiative Forum, Dubai, UAE.

4 December (Monday): AbuDhabi Sustainable Week (ADSW), Dubai, UAE.

8 December (Friday): Youth for Sustainability Forum (Y4S), Dubai, UAE.

12-14 December (Tuesday-Thursday): Green Hydrogen Summit Oman, Oman Convention and Exhibition Center, Muscat, Oman.

18-20 December (Monday-Wednesday): Saudi Arabia Smart Grid Conference, Hilton Riyadh Hotel & Residences, Riyadh, Saudi Arabia.

JANUARY 2024

9-11 January (Tuesday-Thursday): Future Minerals Forum, Riyadh, Saudi Arabia.

FEBRUARY 2024

26-28 February (Monday-Wednesday): Management and Sustainability of Water Resources, Dubai, UAE.

MARCH 2024

4-6 March (Monday-Wednesday): International Conference on Sand and Dust Storms in the Arabian Peninsula, Riyadh, Saudi Arabia.

APRIL 2024

16-18 April (Tuesday-Thursday): World Future Energy Summit, Abu Dhabi, UAE.

23-25 April (Tuesday-Thursday): Connecting Green Hydrogen MENA, Dubai, UAE.

JUNE 2024

5 June (Wednesday): World Environment Day, Saudi Arabia.

DECEMBER 2024

2-13 December (Monday-Friday): Conference of the Parties (COP16) to the United Nation Convention to Combat Desertification, Riyadh, KSA.

EVENTS WITH NO SET DATE

2023

Mid-2023: Oman set to sign contracts for green hydrogen projects.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

2024

12-14 February (Monday-Wednesday): Sustainable Aviation Futures MENA Congress, Dubai, UAE.

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

2025

International Union for Conservation of Nature World Conservation Congress, Abu Dhabi, UAE.

UAE to have over 1k EV charging stations installed.

2026

UITP Global Public Transport Summit, Dubai, UAE.

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2050

Tunisia’s carbon neutrality target.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.