- UAE’s Adnoc is investing USD 15 bn in a massive decarbonization push. (Decarbonization)

- And Morocco’s OCP is following suit with USD 13 bn, too. (Decarbonization)

- Saudi Arabia will have e-waste recycling facilities processing 40k tons of electronics by next year. (Waste Management)

- China is providing inverters for Qatar’s new solar plant + KSA is jumping on the solar components production train. (Solar)

- Belgium sets up a JV with Morocco on green hydrogen production. (Green Hydrogen)

- GCC Exchanges Committee sets new ESG Disclosure Metrics for unification in reporting. (Capital Markets)

- Sony and Honda on track to release a new EV in 2026. (What We’re Tracking Today)

- Coral bleaching is driving fish to fight for resources. (On Your Way Out)

Tuesday, 10 January 2023

UAE’s Adnoc and Morocco’s OCP throw bns at a massive decarbonization push

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people. The world has woken up from the lull of the past few weeks and we have a slew of regional updates for you. Let’s dive right in.

THE BIG CLIMATE STORY- The UAE’s Adnoc and Morocco’s OCP are investing USD bns in decarbonization efforts in the next few years, pivoting to renewable energy and carbon capture. Saudi Arabia is also set to get e-waste recycling facilities off the back of an agreement between recycling company Tadweeer and KSA-based firms Tebrak Trading & Contracting Company and Mounes Mohamed Alshayeb for Civil Construction.

^^ We have chapter and verse on this story and more in the news well, below.

THE BIG CLIMATE STORY OUTSIDE THE REGION– Believe it or not, there’s positive climate news today. Amid quite a lot of climate-focused news, two main stories are dominating international press coverage. The ozone layer is on track to fully recover by 2066 if current policies remain in place, with a 1989 mass phase-out of ozone-depleting substances having helped consistently reduce the size of the ozone hole, the UN announced yesterday, citing a panel of experts.

The story got ink in several international outlets: New York Times | Deutsche Welle | Washington Post | Wall Street Journal | Guardian

Meanwhile, international donors yesterday committed USD 9-10 bn to support Pakistan’s recovery from last year’s devastating climate change-induced floods. The Islamic Development Bank made a whopping USD 4.2 bn contribution, the World Bank committed USD 2 bn, and Saudi Arabia USD 1 bn, Reuters reports. The EU, China, France and the US were also among the list of donors, according to Pakistan’s information minister. The funds exceed the USD 8 bn over three years sought by Prime Minister Shehbaz Sharif, Bloomberg notes, in what’s being widely hailed as a rare example of donor pledges exceeding objectives.

WATCH THIS SPACE #1- Sustainability-linked bonds may bounce back to 2021 levels this year: Corporate bonds with a focus on advancing ESG objectives are set to grow by 30% y-o-y accounting for over USD 460 bn globally, Barclays said in a research note picked up by Reuters. ESG bonds raised USD 362 bn in 2022 — down from USD 461 bn — a 22% drop y-o-y driven by higher interest rates, the UK-headquartered bank said in the note. GCC green and sustainable bond and sukuk issuances saw massive growth in volume and value last year in spite of the global downturn, however, with some USD 8.5 bn raised from 15 issuances — a sizable increase from the USD 605 mn raised from six issuances in 2021.

But there is a caveat: We’ve mentioned previously that a majority of sustainability-linked bonds currently on the market in Europe and the West are tied to weak, irrelevant or already-achieved climate targets, according to Bloomberg analysis. If firms fail to meet the targets they set out for themselves, they repay the capital they amassed from investors with financial penalties on top meaning companies get cheaper financing and a green reputation without really holding up their end of the bargain.

WATCH THIS SPACE #2- US-backed First Movers Coalition doubles number of members in a year: The First Movers Coalition (FMC) — a global initiative launched at COP26 that aims to use company purchasing power to decarbonize seven “hard to abate” industrial sectors — grew its number of corporate members to 67 from 34 in the space of a year and collectively made USD 12 bn worth of purchasing agreements, Reuters recently noted US climate envoy John Kerry having announced at COP27. Purchasing agreements targeted sectors including steel, aluminum, shipping, trucking, and aviation, which currently account for some 30% of global emissions, the news outlet notes.

WATCH THIS SPACE #3- Sony and Honda are releasing a new EV: Sony and Honda’s EV prototype Afeela was revealed in Las Vegas last week, according to a statement. The vehicle will be outfitted with the Snapdragon Digital Chassis developed by Qualcomm Technologies for software-based vehicles to have a more intelligent experience. The new vehicle is projected to hit the North American market by the beginning of 2026, Reuters reports.

HAPPENING TODAY- Saudi Arabia is kicking off The Future Minerals Forum today at the King Abdul Aziz International Conference Center in Riyadh. 200 industry leaders and over 50 ministers will discuss decarbonizing mining projects globally and how to drive investments to the industry.

|

***

YOU’RE READING ENTERPRISE CLIMATE, the essential MENA publication for senior execs who care about the world’s most important industry. We’re out Monday through Thursday at 4am Cairo / 5am Riyadh / 6am UAE.

Were you forwarded this email? Get your own subscription without charge here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

CIRCLE YOUR CALENDAR-

UAE renewable energy firm Masdar will host Abu Dhabi Sustainability Week from Saturday, 14 January to Saturday, 21 January. The event will gather eight presidents and prime ministers and 30k participants in a series of conferences and summits including the Atlantic Council’s Global Energy Forum, the World Future Energy Summit, Masdar’s Green Hydrogen Summit, The International Renewable Energy Agency’s Youth Forum, and the Abu Dhabi Sustainable Finance Forum.

The UAE is hosting the Atlantic Council’s Global Energy Forum on Saturday, 14 January and Sunday, 15 January in Abu Dhabi. The forum will discuss the ongoing global energy crisis and its impact on the green transition, energy security, and decarbonization.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

Editor’s Note: This story and the headline atop the day’s issue were amended on 10 January 2023 to correct the name of the country in which Adnoc is headquartered. As the story below correctly notes, it is the UAE, not Saudi Arabia.

DECARBONIZATION

Adnoc sinks bns in a massive decarbonization push

The UAE’s state-owned Abu Dhabi National Oil Company (Adnoc) intends to allocate USD 15 bn to decarbonization projects by 2030, it announced in a statement on Thursday. The projects include investments in clean power, carbon capture and storage (CCS), electrification, and energy efficiency. Adnoc plans to expand its carbon capture capacity to 5 mn tons per annum by 2030 — in a bid to establish the UAE as a global hub for carbon capture expertise and innovation — and reduce its carbon intensity by 25% by that time, the statement adds.

Details are scant, but we’ll know more this year: Projects set to be announced by Adnoc in 2023 include a “first-of-its-kind” CCS project, technology for carbon removal, international partnerships, and investment in clean energy solutions, the statement says.

Adnoc’s been making big decarbonization moves lately: The company announced in December that it had appointed Musabbeh Al Kaabi (LinkedIn) to head up a new division focused on low-carbon solutions and international growth. The new division would likely focus on areas like renewables, hydrogen, and low-carbon technology like CCS, the statement said. Adnoc’s board of directors approved the acceleration of its low-carbon growth strategy in November, along with its goal of net zero by 2050, Reuters notes.

And some strategic M&A decisions: Alongside the UAE’s Abu Dhabi National Energy Company (Taqa), Adnoc completed a transaction to purchase stakes in UAE sovereign wealth fund Mubadala’s clean energy firm Masdar in December. Adnoc will hold a 24% stake in Masdar’s renewables business and a 43% stake in its nascent green hydrogen business. “Adnoc’s expansion of its new energy portfolio will largely be delivered through its stake in Masdar,” Thursday’s statement notes.

The company has also been decarbonizing its existing operations: Adnoc and Taqa reached financial close in September on a USD 3.8 bn project to build a subsea transmission network designed to reduce emissions at offshore production facilities by providing them with mainland power. Adnoc inked an MoU with India’s Gail Limited in November to decarbonize liquefied natural gas (LNG), with the scope of cooperation including monitoring carbon emissions from LNG cargoes. The oil giant is also working with Siemens Energy to launch a blockchain tech trail intended to measure its carbon footprint across its entire operational chain.

DECARBONIZATION

And not to be outdone, Morocco’s OCP Group is coughing up USD bns too

OCP Group’s strategic plan will cost bns and “greenify” operations: Morocco’s state-owned OCP Group — which mines phosphate, manufactures phosphoric acid, and produces fertilizer — recently announced it will invest some USD 13 bn in a strategic program for 2023-27 to greenify its operations, Morocco World News reports. Under the new program, OCP seeks to increase its fertilizer production, produce “green” fertilizer, and run more of its operations on renewable energy. Its mid-December announcement followed a meeting between OCP’s CEO Mostafa Terrab and Morocco’s King Mohammed VI in late-November, in which some preliminary details about the planned investment were revealed.

The big news? Achieving full carbon neutrality by 2040: OCP is committing to supply all its industrial facilities with clean energy by 2027 and targeting “full carbon neutrality” by 2040 using wind, solar, hydroelectric, and co-generation (the simultaneous production of both electricity and heat, powered by one primary energy source) to power all its industrial facilities by 2027, it notes. It also aims to reach net-zero by 2040. Under the new program, it’s targeting an increase in fertilizer production capacity to 20 mn tons by 2027, up from its current 12 mn tons.

OCP wants to reduce reliance on imports: This hefty investment in renewable energy will allow OCP — currently the world’s top ammonia importer — to reduce its long-term reliance on imports, the company notes. Through “planned substantial investments” in green hydrogen and ammonia production, OCP will be able to produce “wholly sustainable fertilizers,” it adds.

The short term goals: OCP is aiming to produce 1 mn tons of green ammonia by 2027 and 3 mn tons by 2032, it notes on its website. It’s targeting 5 GW of clean energy production by 2027 and “no less” than 13 GW by 2032 and plans to develop 20k tons of fluorine and 30k tons of other specialized chemicals to be used in the production of lithium iron phosphate batteries — essential in electric vehicle manufacturing — by 2027.

Planned new projects will be powered by renewable energy: The energy to desalinate water that OCP will transport from Jorf to Khouribga will be produced by 760 MW capacity solar PV farms, the firm notes, without specifying how many of these farms are already up and running and how many are new. Solar farms with 440 MW total capacity will be built alongside a planned new mine in Meskala, to power mining operations and a desalination plant in Safi, it adds. OCP also intends to set up a 1 mn ton per year green ammonia production complex in the south of Tarfaya, powered by a 3.8 GW solar and wind farm, with an electrolyzer production plant set up to produce the green ammonia and a 60 mn cubic meter capacity desalination plant supplying water to these facilities, OCP adds.

There’s no doubting the scale of ambition: The planned USD 13 bn investment is a leap from the USD 8 bn invested by OCP between 2012 and 2021, according to the company.

WASTE MANAGEMENT

Saudi Arabia gets electronic waste recycling facilities

Saudi Arabia is getting electronic waste recycling facilities: Saudi-based recycling company Tadweeer signed a USD 11.36 mn agreement with KSA-based firms Tebrak Trading & Contracting Company and Mounes Mohamed Alshayeb for Civil Construction for the development of e-waste repurposing plants in the Kingdom, Tabreed disclosed in a Tadawul filing last week. The agreement will expire in December 2024.

The details: The electronic waste recycling factories will have a processing capacity totaling 40k tons per year once they become operational in 2Q 2024, the statement notes, and are expected to double Tadweeer’s sales.

E-waste recycling is picking up in MENA: Canadian waste management outfit ERS International is launching Oman’s first e-waste recycling facility in 1Q 2023. The facility — located in the Dhofar province capital Salalah — aims to process at least 500k pounds of discarded electronic devices in its first year of operation.

SOLAR

China is providing inverters for Qatar’s new solar plant + KSA is set to locally manufacture solar PV products

Qatar is getting a new solar plant: China’s Sungrow signed an agreement with Samsung C&T to supply Qatar’s Al Kharsaah 800 MW solar PV project with inverter solutions, according to a statement. The new facility — poised to be Qatar’s largest solar facility — will be completed by next year. No financial details have been disclosed.

The details: The new project will generate 1.8k GWh of clean electricity and cut 900k tons of carbon dioxide emissions annually.

The new project will be Qatar’s second solar plant: The power plant, which came online last October, is the largest in the peninsula so far. Built at a cost of c. USD 470 mn, the facility delivers about 10% of the country’s peak electricity demand.

Sungrow is expanding in the region: The solar inverter company has projects in 150 countries across the globe, its website states. The firm provides battery storage for KarmSolar’s solar microgrid for a poultry farm in Egypt’s Western Desert as well as solar plants yielding 35 MW in Sharm El Sheikh. Sungrow inked an agreement with KSA’s Acwa Power to build a 536 MW battery storage system in Neom.

IN OTHER SOLAR NEWS- PIF signs agreement with LONGi to manufacture solar PV products: Saudi Arabia’s sovereign wealth fund the Public Investment Fund (PIF) has signed a Joint Development Agreement (JDA) with Chinese solar PV manufacturer LONGi Green Energy Technology, it announced in a tweet last week. The JDA covers the local manufacture of solar PV products in Saudi Arabia, the tweet notes, but no timeline or financial details have been disclosed.

GREEN HYDROGEN

Morocco’s green hydrogen production gets a boost from Belgium

Belgium’s John Cockerill sets up JV with Morocco on green hydrogen: Belgium mechanical engineering group John Cockerill has signed a strategic joint venture (JV) agreement with an unnamed Moroccan energy company to develop a value chain dedicated to undertaking green hydrogen projects in Morocco, it announced in a statement (pdf) last week.

What’s in the pipeline? Among the planned green hydrogen projects is the establishment of Africa’s first alkaline electrolyzer manufacturing plant, a gigafactory aimed at building Morocco’s green hydrogen industry, the statement tells us. The JV will enable large-scale manufacturing of “high powered alkaline electrolyzers,” suggesting we’ll see a rollout of John Cockerill’s 5 MW single stack pressurized electrolyzer — which the company claims is the largest in the market. A large cell stack (which is essentially a number of hydrogen-producing cells stacked together) provides low capex and opex costs and ups efficiency by minimizing the number of units installed, John Cockerill notes on its website.

Morocco is already on its way to becoming a regional renewables powerhouse: The country recently passed a law that will allow individuals and businesses to generate, store, and sell their own electricity from renewables. It also plans to export 3.6 GW of electricity to the UK from solar and wind energy projects with a combined capacity of 10.5 GW by 2030. Morocco received EUR 38 mn from Germany to finance its first green hydrogen plant in October 2022 and it was recently identified as one of three prospective hubs for green hydrogen export in Africa in a European Investment Bank-led study.

A number of regional and international players are eyeing investment: Egypt’s Hassan Allam Holding is looking at investing USD 50-150 mn in Morocco’s renewables, while Orascom Investment Holding is eyeing an initial USD 100 mn investment, and both independent power producer Lekela and Indian conglomerate Adani Group are considering getting in on the action.

CAPITAL MARKETS

GCC Exchanges Committee publishes ESG Disclosure Metrics

GCC exchanges have new ESG standards: The GCC Exchanges Committee published a set of ESG Disclosures Metrics including 29 standards included in the World Federation of Exchanges Sustainable Stock Exchanges Initiative yesterday. The metrics — which are voluntary — were published by the Saudi Exchange Tadawul (statement, pdf) and the Abu Dhabi Securities Exchange (statement).

Why is this important? The metrics are the first step to standardize and unify ESG disclosure reporting standards in the region. The metrics do not replace pre-existing ESG disclosure guidelines for GCC stock exchanges.

What do the new standards include? The metrics cover 29 standards including categories like GHG emissions, energy usage, water usage, environmental operations, climate risk mitigation, gender and CEO pay ratios, employee turnover, gender diversity, temporary worker ratio and non-discrimination, global health and safety, child and forced labor, as well as temporary labor, human rights, board diversity, incentivized sustainability performance, ethics and corruption prevention, data privacy, and disclosure practices.

Which exchanges are included? The GCC Exchanges Committee includes the Saudi Exchange Tadawul, Dubai Financial Market, Abu Dhabi Securities Exchange, Bahrain Bourse, Boursa Kuwait, Qatar Stock Exchange, Oman’s Muscat Stock Exchange,

ALSO ON OUR RADAR

Iraq to spend USD 3 bn on a new power plant: The Iraqi government approved on Sunday a plan to establish a USD 3 bn unspecified energy facility in the southern governorate of Dhi Qar, according to a statement from the Iraqi News Agency. The government has not disclosed the energy source of the production plant or the timeline of the project. The plant would expand the province’s generational capacity by more than threefold to 3.85 GW from 850 MW, the statement notes.

China State Construction Engineering Corp (CSEC) and Korea’s SK Ecoplant are reportedly eyeing Egypt as a potential hub for green hydrogen projects, The Korea Herald reports. Both companies entered a partnership agreement to explore overseas hydrogen markets. SK Ecoplant will facilitate loans for the projects and provide CSEC with green hydrogen tech. CSEC will use its 77 country network to drum up business attraction for the partnership, the news outlet notes.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- Qatar will use EURO5 diesel fuel in all buses and trucks imported into the country from this year onwards. (The Peninsula)

- Oman’s oil company OQ will finance three projects to promote green spaces, support social engagement at a natural park and support first response for oil pollution by the Sultanate’s Environment Authority. (Muscat Daily)

ON YOUR WAY OUT

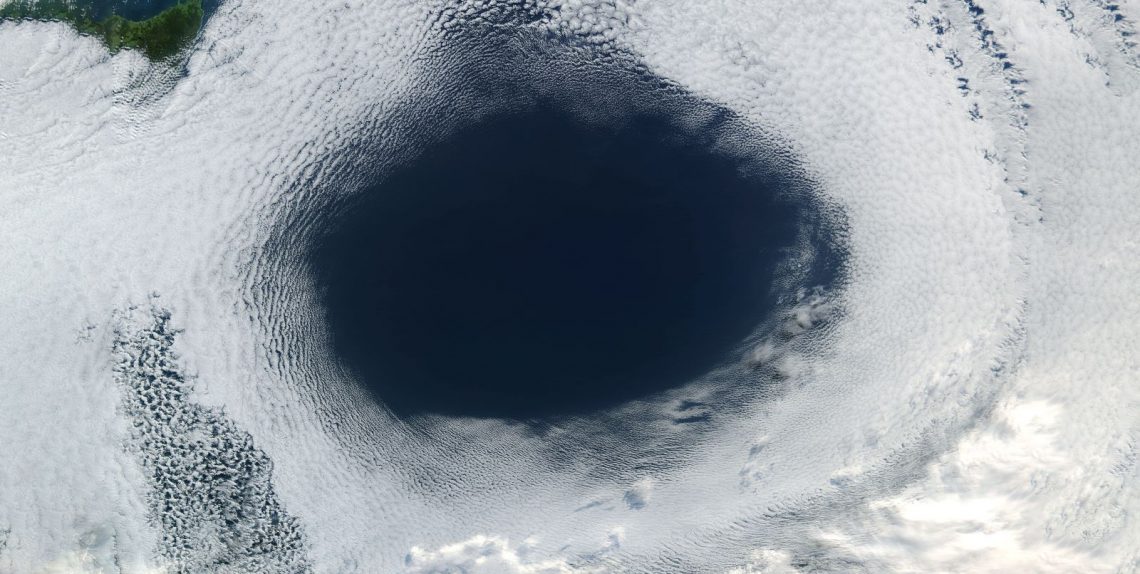

Fish are fighting for food due to lifeless coral: Global warming-induced loss of coral reefs is driving fish to unnecessarily fight for food, according to research published in Proceedings of the Royal Society B. Butterfly fish are severely impacted by coral bleaching because they are heavily dependent on the marine fauna for survival, hence increased battles for food have been observed around scarce corals off the coast of Indonesia, Japan, the Philippines, and Christmas Island.

How can researchers identify fish skirmishes? Butterfly fish signal defensive and aggressive behavior by raising their spinal dorsal fins, and directing their nostrils in a downward position, the researchers explain. Prior to record coral reef losses in 2016, the marine biologists observed that butterfly fish of varying species were able to resolve food-related altercations nearly 28% of the time, with that number plummeting by 18% post-2016, indicating a clear tendency for violence over diminishing food resources, they note in their study.

Our corals are also at risk: The Arabian Gulf water temperature is expected to rise by 4.26°C by 2039, resulting in devastating effects on marine biology including coral bleaching. Egypt’s Ras Shukeir oil terminal was reported to be dumping “barely treated wastewater” in the Red Sea and endangering coral reefs, jeopardizing the survival of the sea fauna and those dependent on it.

But there’s a silver lining for the UAE: An Abu Dhabi marine restoration project has been selected by the UN as one of 10 World Restoration Flagships. The project aims to restore beds of seagrass, coral reefs and mangroves along the Gulf coast to boost coastal resilience, improving conditions for plants and animals — including some 500 species of fish.

CALENDAR

JANUARY 2023

10-12 January (Tuesday-Thursday): The Future Minerals Forum, Riyadh, Saudi Arabia.

12 January (Thursday): Business Transition to Net-Zero – the Path Towards a Successful Low-Carbon Future Forum, Bahrain.

13 January (Friday): The International Renewable Energy Agency’s Youth Forum, Abu Dhabi, UAE.

14-21 January (Saturday-Saturday): Abu Dhabi Sustainability Week, Abu Dhabi, UAE.

14-15 (Saturday-Sunday): Global Energy Forum, Abu Dhabi, UAE.

16-18 January (Monday-Wednesday): EcoWASTE, Abu Dhabi National Exhibition Center (ADNEC), UAE.

16-18 January (Monday-Wednesday): World Future Energy Summit, Abu Dhabi National Exhibition Center (ADNEC), UAE.

22-24 January (Sunday-Tuesday): ESF MENA 2023 – Energy and Sustainability Forum, Manama, Bahrain.

January 2023: Bid submission deadline for green hydrogen projects to Hydrogen Oman (Hydrom).

FEBRUARY 2023

6-8 February (Monday-Wednesday): Saudi International Marine Exhibition and Conference, Hilton Riyadh, Saudi Arabia.

4-9 February (Saturday- Wednesday) International Association for Energy Economics’ International Conference, King Abdullah Petroleum Studies and Research Center, Riyadh, Saudi Arabia.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (EGYPS) 2023, Cairo, Egypt.

21-22 February (Tuesday-Wednesday): The Arab Green Summit, Dubai, UAE.

21-23 February (Tuesday-Thursday): World Environment, Social and Governance (ESG) Summit, Dubai, UAE.

MARCH 2023

15-19 March (Wednesday-Sunday): Qatar International Agricultural and Environmental Exhibition, Doha, Qatar.

MAY 2023

1-4 May (Monday-Thursday): Arabian Travel Market, Dubai World Trade Centre, Dubai, UAE. Register here.

29-31 May (Monday-Wednesday): Electric Vehicle Innovation Summit, Abu Dhabi National Exhibition Centre, Abu Dhabi, UAE.

JUNE 2023

Bloomberg New Economy Gateway Africa Conference, Marrakesh, Morocco.

1-3 June (Thursday-Saturday): Envirotec and Energie Expo, UTICA, Tunis, Tunisia.

SEPTEMBER 2023

Chariot Limited and Total Eren’s feasibility study on a 10 GW green hydrogen plant in Mauritania to be completed.

OCTOBER 2023

2-4 October (Monday-Wednesday): WETEX and Dubai Solar Show, Dubai World Trade Centre, Dubai, United Arab Emirates.

NOVEMBER 2023

6-17 November (Monday-Friday): The UAE will host COP28.

EVENTS WITH NO SET DATE

End-2022

KSA’s Neom wants to tender three concrete water reservoir projects to up its water storage capacity by 6 mn liters.

2023

Early 2023: Egypt’s KarmSolar to launch KarmCharge, the company’s EV charging venture.

1Q2023: Oman will award two blocks of land for green hydrogen projects in Duqm, Oman.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

4Q2023: Oman to award four blocks of land for green hydrogen projects in Thumrait, Oman.

2024

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

First 1.5 GW phase of Morocco’s Xlinks solar and wind energy project to be operational.

2025

Second 1.5 GW phase of Morocco’s Xlinks solar and wind energy project to be operational.

UAE to have over 1k EV charging stations installed.

2026

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

Iraq’s Mass Group Holding wants to invest EUR 1 bn on its thermal plant Mintia in Romania to have 62% of run on renewable energy, while expanding its energy capacity to at least 1.29k MWh.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.