- Veolia-led consortium reaches financial close on two hazardous industrial waste treatment plants in the UAE. (Waste Management)

- Morocco’s Gaia Future Energy and Spain’s HyDeal partner to form green hydrogen transport JV. (Green Hydrogen)

- Cepsa inks agreement to strengthen green hydrogen maritime corridor in Europe. (Green Hydrogen)

- The UAE reveal new policy to regulate its energy market to reduce consumption and increase efficiency. (Regulation Watch)

- Saudi companies bid big at RVCMC’s 2 mn carbon credit auction in Kenya. (Carbon Markets)

- Jordan is drafting a national strategy for hydrogen for a competitive edge in the green fuel market. (What We’re Tracking Today)

- Will the EU approve an escape clause to its landmark renewable energy law? (What We’re Tracking Today)

Thursday, 15 June 2023

Veolia-led consortium reaches financial close on two hazardous industrial waste treatment plants in the UAE

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, ladies and gents. We’re rolling into the weekend with a packed issue full of climate updates from all over the region. Let’s dive right in.

THE BIG CLIMATE STORY- A consortium comprising French waste and water management company Veolia, Abu Dhabi sovereign wealth fund ADQ, and Saudi investment powerhorse Vision Invest has reached financial close for the acquisition of two hazardous industrial waste treatments plants in the UAE.

^^ We have the details on this story and much more in the news well, below.

THE BIG CLIMATE STORY OUTSIDE THE REGION- Pakistan, India brace for Biparjoy cyclone: Roads along areas on India’s western coast are forecast to be flooded, with damage expected for houses and crops when the “extremely severe” Biparjoy cyclone hits later today, the Indian Meteorological Department (IMD) said yesterday. The storm is currently situated in the Arabian Sea approximately 280 km from Gujarat’s Jakhau Port and 340 km away from Pakistan’s Karachi, IMD said. Gujarat has already been seeing an increased intensity of rainfall and wind speed, with heavy rainfall expected in some areas today, according to an IMD official. “The cyclone would create tidal waves of 2 to 3 meters and at the same there would be heavy rainfall. This will cause flooding in low-lying areas,” the official said.

While currently not under immediate threat, emergency measures have been taken in the 20 mn strong Karachi to face winds and rain accompanying the cyclone, Pakistan’s Climate Change Minister Sherry Rehman said. Concerns over Biparjoy’s repercussions come as tens of thousands residing in coastal areas and high risk districts in the two countries have been evacuated in the past days. This year’s first severe cyclone for the two countries comes as the region continues to see climate-driven extreme weather conditions.

The story grabbed headlines in the international press: Reuters | Bloomberg | The Associated Press | CNN | The Washington Post | BBC | France 24 | The Independent

ICYMI- Enterprise Logistics took a deep dive into the growth of sustainable aviation fuels in the aviation sector, the promise these alternative fuels hold, and what needs to be done to accelerate their adoption.

The Enterprise Finance Forum is our flagship gathering — the one so many of you have been waiting for. The two-day event takes place this September and will be the latest in our must-attend series of invitation-only, C-suite-level gatherings. Stay tuned for more information on the location.

TAP OR CLICK HERE if you want to express interest in attending. We’ll be sending out the first batch of invitations just after the 30 June holiday.

Do you want to become a commercial partner? Email mtaalab@enterpriseadvisory.com.

STAY TUNED for more detail about our exciting agenda in the weeks to come.

ENTERPRISE IS LOOKING FOR SMART, TALENTED PEOPLE of all backgrounds to help us build some very cool new things. Enterprise — the essential morning read on all the important news shaping business and the economy in Egypt and the region — is looking for writers, reporters and editors to help us build out new publications. Today, we run four daily Egypt and MENA-focused publications, five weekly industry verticals, and a weekend lifestyle edition designed to make our readers feel just a bit smarter.

We have tons more in the pipeline — come help us build new publications. We offer the chance to work in a fast-paced newsroom on a broad range of topics and in a variety of formats. Our goal is simple: To create value for our growing community of >250k daily readers by telling stories that matter.

Journalists looking to explore business, finance and economic stories are welcome. So are recent journalism school graduates.

That said, we're looking for gifted story-tellers from all walks of life and across all professions, as long as they show a keen interest in learning to write about the stories, topics, businesses, and figures moving markets. Egyptian and foreign nationals alike are welcome to apply. So are job-switchers: If you’re an equities analyst tired of the rat race, we’re a great place to come work.

NEVER WORKED IN A NEWSROOM BEFORE? We have the Enterprise Business Writing Development Program. Whether you are a recent graduate, an industry vet, or looking to switch careers, the Enterprise Business Writing Development Program will give you the tools you need to tell the most important stories to our audience of C-suite officials, government ministers, diplomats, financiers, investors and entrepreneurs.

During the program you will learn:

- The key news stories and trends shaping business and the economy in Egypt and the region, across various sectors;

- Business and finance for non-finance people: Whether it's industry jargon or key concepts or simply how to read a balance sheet;

- How to construct an Enterprise story: From idea formulation down to the structure, style and tone of writing;

- How to develop sources that will give you the key insights needed to tell a complete story;

- How to communicate these stories with the confidence and language of an insider.

Not an internship program — a career: The three-month program will see full-time, paid participants take part in workshops and lectures from veteran business journalists, while also working on and filing stories that will run on any of our publications. Those who have successfully completed the program, will then be given long-term job offers.

Apply directly to jobs@enterprisemea.com and mention “writing development program” in your subject line.

SOUNDBITE OF THE WEEK- “If we do not adopt the agenda [during the conference], all the work that we are doing goes to waste,” UN Subsidiary Body for Implementation Chair Nabeel Munir said during an open session of the Bonn Climate Change Conference. Munir pleaded for heads of departments present at the event to not let the hours of negotiations go to waste, telling the audience to “wake up … what is happening around you is unbelievable. I come from a country where it happened last year. 33 mn people impacted. A third of [Pakistan] underwater. And I go back to tell my people that I have been fighting for an agenda for two or three weeks?” Munir asked.

Essential preparations for COP28: Although months of discussions have been taking place since COP27 in Egypt, no agreement has been reached on adopting the agendas proposed by the COP permanent subsidiary bodies for the Bonn conference. While the non-adoption of an agenda is “not uncommon in a party driven process,” making as much progress as possible during Bonn is crucial, since the conference will set the technical groundwork for the political decisions required at COP28, said Executive Secretary of the UN Framework Convention on Climate Change Simon Stiell. The conference is set to close today with no agenda in sight as we publish this morning’s edition.

WATCH THIS SPACE #1- Jordan is drafting a national strategy for hydrogen: Jordan’s Energy Ministry is currently working on developing a hydrogen strategy in a bid to turn the kingdom into a competitive hub for low-carbon hydrogen production, The Jordan Times reports. “The strategy will lay out a comprehensive regulatory framework that encompasses the entire hydrogen value chain, from production and supply to infrastructure development,” Director of Awraq Organization for Environmental Development Zeina Hamdan said. The strategy would also pave the way to attract investments for sustainable growth in the sector, Hamdan added. The ministry is currently holding workshops where the outcomes of the discussions will be used as the foundation for the hydrogen framework.

REMEMBER- Jordan is joining a list of countries in the region that have been working towards launching their own national hydrogen strategies. To date, Oman is the only country to have released its strategy, while Morocco and the UAE have released a hydrogen roadmap. In 2022, Saudi Arabia was developing a national hydrogen strategy, outlining its production, export and domestic uses, and Egypt is expected to announce its hydrogen strategy soon. As of March, a total of 68 low-carbon hydrogen preliminary agreements have been signed, but are now awaiting the launch of the strategies to secure financing and move forward with the plans.

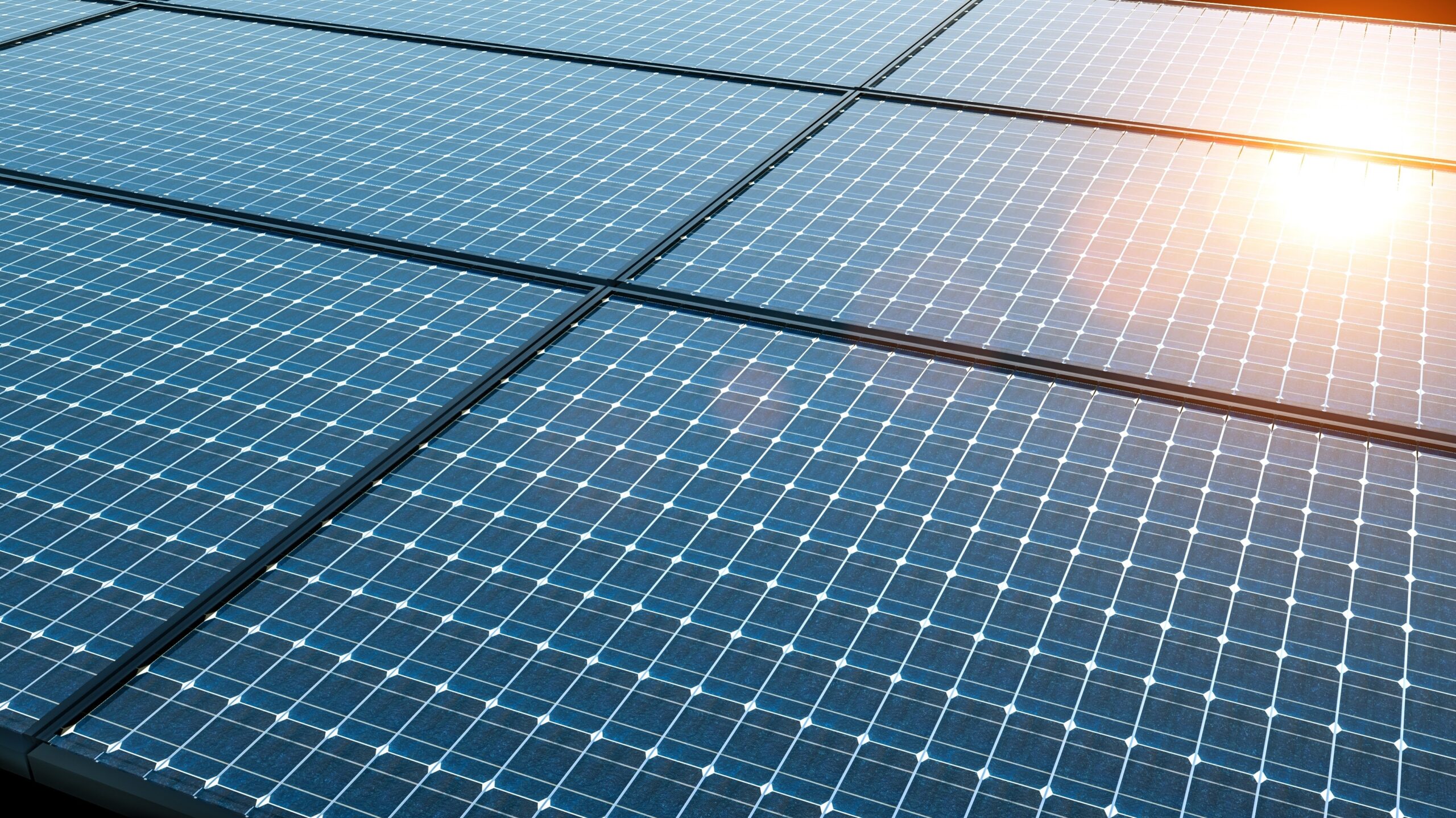

WATCH THIS SPACE #2- Morocco is planning to produce 10.5 GW of clean energy by 2027, the country’s Director of Renewable Energies Mohamed Hamid told Asharq Business. The country — which invests some MAD 10 bn (c. USD 991 mn) annually in renewables projects — has a current generation capacity of 4 GW and wants to have renewables account for 50% of its energy mix by 2030, Hamid added.

WATCH THIS SPACE #3- EU divided on ammonia opt-out in renewable energy law: EU countries are divided on whether they will add an escape clause to its landmark renewable energy law that would allow nuclear power to be used in ammonia production, diplomats told Reuters. The move comes after a group of nations, led by France, demanded a more agreeable position for zero-carbon nuclear energy and an opt-out for ammonia plants not capable of making the switch from gas. The bloc’s ambassadors discussed a proposal that would provide exemptions from some ammonia plants from the targets, giving them the green light to switch to fuels made using nuclear energy instead, the sources told Reuters. The floated amendments have sparked a dispute between France and Germany, with Germany opposing the changes, according to Bloomberg. Countries will meet again tomorrow to consider the proposal, yet some have already voiced concerns about amending the text of the renewable energy law, which was agreed upon by the EU countries and lawmakers this year and was supposed to be final.

Is it likely to pass with a loophole? The EU Parliament’s lead negotiator Markus Pierper said lawmakers did not want to reopen the landmark agreement, which means the escape clause may not pass even if countries voiced their support, according to Reuters.

WATCH THIS SPACE #4- EU deforestation law risks shareholder exit: Shareholders may pull their money from firms that are likely to be impacted by the EU’s new law that bars consumer goods from the EU market if they are linked to deforestation, Reuters reports. Lawmakers expect the law to be implemented by the end of 2024 for “big operators.” The law will also affect other sectors that import goods associated with deforestation — including commodities houses and industrial companies. EU consumption represents some 10% of global deforestation, Reuters said, citing the European Parliament. Some of the companies expected to be impacted by the new law include consumer goods giants Nestle, Unilever, P&G, and Schroders.

REMEMBER- In December, the European Commission sealed a provisional agreement banning the import and sale of products that come from deforested lands including coffee, beef, palm oil, timber, cocoa, rubber, charcoal, and soy and their derivatives. “Companies must prove their supply chains aren’t contributing to the destruction of forests or be fined up to 4% of their turnover in an EU member state,” Reuters explains.

WATCH THIS SPACE #5- Shell plans to ramp up investments in low-carbon solutions: Oil giant Shell said it plans to invest USD 10-15 bn until 2025 to support the development of low-carbon energy solutions, according to a statement. These solutions include biofuels, hydrogen, electric vehicle charging, and carbon capture storage. “We need to continue to create profitable business models that can be scaled at pace to truly impact the decarbonization of the global energy system. We will invest in the models that work — those with the highest returns that play to our strengths,” Shell CEO Wael Sawan said. The company said it is committed to achieving near-zero methane emissions by 2030 and ending routine flaring from its upstream operations by 2025.

Oil production isn’t being reduced though: Shell has shelved plans to slash oil production each year, saying it would keep oil output steady until 2030, with plans to extend its advantaged position upstream to achieve cashflow longevity by stabilizing liquids production to 2030, the statement notes. The backtracking comes a few years after Shell said it would slash oil production by 1-2% every year.

WATCH THIS SPACE #6- Renewables capacity must grow five times faster to avert a climate crisis, according to a study (pdf) by think tank Climate Analytics revealed. Global wind and solar capacity needs to be scaled up five times faster by 2030, with new installations of up to at least 1.5 TW needed annually, the study says. Fossil fuel production will also need to be cut by 6% per year to help stay within the 1.5°C global warming limit and slash reliance on carbon dioxide removal, it said. Renewable energy’s share in electricity generation should surge to at least 70% by 2030, up from the current 30%, to “limit warming to 1.5°C with no or limited overshoot.” The study said that the 6% annual target for global fossil fuel reduction would help reduce fossil fuel use by around 40% over the decade.

|

***

YOU’RE READING ENTERPRISE CLIMATE, the essential regional publication for senior execs who care about the world’s most important industry. Enterprise Climate covers everything from finance and tech to regulation, products and policy across the Middle East and North Africa. In a nod to the growing geographical ambitions of companies in our corner of the world, we also include an overview of the big trends and data points in nearby countries, including Africa and southern Europe.

Enterprise Climate is published by 5am CLT / 5am Riyadh / 6am UAE Monday through Thursday by Enterprise, the folks who bring you Enterprise Egypt, your essential 6am and 3pm read on business, finance, policy and economy in Egypt and emerging markets.

EXPLORE MORE OF ENTERPRISE ON THE WEB — tap or click here to read EnterpriseAM, EnterprisePM, and The Weekend Edition on our powerful new website packed with reader-friendly features.

Subscribe to Enterprise Climate here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

CIRCLE YOUR CALENDAR-

Ireland will host the European Climate Change Adaptation Conference next Monday, 19 June to Wednesday, 21 June in Dublin. During the two-day conference, Europe’s leading climate researchers will present the latest climate action tools, decision-support platforms, and prototype climate adaptation services to 500 attendees. The audience includes adaptation experts, policy-makers, local authorities, private sector companies, investors, NGOs, and citizen and youth organizations.

France will host The Summit for a New Global Financial Pact on Thursday, 22 June to Friday, 23 June in Paris. The two-day summit will bring together heads of states and heads of multilateral development banks, international organizations, the private sector and international NGOs to shape a new finance “toolbox” and “pave the way towards a more balanced financial partnership between the north and south.” It will also see new agreements in a bid to relieve debt distress and allow countries to access additional financing to invest in sustainable development and slash emissions.

Thailand will host the second workshop on addressing loss and damage from 15-16 July in Bangkok. The workshop will see discussions on pathways to increasing funding for climate-induced loss and damage. The workshop is being held in preparation for the third meeting of the COP27 Transitional Committee in August. The committee is tasked with operationalizing the Loss and Damage Fund, to be approved during the fourth transitional meeting in October.

Check out our full calendar on the web for a comprehensive listing of upcoming news events and news triggers.

WASTE MANAGEMENT

Veolia-led consortium reaches financial close on two hazardous industrial waste treatment plants in the UAE

Veolia-led consortium is taking the waste out of Al Ruwais: A consortium comprising French waste and water management company Veolia, ADQ, and Saudi investment powerhouse Vision Invest has reached financial close on the acquisition of two hazardous industrial waste treatments plants in the UAE’s Al Ruwais Industrial City, according to a statement. Veolia will hold a 50.1% stake in the operating company, with Vision Invest and ADQ owning an equal share of 24.95% each. The parties signed the conditional agreement for the transaction last November.

What we know: The Veolia-led consortium will treat the hazardous industrial waste of the emirate’s biggest industrial complex in Al Ruwais, which is home to the region’s biggest oil refinery, the statement said. The waste treatment plants will have an annual capacity of nearly 70k tons. They will focus on maximizing the resource recovery of water and oil from the hazardous waste generated by the complex to reuse them in nearby industrial plants. It also plans to expand the existing solar farm in the area to manufacture more locally sourced green energy.

Where the funds are coming from: The acquisition was financed through a mix of equity and long-term non-recourse project finance debt with completion contingent to interest rate hedges agreed on in November, according to the statement. Natixis and Arab Petroleum Investments Corporation (Apicorp) acted as the lead mandated lead arrangers and structuring banks, while JP Morgan and Natixis acted as the contingent hedge and hedge providers.

IN OTHER VEOLIA NEWS- Veolia’s subsidiary SIDEM has been tapped to lead a consortium tasked with the engineering, procurement, and construction (EPC) of the AED 2.3 bn low-carbon Mirfa 2 Reverse Osmosis (M2 RO) desalination plant, according to a statement (pdf). The plant — commissioned by the UAE’s state-owned Abu Dhabi National Energy Company (Taqa) and French utility company Engie — will hold a production capacity of 550k cubic meters per day of potable water. This will make it the third largest RO desalination facility in the country, the statement notes. The contract is set to represent revenue of EUR 300 mn for Veolia, it added.

GREEN HYDROGEN

Morocco’s Gaia Future Energy and Spain’s HyDeal partner to form green hydrogen transport JV

Morocco’s Gaia Energy teams up with Spain’s HyDeal on green hydrogen exports: Moroccan hydrogen developer Gaia Future Energy signed a partnership agreement with Spanish hydrogen provider HyDeal that will see them form a JV — HyDeal Africa — with the aim of transporting green hydrogen from Gaia Future Energy projects in Morocco and Mauritania to Europe, according to a company statement (pdf). The financials of the agreement and a timeline on the launch of HyDeal Africa’s operational launch were not disclosed.

The details: The JV intends to transport 1 mn tons of green hydrogen from Morocco by 2030 and 5 mn tons of green hydrogen from Mauritania by 2035 to Europe, the statement notes. The hydrogen sourced from North Africa will be transported through a subsea coastal hydrogen pipeline connecting Mauritania and Morocco to Spain, and will leverage opportunities provided by the H2Med pipeline project to connect with more by 2030, the statement notes. Consultations between Gaia Energy, HyDeal, European institutions and governments on both sides of the Mediterranean sea are already underway on the hydrogen interconnector.

Next steps: HyDeal Africa will work on conducting a feasibility study on the design and construction of a subsea hydrogen pipeline connecting Mauritania and Morocco to Spain with the first phase of the study set for a reveal in November during COP28, the statement notes.

EU needs a lot of green H2O: The partnership agreement falls under the umbrella of Europe’s RepowerEU plan of importing 10 mn gallons of green hydrogen by the end of the decade. HyDeal plans to produce 3.6 mn tons of green hydrogen annually by 2030.

Gaia Energy has been making moves: The company — which has an 80 GW pipeline of hydrogen projects under development — signed an agreement back in March with China Energy Engineering Corporation and Saudi Arabia’s Ajlan & Bros to jointly build a green hydrogen production facility in Morocco set to produce some 1.4 mn tons of the green ammonia and 320k tons of green hydrogen annually once operational. Back in November, Gaia Energy signed an agreement to use Israeli firm H2Pro’s electrolyzer tech to accelerate its green hydrogen generational capacity for export to Europe.

GREEN HYDROGEN

Cepsa inks agreement to strengthen green hydrogen maritime corridor in Europe

Cepsa inks agreements for green hydrogen transport in Europe: Spanish oil company Cepsa — which is majority owned by UAE sovereign fund Mubadala — signed agreements with Norwegian ammonia producer and shipper Yara Clean Ammonia and Dutch energy network operator Gasunie to facilitate transportation of green hydrogen to Germany and neighboring European countries, Reuters reports.

The details: The agreement with Yara Clean Ammonia — a subsidiary of Yara International — will see the two parties establish a green hydrogen maritime corridor between the Spanish port of Algeciras, near Cepsa’s green hydrogen hub, and the Dutch port of Rotterdam, the newswire explains. The agreement with Gasunie will allow Cepsa access to its green hydrogen transport network in the Netherlands. Cepsa will also invest EUR 3 bn in its flagship green hydrogen project in Andalusia, which includes a EUR 1 bn green ammonia plant, the newswire notes.

About Cepsa: Cepsa is Europe’s largest privately-owned integrated energy company. The firm was fully owned by Mubadala before US-based multinational private equity and asset management company Carlyle Group bought a 37% stake in October 2019, according to a statement (pdf) published at the time.

REGULATION WATCH

The UAE reveal new policy to regulate its energy market to reduce consumption and increase efficiency

The UAE has unveiled a new state policy on regulating the country’s energy market, Wam reports. The policy aims to slash water consumption by 23%, increase clean energy utilization by 5%, and push down the construction sector’s energy demands by 51% by 2050, UAE Energy and Infrastructure Minister Suhail Al Mazrouei revealed yesterday.

Targets: The new policy — which, among other things, is expected to cut down operational costs in federal buildings by 20% through retrofitting projects — will serve as a contractual rulebook between energy stakeholders, consolidating the financing and partnership frameworks between private and public sector players in the energy industry, the news agency notes. The regulation is expected to incentivize energy providers and private sector stakeholders to up investments in government projects to reduce their energy and water consumption, carbon generation, and operational costs in buildings.

What they said: “The new policy will contribute to the UAE’s GDP and help achieve financial returns that amount to AED 21.5 bn by 2050, resulting from retrofitting federal buildings as part of the National Water and Energy Demand Management Program 2050, helping establish a local market of energy services and products, creating opportunities for the private sector to invest in energy efficiency systems and renewables projects, improving productivity, and lowering operational costs,” Wam quotes Al Mazrouei as saying.

CARBON MARKETS

Saudi companies bid big at RVCMC’s 2 mn carbon credit auction in Kenya

RVCMC’s credit auction draws big interest from KSA: A carbon credit auction hosted by Saudi Arabia’s Regional Voluntary Carbon Market Company (RVCMC) in Nairobi drew big demand from over a dozen firms — a majority of which were Saudi Arabian firms — who bid on an available 2 mn tons of carbon credits, Reuters reports. The company — established by Saudi Arabia’s sovereign wealth fund the Public Investment Fund (PIF) and the Saudi Tadawul Group — sold some 1.4 mn tons of carbon credits during its first auction, which was held in Riyadh, Saudi Arabia, last October.

Where are the proceeds going? Financing generated by the sale of RVCMC’s carbon credits will be channeled toward funding carbon capture projects and clean energy projects that avoid greenhouse gas emissions, the newswire writes, citing a statement by RVCMC. 70% of the credits on sale were produced via Africa-based projects especially from Egypt, Mauritania, South Africa, Uganda, and Kenya, company CEO Riham ElGizy told the National earlier this week. The PIF-backed company also plans to launch a carbon trading exchange early next year, as well as establish a fund to invest in climate projects, according to ElGizy.

The voluntary carbon market is picking up steam: The voluntary carbon market quadrupled to some USD 2 bn in 2021, and could be worth in excess of USD 50 bn in 2023, according to McKinsey. The UAE and Egypt are also working to establish carbon exchanges. The UAE Independent Climate Change Accelerators (UICCA) launched the UAE Carbon Alliance earlier this month in partnership with Singapore-based carbon trading exchange AirCarbon Exchange (ACX) in a bid to establish a framework for carbon markets. The alliance was launched a year after the Abu Dhabi Global Market (ADGM) said it was working with ACX on launching the world’s first fully regulated carbon trading exchange. In April, Egypt’s Financial Regulatory Authority (FRA) formed a committee to supervise and regulate the country’s soon-to-be launched voluntary carbon market.

DEBT WATCH

Commercial Bank of Dubai raises USD 500 mn in inaugural green bond issuance

CBD pulls the trigger on its debut green bond issuance: The Commercial Bank of Dubai has raised USD 500 mn through its inaugural green bond issuance, according to a statement. The five-year bond, which held a coupon rate of 5.319%, was priced at 140 basis points (bps) over US Treasuries, with the issuance generating “substantial interest from investors following a well-received global road show.”

Where the proceeds are going: The proceeds from the inaugural issuance will be “exclusively allocated to financing projects adhering to the criteria outlined in CBD's Sustainable Finance Framework,” the bank said. Those include renewable energy, green buildings, clean transportation, and pollution prevention and control, it said, adding that the framework comes in line with the UN Sustainable Development Goals.

REMEMBER- The UAE wants to stimulate green debt issuances: The UAE said it would be axing registration fees for firms issuing green debt instruments — including sukuk and traditional climate-aligned bonds — in 2023 to support funding for climate-friendly projects last week.

MOVES

Mohammed Alhajjaj (LinkedIn) has been appointed as the CEO of Engie Solutions in Saudi Arabia — a subsidiary of the French utility company Engie, Alhajjaj said. The company provides sustainable energy and service solutions for cities, communities, industries and properties. Prior to this appointment, he served as the executive managing director for regional investment development at the Kingdom’s Investment Ministry. Alhajjaj replaced Turki Alshehri, who has been promoted to a global role as the group vice president for Key Client Office.

KUDOS

Bahrain’s Bepco recognized for USD 2.2 bn corporate green note: Bahrain-based Bapco Energies has snapped up two awards; the Best Islamic Finance Facility Award at the EMEA Annual Achievement Awards and ESG Loan Transaction of the Year at GFC Media Group’s Bonds, Loans & Sukuk Middle East Awards in recognition of its USD 2.2 bn dual-tranche shariah-compliant and conventional corporate green bond, which is set to mature in 2026, Zawya reports.

Empower bags 2 gold awards at IDEA 2023: The UAE’s Emirates Central Cooling Systems Corporation (Empower) won the Total Number of Buildings Committed and Total Building Area Committed gold awards at the International District Energy Association (IDEA) Annual Conference 2023 held in Chicago last week, it said in a bourse filing. This is the seventh consecutive year Empower bags the same titles for the categories, it notes.

ALSO ON OUR RADAR

UAE’s Etihad Credit Ins. teams up with KazakhExport on renewables and waste management: Etihad Credit Ins. — the federal export credit firm of the UAE — has signed an MoU with export insurance company KazakhExport to boost trade between the UAE and Kazakhstan in renewables and waste management, Wam reports. The MoU — which aims to increase export capacities for small and medium-sized enterprises in both countries in the clean energy and waste management industries — falls under the umbrella of the emirates’ We the UAE 2031 sustainable development plan.

ALSO WORTH KNOWING ABOUT THIS MORNING-

- Schneider Electric has signed an MoU with the Royal Commission for AlUla (RCU) to advance the adoption of sustainable energy management solutions and advanced technologies. (Statement)

AROUND THE WORLD

Germany is now the second-most attractive renewables market in the world: For the first time since 2013, Germany has ascended to the global second place in investment attractiveness in the renewables sector, surpassing China and coming in behind world number one USA, Reuters reports, citing this year’s rankings of 40 countries by consultancy firm EY. Germany — which has a target to source 80% of its energy demands from net zero power sources — has upped its renewables production volume 5% since the start of 2022, and clean energy currently makes up 46% of Germany’s energy mix, the EY report notes. The USA’s passing of its USD 369 bn Inflation Reduction Act climate bill last year secured its place as the global leader in market attractiveness in the renewables sector, the reports finds.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- The African Development Bank has provided a c. USD 49 mn grant to Tanzania to support its blue economy sector. (Saudi Press Agency)

- Shares in Japanese carmaker Toyota are up 12% since the company’s announcement of its big EV plans on Monday, marking their biggest jump since 2020. (Bloomberg)

- Serbia launched a three-year program to issue tenders for the development of 1 GW of wind energy and 300 MW solar energy. The first round of tenders is scheduled for the end of August. (Reuters)

- UK universities and tech companies will receive GBP 4.3 mn in government funding to develop a solar power satellite that can collect the sun's energy and transmit it to Earth. (The Guardian)

CALENDAR

JUNE 2023

5-15 June (Monday-Thursday): Bonn Climate Change Conference, Bonn, Germany.

12-15 June (Monday-Thursday): Saudi Plastics & Petrochem, Riyadh, KSA.

13-14 June (Tuesday- Wednesday): The Arab Green Summit, Dubai, UAE.

13-14 June (Tuesday- Wednesday) Bloomberg New Economy Gateway Africa Conference, Marrakesh, Morocco.

13-14 June (Tuesday- Wednesday): Vision Golfe 2023, French Ministry of the Economy, Finance and Industrial and Digital Sovereignty, Paris, France.

13-14 June (Tuesday-Wednesday): Innovation Summit Saudi Arabia 2023, Riyadh, Saudi Arabia.

19-21 June (Monday-Wednesday): European Climate Change Adaptation Conference 2023, Dublin, Ireland.

22-23 June (Thursday-Friday) The UN’s Summit for a New Global Financing Pact, Paris, France.

JULY 2023

3-7 July (Monday-Friday): The 36th Conference of the International Association of Climatology, Bucharest, Romania.

15-16 July (Saturday-Sunday): Second COP27 transitional committee workshop, Bangkok, Thailand.

TBD: Egypt’s post-COP27 Environmental and Climate Investment Forum, hosted by Egypt, Switzerland and UNIDO.

AUGUST 2023

20-24 August (Sunday-Wednesday): World Water Week 2023, Stockholm, Sweden.

21-22 August (Monday-Tuesday): International Conference on Recycling and Waste Management, USA.

21-22 August (Monday-Tuesday): International Conference on Environmental Sustainability and Climate Change, USA.

29 August-1 September (Tuesday-Friday): Third meeting of the COP27 Transitional Committee, TBD.

SEPTEMBER 2023

9-10 September (Saturday-Sunday): G20 Heads of State and Government Summit, New Delhi, India.

9-20 September (Saturday-Wednesday): 2023 Sustainable Development Goals Summit, New York, USA.

11-13 September (Monday-Wednesday): Global Congress on Renewable and Non-Renewable Energy, Dubai, UAE.

12-15 September (Tuesday-Friday): WTO Public Forum, Geneva, Switzerland.

19-21 September (Tuesday-Thursday): World Power-to-X Summit, Marrakesh, Morocco.

28 September (Thursday): International Energy Agency Critical Minerals and Clean Energy Summit, Paris, France.

Chariot Limited and Total Eren’s feasibility study on a 10 GW green hydrogen plant in Mauritania to be completed.

Egypt set to launch alliance to shore up climate financing in developing countries

OCTOBER 2023

4 October (Wednesday): Arabia CSR Gala Awarding Ceremony, UAE.

9-15 October (Monday-Sunday): World Bank/IMF 2023 Annual Meetings, Marrakech, Morocco.

16-18 October (Monday-Wednesday): Climate Week, Rome, Italy.

17-20 October (Tuesday-Friday): Fourth meeting of the COP27 Transitional Committee, TBD.

29 October- 2 November (Sunday-Thursday): Cairo Water Week, Cairo, Egypt

31 October – 2 November (Tuesday-Thursday): World Hydropower Congress, Bali, Indonesia.

NOVEMBER 2023

9-10 November (Thursday-Friday): International Renewable Energy Agency Investment Forum, Uruguay.

15-17 November (Wednesday-Friday): WETEX and Dubai Solar Show, Dubai, UAE.

16-17 November (Thursday-Friday): World Green Economy Summit (WGES), Dubai, UAE.

15-18 November (Wednesday-Saturday): DEWA’s First MENA Solar Conference, Dubai, UAE.

30 November – 12 December: Conference of the Parties (COP 28), Dubai, UAE.

FEBRUARY 2024

26-28 February (Monday-Wednesday): Management and Sustainability of Water Resources, Dubai, UAE.

APRIL 2024

16-18 April (Tuesday-Thursday): World Future Energy Summit, Abu Dhabi, UAE.

23-25 April (Tuesday-Thursday): Connecting Green Hydrogen MENA, Dubai, UAE.

EVENTS WITH NO SET DATE

2023

Mid-2023: Oman set to sign contracts for green hydrogen projects.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

2024

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

2025

International Union for Conservation of Nature World Conservation Congress, Abu Dhabi, UAE.

UAE to have over 1k EV charging stations installed.

2026

UITP Global Public Transport Summit, Dubai, UAE.

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2050

Tunisia’s carbon neutrality target.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.