- UAE’s Masdar nabs 50% stake in EDF renewables’ California Big Beau solar plant. (M&A Watch)

- KSA is getting a hydrogen fuel cell assembly plant. (Investment Watch)

- UAE’s Taqa is getting its ducks in a row for green finance with a new finance framework. (What We’re Tracking Today)

- Algeria is studying electricity exports to Europe through undersea cables. (On Our Radar)

- Oman is exploring a concentrated solar power project in Duqm. (On Our Radar)

- Egyptian startup VAIS is using satellite data and AI Solutions to boost irrigation efficiency. (Green Tech)

- Kazakhstan is increasing uranium production as Europe reduces dependence on Russia. (Around the World)

- Etihad Airways’ ads won’t fly in the UK due to greenwashing concerns. (On Your Way Out)

Thursday, 13 April 2023

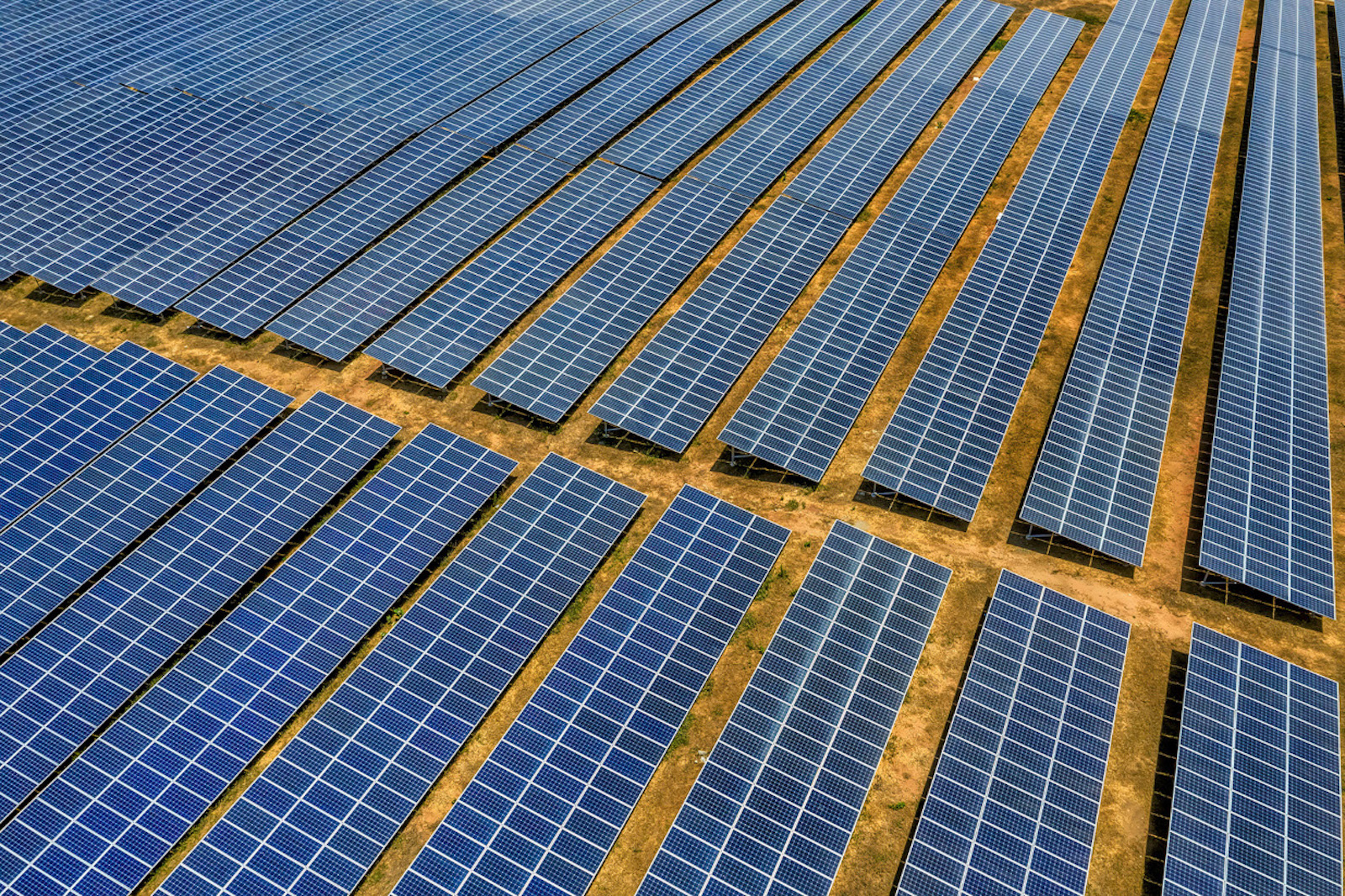

Masdar nabs 50% stake in EDF renewables’ California Big Beau solar plant

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, ladies and gents. Thursday has finally rolled back around as we slide into the weekend — but first we have a few climate updates from the UAE and KSA.

A quick programming note: Enterprise Climate will be taking a publication holiday on Monday in observance of the Egyptian national holiday of Sham El Nessim. We’ll be back in your inboxes on Tuesday morning at our regularly scheduled time.

THE BIG CLIMATE STORY- UAE renewables giant Masdar has acquired a 50% share in EDF Renewables North America’s 128 MW Big Beau solar plant in California. Masdar and EDF inked an agreement to jointly co-develop eight US-based renewables plants that would yield a total of 1.6 GW in 2020. Closer to home, two US companies inked a joint venture agreement to establish a hydrogen fuel cell products assembly plant in Saudi Arabia.

^^ We have the details on these stories and more in the news well, below.

THE BIG CLIMATE STORY OUTSIDE THE REGION- US proposes its toughest tailpipe emissions standards yet: The US Environmental Protection Agency unveiled yesterday hardened tailpipe emissions regulations on 2027 car models through 2032 in a move it says could have EVs comprise 60% of total domestic car sales by 2030, and 67% by 2032. If passed, the sweeping standards would be the country’s most severe vehicular carbon slashing plan, requiring annual emissions cuts of 13% as well as a 56% push down in estimated fleet average emissions above previously announced 2026 requirements, effectively forcing automakers to transition to EVs to meet the new requirements.

The story got widespread coverage in the international press: Bloomberg | Financial Times | Reuters | Associated Press | CNN | Wall Street Journal | Washington Post | New York Times

ICYMI- EnterpriseAM took a look at where progress stands on Egypt’s 4.8 GW Dabaa nuclear power plant, the first ever nuclear project in the country.

OVER IN COPLAND- IMF, UN, and COP28 president-designate discuss pushing pace of climate action: IMF Managing Director Kristalina Georgieva, UN Special Envoy for Climate Action Mark Carney, and COP28 President-Designate Sultan Al Jaber discussed yesterday the necessity of scaling up climate finance to unlock tns of USD to help meet climate goals, according to a joint statement. At a roundtable discussion in Washington, the three agreed on the importance of making the investment climate more conducive to climate finance while identifying specific obstacles that hinder private sector climate finance. They also agreed on “using innovative financing instruments to scale up private investment in emerging and developing economies,” according to the statement.

WATCH THIS SPACE #1- Taqa is getting its ducks in a row for green finance: The UAE’s state-owned Abu Dhabi National Energy Company (Taqa) has launched a new Green Finance Framework to issue green bonds, sukuk, loans, and other debt instruments under the company’s long-term net-zero goal, it said in a tweet. Proceeds from the issuances will be allocated to eligible green projects, including renewable energy, energy efficiency, sustainable water and wastewater management, clean transportation, and terrestrial and aquatic biodiversity, according to a statement picked up by Wam. The framework has received backing from Citi, Standard Chartered Bank, MUFG, and HSBC as joint sustainability structuring banks alongside First Abu Dhabi Bank (FAB) as a sustainability finance framework advisor.

We knew this was coming: The announcement comes months after Taqa CEO Jasim Husain told Bloomberg in February that his company plans to issue “several hundred mn USD” in green bonds in 2023 for specific projects.

REMEMBER– Interest in these debt instruments have been on the rise in the region in recent months ahead of COP28 in the UAE. Sources told Reuters last week that the UAE federal government, Abu Dhabi and its sovereign wealth fund Mubadala are looking into issuing green bonds. Adnoc is also considering putting its bond plans back on the table and Masdar looking into issuances this year, according to the business newswire. Saudi Electricity Co raised USD 2 bn through USD-denominated green and conventional sukuk this month, while Saudi Arabia’s Al Rajhi Bank also raised USD 1 bn from its five-year USD-denominated sustainable sukuk issuance the same week. Back in February, KSA’s sovereign wealth fund the Public Investment Fund (PIF) sold USD 5.5 bn of green bonds in its second issuance of the debt instruments.

WATCH THIS SPACE #2- A sudden change of heart? G7 climate ministers have backtracked and softened on previous language anticipating growing future demand for LNG, Reuters reports, citing the latest G7 draft communique it has seen. The latest draft document ahead of the ministerial meeting on Saturday in Japan now suggests “considerable uncertainty for future demand of natural gas and LNG and consequently there are risks of supply and demand gap to be addressed.” The draft also stresses the necessity of LNG and gas investments to help "bridge the gap” while still maintaining climate objectives and commitments. A previous draft of the document urged "necessary upstream investments in LNG and natural gas" on the back of the energy crunch from the Russia-Ukraine crisis, anticipating demand for natgas will increase.

WATCH THIS SPACE #3- Carbon emissions from the global power sector may have peaked in 2022, according to a new report by climate think tank Ember. An increase in solar and wind energy deployments tamped carbon output last year, and the continued building of renewable energy installations this year could see carbon output from fossil fuel-generated electricity decline 0.3% in 2023. In 2022, solar and wind energy assets generated some 12% of the world’s electricity supply, up from 10% in 2021. Ember’s Global Electricity Review studied the power sectors of 78 countries representing 93% of the world’s collective energy demands, and found that renewables and other clean energy sources comprised 39% of the total global power output last year, with solar and wind’s share rising y-o-y by 24% and 17%, respectively. The hike in solar and wind capacity met nearly 80% of the increase in electricity demand in 2022, Ember finds, adding that had the uptick in demand been sourced from fossil fuels, emissions from the power sector would have been 20% higher in 2022.

|

***

YOU’RE READING ENTERPRISE CLIMATE, the essential regional publication for senior execs who care about the world’s most important industry. Enterprise Climate covers everything from finance and tech to regulation, products and policy across the Middle East and North Africa. In a nod to the growing geographical ambitions of companies in our corner of the world, we also include an overview of the big trends and data points in nearby countries, including Africa and southern Europe.

Enterprise Climate is published at 4am CLT / 5am Riyadh / 6am UAE Monday through Thursday by Enterprise, the folks who bring you Enterprise Egypt, your essential 6am and 3pm read on business, finance, policy and economy in Egypt and emerging markets.

EXPLORE MORE OF ENTERPRISE ON THE WEB — tap or click here to read EnterpriseAM, EnterprisePM, and The Weekend Edition on our powerful new website packed with reader-friendly features.

Subscribe to Enterprise Climate here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

COME TO OUR NEXT ENTERPRISE FORUM-

The Enterprise Exports & FDI Forum, our latest industry-specific conference, is taking place on Monday, 15 May at Four Seasons, Nile Plaza in Cairo. The Enterprise Exports & FDI Forum will give insiders and newcomers alike the chance to talk about how to develop an export-centered business and how their companies can help Egypt build an export-led economy that makes it a magnet for foreign direct investment (FDI).

What’s the Enterprise Exports & FDI Forum? In the wake of successive floats of EGP, exports and FDI have never been more important to Egypt’s economy — or its businesses. We’re gathering some of the CEOs, top execs from local companies and multinationals, investors, bankers, and finance folks to speak on how businesses can adapt their strategies to be export-oriented and what Egypt as a country can do to draw foreign investment and much-needed FX. Expect it to be heavy on lessons learned in Egypt and other global growth markets — and lots of success stories. You can learn more on our conference website here.

Some of the biggest names in business and finance are on board — are you? If you’re a C-suite exec, business owner, DFI staff, export executive, investor or banker, please fill out the form here to signal your interest, letting us know your name, title and where you work.

WANT TO BECOME A COMMERCIAL PARTNER? Ping a note to Moustafa, our head of commercial, here.

CIRCLE YOUR CALENDAR-

Japan will host The G7 Ministers’ Meeting on Climate, Energy, and Environment on Saturday, 15 April in Sapporo. The two-day event will see cabinet members from G7 member states discuss solutions for the global power crunch triggered by the Russia-Ukraine war, explore pathways to transition the global economy toward 100% clean energy, further negotiations on the UN’s plastic pollution treaty, as well as the Kunming-Montreal Global

Biodiversity Framework, and devise a roadmap for strengthening climate resilience for climate-vulnerable countries.

The UAE is hosting the International Conference on Green Energy and Environmental Technology (ICGEET) on 18 and 19 April in Dubai. The event will bring together stakeholders from academia, the healthcare industry, and the private sector to discuss energy conservation among other topics.

Germany will host the first COP27 transitional committee workshop from Saturday, 29 April to Sunday, 30 April in Bonn. The workshop will address climate-driven loss and damage impacts, will spotlight the findings of a report prepared by the UN on current funding arrangements for climate mitigation efforts, and bring together a host of international financial institutions to discuss pathways to upping funding capacity for climate-induced loss and damage.

Turkey is hosting the International 100% Renewable Energy Conference from 4-6 May in Istanbul. The event will bring together experts to discuss the integration of renewables, renewable energy technologies and applications, and the Roadmap to 2050.

The UAE is hosting the UAE Climate Tech forum on 10 and 11 May in Abu Dhabi. The event will gather over 1k policymakers, CEOs, experts, and investors to discuss collaboration on innovative technologies and economic opportunities in advancing decarbonization across all sectors.

The first MENA Solar Conference is accepting applications from published researchers specialized in PV technology until Sunday, 30 April. The Dubai Electricity and Water Authority will be hosting the conference from 15 to 18 November, in conjunction with the Water, Energy, Technology, and Environment Exhibition and the Dubai Solar Show 2023. Researchers can submit their papers here.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

M&A WATCH

Masdar nabs 50% stake in EDF Renewables’ California Big Beau solar plant

Masdar acquires 50% stake in California solar project: UAE renewables giant Masdar finalized its acquisition of a 50% share in EDF Renewables North America’s 128 MW Big Beau solar plant in California, according to a statement. The plant is accompanied with a 40 MW battery energy storage system (BESS) facility. Big Beau offsets some 315k tons of CO2 equivalent, and produces enough clean energy to power some 64k homes, according to EDF.

Part of Masdar’s red, white, and blue 1.6 GW pipeline with EDF: In 2020, Masdar and EDF inked an agreement to jointly co-develop eight US-based renewables plants that would yield a total of 1.6 GW, the statement notes. Those include three wind farms in Nebraska yielding a combined 815 MW, and five solar farms — including the newly acquired Big Beau plant — generating some 690 MW of clean energy. Other than Big Beau’s BESS facility, EDF’s California PV farms are accompanied by another BESS unit with 30 MW storage capacity, according to Masdar. All of the renewables ventures Masdar is partnering with EDF on in the US are already operational.

Building on the US-UAE PACE accords to expand its foothold state-side: In January, the UAE and US agreed they would earmark USD 20 bn to fund 15 GW of new clean energy projects in the US by 2035, marking the first wave of investments under the USD 100 bn partnership to accelerate transition to clean energy (PACE) agreement announced by the two countries last November.

Beyond the US, there are other projects in the pipeline: Masdar and EDF are developing Abu Dhabi’s 2 GW Al Dhafra solar park alongside Taqa and China’s Jinko Power. The consortium installed the last of the farm’s 3.5 mn PV panels earlier this month. Over in Indonesia, the companies are joining forces with Tuas Power on solar energy projects that would collectively generate nearly 1.2 GW of renewable power.

INVESTMENT WATCH

KSA is getting a hydrogen fuel cell assembly plant

US companies are setting up shop in the KSA for a HFC assembly plant: US-based hydrogen fuel cell (HFC) solutions company Renewable Innovations (RI) signed a joint venture agreement with Utah-headquartered Mena Holdings to establish a hydrogen fuel cell (HFC) products assembly plant in Saudi Arabia, Bloomberg writes, citing a company statement. The financial details of the agreement and projected timeline have not been disclosed.

What we know: The facility will build HFC products for distribution in the Middle East and North Africa and will enable Mena Holdings to offtake an undisclosed amount of RI products produced at the plant. The agreement may also allow Mena Holdings to acquire a stake in RI, though it is unclear how much of the company’s shares would be divided under the JV’s terms.

Who is involved? The former governor of Utah — where both companies are based — Gary Herbert, will act as an advisor to RI per the agreement, while Mena Holdings Partner Abdulrahman Alnasri will leverage his connections as an industry player in the Saudi market to facilitate investments for the JV.

About the companies: Mena Holdings operates in several sectors, with one of its divisions focused entirely on renewable energy. Its partners have been operating in Saudi Arabia for some 15 years, according to the statement picked up by Bloomberg. RI is a global hydrogen and fuel cell integration solutions company with a foothold in the US, Europe, and New Zealand, with various arms operating in the renewables, alternative, and hydrogen production sectors.

GREEN TECH

Egyptian startup VAIS is harnessing satellite data and AI Solutions to boost irrigation efficiency

Controlling water waste with AI and data: Egyptian deeptech startup Visual and AI Solutions (VAIS) combines geospatial intelligence with AI to inform efficient agricultural practices using proprietary technology. The startup invented patent-pending Virtual Field Probing (VFP) technology to offer AI solutions for optimizing the use of irrigation water and mitigating the impacts of climate change. VAIS solutions also include dynamic crop mapping, nutrient distribution mapping and fertilization plans, monitoring and detection of crop diseases, and early warning systems to protect against weather incidents.

Co-founded by Karim Amer and Mohamed ElHelw in 2020, VAIS was previously incubated by NilePreneurs and received its first equity investment in Catalyst Fund’s pre-seed round in January after participating in four accelerators. The startup has partnered with Radiant Earth Foundation, the European Space Agency, GIZ, Rwanda Space Agency, and the One Acre Fund.

We spoke with co-founder Karim Amer about how VAIS tech can inform climate-smart agriculture in Africa. Below is an edited transcript of our conversation.

Enterprise: What are the problems VAIS addresses?

Karim Amer: We offer farmers climate-smart agriculture AI solutions with a tool that integrates weather data, soil data, and crop-related data. We also help farmers reduce their carbon footprint by addressing over-irrigation and over-fertilization, which can increase greenhouse gas emissions (GHGs).

Agriculture in Africa is not very efficient. According to reports from the World Bank, we use 85% of our freshwater for irrigation and waste around 60% of it in over-irrigation. We see USD bns in crop yield losses each year, and the reason for this is farmers don’t have good live data to monitor what’s happening on the ground. Farmers in Africa rely on very basic technology and use the same methods that have been used for the past 70-100 years, but those methods don’t work anymore. Surging prices in water, fertilizer and energy are making things worse as well.

E: Tell us more about your VFP technology and FarmGate.

KA: VFP analyzes huge amounts of data coming from several satellites — which we call multimodal satellite data — and combines it with AI to inform us of what's going on the ground. Because it’s a pure software solution that eliminates the need for hardware, it’s very scalable and affordable. VFP allows us to monitor soil water levels hourly throughout the season, and based on that, we provide actionable recommendations to farmers on how, when, and where they should irrigate. It's quite revolutionary on the farmers’ side, because it allows them to benefit without a huge investment. We’ve seen up to 30% reduction in water and fertilizer use in the farms that we monitor.

FarmGate is the user-end of the solution, which we launched one year ago. Right now, we have a subscription model based on area, so we charge USD 10 per acre annually for a basic package, and we have premium subscriptions as well. It’s available as a web dashboard and a mobile application, and farmers only receive actionable recommendations, which includes when to irrigate and where the stress points are.

For the past year, we have worked with several partners on hundreds of acres in Egypt which grow crops like potatoes, medical herbs, sesame and ground cherries. Our plan this year is to aggressively expand our traction to reach tens of thousands of acres, then later on expand in Africa.

E: You also have a product called the Global Soil Moisture Engine. What is it and how is it different from VFP?

KA: The Global Soil Moisture Engine is one of the byproducts of VFP. It provides information about soil water levels and water consumption in agriculture not just on a farm scale, but on a regional or global scale as well. It targets international organizations, governmental agencies, traders, insurers, etc. The Engine also provides historical data on root zone soil moisture, which measures how much water is in the deep layers of the soil. This is very important for irrigation and water in general, because some plants have roots that go up to 1 meter in depth. It also provides historical data, which can help governmental agencies improve their water quota allocation and plan better.

E: What is the company’s goal for the region?

KA: We would like to democratize access to tech in the region. Wealthy farmers in the US and Canada can buy the expensive hardware to monitor crops, but in our region, it’s more difficult to rely on hardware because of prices and supply chains. The technology that we use is as accurate as ground probes, but rather than giving farmers raw data, we give them actionable information and future forecasts.

Right now, we work with medium- and large-scale farms that have 40+ acres per farm area in Beheira. Small-holders are definitely in our plan over the next couple of years. Some farmers are aware of the waste because it carries a financial burden for them.

E: How do you acquire data?

KA: There are two sources of satellite data: Open sources from government agencies and private companies that operate their own satellite constellations, and we use both. The beauty of satellite data is that it covers pretty much anywhere in the world, so we can easily scale up. Think of satellite data as an untapped mind — it’s just raw data; it doesn't mean anything on its own. We use AI to harness and understand the deeper meaning of data and provide actionable results based on it.

E: Can geospatial intelligence inform climate solutions in other sectors?

KA: Geospatial intelligence can inform many industries besides farming. VFP can definitely be used for environmental monitoring, detecting fuel and gas leakages and coastal erosion monitoring, to give just a few examples. Our work is focused on agriculture, but the technology can definitely be used to inform other sectors.

CLIMATE DIPLOMACY

Regional discussions continue on interconnection projects in KSA and Greece

KSA, Iraq discuss interconnection project: Saudi Energy Minister Prince Abdulaziz bin Salman met in Riyadh with Iraq’s Electricity Minister Ziyad Fade to discuss progress on the 1 GW electrical interconnection project between the two countries, according to a statement. The interconnection project will be used to export electricity to Iraq, including electricity generated by renewable energy, and will extend 435 km from Arar in northern Saudi Arabia to Yusufiya near Baghdad, the Saudi Gazette reported during the MoU signing ceremony last year. The two countries signed an agreement in September to begin work on the project after having determined the paths for the electricity lines and their connection points.

ALSO- Egypt + Greece talk EuroAfrica Interconnector: Egypt’s Foreign Minister Sameh Shoukry and Greek Prime Minister Kyriakos Mitsotakis and his Foreign Minister Nikos Dendias met earlier this week to discuss developments in the USD 4 bn 2 GW EuroAfrica Interconnector, which will see Egypt transport renewable energy and gas to both Cyprus and Greece, a cabinet statement said. The three also talked through the status of both current and potential joint renewable projects.

MOVES

Canada-based plastic collection and recycling company Plastic Bank has appointed Ahmed Abdelaleem (LinkedIn) to serve as regional head. Prior to the appointment, Abdelaleem held the position of supply chain and operations manager at Plastic Bank for two years. Before joining the company, he held the position of alternative fuels director at Geocycle Egypt, a subsidiary of LafargeHolcim. At Geocycle, Abdel Aleem led an initiative to stop burning rice straw — used to produce lightweight cement bricks — in open fields. The initiative helped reduce carbon emissions by 100k tons of CO2.

About Plastic Bank: Plastic Bank is a social enterprise that works on collecting plastic waste, stopping waste from being dumped in the oceans, recycling ecosystems in coastal communities, reprocessing materials to introduce into the global manufacturing supply chain, and offers monetary compensation for plastic waste collectors, according to their website. Plastic Bank currently operates in Brazil, Egypt, Indonesia, and the Philippines, with franchise-based expansion in Cameroon and Thailand.

Plastic Bank in Egypt: Plastic Bank collected 2.7k tons of plastic waste from Egypt in 2021 and aims to collect a total of 5k tons by 2023. In 2022 Plastic Bank planned to recycle 20k kg of plastic produced by German snackmaker Lorenz Snack World factory in Egypt, and celebrated the collection of more than 300 mn plastic bottles with Henkel Egypt in less than two years.

ALSO ON OUR RADAR

Algeria could be an energy supplier for Europe: Preparations and studies are underway to export electricity from Algeria to Europe through undersea cables, Algerian Energy Minister Mohammed Arkab said, according to state-owned Radio Algeria. Algeria has become well-positioned in electricity production with a capacity of 25 GW, the minister said. The studies are being implemented with “European partners,” the minister said, without naming the entities or countries involved. The Europe-bound electricity will be produced by gas-operated power plants as well as solar plants that are still being developed by Algeria, the minister said.

REMEMBER- MENA is emerging as an energy lifeline for Europe: Europe is continuing to wean itself off of Russian fossil fuels after imposing sanctions on Moscow in response to the Ukraine invasion. Supply shortages have caused natural gas and electricity prices in the continent to surge to record highs this year, pushing the EU to strengthen ties with other energy suppliers, including Egypt. The EU signed last year a gas import agreement with Egypt and Israel and is looking to accelerate interconnection projects with the region.

Oman is exploring concentrated solar power in Duqm: A potential 600 MW concentrated solar power (CSP) project in Duqm, Oman, is currently being studied by the Oman Power and Water Procurement Company (OPWP), Oman Observer reports. The feasibility study was expected to be completed last year but was delayed for unknown reasons. OPWP plans to include thermal storage in the project to ensure a stable supply of electricity from the plant. If completed, the project would be the first CSP project in Oman, which is looking to integrate different renewable technologies.

What is CSP? CSP uses steam generated from heated water to produce electricity, and it requires collector and generator systems. Its biggest advantage is that it can store power, helping to resolve the issue of peak energy demand, which is often at night or early in the morning when there is no sunlight. However, CSP is often more expensive and water-intensive than photovoltaic tech. Morocco’s Noor I and II solar parks use CSP technology.

AROUND THE WORLD

Kazakhstan’s state-owned uranium miner Kazatomprom is preparing to increase its production as Europe reduces its dependence on Russia for nuclear fuel, Bloomberg reports. Nuclear plants in Eastern Europe that had previously obtained their uranium from Russia are seeking contracts starting 2025, Kazatomprom CEO Yerzhan Mukanov told Bloomberg. Kazatomprom intends to open a third export route in 2023, shipping uranium through a Chinese port to meet increased demand from China, Mukanov said. China aims to have “uninterrupted long-term supplies,” he said, as Beijing is looking to obtain atomic fuel for nuclear power plants in the pipeline and shore up reserves.

India gives green hydrogen plants more time to set up shop: India’s government has expanded the eligibility of its previously announced waiver on transmission fees for green hydrogen producers to include plants commissioned before 2031, Reuters reports, citing a government source. The decision — a six-year extension from the previous 2025 cut off for eligibility — was made to allow more time for the commissioning of large-scale hydrogen and ammonia projects which typically take three to four years to construct. The decision is also expected to cut the cost of green hydrogen by a fifth. India aims to produce 5 mn tons of green hydrogen annually by 2030 as well as reduce the cost of its production from the current USD 4-5 per kg to USD 1-1.50 per kg.

The US ratifies WTO agreement to cut subsidies contributing to overfishing: The US has ratified a subsidy cut meant to reduce unsustainable fishing practices, making it the first major fishing country to take such a step in adherence with a WTO agreement signed last year, Reuters reports. Over 100 trade ministers reached an agreement to limit subsidies for illegal and unregulated fishing last June. Two-thirds of the 168 WTO member states need to ratify the agreement for the agreement to come into force, but only a few smaller countries have done so. WTO Director-General Ngozi Okonjo-Iweala hopes to have the agreement ratified before the next WTO meeting in 2024, she told Reuters. Countries have until 2026 to reach the two-thirds goal before the agreement expires, Bloomberg said.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- General Motors will invest in lithium technology startup EnergyX through a USD 50 mn series B round of financing under its push to secure long-term supplies for the critical components of EV batteries. (Reuters | CNBC)

- Advocacy groups are suing the US Federal Emergency Management Agency for failing to integrate renewable energy sources into an agency-funded project to build a more resilient power grid for Puerto Rico that can withstand the impact of hurricanes. (Reuters)

ON YOUR WAY OUT

UK regulator axes Etihad Airways’ ads over greenwashing: The UK’s Advertising Standards Authority (ASA) issued a ruling yesterday halting circulation of two of UAE national carrier Etihad Airways’ advertisements for its failure to substantiate claims regarding sustainable aviation, Bloomberg writes.

Airlines have to back up absolute green claims like “sustainable aviation,” according to the ASA, which says the ads Etihad Airways ran last year do not clarify how sustainable, net-zero, or low-carbon flights would be achieved. “We understood that there were currently no initiatives or commercially viable technologies in operation within the aviation industry which would adequately substantiate an absolute green claim such as ‘sustainable aviation’ as we considered consumers would interpret it in this context,” ASA notes.

Etihad has been battling with greenwashing allegations for some time: Climate activists reported the airline to the Austrian Competition and Consumer Commission for running last year an ad spotlighting its net zero targets for 2050, allegedly without having a solid path to achieving carbon neutrality. Despite the blowback, the airline has been making strides in the sustainability front, signing an agreement in 2022 with Microsoft to begin using AI to measure and benchmark its environmental footprint, as well as operating its first SAF-fueled flight last October.

The ASA is clamping down on other airlines too: ASA took another ad by Austrian airline Lufthansa off the air in March for asserting flying with the carrier can “protect the future of the planet” without providing concrete initiatives or technologies backing up their claim.

CALENDAR

APRIL 2023

15-16 April (Saturday-Sunday): G7 Ministers’ Meeting on Climate, Energy, and Environment, Sapporo, Japan.

18-19 April (Tuesday-Wednesday): International Conference on Green Energy and Environmental Technology (ICGEET), Dubai, UAE.

29-30 April (Saturday-Sunday): First COP27 transitional committee workshop, Bonn, Germany.

MAY 2023

1-4 May (Monday-Thursday): Arabian Travel Market, Dubai, UAE.

2-7 May (Tuesday-Sunday): Salon International de l’Agriculture au Maroc (SIAM), Meknes, Morocco.

4-6 May (Thursday-Saturday): International 100% Renewable Energy Conference, Istanbul, Turkey.

8-10 May (Monday-Wednesday): Global Green Future Fuel, Dubai, UAE.

8-10 May (Monday-Wednesday): Annual Investment Meeting, Abu Dhabi, UAE.

9 May (Tuesday): World Hydrogen 2023 Summit & Exhibition, Rotterdam, Netherlands.

9-10 May (Tuesday-Wednesday): The Solar Show MENA, Cairo, Egypt.

10-11 May (Wednesday-Thursday): UAE Climate Tech, Abu Dhabi, UAE.

16-18 May (Tuesday-Thursday): Seatrade Maritime Logistics Middle East, Dubai, UAE.

19-21 May (Friday-Sunday): G7 Hiroshima Summit, Hiroshima, Japan.

24-27 May (Wednesday-Saturday): Second meeting of the COP27 Transitional Committee, TBD.

29-31 May (Monday-Wednesday): Electric Vehicle Innovation Summit, Abu Dhabi, UAE.

29-31 May (Monday-Wednesday): CCUS Forum, Doha, Qatar.

30 May-1 June (Tuesday-Thursday): Global Sustainable Development Congress, King Abdullah University of Science and Technology (KAUST), KSA.

JUNE 2023

1 June (Thursday): Invest in African Energy Forum, Paris, France.

1-3 June (Thursday-Saturday): Envirotec and Energie Expo, Tunis, Tunisia.

12-15 June (Monday-Thursday): Saudi Plastics & Petrochem, Riyadh, KSA.

13-14 June (Tuesday- Wednesday) The Arab Green Summit, Dubai, UAE.

13-14 June (Tuesday- Wednesday) Bloomberg New Economy Gateway Africa Conference, Marrakesh, Morocco.

13-14 June (Tuesday- Wednesday) Vision Golfe 2023, French Ministry of the Economy, Finance and Industrial and Digital Sovereignty, Paris, France.

JULY 2023

3-7 July (Monday-Friday): The 36th Conference of the International Association of Climatology, Bucharest, Romania.

22-23 July (Saturday-Sunday): Second COP27 transitional committee workshop, Bangkok, Thailand.

AUGUST 2023

20-24 August (Sunday-Wednesday): World Water Week 2023, Stockholm, Sweden.

29 August-1 September (Tuesday-Friday): Third meeting of the COP27 Transitional Committee, TBD.

SEPTEMBER 2023

9-20 September (Saturday-Wednesday): 2023 Sustainable Development Goals Summit, New York, USA.

11-13 September (Monday-Wednesday): Global Congress on Renewable and Non-Renewable Energy, Dubai, UAE.

12-15 September (Tuesday-Friday): WTO Public Forum, Geneva, Switzerland.

Chariot Limited and Total Eren’s feasibility study on a 10 GW green hydrogen plant in Mauritania to be completed.

OCTOBER 2023

2-4 October (Monday-Wednesday): WETEX and Dubai Solar Show, Dubai, UAE.

4 October (Wednesday): Arabia CSR Gala Awarding Ceremony, UAE.

16-18 October (Monday-Wednesday): Climate Week, Rome, Italy.

17-20 October (Tuesday-Friday): Fourth meeting of the COP27 Transitional Committee, TBD.

29 October- 2 November (Sunday-Thursday): Cairo Water Week, Cairo, Egypt

31 October – 2 November (Tuesday-Thursday): World Hydropower Conference, Bali, Indonesia.

NOVEMBER 2023

9-10 November (Thursday-Friday): International Renewable Energy Agency Investment Forum, Uruguay.

30 November – 12 December: Conference of the Parties (COP 28), Dubai, UAE.

FEBRUARY 2024

22-26 February (Thursday-Monday): Management and Sustainability of Water Resources, Dubai, UAE.

EVENTS WITH NO SET DATE

End-2022

KSA’s Neom wants to tender three concrete water reservoir projects to up its water storage capacity by 6 mn liters.

2023

Early 2023: Egypt’s KarmSolar to launch KarmCharge, the company’s EV charging venture.

1Q2023: Oman will award two blocks of land for green hydrogen projects in Duqm, Oman.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

4Q2023: Oman to award four blocks of land for green hydrogen projects in Thumrait, Oman.

2024

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

First 1.5 GW phase of Morocco’s Xlinks solar and wind energy project to be operational.

2025

Second 1.5 GW phase of Morocco’s Xlinks solar and wind energy project to be operational.

UAE to have over 1k EV charging stations installed.

2026

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2050

Tunisia’s carbon neutrality target.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.