- Saudi Arabia’s Maaden enters multiple JVs in a bid to capitalize on mining push. (Minerals)

- And KSA is eyeing the development of a domestic nuclear power industry. (Nuclear)

- The UK’s Hive Energy wants to invest USD 4 bn in Turkish solar energy projects. (Solar)

- Israel sells USD 2 bn worth of green bonds in maiden issuance. (Debt Watch)

- Kenyan VC firm invests USD 2 mn in 10 climate-focused African startups. (On Our Radar)

- Germany’s Stellantis and US firm Archer work on new eVTOL. (Green Tech)

- How effective is Ocean Iron Fertilization as a natural carbon capture method? (Carbon Capture)

Thursday, 12 January 2023

Saudi Arabia’s Maaden enters multiple JVs in a local and global mining industry push.

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people, and welcome to the tail-end of what felt like the first real work week of 2023.

THE BIG REGIONAL CLIMATE STORY? Saudi Arabia’s mining industry and massive potential is in the spotlight, with the country’s mining player Maaden signing a number of key agreements at the Future Minerals Forum yesterday. The country is also eyeing domestic nuclear power generation.

^^ We have chapter and verse on this story and more in the news well, below.

THE BIG CLIMATE STORY OUTSIDE THE REGION- Failure to act on climate change is our biggest long-term global threat — but inflation is delaying action: Climate change and the failure to take action on global heating are the most urgent long-term challenges facing the world, but inflation and the current cost-of-living crisis threaten to overshadow them in the short-term — further delaying essential action, the World Economic Forum said in a report (pdf) published yesterday. The Global Risks Report, based on a survey of 1.2k risk experts, was released ahead of the annual gathering of government and business leaders at Davos next week. The story is attracting widespread coverage in the international press: Reuters | CNBC | Independent | Bloomberg | AP

AND IN COP LAND- The UAE is set to launch its COP28 presidency today, the Guardian notes. UAE climate change envoy and head of renewables company Masdar and the Abu Dhabi National Oil Company (Adnoc) Sultan Al Jaber (LinkedIn) is the front runner for a hat tip, the outlet tells us.

Davos will set the stage for COP28: A preliminary agreement will be signed between the COP28 host country the UAE and the World Economic Forum (WEF) next week in Davos, WEF President Borgan Brende said (watch, runtime 11:03). Details are unclear, but the agreement is said to support new technologies in power and electricity generation globally, according to Brende.

Also, an Amazonian COP30 is in play: Brazil’s new President Luiz Inacio Lula da Silva officially launched a bid for the country to host the summit in 2025 in its Amazonian city of Belem, Reuters reports.

PSA- Plastic’s days are numbered in the UAE: The UAE will enforce a nationwide ban on single-use plastics by 2024, The National reports. From 1 January 2024, the use of plastic bags of any kind will be prohibited and the import of all plastic materials will be outlawed by 2026.

|

***

YOU’RE READING ENTERPRISE CLIMATE, the essential regional publication for senior execs who care about the world’s most important industry. Enterprise Climate covers everything from finance and tech to regulation, products and policy across the Middle East and North Africa. In a nod to the growing geographical ambitions of companies in our corner of the world, we also include an overview of the big trends and data points in nearby countries, including Africa and southern Europe.

Enterprise Climate is published at 4am CLT / 5am Riyadh / 6am UAE Monday through Thursday by Enterprise, the folks who bring you Enterprise Egypt, your essential 6am and 3pm read on business, finance, policy and economy in Egypt and emerging markets.

Subscribe to Enterprise Climate here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

CIRCLE YOUR CALENDAR-

UAE renewable energy firm Masdar will host Abu Dhabi Sustainability Week from Saturday, 14 January to Saturday, 21 January. The event will gather eight presidents and prime ministers and 30k participants in a series of conferences and summits including the Atlantic Council’s Global Energy Forum, the World Future Energy Summit, Masdar’s Green Hydrogen Summit, The International Renewable Energy Agency’s Youth Forum, and the Abu Dhabi Sustainable Finance Forum.

The UAE is hosting the Atlantic Council’s Global Energy Forum on Saturday, 14 January and Sunday, 15 January in Abu Dhabi. The forum will discuss the ongoing global energy crisis and its impact on the green transition, energy security, and decarbonization.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

MINERALS

Saudi doubles down on its mining ambitions at Future Minerals Forum

Over in Riyadh, it’s mining, mining, mining: A host of announcements have come out of Saudi Arabia’s Future Minerals Forum, which kicked off in Riyadh on Tuesday and runs through today. Saudi mining company Ma’aden was in the spotlight, announcing multiple joint ventures to spur mining exploration both at home and abroad. Energy Minister Prince Abdulaziz bin Salman also outlined plans to set up a nuclear power industry for domestic use and export, touting the country’s diverse and abundant supplies of uranium.

FIRST, A REFRESHER ON SAUDI’S ABUNDANCE OF RARE MINERALS-

Saudi Arabia aims to become a global hub for the “green metals” needed in the energy transition, bin Salman announced at the forum yesterday. This includes significant amounts of uranium and titanium discovered in the country, Arab News quoted bin Salman as saying. The demand for key minerals including copper, aluminum, zinc, nickel, lithium, and silicon is poised to surge, bin Salman later added.

An industry has been developing for a while: The kingdom says it has untapped metals and minerals — including copper, zinc, phosphate, and gold — collectively worth USD 1.3 tn, according to Bloomberg Asharq, and plans to attract some USD 32 bn in investment in its mining and mineral sector and award more than a dozen mining exploration licenses to international investors, Saudi Mining Minister Bandar Al Khorayef said in November. Lithium, nickel, and cobalt are essential to manufacture EV batteries. And phosphorus — the mineral found in phosphates — is essential for the growth of food.

YESTERDAY SAW SAUDI’S MA’ADEN ENTER MULTIPLE JVS-

Saudi’s Ma’aden is entering a JV with PIF to invest in mining assets overseas: Saudi Arabia’s mining company, Ma’aden, and the country’s sovereign wealth fund, the Public Investment Fund (PIF), are forming a joint venture to invest in mining assets globally, they announced yesterday, according to a Saudi Press Agency (SPA) statement. Strategically, the JV aims “to initially invest in iron ore, copper, nickel, and lithium as a non-operating partner taking minority equity positions,” the SPA statement added.

By the numbers: Ma’aden will hold 51% of the company and PIF will own the remaining 49%. When the company needs additional financing, Ma’aden and PIF will commit to providing up to SAR 11.9 bn (USD 3.2 bn), with Ma’aden’s maximum investment in the company totaling SAR 6 bn (USD 1.6 bn), Ma’aden said in a disclosure to the Tadawul.

And it’s investing in US firm Ivanhoe Electric to develop mining projects at home: Ma’aden is also acquiring a minority 9.9% stake in US tech and mineral exploration company Ivanhoe Electric (IE) for USD 126 mn, according to a separate disclosure. Ma’aden and IE are also forming their own 50-50 JV to explore and develop mining projects in Saudi Arabia. This partnership will give Ma’aden access to proprietary technology that will enable it to detect minerals that contain copper, nickel, gold, and silver, the company said.

Ma’aden also signed other agreements for mining exploration: The Saudi mining company signed two JV agreements with Canada-headquartered Barrick Gold yesterday for prospective copper exploration projects in Saudi’s Um Al Damar and south Jabal Sayid regions, Barrick notes in a statement. The JVs will “open up potential synergies with the neighboring Jabal Sayid mine, an existing 50-50 JV between Barrick and Ma’aden,” Reuters notes.

And one for phosphate production: Finally, Ma’aden signed a SAR 1 bn (USD 278 mn) engineering, procurement and construction (EPC) management services contract with WorleyParsons Arabia and JESA International to construct the first phase of the Phosphate 3 project, which targets the production of some 1.5 mn tons per year of phosphate fertilizers, according to a Tadawul filing.

PLANS FOR A DOMESTIC NUCLEAR POWER INDUSTRY ARE IN THE WORKS-

The “diverse portfolio” of uranium reportedly found during recent explorations can be used at every point of the nuclear fuel cycle, the National quotes bin Salman as saying. Plans include producing yellowcake (partially processed uranium) and low-enriched uranium, as well as manufacturing nuclear fuel. All would be for domestic use and export, he added. Saudi would be open to setting up JVs with partners, adhering to international standards of transparency, bin Salman said.

How much power are we talking about? The country is targeting 17 GW of nuclear capacity by 2040 and bringing online two reactors with a combined capacity of 3.2 GW within the coming decade, the National notes. Contracts for building these reactors will be awarded “very soon,” bin Salman said, according to Bloomberg Asharq.

SOLAR

The UK’s Hive Energy wants to invest USD 4 bn in Turkish solar energy projects

UK-based Hive Energy is looking to invest USD 4 bn to develop solar farms generating a combined 4 GW of power in Turkey, according to Turkish news agency Anadolu. The company submitted requests to Turkey’s Energy Market Regulatory Authority (EMRA) to construct 30 solar plants that would range between 11 MW to 230 MW in 19 Turkish cities. The preliminary paperwork for the projects is expected to be completed by the end of 1Q 2023.

The details: Hive Energy would partner with Turkish firms Çuhadar Energy and Viva Energy to develop some of the plants — with a total capacity of 3 GW — upon raising the funds needed, the news outlet notes. Details on who the company would work with to co-develop the farms generating the remaining 1 GW have not been disclosed.

Not Hive’s first rodeo: The company owns a 10.5 MW solar plant in Turkey which generates enough energy to power 1.3k homes in the country and offsets 10k tons of CO2 equivalent per year, according to their website.

A recent regulatory change may drive more investment Turkey’s way: The country’s EMRA enforced a regulation in November that streamlines the process for firms to secure a pre-license and grid capacity without enrolling in lengthy and costly auctions, with the stipulation that the firm co-locates battery storage assets. EMRA’s framework is expected to rake in investments between USD 20-25 bn for renewable energy projects.

DEBT WATCH

Israel takes maiden USD 2 bn green bond issuance to market

Israel sold USD 2 bn of 10-year green bonds, marking the country’s maiden green bond issuance, Reuters reports, citing a Finance Ministry statement. The bonds were reportedly 6x oversubscribed, with USD 12 bn in demand from about 200 buyers in 35 different nations including the UAE. The bonds were sold at a 95 bps premium to the benchmark rate on US government bonds. Last November, the Israeli government announced a Green Bond Framework in accordance with the ICMA Green Bond Principles to support national environmental goals.

What they said: “The green bond issuance supports the government’s debt management strategy, and in particular the diversification of funding sources and the expansion of the investor base,” senior deputy to the Accountant General Gil Cohen told the newswire.

Advisors: Barclays, BNP Paribas, Bank of America Securities, and Citi were underwriters on the transaction.

GREEN TECH

Germany’s Stellantis and US firm Archer work on new eVTOL

Germany and the US join forces on new eVTOL: German auto manufacturer Stellantis and US-based aircraft maker Archer are partnering up to manufacture a new electric vertical take-off and landing aircraft (eVTOL) by 2024, according to a company statement. Stellantis will provide USD 150 mn in equity funding to bolster Archer’s production capacity to be disbursed by the former at its discretion in 2023 and 2024. The German automaker also announced that it is eyeing an increased stake in Archer through stock purchases.

SOUND SMART- What are eVTOLs and how do they work? eVTOLS are drone-like aircraft that use electric propulsion and large omnidirectional fans to allow them to takeoff vertically and to act like air taxis. They are meant to be energy efficient, quiet, environmentally friendly, and eventually pilotless. Beyond their applications as air taxis, the vehicles are expected to be able to operate on an inter-city basis and even be used for cargo shipping.

The specs: The eVTOL — named Midnight — will transport 5 passengers and have a flight range exceeding 160 kilometers with a top speed of over 240 km per hour, the statement notes. The aircraft is designed with short commutes in mind, with back-to-back trips over 30 kms being the primary target and short charging intervals of 10 minutes in between flights, Archer details on its website.

eVTOLs are drawing heavy interest from MENA: Saudi Arabia’s Neom invested USD 175 mn as part of a series E investment in German electric vertical takeoff and landing (eVTOL) vehicle maker Volocopter. Neom signed a JV agreement with the German firm late last year to design, implement, and operate a tailored and customized public vertical mobility system in the smart city.

The EV air mobility market is on track to boom: The global urban air mobility market was valued at USD 2.3 bn in 2021 and is projected to reach USD 30.7 bn by 2031. KSA’s national flag carrier Saudia signed in October an agreement with German aircraft maker Lilium to purchase 100 electric jets, while UAE-based charter flight operator Falcon Aviation Services is buying up to 35 flying taxis from electric aircraft company Eve Holding, with deliveries expected to start in 2026.

CARBON CAPTURE

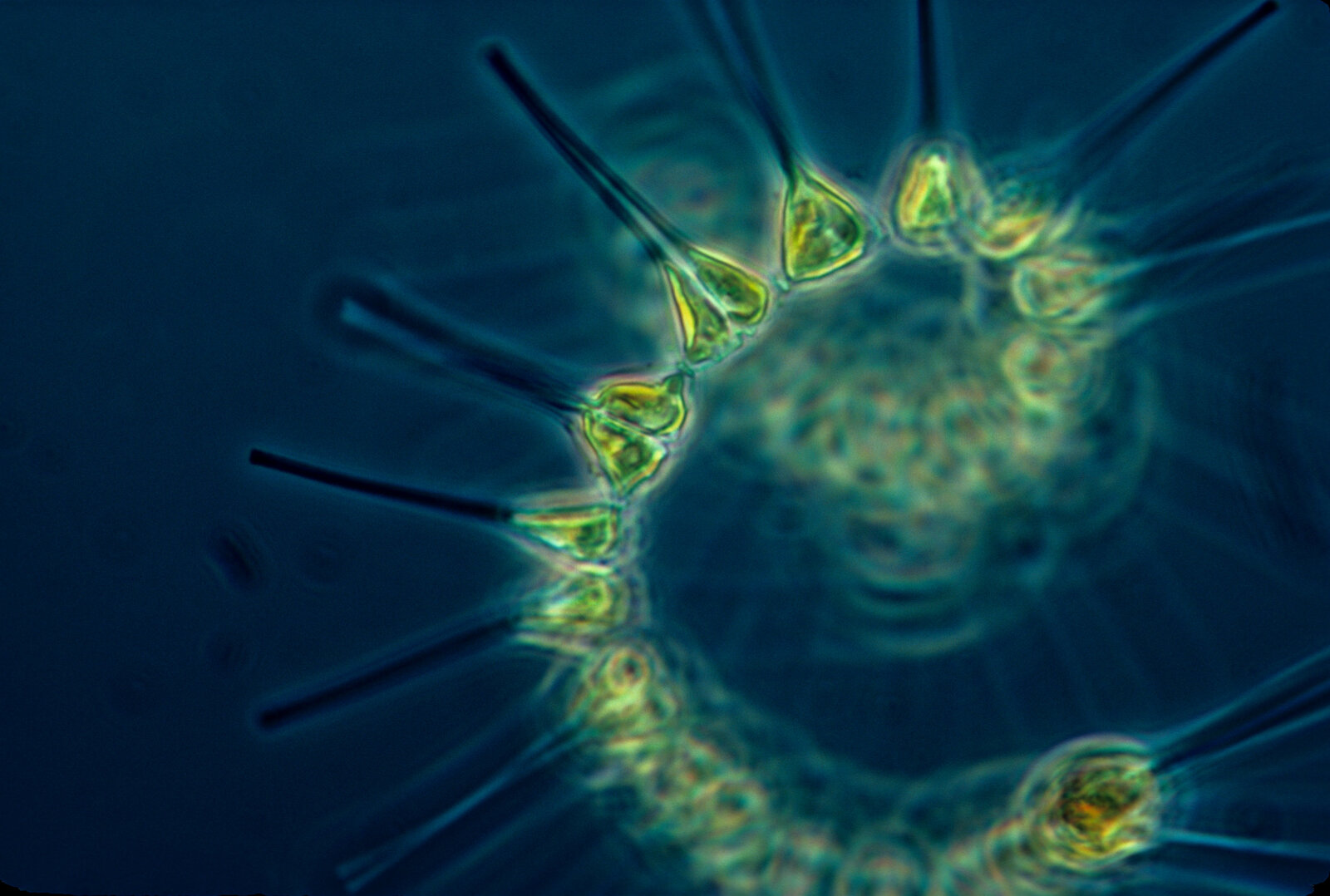

How effective is Ocean Iron Fertilization as a natural carbon capture method?

Could Ocean Iron Fertilization help MENA absorb more carbon? MENA’s blue assets continue to deteriorate due to unchecked polluting industries like transportation and poor waste management among other reasons, a World Bank study (pdf) found. With water temperatures in the Arabian Gulf expected to rise by 4.26°C by 2039, devastating effects on marine biology, including coral bleaching, are at the forefront of the GCC’s concerns. Ocean Iron Fertilization (OIF) — or ocean “seeding” — could potentially help rebalance the amount of algae and natural carbon capture to combat the effects of climate change.

What is OIF? OIF is an innovative solution circulating since 1990 when oceanographer and Moss Landing Marine Laboratories Director John Martin made a case for the geoengineering strategy. In short, OIF is a process where large amounts of iron dust or powder are scattered across parts of the ocean to stimulate algae growth, ultimately leading to more microscopic algae — or phytoplankton — absorbing carbon from the atmosphere through photosynthesis.

A natural decarbonizer: Phytoplankton productivity captures c. 37 bn metric tons of CO2 from the air we breathe, according to a 2019 IMF report (pdf). The study estimates that phytoplankton capture as much carbon as 1.7 tn trees — or four times the capacity of the Amazon forest. Experiments suggest that every ton of iron added to the ocean could remove 30k to 110k tons of carbon from the air, and iron fertilization across the entire Southern Ocean could erase 1 to 2 bn tons of carbon emissions annually accounting for 10-25% of the world’s total annual emissions.

But there are limitations: Meddling with ecosystems could have unforeseen repercussions like oxygen depletion in deep waters, Dalhousie University oceanographer John Cullen told The Guardian and OIF runs the risk off feeding too much algal growth which could lead to toxic blooms — an issue that is already occurring increasingly in Kuwait. However, champions of the technology argue toxic blooms are a result of an excessive run-off of agricultural nitrogen and phosphorus fertilizers into inshore waters and the case doesn’t apply when distributing the iron further out to sea in deeper waters.

Unsustainable sustainability? Another study also raised the issue of how sustainable it is to dump iron into the ocean. If fertilization is not carried out continuously, a large part of the sequestered carbon will be returned to the atmosphere over time, research published in the Frontiers in Climate Journal states. There is also the issue of how reasonable the price of scaling OIF would be given that the lowest cost estimate of removing one ton of CO2 using OIF costs USD 230.

Is the geoengineering push at the expense of mitigation? Geoengineering techniques like OIF which manipulate natural conditions to alleviate the consequences of climate change fall under adaptation interventions. While experts agree that adaptation and mitigation are not mutually exclusive, the regional private sector is growing particularly interested judging from COP27’s ambitious adaptation agenda which earmarks USD 140-300 bn in public and private sector funding for adaptation and resilience by 2030.

And while MENA hasn’t hopped onto OIF, it’s exploring other options: The UAE, Saudi Arabia and Kuwait are among those who have been experimenting with cloud seeding — with considerable geopolitical and environmental consequences and the lingering matter of failing to solve the systemic causes of climate extremes.

ALSO ON OUR RADAR

Nairobi-based VC firm Catalyst Fund is investing USD 2 mn in 10 African startups focused on climate resilience, according to a statement. Egyptian waste management company Bekia, Egyptian agritech firm Visual and AI solutions (VAIS), and Moroccan agroforestation startup Sand to Green are three of the firms selected. Each of the startups will receive USD 100k in equity financing and another USD 100k for venture building assistance.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- Egypt and Greece will appoint a third party consultant to conduct feasibility studies for their subsea EUR 3.5 bn Greece-Egypt Interconnector power line. (Al Ahram)

- The Saudi cabinet approved energy agreements with Ecuador and Colombia. (Statement)

KUDOS

A round of applause goes out to the following high-achievers in climate-friendly initiatives.

- Dubai’s Water and Electricity Authority secured the Global Excellence Assembly’s Organizational Achievement award for 2022 in recognition of its sustainability-focused projects and sustainability targets for 2030 and 2050, according to a statement.

- Wizz Air achieved the lowest ever recorded average carbon emissions by an airline in 2022 reducing emissions by 15.4% lower than in 2021, according to a statement. The European company — which operates flights in the MENA region — pledged to further reduce its carbon emissions intensity by an additional 25% by 2030.

- 30 Hilton hotel kitchens across the UAE cut 9k tons of CO2 emissions by buying farm to table produce and ingredients, Caterer Middle East reports.

ON YOUR WAY OUT

“What you see over there aren't giants, they're windmills”: China’s Ming Yang Smart Energy Group Ltd. just unveiled the world’s largest offshore wind turbines with blades spanning a staggering 140 meters, according to a company statement. Just to give you a rough equivalent, that’s a line-up of four Airbus planes.

Mega output: The production capacity of each of these beasts will have a peak output of 18 MW per turbine — or 80 mn kWh of electricity annually. This would reduce approximately 66k tons of CO2 emissions annually and provide the equivalent total annual energy consumption of 96k people.

CALENDAR

JANUARY 2023

10-12 January (Tuesday-Thursday): The Future Minerals Forum, Riyadh, Saudi Arabia.

12 January (Thursday): Business Transition to Net-Zero – the Path Towards a Successful Low-Carbon Future Forum, Bahrain.

13 January (Friday): The International Renewable Energy Agency’s Youth Forum, Abu Dhabi, UAE.

14-21 January (Saturday-Saturday): Abu Dhabi Sustainability Week, Abu Dhabi, UAE.

14-15 (Saturday-Sunday): Global Energy Forum, Abu Dhabi, UAE.

16-18 January (Monday-Wednesday): EcoWASTE, Abu Dhabi National Exhibition Center (ADNEC), UAE.

16-18 January (Monday-Wednesday): World Future Energy Summit, Abu Dhabi National Exhibition Center (ADNEC), UAE.

22-24 January (Sunday-Tuesday): ESF MENA 2023 – Energy and Sustainability Forum, Manama, Bahrain.

January 2023: Bid submission deadline for green hydrogen projects to Hydrogen Oman (Hydrom).

FEBRUARY 2023

6-8 February (Monday-Wednesday): Saudi International Marine Exhibition and Conference, Hilton Riyadh, Saudi Arabia.

4-9 February (Saturday- Wednesday) International Association for Energy Economics’ International Conference, King Abdullah Petroleum Studies and Research Center, Riyadh, Saudi Arabia.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (EGYPS) 2023, Cairo, Egypt.

21-22 February (Tuesday-Wednesday): The Arab Green Summit, Dubai, UAE.

21-23 February (Tuesday-Thursday): World Environment, Social and Governance (ESG) Summit, Dubai, UAE.

MARCH 2023

15-19 March (Wednesday-Sunday): Qatar International Agricultural and Environmental Exhibition, Doha, Qatar.

MAY 2023

1-4 May (Monday-Thursday): Arabian Travel Market, Dubai World Trade Centre, Dubai, UAE. Register here.

2-7 May (Tuesday-Sunday): Salon International de l’Agriculture au Maroc (SIAM), Meknes, Morocco.

16-18 May (Tuesday-Thursday): Seatrade Maritime Logistics Middle East, Dubai World Trade Center, Dubai, UAE.

29-31 May (Monday-Wednesday): Electric Vehicle Innovation Summit, Abu Dhabi National Exhibition Centre, Abu Dhabi, UAE.

JUNE 2023

Bloomberg New Economy Gateway Africa Conference, Marrakesh, Morocco.

1-3 June (Thursday-Saturday): Envirotec and Energie Expo, UTICA, Tunis, Tunisia.

SEPTEMBER 2023

Chariot Limited and Total Eren’s feasibility study on a 10 GW green hydrogen plant in Mauritania to be completed.

OCTOBER 2023

2-4 October (Monday-Wednesday): WETEX and Dubai Solar Show, Dubai World Trade Centre, Dubai, United Arab Emirates.

NOVEMBER 2023

6-17 November (Monday-Friday): The UAE will host COP28.

EVENTS WITH NO SET DATE

End-2022

KSA’s Neom wants to tender three concrete water reservoir projects to up its water storage capacity by 6 mn liters.

2023

Early 2023: Egypt’s KarmSolar to launch KarmCharge, the company’s EV charging venture.

1Q2023: Oman will award two blocks of land for green hydrogen projects in Duqm, Oman.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

4Q2023: Oman to award four blocks of land for green hydrogen projects in Thumrait, Oman.

2024

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

First 1.5 GW phase of Morocco’s Xlinks solar and wind energy project to be operational.

2025

Second 1.5 GW phase of Morocco’s Xlinks solar and wind energy project to be operational.

UAE to have over 1k EV charging stations installed.

2026

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

Iraq’s Mass Group Holding wants to invest EUR 1 bn on its thermal plant Mintia in Romania to have 62% of run on renewable energy, while expanding its energy capacity to at least 1.29k MWh.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.