- Qatar Investment Authority could end up acquiring around 9% of European energy company RWE for EUR 2.4 bn. (M&A Watch)

- Egypt is leading MENA in value of green hydrogen projects worth USD 63.8 bn out of a total of USD 180 bn worth of projects. (Green Hydrogen)

- France’s Engie plans to bid on the 1.5 GW Al Ajban solar project in Abu Dhabi. (Solar)

- Carmaker Stellantis, Siemens want to upscale EV last mile delivery infrastructure in MENA. (Electric Vehicles)

- Maersk could break ground on its green hydrogen project in Egypt as early as December. (Green Hydrogen)

- UK embassy in Egypt kicks off GBP 10.8 mn climate finance accelerator this week. (What We’re Tracking Today)

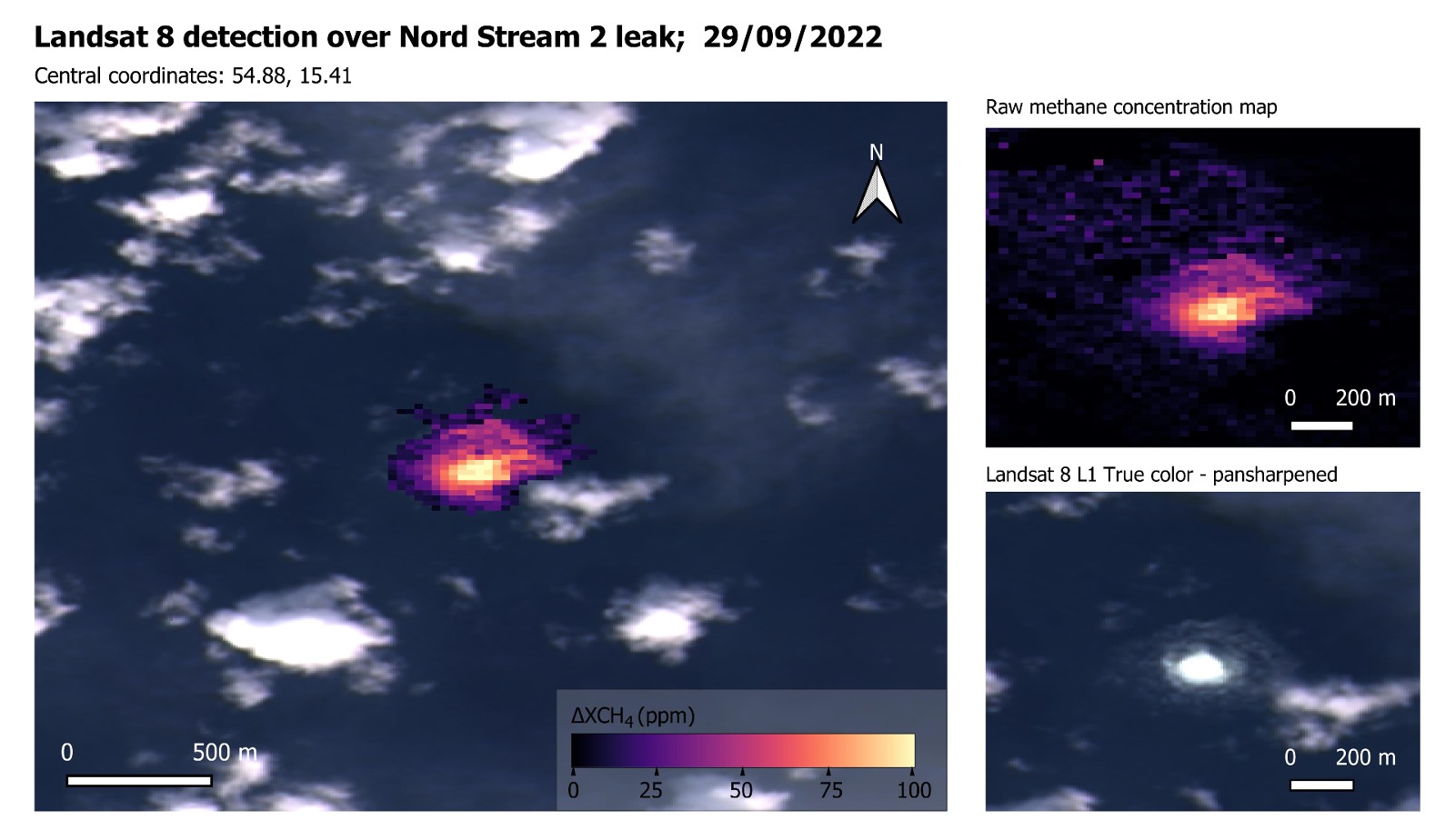

- This is what the LNG Nord Stream pipeline leak looks like from space. (Image Of The Day)

- Dubai Police add the first electric vehicle to its luxury patrol fleet. (On Your Way Out)

Monday, 3 October 2022

Qatar Investment Authority to acquire 9% of Europe’s RWE for EUR 2.4 bn

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people — and welcome to another news-heavy Monday.

THE BIG CLIMATE STORY in our corner of the world- Qatar’s sovereign wealth fund could end up acquiring around 9% of European energy company RWE for EUR 2.4 bn in a debt-to-equity transaction. RWE wants to use the funding to acquire US renewable energy developer Con Edison Clean Energy Businesses.

ALSO- Egypt is leading MENA in value of green hydrogen projects, with USD 63.8 bn out of a total of USD 180 bn worth of projects. We have more on both of these stories in the news well, below.

THE BIG CLIMATE STORY OUTSIDE THE REGION still has a MENA angle: King Charles will not be coming to COP27: The UK’s King Charles III, a long-time climate advocate, has scrapped plans to attend November’s COP27 summit in Egypt. Charles had been scheduled to attend in his capacity as Prince of Wales and founder of the Terra Carta initiative. The cancellation comes on the “advice” of UK Prime Minister Liz Truss, but speculation in the UK press corps is that Truss scuppered the trip and that Buckingham Palace leaked the news in retaliation.

The story is front-page news in the UK and around the world: BBC | Guardian | Reuters | AP

GO DEEPER- Charles’ Terra Carta Action Forum, which is scheduled to take place during COP27, will focus on how to deliver on “the promises made in Glasgow” at COP26, to unlock USD tns of private sector investment for climate action, the then-Prince of Wales said.

ALSO- Oil prices could be heading back up this week as OPEC+ mulls on Wednesday whether to slash production by 1 mn barrels or more — the cartel’s largest output cut since the start of the covid-19 pandemic. Brent Crude climbed 2.5% overnight on the news to USD 81.47 / barrel, but was well above USD 100 / barrel from March through July of this year. The Financial Times and Wall Street Journal have more.

AND speaking of fossil fuels: French filling stations are running dry on the back of strikes at four of six of France’s refineries.

WATCH THIS SPACE- The global green sukuk market could grow anywhere between USD 30-50 bn by 2025, according to a majority of Islamic finance professionals surveyed by Islamic Markets. The outfit found that GCC investment in renewables, along with COP27 and COP28 taking place our part of the world, are driving a rise in demand for shariah-compliant green bonds.

But the industry need more regulation and standardization for the green sukuk market to reach its potential, said Arsalaan Ahmed, chair of the Global Islamic Finance Forum, which is set to take place on 5-6 October in Kuala Lumpur, Malaysia.

Uh, Enterprise, what’s a sukuk? We’ve got your covered in this Enterprise Explains column.

IMAGE OF THE DAY- You can (could?) see plumes of the Nord Stream explosions from space. Images taken from space show plumes of methane belching from four leaks along the two Nord Stream pipelines that transport gas from Russia to Europe, Bloomberg reports. Western nations are accusing Russia of deliberate sabotage to put additional pressure on Europe’s energy market.

What’s happening now? The pressure in the pipelines has now stabilized, meaning the leaks should have stopped, the Danish Energy Agency tweeted yesterday. While scientists haven’t yet calculated the extent of the damage, the images suggest the leaks are “substantially larger” than a so-called super-emitter event off the Gulf of Mexico last year that saw the equivalent of 3% of Mexico’s annual oil and gas emissions discharged into the water, the business newswire reports.

|

***

YOU’RE READING ENTERPRISE CLIMATE, the essential regional publication for senior execs who care about the world’s most important industry. Enterprise Climate covers everything from finance and tech to regulation, products and policy across the Middle East and North Africa. In a nod to the growing geographical ambitions of companies in our corner of the world, we also include an overview of the big trends and data points in nearby countries, including Africa and southern Europe.

Enterprise Climate is published at 4am CLT / 5am Riyadh / 6am UAE, Monday through Thursday, by Enterprise, the folks who bring you Enterprise Egypt, your essential 6am and 3pm read on business, finance, policy and economy in Egypt and emerging markets.

Subscribe to Enterprise Climate here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

COUNTDOWN TO COP (35 days to go)-

UK to launch climate finance accelerator in Egypt this week: The British Embassy in Cairo is launching a GBP 10.8 mn (USD 11.2 mn) Climate Finance Accelerator (CFA) program in Egypt at an event on Tuesday, according to a statement (pdf). The program will help eight middle-income countries — including Egypt, South Africa, Nigeria, Pakistan, and Turkey — design more bankable projects and connect them with investors. Egypt’s Vice Minister of Finance Ahmed Kouchouk and CIB Chief Sustainability Officer Dalia Abdel Kader will be among speakers on a panel at Tuesday’s launch event.

HAPPENING TODAY-

The Egyptian Center for Economic Studies is today hosting an event focusing on green finance at the Four Seasons Hotel in Cairo, Egypt. Egyptian Environment Minister Yasmine Fouad and COP27 Presidency Special Representative Wael Aboulmagd. Want to go in person? Register here. Want to dial in thought Zoom? Register here.

CIRCLE YOUR CALENDAR-

The Green Energy Africa conference will run this Tuesday-Wednesday, 4-5 October in Cape Town, South Africa. The event aims to bring together executives, investors, utility firms, and government leaders to drive investment in Africa’s renewable and low carbon sector. You can register for the event here.

UN’s NZAOA to host virtual forum on blended finance for climate investments in EMs: The Net-Zero Asset Owner Alliance (NZAOA) will discuss blended finance for climate investment in emerging markets and developing economies on Wednesday, 5 October, ahead of the IMF-World Bank Annual Meetings next week. (Blended finance = using development finance to leverage private capital for countries’ sustainable development plans.) You can register for the event here.

The IMF and World Bank will hold their annual meetings in Washington, DC, on 10-16 October.

Closer to home, the International Exhibition of Renewable Energies, Clean Energies and Sustainable Development take place from 24-26 October in Oran, Algeria. The event will include panels focusing on energy efficiency and energy saving, startups’ role in the energy transition, and the bankability of renewable energy projects.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

PUBLIC SERVICE ANNOUNCEMENTS-

PSA #1- If you’re bidding on a water project in Dubai, make sure it is NSF 61-compliant: Dubai Electricity and Water Authority will be making it mandatory for anyone bidding on drinking water projects to adopt NSF International’s NSF 61 certification — a drinking water system health standard — starting from 23 November, Zawya reported Wednesday.

PSA #2- Applications for the Smart Energy Solutions for Africa program are open until 20 November, Siemens Stiftung said in a statement. The initiative will target SMEs building clean, energy-focused businesses from Ghana, Malawi, Morocco and South Africa that focus on sustainable energy solutions, Siemens says. You can download the application form here.

M&A WATCH

QIA could end up acquiring around 9% of RWE for EUR 2.4 bn: Qatar’s sovereign wealth fund — Qatar Investment Authority (QIA) — invested EUR 2.4 bn in major German utilities provider RWE in a debt-to-equity swap that will eventually see QIA own 9.09% of RWE. RWE made the announcement yesterday.

What’s RWE going to do with the proceeds from the transaction? RWE plans to acquire 100% of US renewable energy developer Con Edison Clean Energy Businesses in a USD 6.8 bn transaction (that’s about 11x EBITDA, for you finance nerds out there), RWE said in a separate statement. The sale would double RWE’s renewables portfolio in the US to more than 7 GW of operating assets and expand its pipeline in the US to more than 24 GW in onshore wind, solar and batteries projects. It would also make RWE as the second-largest solar operator in the US.

RWE thinks the transaction can be completed in 1H 2023 if it gets its regulatory ducks in a row. The transaction announcement goes deeper into the mechanics if you want to nerd out over the details.

QIA is on a European green shopping spree: The QIA recently invested EUR 250 mn in Paris-based biotech company Innovafeed, we previously wrote. In 2020, the fund announced it would no longer deploy new investment in hydrocarbons, and as of 2021, almost 50% of the infrastructure power generation projects in its portfolio are “zero-emission investments”, according to The Peninsula Qatar.

GREEN HYDROGEN

Egypt is leading MENA in terms of value of green hydrogen projects in the pipeline, with some USD 63.8 bn (or a hair over 35%) of the USD 180 bn worth of projects that have so far been announced, according to data from Middle East Business Intelligence (MEED) picked up by Kuwait’s Al Anba on Friday. Egypt was followed by Oman (USD 48.9 bn) and Morocco (USD 16.85 bn). Saudi Arabia came in fourth with USD 10.5 bn, while the UAE ranked fifth across the region with USD 10.3 bn. Qatar and Kuwait both ranked last with USD 15 mn each.

It’s not a surprise that Egypt is in the lead: This summer alone, Egypt signed USD 32 bn worth of preliminary agreements for green ammonia and hydrogen projects with seven international companies set to generate a combined annual capacity of around 5.5 mn tons of green fuel in the Ain Sokhna industrial zone.

But MENA’s green hydrogen projects need some foundational work. These include the development of clear regulations, agreements on certifications and streamlining electrolyzer production to make investments more profitable, Al Anba writes, referring to discussions held among industry professionals at the Wetex and Dubai Solar Show.

The bigger question: How many of these MENA plants will get built in the wake of the US Inflation Reduction Act, which includes a 10-year production tax credit of as much as USD 3 / kg of H2 produced with no emissions.

COULD WORK ON A MAERSK HYDROGEN PLANT IN EGYPT BEGIN IN DECEMBER?

Maersk could break ground on its green hydrogen project in Egypt as early as December, Al Mal reported yesterday, citing what it said are “sources close to the matter.” The initial phase of the project is expected to be finalized within a year after land for the project gets allocated, the sources said, with hydrogen shipments expected to be exported the following year. Al Mal’s sources say the output could go for as much as USD 2.5 / kg, but says nothing about who the offtaker would be.

No comment so far from the principals: We reached out to Maersk and the Suez Canal Economic Zone (SCZone), who have yet to comment on the matter as of dispatch.

Background: The plant comes as part of a USD 15 bn project to produce clean fuel for shipping in the SCZone, which Maersk said last month it could sign up for.

SOLAR

France’s Engie to bid on renewables projects in MENA

France’s Engie makes another big GCC solar play: France’s utility company Engie plans to bid on the 1.5 GW Al Ajban solar project in Abu Dhabi, Engie’s country manager for GCC and Pakistan, Frederic Claux, told The National on the sidelines of the World Green Economy Summit in Dubai last week. Emirates Water and Electricity Company (EWEC) put the project up for bidding last May.

Engie also wants to bid on a renewables project in Saudi Arabia, Claux told the newspaper without naming the project.

If recent transactions are anything to go by, MENA is a big market for Engie: Engie owns 20% of the Mirfa International Power and Water Plant (Mirfa IWPP) in the UAE, which secured AED 4 bn (USD 1 bn) in refinancing last month. In Saudi Arabia, Engie is part of a consortium building the solar-powered Jubail 3B Independent Water Project (IWP) for Saudi Water Partnership Company (SWPC), which kicked off construction in May. Last year, Engie was part of a consortium that will develop, construct and operate a 500 MW wind farm in Ras Ghareb in Egypt.

ALSO IN GCC SOLAR NEWS-

SMART POLICY- Bahrain is planning on building a 100 MW solar farm on the site of an old landfill. Bahrain’s Electricity and Water Authority (EWA) issued a tender to cleanup and ready the landfill site at Askar in the kingdom’s Southern Governorate for the power plant, EWA published on its tender board last week. The tender includes designing and constructing a landfill gas extraction and treatment system, as well as designing a drainage system

The deadline for sending in proposals is November 14.

SYRIA IS GETTING A 100 MW SOLAR PLANT, BUT THAT WON’T BE THE NORM-

Syria launched the first phase of a 100 MW solar energy plant in Adra, the country’s prime minister’s office announced last week. The plant, which will be built under a public private partnership (PPP), currently has 10 MW installed capacity connected to the grid.

Al Asad weighs in on the great debate: Renewable energy is not intended to replace traditional energy sources in Syria, but rather to supplement traditional energy sources, which currently fall short of providing coverage in the country, which has suffered from a 12-year-long civil war, Syrian president Bashar Al Asad told The Syrian News Channel and Al Ekhbariya on the inauguration of the first phase (watch, runtime: 7:56).

ELECTRIC VEHICLES

Stellantis and Siemens partner up to accelerate MENA delivery ecosphere’s transition to EVs

Stellantis and Siemens are working to upscale EV last mile delivery infrastructure in MENA: Netherlands-headquartered automotive company Stellantis inked an MoU with Siemens to work together on the electric vehicle (EV) infrastructure needed for delivery services in MENA, a Stellantis statement said last Thursday.

Who’s doing what: The agreement will see Stellantis provide electric delivery vehicles and “EV charging technologies,” the statement read. Meanwhile, Siemens will work on developing EV tech, including software that caters to the needs of EV consumers in the region, and EV- related retail logistics solutions for electric vehicles customers in the region, including last mile delivery services.

Greenifying delivery fleets in MENA seems to be on the rise: Talabat UAE, for instance, inked an MoU in July with Emirati mobility solutions company Motoboy to trial EVs for last-mile delivery services in Dubai, according to a company statement. UAE EV manufacturer Barq EV also introduced EVs designed specifically to cater to delivery needs in the MENA region, the National reported in March.

Want to go deeper on green last mile delivery? You need to meet Shift EV’s Aly El Tayeb.

ON YOUR WAY OUT

Catching the bad guys — sustainably: The Dubai Police General Command (DPGC) added the first electric vehicle to its luxury patrol fleet, WAM said yesterday. The first EV that made its way into the DPGC’s fleet is the Chinese-manufactured Hongqi E-HS9. The sports utility vehicle accelerates from 0 to 100 km/h in five seconds (for those high speed chases). Its battery can be fully charged in 6-8 hours, and the car can travel almost 440 km on one full charge.

CALENDAR

OCTOBER

4-5 October (Tuesday- Wednesday): Green Energy Africa, Cape Town International Convention Centre 2, South Africa.

16-21 October (Sunday-Friday): Arab Conference of Plant Protection, Le Royal Hotel, Hammamet, Tunisia.

24-26 October (Monday-Wednesday): International Exhibition of Renewable Energies Clean Energies and Sustainable Development, Centre Des Conventions Mohammed Ben Ahmed, Oran, Algeria.

24-28 October (Monday-Friday): Arab Sustainability Week, virtual event. Register.

31 October (Monday): Deadline for proposals for Jordan’s USD 2 bn Aqaba-Amman desalination project.

31 October-3 November (Monday-Thursday): Egypt Energy Exhibition and Congress, Egypt International Exhibition Center, Cairo, Egypt. Register here.

Approval of EU draft document pushing countries participating in COP27 to to improve their climate change targets.

NOVEMBER

Sustainability Forum Middle East is taking place in Bahrain.

Nigeria hopes to secure USD 10 bn support package for green energy transition before COP27.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

23-24 November (Wednesday-Thursday): Global Conference on Sustainable Partnerships, The Ritz-Carlton, Riyadh, Saudi Arabia.

Deadline of bid submissions for the Ras Mohaisen – Baha – Makkah Independent Water Transmission Pipeline in Saudi Arabia.

COP27 sub-events:

Terra Carta Action Forum (2 days) organized by the Prince of Wales’ Sustainable Markets Initiative.

UNFCCC’s capacity building hub.

DECEMBER

13-15 December (Tuesday-Thursday): International Renewable Energy Congress, Hammamet, Tunisia.

15 December (Thursday) The UN’s 15th meeting of the Conference of the Parties to the Convention on Biological Diversity (COP15), Montreal, Canada.

JANUARY 2023

14-21 January (Saturday-Saturday): Abu Dhabi Sustainability Week takes place in the UAE.

16-18 January (Monday-Wednesday): EcoWASTE, Abu Dhabi National Exhibition Center (ADNEC), UAE.

FEBRUARY 2023

6-8 February (Monday-Wednesday): Saudi International Marine Exhibition and Conference, Hilton Riyadh, Saudi Arabia.

The second edition of The Arab Green Summit (TAGS), Dubai, UAE

MARCH 2023

15-19 March (Wednesday-Sunday): Qatar International Agricultural and Environmental Exhibition, Doha, Qatar.

JUNE 2023

1-3 June (Thursday-Saturday): Envirotec and Energie Expo, UTICA, Tunis, Tunisia.

SEPTEMBER 2023

Chariot Limited and Total Eren’s feasibility study on a 10 GW green hydrogen plant in Mauritania to be completed.

NOVEMBER 2023

6-17 November (Monday-Friday): The UAE will host COP28.

EVENTS WITH NO SET DATE

End-2022

KSA’s Neom wants to tender three concrete water reservoir projects to up its water storage capacity by 6 mn liters.

2023

Early 2023: Egypt’s KarmSolar to launch KarmCharge, the company’s EV charging venture.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

2024

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

First 1.5 GW phase of Morocco’s Xlinks solar and wind energy project to be operational.

2025

Second 1.5 GW phase of Morocco’s Xlinks solar and wind energy project to be operational.

UAE to have over 1k EV charging stations installed.

2026

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

Iraq’s Mass Group Holding wants to invest EUR 1 bn on its thermal plant Mintia in Romania to have 62% of run on renewable energy, while expanding its energy capacity to at least 1.29k MWh.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.