- South Korea’s Doosan Enerbility will build a USD 378 mn cogeneration plant in Saudi Arabia. (Investment Watch)

- Oman’s OQ Group wants to sell a stake in its 100 MW Liwa solar plant. (Renewables)

- Emirates Steel Arkan and Japanese partners want to “greenify” the UAE steel industry. (Decarbonization)

- Saudi Arabia’s vast mineral reserves could help lower costs for renewables — if only it had better access to water and logistics. (Macro Picture)

- Most of the world did not deliver on its COP26 promises — and that includes MENA. (What We’re Tracking Today)

- Saudi Arabia is providing USD 10 mn in funding to help avoid the risk of a “catastrophic” oil spill in the Red Sea. (What We’re Tracking Today)

- UAE developer Aldar moves forward with decarbonisation as it looks to slash utility consumption. (Also on our Radar)

- Using trash: A Moroccan NGO’s is trying to turn waste into useful products. (On Your Way Out)

Tuesday, 27 September 2022

Lots of climate investment news out of GCC

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people. If you’re working in one corner of the MENA renewables industry, are you getting ready to attend one of the many events happening today?

THE BIG CLIMATE STORY- The region’s awash in climate investment: Saudi Arabia will be building a USD 378 mn cogeneration plant in partnership with South Korean companies. Oman’s OQ Group has received some interest from equity investors to buy a stake in the 100 MW Liwa solar plant, and Emirates Steel Arkan is partnering with Japanese companies to “greenify” the UAE’s steel industry. We have chapter and verse on these stories and more in the news well below.

KUDOS- KSA is kicking in c. USD 10 mn in funding in a bid to prevent a a catastrophic oil spill in the Red Sea. The problem: a now-decrepit oil tanker named the FSO Safer that Yemen’s government had been using to store oil. KSrelief chief Abdullah Al Rabiah signed an MoU agreeing on the funding on Saturday on the sidelines of the UN General Assembly, the agency noted in a Sunday statement. The UN has been seeking USD 75 mn in funding to get phase one of the tanker salvage operation off the ground, in a bid to avoid a >USD 20 bn cleanup operation, we noted last week.

THE BIG CLIMATE STORY OUTSIDE THE REGION- The UK’s opposition Labour party is pulling no punches in its criticism of current government climate action — with vows to do better. UK shadow chancellor Rachel Re{eves yesterday pledged that a Labour government would spend GBP 8 bn (some USD 8.5 bn) co-investing in green projects with private companies in a speech at the party’s annual conference in Liverpool, the Guardian reports. Reeves criticized the plan by new UK Prime Minister Liz Truss to lift a three-year ban on fracking in England — one of several energy supply reforms aimed at securing energy independence amid fallout from the Russia-Ukraine war. “With Labour, [fracking] will not happen,” said Reeves. (Reuters | Independent | Financial Times)

This comes as the UK government announced that it’s launching an independent review into how it can deliver on its commitment to reach net zero by 2050. The review will focus on maximizing economic growth while increasing energy security and affordability, the government announced in a statement yesterday. It will be submitted to the government by the end of the year.

SOUND PLUGGED IN- The GBP hit an all-time low yesterday against the greenback. The news is all over UK media as well as the global financial press.

|

***

YOU’RE READING ENTERPRISE CLIMATE, the essential regional publication for senior execs who care about the world’s most important industry. Enterprise Climate covers everything from finance and tech to regulation, products and policy across the Middle East and North Africa. In a nod to the growing geographical ambitions of companies in our corner of the world, we also include an overview of the big trends and data points in nearby countries, including Africa and southern Europe.

Enterprise Climate is published at 4am CLT / 5am Riyadh / 6am UAE Monday through Thursday by Enterprise, the folks who bring you Enterprise Egypt, your essential 6am and 3pm read on business, finance, policy and economy in Egypt and emerging markets.

Subscribe to Enterprise Climate here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

THE COUNTDOWN TO COP-

Most of the world did not deliver on COP26 climate action targets (CAT) — even at the most basic level, the independent CAT Climate Target Update Tracker revealed yesterday. Countries had a deadline of last Friday to turn their plans to slash greenhouse gas emissions (called “nationally determined contributions,” or NDCs) to the UN Framework Convention on Climate Change (UNFCCC). With less than 39 days before COP27, only 19 of the 193 countries that promised more ambitious targets in Glasgow last year submitted NDCs at all.

The MENA region was not among them, with the tracker showcasing a naughty list of countries that failed their targets. Some notable mentions: Egypt got a “highly insufficient” rating for not setting specific targets — and for making its goal contingent on foreign support. Tunisia’s NDCs do not fall within the scope of CAT and were therefore not assessed, while the UAE’s NDC analysis is still pending.

SMART POLICY? By making goals contingent on foreign support, Egypt is drawing a line under COP27 czar Mahmoud Mohieldin’s point that emerging markets did not cause the climate crisis — but are now being asked to pay to fix it after advanced economies have reaped the benefits of having nuked the environment for centuries. You can read more about Mohieldin’s views in our two-part interview here and here.

What’s this “CAT” and and who put them in charge? To answer your last question first: Nobody. But they’re still worth a look. CAT bills itself as an independent scientific watchdog that claims to track “all the biggest emitters and a representative sample of smaller emitters covering about 85% of global emissions and approximately 70% of global population.” It is backed by a bunch of nonprofits that you can read more about here.

HAPPENING TODAY- We have a number of two-day events that are kicking off today:

Our friends at HSBC are hosting an energy transition webinar series today, which will run until Thursday. The series will look at the “latest climate analysis in relation to the global energy market and transition to net zero” in six different sessions covering energy security, what is required to ensure the success of COP27, financing and investment needs for the energy transition, and the scaling up of renewables in the region, among other topics. You can register for the series here.

WANT MORE on the region’s energy transition? Catch this op-ed in EnterpriseAM by HSBC’s Group Head, Center of Sustainable Finance and Head of Climate Change Middle East, North Africa and Turkey, Zoe Knight, on the capital that’s needed to help drive that shift.

The Wetex and Dubai solar show will also kick off today at the Dubai World Trade Center (DWTC). One thing to look out for during the event is Dubai-based water conservation solutions company Dake Rechsand, which will be discussing ‘Sponge City technology’ at the two-day event.

SOUND SMART- What exactly are sponge cities? Sponge cities are basically urban areas with lots of parks, lakes and other natural landscapes that can absorb excess water from flash floods. For cities lacking these natural barriers, developing man-made landscapes could be a solution, such as building underground reservoirs and sand barriers, as we previously explained.

The two-day Africa-France Forum for Ecological and Energy Transition starts today and will run through Thursday at the Four Seasons Hotel in Gammarth, Tunis, Tunisia. The gathering will see representatives from MENA countries, including Tunisia, Algeria, Egypt and Libya, showcase the environmental challenges in their respective countries and will spotlight the renewable energy solutions they plan to use to solve these challenges, the French Embassy in Tunisia says. Organizers include the French Agency for the Environment and Energy Management (ADEME) and Business France with support from Schneider Electric.

ALSO TODAY (and also in Tunis)- The European Bank for Reconstruction and Development’s (EBRD) BoD will arrive to meet with members of cabinet to “gain first-hand experience of the country’s economic and political development,” according to an EBRD statement. Renewables and the green transition are key to the EBRD’s regional strategy, EBRD President Odile Renaud told Enterprise last year. Earlier this month, the EBRD earmarked over USD 1 bn for the Egyptian government’s Nexus on Water, Food and Energy (NWFE) program. It stands to reason that discussions in Tunisia would involve some talk on climate funding.

HAPPENING THIS WEEK-

Conference season is ramping up to a fever pitch. Among the regional climate events taking place this week:

- Dubai will host the World Green Economy Summit on 28-29 September. (Register).

- Fitch Solutions is hosting a webinar on Saudi Arabia’s energy transformation next Thursday, 29 September. (Register).

- The Global Manufacturing and Industrialisation Summit (GMIS) will be taking place from 28-30 September in Pittsburgh, US. The event is co-chaired by the UAE’s Industry and Advanced Technology Ministry and the United Nations Industrial Development Organisation, and will see the participation of Sanad, ICT Fund, Etihad Rail and Emirates Global Aluminum (EGA). (Register).

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

INVESTMENT WATCH

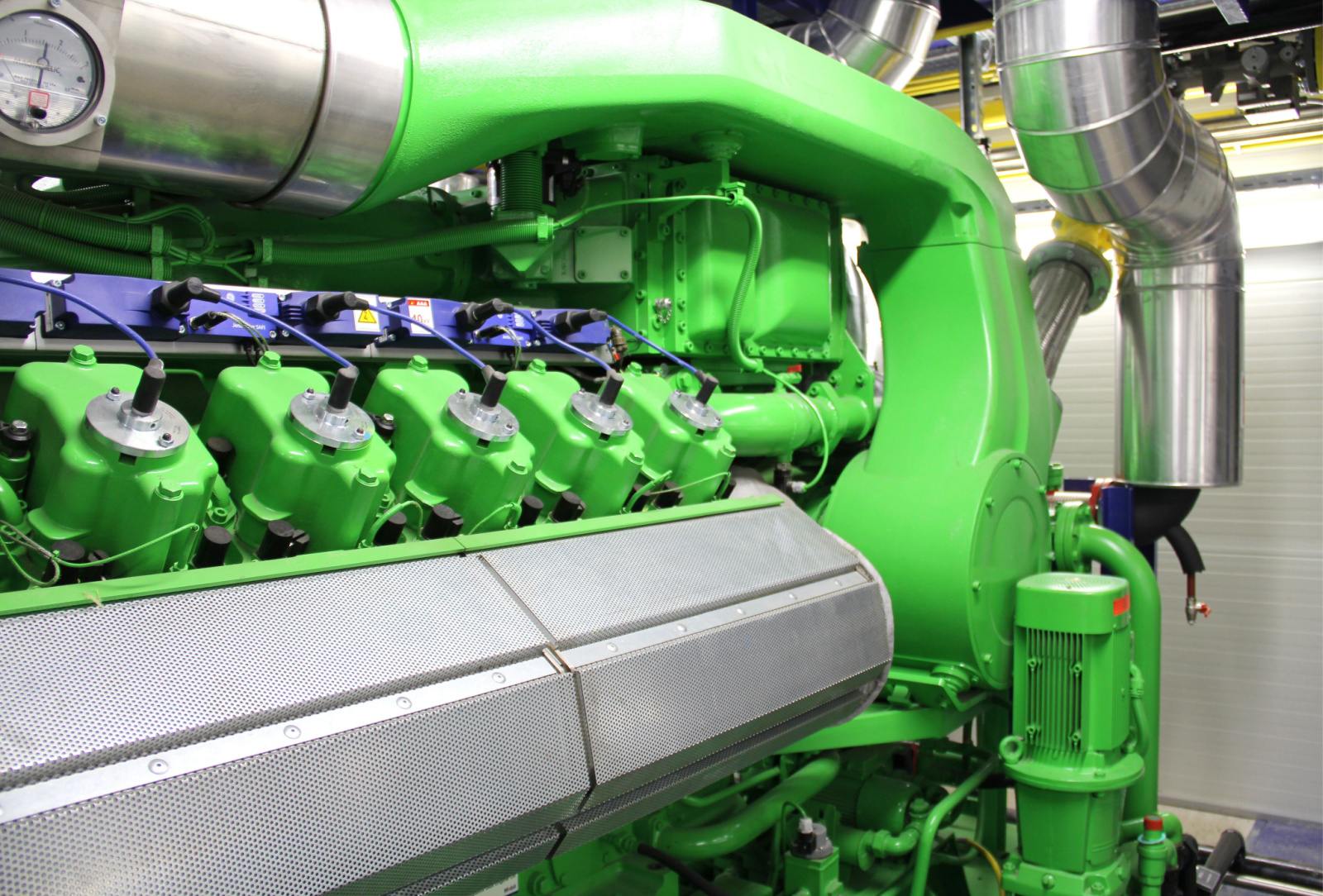

Saudi Arabia will get a 310 MW cogeneration plant in 2025

Doosan Enerbility will build a USD 378 mn cogeneration plant in Saudi Arabia under an agreement with Korea Electric Power Corporation (Kepco). The plant will be in KSA’s Jafurah, east of Riyadh, Doosan said in a press release. The 320 MW plant will be completed in 1H2025 and is expected to produce electricity and 314 tons of steam per hour to power and heat the Jafurah gas field.

SOUND SMART- What is a cogeneration plant? The plant traps waste heat from industrial processes and reuses it to generate electricity for something else. Trying to reduce the carbon footprint of fossil fuel production (not its use, but of the process of pulling fossil fuels out of the ground) is increasingly a “thing” as we noted yesterday, when we covered a pact that will see Adnoc and Taqa work together in the UAE to curb the carbon footprint of Adnoc’s offshore production infrastructure.

There is already a cogeneration plant in MENA’s pipeline: Abu Dhabi National Energy Company (Taqa) partnered with Japanese trading company Marubeni Corporation to develop a greenfield industrial steam, water and electric cogeneration plant and seawater desalination plant in September last year.

Who’s doing what: “As the project developer, Kepco will oversee the project development and operation, while Doosan in its role as EPC contractor will handle the overall process starting from design to the equipment supply, installation and plant commissioning,” the statement said.

This is the third project that Doosan Enerbility was awarded in Saudi Arabia this year. In August, the company signed a USD 587 mn desalination plant construction contract, and in February, it was awarded a USD 699 mn contract for the construction of a casting and forging facility in the kingdom.

RENEWABLES

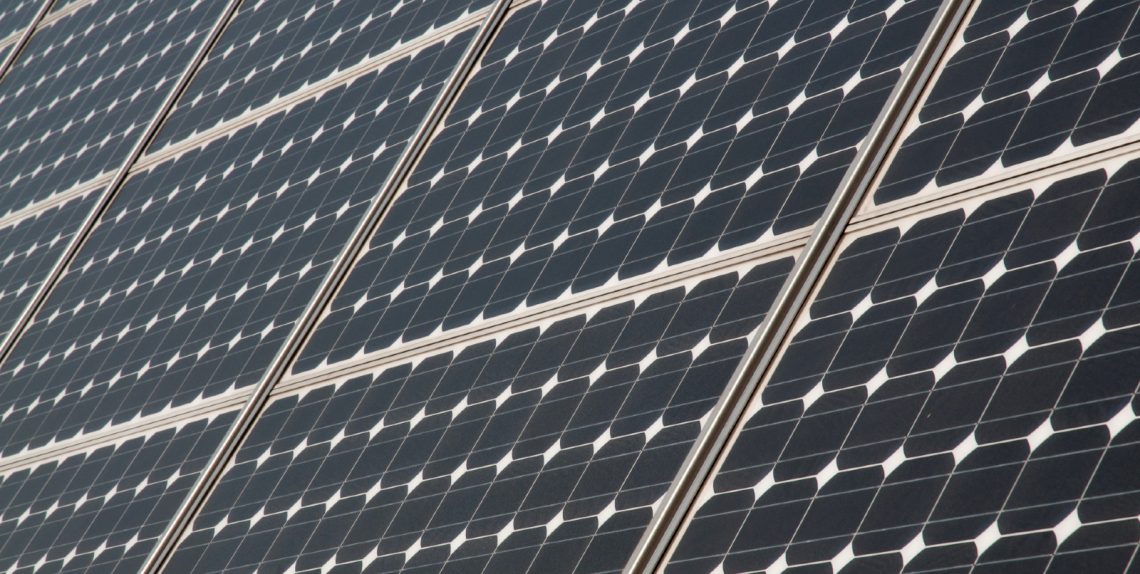

Oman’s Liwa solar project gains equity investor interest

OQ Group wants to sell a stake in 100-MW solar plant: Omani energy company OQ Group plans to sell an equity stake in its planned 100-MW Liwa solar project, the company said in its 2021 Sustainability Report (pdf) published Sunday. While the company has not disclosed an estimated price tag for the sale, the potential transaction has garnered interest from investors, the report notes. The OQ Group will settle on an investor and a price by 2023.

Expect bidding to start later this year: The tender for the engineering, procurement and construction (EPC) contract is being prepared and will likely go live before the end of the year, the report said. OQ Group’s Block 60 Bisat solar power plant, which is powered by a combination of solar panels and traditional electricity grid power, is expected to launch in 2022.

OTHER RENEWABLES NEWS-

- Bahrain-based utility company Pavilion Group signed a power purchase agreement with MTQ, the Singapore-based oilfield engineering firm, that will see Pavilion produce some 19.9 GWh of electricity from renewable sources to power MTQ’s oil rigs in Bahrain. (Statement)

- Abdul Latif Jameel Energy’s Fotowatio Renewable Ventures (FRV) reached financial close on a EUR 81 mn, 123 MWp PV plant in Spain. Mitsubishi UFJ Financial Group, Dutch ING and Santander Corporate and Investment Banking are providing finance. A power purchase agreement for the plant’s output is in place; FRV expects the first component of the planet will be operational by 2023. (Statement)

DECARBONIZATION

Emirates Steel Arkan and Japanese partners are trying to “greenify” the steel industry

Is the UAE getting “greener” steel? ADX-listed Emirates Steel Arkan plans to partner with two Japanese companies to conduct feasibility studies for an iron ore processing facility in Abu Dhabi, according to a statement carried by state news agency WAM. Emirates Steel Arkan, Japanese trading and investment company Itochu Corporation and Japanese steel manufacturing firm JFE Steel Corporation’s plant is expected to begin production in 2H 2025, the statement says. No information has been disclosed on the scale of investment in the project.

SOUND SMART- What makes this project “green”? Presumably because it’s using less coal: The plan is to import high-grade iron ore — which is purer and lower in emissions than other kinds of iron ore, and seen as an essential part of lower-emissions steelmaking. The iron ore reduction process — where metallic iron is produced — would initially be done using natural gas, in what the statement terms “an enhanced decarbonized process.” “The project also makes provisions for the adoption of renewable energy power sources, as well as green hydrogen for the reduction process,” the statement adds.

Steel is one of the world’s dirtiest industries: The iron and steel sector is the largest industrial producer of CO2, other than industries involved in power generation, and accounts for some 7-9% of all direct fossil fuel emissions.

And Emirates Steel Arkan is a major producer: Emirates Steel Arkan is the UAE's largest steel and building materials manufacturer and has a total steel production capacity of 3.5 mn tons a year.

THE MACRO PICTURE

Could KSA hold the keys to lowering greentech costs?

KSA’s USD 1.3 tn mineral reserves could help lower costs for renewables — but can they be accessed? Saudi Arabia is looking to unlock an estimated USD 1.3 tn in mineral reserves, the Kingdom’s industry and mineral resources minister, Bandar Al Khorayef, told Bloomberg. the issue is that the kingdom lacks a ready supply of water, which is key for mining, as well as the road, railway and port infrastructure required to transport resources from mines in the north to the east of the country, where reserves will be processed and shipped.

These minerals are crucial for the green transition: Take Copper, which is used in everything from consumer electronics to home appliances, is key to powering renewable energy systems, including solar, hydro, thermal and wind, making it key to the energy transition. Experts have warned of a looming copper shortage, even as prices dipped earlier this month.

Tenders for mineral extraction are underway, but bidders may be hard to come by: The kingdom is looking to attract global mining companies that have the expertise and financing to compete in auctions for exploration rights, partly by accelerating permit processing to 30 days, Al Khorayef told the business information service. Earlier this month, the country awarded a mining license to British mining company Moxico Resources and Saudi Arabia’s Ajlan and Bros. The mine’s estimated copper reserves are worth USD 222 bn, at current prices “equal to 1.4x the global mine supply in 2021”, it adds. A second and third tender may be in the cards, the minister stated.

SMART POLICY- Saudi Arabia will invest SAR 105 bn to make its water industry more efficient: Over the next two years, the Environment, Water and Agriculture Ministry will invest the equivalent of USD 28 bn to secure sustainable water supply and grow its desalination capacity, the minister was quoted as saying in a statement published on Thursday.

And private sector collaboration is on the table: The ministry is bringing the private sector on board with the aim of increasing water resources, boosting the efficiency and capacity of water treatment plants and reducing overall waste in the country’s water networks, he said. Overall goals include securing high quality drinking water for all citizens, protecting the environment, connecting all homes to sewage networks and using treated water as efficiently as possible. Some 22 agreements have already been signed with companies to treat and distribute water, he said, without specifying when.

MOVES

ALSO ON OUR RADAR

Aldar moves forward with decarbonisation

Aldar Properties is moving ahead with energy retrofit projects to reduce utility consumption by USD 12 mn, the company said in a statement yesterday. The Abu Dhabi-based developer is aiming to make 13 of its residential communities more energy efficient and reduce electricity consumption by 29% per annum, equivalent to 45 GWh. The project will be managed by UAE’s energy project management company Grfn and carried out by Siemens.

ON YOUR WAY OUT

Before you bin it, think twice — there may be use in it: Koun, a Moroccan NGO, is creatively transforming tonnes of discarded waste — including plastic products, paper and cardboard — into chairs, bags and a plethora of other products, Africa News writes. Aside from collecting waste dumped in the sea and streets of Morocco, Koun also collects and recycles waste produced by five Moroccan companies, ultimately recycling between 100-200 kg of refuse per day. The NGO says that single use plastics make up 60% of the waste they collect on any given day.

CALENDAR

SEPTEMBER

27-29 September (Tuesday-Thursday): Wetex and Dubai Solar Show, UAE.

28-29 September (Wednesday-Thursday): World Green Economy Summit (WGES), UAE.

28-29 September (Wednesday- Thursday): Saudi Maritime Congress, Dhahran Expo, Dammam, Saudi Arabia.

28-30 September (Wednesday-Friday): Ethio Weetex- Water, Energy, Electricity, Renewable (Solar, Wind) Energy, Technology Exhibition, Millennium Hall, Addis Ababa, Ethiopia.

OCTOBER

4-5 October (Tuesday- Wednesday): Green Energy Africa, Cape Town International Convention Centre 2, South Africa.

16-21 October (Sunday-Friday): Arab Conference of Plant Protection, Le Royal Hotel, Hammamet, Tunisia.

24-26 October (Monday-Wednesday): International Exhibition of Renewable Energies Clean Energies and Sustainable Development, Centre Des Conventions Mohammed Ben Ahmed, Oran, Algeria.

31 October (Monday): Deadline for proposals for Jordan’s USD 2 bn Aqaba-Amman desalination project.

Approval of EU draft document pushing countries participating in COP27 to to improve their climate change targets.

NOVEMBER

Sustainability Forum Middle East is taking place in Bahrain.

Nigeria hopes to secure USD 10 bn support package for green energy transition before COP27.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

23-24 November (Wednesday-Thursday): Global Conference on Sustainable Partnerships, The Ritz-Carlton, Riyadh, Saudi Arabia.

Deadline of bid submissions for the Ras Mohaisen – Baha – Makkah Independent Water Transmission Pipeline in Saudi Arabia.

COP27 sub-events:

Terra Carta Action Forum (2 days) organized by the Prince of Wales’ Sustainable Markets Initiative.

UNFCCC’s capacity building hub.

DECEMBER

13-15 December (Tuesday-Thursday): International Renewable Energy Congress, Hammamet, Tunisia.

15 December (Thursday) The UN’s 15th meeting of the Conference of the Parties to the Convention on Biological Diversity (COP15), Montreal, Canada.

JANUARY 2023

14-21 January (Saturday-Saturday): Abu Dhabi Sustainability Week takes place in the UAE.

16-18 January (Monday-Wednesday): EcoWASTE, Abu Dhabi National Exhibition Center (ADNEC), UAE.

FEBRUARY 2023

6-8 February (Monday-Wednesday): Saudi International Marine Exhibition and Conference, Hilton Riyadh, Saudi Arabia.

The second edition of The Arab Green Summit (TAGS), Dubai, UAE

MARCH 2023

15-19 March (Wednesday-Sunday): Qatar International Agricultural and Environmental Exhibition, Doha, Qatar.

JUNE 2023

1-3 June (Thursday-Saturday): Envirotec and Energie Expo, UTICA, Tunis, Tunisia.

SEPTEMBER 2023

Chariot Limited and Total Eren’s feasibility study on a 10 GW green hydrogen plant in Mauritania to be completed.

NOVEMBER 2023

6-17 November (Monday-Friday): The UAE will host COP28.

EVENTS WITH NO SET DATE

End-2022

KSA’s Neom wants to tender three concrete water reservoir projects to up its water storage capacity by 6 mn liters.

2023

Early 2023: Egypt’s KarmSolar to launch KarmCharge, the company’s EV charging venture.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

2024

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

First 1.5 GW phase of Morocco’s Xlinks solar and wind energy project to be operational.

2025

Second 1.5 GW phase of Morocco’s Xlinks solar and wind energy project to be operational.

UAE to have over 1k EV charging stations installed.

2026

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

Iraq’s Mass Group Holding wants to invest EUR 1 bn on its thermal plant Mintia in Romania to have 62% of run on renewable energy, while expanding its energy capacity to at least 1.29k MWh.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.