- PIF-owned Badeel, Acwa Power sign PPA for USD 1.75 bn, 2.06 GW solar plant. (Solar)

- We’re less than a week away from the Enterprise Climate X Forum. (What We’re Tracking Today)

- Climate czar Mahmoud Mohiledin tells us what we need to do until COP28. (Newsmakers)

- UAE’s Amea Power secured USD 1.1 bn in funding for its >1 GW renewable energy plants in Egypt. (Climate Finance)

- The EU is making shipping lines buy carbon credits starting in 2024 — with the requirement that 100% of emissions be covered by 2026. (What We’re Tracking Today)

- A new phase of the Mohammed bin Rashid Al Maktoum Solar Park has is supplying UAE’s national grid with electricity. (Solar)

- EU looking at Morocco and Algeria (and others) for raw materials to get through the green transition + Egypt and KSA are set to start work on their electricity grid link-up. (What We’re Tracking Today)

- MENA has been doing good this past week, at least climate-wise. (Kudos)

Thursday, 1 December 2022

MENA is ablaze with solar energy today, from Saudi Arabia to Egypt

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people. With just five days left to go until the Enterprise Climate X Forum (more on that below), it’s refreshing to see our region making big moves in the business of climate.

Solar is the name of the game across the region this fine morning. The green hydrogen bonanza is (for a change) taking a break today, but other green energy sources are stepping in.

THE BIG CLIMATE STORY- Saudi’s Al Shuaibah is getting a 2.06 GW solar plant, courtesy of Badeel and Acwa. Saudi Arabia’s Water and Electricity Holding Company and developer Acwa Power signed a PPA for a 2.06 GW solar plant in Al Shuaibah. As things stand today, the facility is set to be the largest of its kind in the Middle East and when it comes online in 4Q 2025.

In Egypt, AMEA Power has locked down USD 1.1 bn for its solar and wind projects in the country. The financing is being provided by several government players, development finance institutions, and commercial banks.

ALSO- We sat down with climate czar Mahmoud Mohieldin for a post-COP27 debrief on the summit’s achievements, how to build on the progress we’ve recently seen on climate finance (a big win for Egypt in Sharm), and priorities in the run-up to COP28.

^^We have chapter and verse on these stories and more in the news well, below.

THE BIG CLIMATE STORY OUTSIDE THE REGION- The European Union has agreed to add shipping to its carbon market for the first time. Shipping companies will soon be obligated to buy EU carbon permits to cover their emissions. And the bloc isn’t messing around — it’s phasing in the regulations very quickly: Shippers will need to cover 40% of their emissions starting in 2024, followed by 70% in 2025 and 100% in 2026, according to Reuters.

Why this is really big: Transport and power generation are the industries with the heaviest carbon footprint, and shipping is particularly hard to regulate given much of the voyage takes place in international waters. The plan covers “all carbon dioxide, methane and nitrogen dioxide emissions from maritime voyages within the EU” and will include 50% of emissions for runs that start and end in the bloc.

The EU announced a number of other climate-focused plans yesterday, including a proposal paving the way for government-approved certification of carbon removal projects in areas like carbon capture and soil sequestration and another that aims for all EU packaging to be recyclable by 2030 and for waste in the bloc to be slashed by 5% from a 2018 baseline. The proposals are getting plenty of attention in the international business press, including Reuters, the Financial Times, and Bloomberg.

|

WATCH THIS SPACE #1- Contractors are scheduled to break ground on the Egypt-Saudi interconnection project, according to a report in the Egyptian press. The 3 GW electricity linkup is projected to go live in mid-2025.

WATCH THIS SPACE #2- Morocco and Algeria to supply the EU with energy-transition materials: The EU is planning to sign MoUs with Morocco and Algeria, in addition to several other African countries, to supply the bloc with raw materials for renewables projects, the EU said in a statement (pdf) this week. The statement does not clarify when the agreements will be signed. This comes as part of the Africa-EU Green Energy Initiative, as the EU is mobilizing funding for clean energy projects across Africa in return for energy-transition minerals.

WATCH THIS SPACE #3- The majority of Europe’s corporate loans market will have ESG provisions in 2023, Bloomberg reports. Bankers interviewed by the business information service say at least half of the loans for firms in Europe, MENA, and Africa will be tied to ESG targets in the coming year — up some 14% from 2022.

What does this mean? Firms can lower their cost of borrowing if they meet pre-defined ESG performance targets such as reducing pollution, better waste management, hitting gender targets.

WATCH THIS SPACE #4- Innovate Egypt plans to debut two types of EVs in the Egyptian market next year, including one resembling a tuktuk that can be used for short distances, and another for longer distances, Al Mal quotes global satellite provider EgyptSat Chairman Mohamed El Ghamry as saying. Innovate Egypt has partnered up with an unnamed firm to begin producing electric vehicles before the end of the year, El Ghamry reportedly said. The vehicle will retail in the EGP 150-250k, he added.

PSA #1- UAE companies can now get an “Islamic sustainable account” from Standard Chartered. The Shariah-compliant accounts will be used to fund sustainability projects, including renewables.

PSA #2- Fancy a BMW EV? New distributor Global Auto Group is gearing up to introduce BMWi EVs to the Egyptian market, EnterpriseAM reports. The news comes the same week that BMW said it is launching the its i7 model in the UAE, as we’ve previously noted.

CORRECTION- We incorrectly wrote in yesterday’s issue that Lekela is a unit of renewables player Infinity. Infinity and the Africa Finance Corporation have entered into a transaction with private equity firm Actis (which owns 60% of Lekela) and Irish wind / solar developer Mainstream Renewable Power (40%) to acquire 100% of Lekela. The transaction is in progress. The story has been corrected on our web edition.

Todd Wilcox, CEO and deputy chairman of HSBC Egypt, is joining us for the Enterprise Climate X Forum, taking place this coming Tuesday the Grand Egyptian Museum. Are you? We’re proud to announce that our friend Todd Wilcox is going to be speaking at the forum on how banks and corporates are tackling financing for the most compelling industry of our generation. Joining him on stage will be our friends Tarek El Nahas, group head of international banking at Mashreq, and Nader Abushadi, group treasurer at Dar Group.

They’re not the only ones: Among the top execs, bankers, and development finance folks speaking at the conference are: Amr Allam, co-CEO of Hassan Allam Holding; Mohamed Ismail Mansour, co-founder and CEO of Infinity; Sherif El Kholy, partner and head of MENA at Actis; Khalid Hamza, director and head of Egypt at European Bank for Reconstruction and Development (EBRD), Simon Kitchen, head of strategy at EFG Hermes Research; Karim Hussein, managing partner at Algebra Ventures; Aly El Tayeb, CEO and co-founder of ShiftEV; Jorgo Chatzimarkakis, CEO of Hydrogen Europe; Khaled Naguib, CEO of H2Egypt, and Leslie Reed, Mission director for Egypt, USAID.

Topics and live interviews will include:

- What are green hydrogen and NWFE? Why do they matter to businesses, banks and investors?

- How are CEOs across global emerging markets are dealing with (and being constrained by) climate change?

- What’s keeping bankers awake at night when it comes to climate finance?

- Meet the startup and VC in line to be Egypt’s first climate b’naires.

For the full agenda please click here.

** Have you confirmed your attendance? We’ll be sending you on Sunday, 4 December the QR code you’ll need to gain admission to the Grand Egyptian Museum, along with a Google Maps link and some other pointers — including a reminder that the event takes place under Chatham House Rules. Only confirmed invitees who can present their personal QR codes will be able to gain admission to the GEM on event day.

HAPPENING TODAY–

THE WORLD CUP TODAY- It’s day 12 of the tournament, and Group E and F teams are facing off again (all times CLT):

- Croatia v Belgium (5pm)

- Canada v Morocco (5pm)

- Japan v Spain (9pm)

- Costa Rica v Germany (9pm)

CIRCLE YOUR CALENDAR-

Oman will host a two-day green hydrogen summit next Monday, 5 December, at Oman’s Convention and Exhibition Center in Muscat. The summit will discuss all aspects of the hydrogen value chain including production, transportation, and storage challenges.

Rwanda is hosting the World Circular Economy Forum from Tuesday, 6 December to 8 December in Kigali. The forum — taking place in Africa for the first time — will shed light on how the circular economy can reduce greenhouse gas emissions, support climate change adaptation, and protect the planet’s biodiversity.

UAE will host the Big 5 global construction impact summit next Wednesday, 7 December at the Dubai World Trade Center, bringing more than 2k exhibitors from 60 countries, as well as regional and global construction industry leaders together to discuss ways to meet local and global net zero and waste reduction targets.

FURTHER DOWN THE LINE- Dubai will be host to the food and sustainability Middle East challenge on 2 March, 2023. The Rome-based European Institute of Innovation for Sustainability is partnering with SDG Global to bring a six-month long, online interactive course to align the region’s food industry with ESG sustainability and development targets. You can register interest in the for-pay course here.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

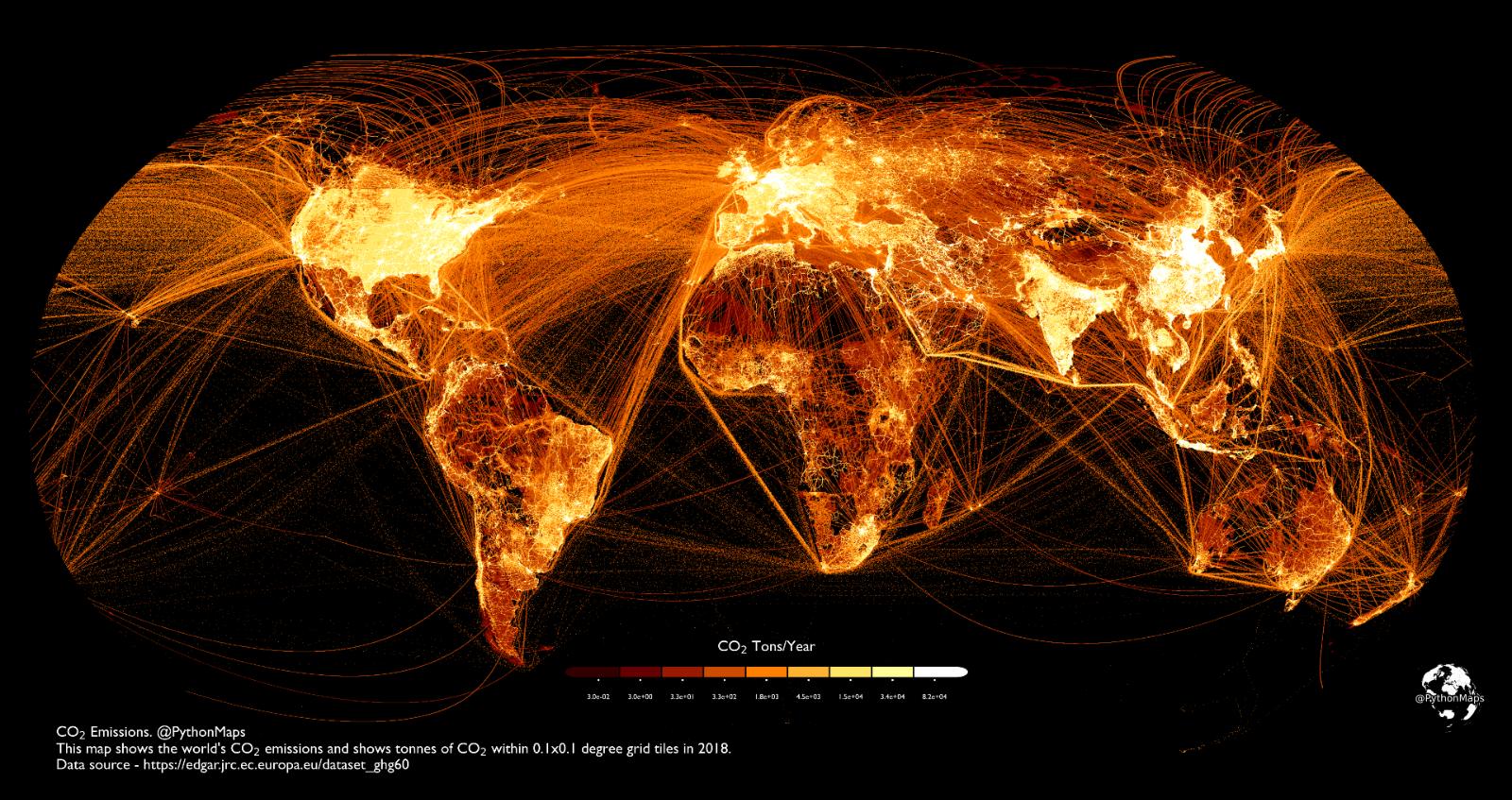

IMAGE OF THE DAY- MENA and Africa are far from being the world’s biggest CO2 pains: The graphic map uses carbon emissions data collected by the European Commission in 2018 to visualize population centers, flight paths, shipping lanes, and high production areas. The Middle East and North Africa show bright spots around Egypt, Israel, Morocco and the Suez Canal — indicating emissions from population and shipping centers — but it is China, India, the US, Central America and Europe — with Germany and Italy standing out — that light up the brightest when it comes to emissions.

SOLAR

PIF’s Badeel is leading a consortium for a 2.06 GW solar plant in KSA

PIF-owned Badeel, Acwa Power sign PPA for USD 1.75 bn, 2.06 GW solar plant: A joint venture between Saudi renewable energy developer Acwa Power and Saudi Arabia’s Water and Electricity Holding Company (Badeel) signed a 35-year power purchase agreement (PPA) with the Saudi Power Procurement Company (SPPC) for a 2.06 GW solar plant in Al Shuaibah, according to an Acwa Power statement. The USD 1.75 bn facility is set to be the largest of its kind in the Middle East and is expected to come online by 4Q 2025, the statement notes.

The details: The joint venture — Shuaibah 2 Electrical Energy Company — will develop the facility. Badeel, a unit of the kingdom’s Public Investment Fund (PIF), and Acwa Power will each hold a 50% stake in the JV. No details were provided on how the facility will be financed.

Not their first time around the block: A consortium of Acwa Power, Badeel, and Saudi Aramco Power Company established the Sudair One Renewable Energy Company in August 2021. The SAR 3.4 bn company signed a PPA with the SPPC as an offtaker for the 1.5 GW Sudair solar plant in Riyadh.

IN THE UAE- Trough Unit 1 of Phase 4 of the Mohammed bin Rashid Al Maktoum Solar Park has begun supplying electricity to UAE’s national grid, Zawya reports. The 700 MW concentrated solar power unit can generate power continuously for an average of 13.5 hours at night and 15 hours during periods of overcast or rainy weather, according to the statement.

AND OVER IN EGYPT- Eight unnamed companies submitted tenders for a new USD 91 mn, 20 MW solar plant in Hurghada, Al Dostor quotes New and Renewable Energy Agency (NREA) Deputy Chairman Ihab Ismail as saying. The Electricity Ministry’s New and Renewable Energy Agency’s (NREA) issued a tender to develop the project, with a two-year operation and maintenance contract. The Japan International Cooperation Agency (JICA) is providing funding for the project through a Special Terms for Economic Partnership (STEP) loan.

CLIMATE FINANCE

Amea Power secures over USD 1 bn in funding for Egypt’s renewables projects

Amea Power locks in funding for 1 GW renewables projects in Egypt: The UAE’s Al Nowais subsidiary Amea Power secured USD 1.1 bn in debt and equity funding for a 560 MW solar plant and 505 MW wind farm in Egypt, according to statements from Egypt’s cabinet and the IFC (pdf). Construction of the facilities is due to begin in December and will be delivered under a build-own-operate (BOO) framework, according to the IFC statement.

The breakdown: The World Bank’s International Finance Corporation (IFC), Dutch development bank FMO and Japan International Cooperation Agency (JICA) are collectively providing USD 500 mn for the solar plant. Meanwhile, the USD 800 mn wind farm is receiving USD 500 mn from the Japanese Bank for International Cooperation, the IFC, and three commercial banks — Sumitomo Mitsui Banking Corporation, Sumitomo Mitsui Trust Bank, and Standard Chartered Bank — covered in ins. by Nippon Export Investment Ins., according to a statement from the IFC, which was the lead arranger for the funding package. The IFC also managed to mobilize a working capital facility from CIB, the statement said, without disclosing the exact amount the bank is lending.

More about the projects: The Abydos solar plant and Amunet wind project will generate over 4k GWh a year of power, according to the IFC statement. Power from Abydos will be priced at USD 0.02/KWh, while power from Amunet will be priced at USD 0.03/KWh — “among the least expensive rates globally,” it adds. Construction of the Abydos solar plant near Kom Ombo should be finished within 18 months, and the Amunet wind farm in the Gulf of Suez within 30 months.

We caught wind of the Amunet project earlier this month, when the IFC indicated it could provide USD 83 mn in partial funding. Total cost was estimated at USD 709 mn, with the electricity produced to be sold to state-owned Egyptian Electricity Transmission Company under a 25-year power purchase agreement.

Amea seems set on continuing its growth spurt: Amea put pen to paper during COP27 for a 390k ton per annum green ammonia plant in Egypt’s Ain Sokhna that could be up and running by the end of 2025. It’s adding 20 MW of capacity to its solar project in Togo to reach 70 MW. Its portfolio also includes a USD 100 mn 100 MW solar plant in Tunisia and a 100 MW wind project in Morocco. The company has some 6 GW of renewables projects in 15 countries in the pipeline, according to its website.

NEWSMAKERS

A post-COP27 analysis with Egypt’s climate czar Mahmoud Mohieldin

Where we stand with climate finance after COP27: The dust has settled after an eventful COP27 that ended with the agreement to create a landmark loss and damage fund. In the run-up to the summit, Egypt’s UN high-level climate champion Mahmoud Mohieldin (LinkedIn) led calls for developed economies to step up funding for adaptation and economic development in climate-vulnerable countries — as part of overall climate finance provision. (Catch up on our September interviews with Mohieldin here and here.)

So what needs to be done before COP28? We sat down with Mohieldin for a post-COP27 debrief on the summit’s achievements, how to build on recent progress on climate finance, and priority action in the run-up to COP28.

Edited excerpts of our conversation below:

For Mohieldin, COP27 marked an important step towards climate justice: “Developing economies — and developed economies that care about fairness and the just transition — will be very pleased with COP27’s outcomes,” he notes, “although we know agendas and priorities differ.”

Arguably the biggest W? There’s now explicit recognition that loss and damage is a separate issue from adaptation — requiring different evidence, funding, support and technical work, says Mohieldin. The long-term conflation of the two by some advanced economies “wasn’t helpful and delayed matters for many years.”

What happens next: A 24-member committee — with representatives from the current and incoming COP presidencies, developing and advanced economies — will identify the scope of work, funding sources, and priorities for loss and damage action, with a schedule due before the end of the year. “We’re expecting a lot of practical solutions,” Mohieldin says.

These financing solutions need to be separate from the USD 100 bn a year funding commitment previously made by developing nations, Mohieldin says. There’s a USD 1 tn financing gap just to address mitigation, with additional funding needed for adaptation, he adds. “In terms of overall climate finance requirements, USD 100 bn is less than 3% of what’s needed.”

Mobilizing concessional financing for adaptation: Adaptation funding should ideally come from grants, foreign direct investment, or concessional long-term financing — with a minimum grace period of 10 years, a 20-year payback period and an interest rate capped at 1%.

“How could we subsidize this interest rate? From the promised USD 100 bn — which could be used to reduce the cost of borrowing,” he says. “Adaptation requires long-term finance, and I don’t really see the private sector doing more in the short-term, because its current global contribution doesn’t exceed 2%.”

Mitigation should be the purview of the private sector, with de-risking, packaging and political assurances, he says. “In a typical project, you might target 10-20% of funding from DFIs — as project participation, long-term finance, guarantees or taking the first loss. Then you’d hope for 80% of funding from the private sector.”

His take on the Great Debate? Before pointing the finger at developing nations wanting to use fossil fuels for development, advanced economies need to reduce their own emissions significantly, pay their fair share in climate finance, and help with the just energy transition — “not just with drops of USD bns every now and then, as we’re seeing with South Africa and Indonesia.”

What’s next for him? He’ll be working to bring other stakeholders into loss and damage action: “I’ll be meeting in the US with leading names in the ins. industry to build on discussions in Sharm, and will meet with the Ins. Development Forum (IDF),” Mohieldin says. Non-state actors can also do a lot of capacity building for developing economies, he adds.

Egypt’s Africa carbon credit market is a priority: Mohieldin is working closely with Financial Regulatory Authority Executive Chairman Mohamed Farid (LinkedIn) on areas including carbon credit markets, he tells us. The two recently discussed the market’s technical and regulatory requirements, issues related to market integrity, and adopting currently available standards and technical assistance, he notes.

A Glasgow Financial Alliance for Net Zero (GFANZ) project pipeline is also coming together: “We have a list of 50 projects which basically translates the promise of GFANZ into project pipelines,” he says. Projects span mitigation and adaptation initiatives, from countries within and beyond Africa.

Several key COP27 learnings can be carried into COP28: Public-private partnerships for COP arrangements need to go beyond transactions and translate into institutional coordination, Mohieldin says. COP28 will benefit from a strong project pipeline, he adds. COP27 and the G20 summit showed that “multilateralism can still be a vehicle for reform and getting things done, with tangible and substantive outcomes,” he says.

CORRECTED ON 1 DECEMBER

A previous version of the story had put a USD 100 bn figure on the loss and damage fund. No USD amount has yet been placed on the loss and damage fund announced at COP27.

KUDOS

MENA has been good this past week, at least climate-wise

There’s quite a few rounds of applause due today:

- MEED Projects Awards 2022 and Mashreq named ICD Brookfield Place the project of the year, MEED announced this week. The building is located in the UAE’s Dubai International Financial Center and is LEED Platinum certified.

- Only 24% of Bee’ah’s waste ends up in landfills, with the remaining 76% being diverted, Arab News reported.

- UAE-based asset management firm Kaizen received the WELL Health Safety Rating award for 90 of its assets, the company said in a statement this week. The award was granted on grounds of compliance with environmental, social, and governance standards.

- Switzerland-based Open Minerals (OME) received the World Economic Forum’s Global Innovators award, Zawya reports. The company had raised USD 33 mn from investors in 2021, including Mubadala Investment Co.

CALENDAR

DECEMBER

6 December (Tuesday): Enterprise Climate X Forum, Cairo, Egypt.

6-8 December (Tuesday-Thursday): World Circular Economy Forum WCEF2022, Kigali, Rwanda.

7 December (Wednesday): The Big 5 Global Construction Impact Summit, Dubai World Trade Center, Dubai, UAE.

13-14 December (Tuesday-Wednesday): Seminar on EU standards for agri-food products for the Gulf Cooperation Council countries, Grand Millennium Business Bay Hotel, Dubai, UAE.

13-15 December (Tuesday-Thursday): International Renewable Energy Congress, Hammamet, Tunisia.

15 December (Thursday): The UN’s 15th meeting of the Conference of the Parties to the Convention on Biological Diversity (COP15), Montreal, Canada.

JANUARY 2023

10-12 January (Tuesday-Thursday): The Future Minerals Forum, Riyadh, Saudi Arabia.

13 January (Friday): The International Renewable Energy Agency’s Youth Forum, Abu Dhabi, UAE.

14-21 January (Saturday-Saturday): Abu Dhabi Sustainability Week, Abu Dhabi, UAE.

16-18 January (Monday-Wednesday): EcoWASTE, Abu Dhabi National Exhibition Center (ADNEC), UAE.

16-18 January (Monday-Wednesday): World Future Energy Summit, Abu Dhabi National Exhibition Center (ADNEC), UAE.

January 2023: Bid submission deadline for green hydrogen projects to Hydrogen Oman (Hydrom).

FEBRUARY 2023

6-8 February (Monday-Wednesday): Saudi International Marine Exhibition and Conference, Hilton Riyadh, Saudi Arabia.

21-22 February (Tuesday-Wednesday): The Arab Green Summit, Dubai, UAE.

21-23 February (Tuesday-Thursday): World Environment, Social and Governance (ESG) Summit, Dubai, UAE.

MARCH 2023

15-19 March (Wednesday-Sunday): Qatar International Agricultural and Environmental Exhibition, Doha, Qatar.

MAY 2023

1-4 May (Monday-Thursday): Arabian Travel Market, Dubai World Trade Centre, Dubai, UAE. Register here.

29-31 May (Monday-Wednesday): Electric Vehicle Innovation Summit, Abu Dhabi National Exhibition Centre, Abu Dhabi, UAE.

JUNE 2023

Bloomberg New Economy Gateway Africa Conference, Marrakesh, Morocco.

1-3 June (Thursday-Saturday): Envirotec and Energie Expo, UTICA, Tunis, Tunisia.

SEPTEMBER 2023

Chariot Limited and Total Eren’s feasibility study on a 10 GW green hydrogen plant in Mauritania to be completed.

OCTOBER 2023

2-4 October (Monday-Wednesday): WETEX and Dubai Solar Show, Dubai World Trade Centre, Dubai, United Arab Emirates.

NOVEMBER 2023

6-17 November (Monday-Friday): The UAE will host COP28.

EVENTS WITH NO SET DATE

End-2022

KSA’s Neom wants to tender three concrete water reservoir projects to up its water storage capacity by 6 mn liters.

2023

Early 2023: Egypt’s KarmSolar to launch KarmCharge, the company’s EV charging venture.

1Q2023: Oman will award two blocks of land for green hydrogen projects in Duqm, Oman.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

4Q2023: Oman to award four blocks of land for green hydrogen projects in Thumrait, Oman.

2024

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

First 1.5 GW phase of Morocco’s Xlinks solar and wind energy project to be operational.

2025

Second 1.5 GW phase of Morocco’s Xlinks solar and wind energy project to be operational.

UAE to have over 1k EV charging stations installed.

2026

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

Iraq’s Mass Group Holding wants to invest EUR 1 bn on its thermal plant Mintia in Romania to have 62% of run on renewable energy, while expanding its energy capacity to at least 1.29k MWh.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.