- Acwa Power inaugurates KSA’s first large-scale solar-powered desalination plant. (Desalination)

- Canadian EV company AXL is looking to set up an assembly line in the UAE. (Electric Vehicles)

- UAE’s Adnoc, Strata, and Belgium’s John Cockerill sign agreement for UAE-based manufacture of hydrogen electrolyzers. (Green Hydrogen)

- Oman awards three hydrogen blocks at an estimated investment ticket of USD 20 bn. (Green Hydrogen)

- Morocco takes the first step in establishing a USD 6.4 bn EV battery “gigafactory”. (Investment Watch)

- EV maker Lucid set to raise USD 3 bn, with KSA’s PIF contributing USD 1.8 bn. (Capital Markets)

- UAE and Brazil talk renewables at BRICS meeting in Cape Town. (Climate Diplomacy)

- UAE set to build EV charging factory in Abu Dhabi. (What We’re Tracking Today)

- New World Bank president Ajay Banga urges staff to double down on development and climate efforts. (What We’re Tracking Today)

- Is the first draft for a UN plastics treaty coming in November? (The Big Story Abroad)

Monday, 5 June 2023

Acwa Power inaugurates KSA’s first large-scale solar-powered desalination plant

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people. It’s another busy start to the week in the region with plenty of climate updates to dive into.

THE BIG CLIMATE STORY- Saudi renewables giant Acwa Power, Gulf Investment Corporation, and Al Bawani Water and Power Company inaugurated the Jubail 3A solar-powered independent water desalination plant. Over in the UAE, Canadian EV company AXL is eying the possibility of establishing an assembly line with a 50k production capacity either in Dubai or Abu Dhabi.

^^ We have the details on these stories and much more in the news well, below.

HAPPENING TODAY- The Sustainability and Governmental Action Forum will kick off in Cairo today, bringing together global leaders and experts to discuss improving sustainability in government work through private-public partnerships]. The event is hosted by the Arab League’s Arab Administrative Development Organization and will culminate with the publication of the “Sustainability and Government Work: The State of Arab Governments” report prepared in cooperation with the UAE.

THE BIG CLIMATE STORY OUTSIDE THE REGION- Will we see a first draft of a plastics treaty in November? Around 170 countries agreed on Friday to outline a first draft for a plastics treaty in November, bringing the world one step closer to the first global treaty to limit plastic pollution. The nations agreed during UN treaty talks in Paris last week to prepare a “zero draft” text of what could possibly be a legally binding treaty by the start of the next round of talks in Kenya’s Nairobi in November. The agreement comes after the five-day negotiations got off to a poor start due to arguments between delegations on procedural issues. Saudi Arabia, Russia, and China objected to having treaty decisions adopted by majority vote rather than a consensus, which would allow one or a few states to block adoption.

REMEMBER- The UN Environment Program outlined a plan to reduce the world’s plastic waste levels by nearly 80% in less than two decades in May. The report — released two weeks before the talks in Paris — champions policy shifts geared toward keeping produced goods in circulation for as long as possible under “reuse, recycling, and alternative materials” strategies.

The story made headlines over the weekend in the international press: Reuters | The Associated Press | AFP | Financial Times | CNN

ENTERPRISE IS LOOKING FOR SMART, TALENTED PEOPLE of all backgrounds to help us build some very cool new things. Enterprise — the essential morning read on all the important news shaping business and the economy in Egypt and the region — is looking for writers, reporters and editors to help us build out new publications. Today, we run four daily Egypt and MENA-focused publications, five weekly industry verticals, and a weekend lifestyle edition designed to make our readers feel just a bit smarter.

We have tons more in the pipeline — come help us build new publications. We offer the chance to work in a fast-paced newsroom on a broad range of topics and in a variety of formats. Our goal is simple: To create value for our growing community of >250k daily readers by telling stories that matter.

Journalists looking to explore business, finance and economic stories are welcome. So are recent journalism school graduates.

That said, we're looking for gifted story-tellers from all walks of life and across all professions, as long as they show a keen interest in learning to write about the stories, topics, businesses, and figures moving markets. Egyptian and foreign nationals alike are welcome to apply. So are job-switchers: If you’re an equities analyst tired of the rat race, we’re a great place to come work.

NEVER WORKED IN A NEWSROOM BEFORE? We have the Enterprise Business Writing Development Program. Whether you are a recent graduate, an industry vet, or looking to switch careers, the Enterprise Business Writing Development Program will give you the tools you need to tell the most important stories to our audience of C-suite officials, government ministers, diplomats, financiers, investors and entrepreneurs.

During the program you will learn:

- The key news stories and trends shaping business and the economy in Egypt and the region, across various sectors;

- Business and finance for non-finance people: Whether it's industry jargon or key concepts or simply how to read a balance sheet;

- How to construct an Enterprise story: From idea formulation down to the structure, style and tone of writing;

- How to develop sources that will give you the key insights needed to tell a complete story;

- How to communicate these stories with the confidence and language of an insider.

Not an internship program — a career: The three-month program will see full-time, paid participants take part in workshops and lectures from veteran business journalists, while also working on and filing stories that will run on any of our publications. Those who have successfully completed the program, will then be given long-term job offers.

Apply directly to jobs@enterprisemea.com and mention “writing development program” in your subject line.

SOUNDBITE OF THE WEEK- “We are at a critical moment in the arc of humanity and the planet. The World Bank Group is being asked to lead the way, to double down on development and climate efforts and to deliver even more impact and results,” the World Bank's new president Ajay Banga said in statements to staff picked up by Reuters on Friday. In a memo seen by the newswire, Banga asked the World Bank’s 16k employees to “double down” on development and climate efforts, stressing the responsibility “to create a world [devoid of] poverty on a livable planet.” He asked the staff to “maximize resources and write a new playbook… take informed risks and forge new partnerships with civil society and multilateral institutions.” Banga also asked that the bank cut lengthy approval times for financing projects in a bid to raise efficiency. “The process is overly elaborate and subject to multiple review mechanisms that not only cost valuable years but erode staff ambition,” he said, adding that the lengthy process augments a “trust deficit” among developing nations.

WATCH THIS SPACE #1- UAE to build EV charging factory in Abu Dhabi: The UAE’s Industry and Advanced Technology Ministry signed a letter of intent with EV solutions firm Shahin to establish an EV charging station factory in Abu Dhabi, The National reported on Thursday. Shahin — a subsidiary of Dubai-based NEV Enterprise that is currently being established in Abu Dhabi — aims to fulfill 40% of the country’s direct current charging demands by 2030. The timeline and financials of the project have not been disclosed. The UAE EV market, which is expected to grow 27% by 2029, currently makes up a little over 1% of the country’s total automotive market. The government has increased the number of EV charging stations in the country by 60% over the last three years to reach 800 charging points, the news outlet quotes UAE Energy and Infrastructure Minister Suhail Al Mazrouei as saying.

WATCH THIS SPACE #2- The Kuwait Oil Company (KOC) will likely award a construction contract for a wind energy project by 3Q 2023, Zawya reported on Friday, citing a source it says has knowledge of the matter. The bid submissions deadline has been extended twice and is now set for 12 June, with the KOC expected to award the contract by early September 2023. The project’s financials have not been disclosed. Back in March, KOC sent out requests for proposals to five companies for the installation of the wind turbine at its Ratqa oil field. The generational capacity will range between 3.4 and 3.6 MW, it noted. Bidders included Elecnor, Vestas Mediterranean, Vensys Energy AG, Power Construction Corporation, and Eno Energy.

WATCH THIS SPACE #3- Global airlines group explores contrail reduction: Global airlines are setting up a task force to limit the creation of contrails — the ice-particle-filled white lines visible behind airplanes — in a bid to rein in its contribution to global warming, Reuters reports. The move comes as the Annual General Meeting & World Air Transport Summit 2023 convenes in Istanbul this week and concludes tomorrow. The International Air Transport Association — representing some 300 major airlines — is hosting the summit, which includes a discussion on the warming effect of contrails for the first time.

Etihad Airways was ahead of the game: The UAE carrier inked a future carbon credits from contrail management agreement with green aviation firm Satavia back in January to produce future carbon credits by managing contrail activity.

The jury is out on contrails: While contrails don’t emit CO2, they can trap radiation and reflect it back down to earth, according to the newswire. “The annual warming effects of contrails could be two times larger than the cumulative effects from CO2 [emissions from flights],” Imperial College London researcher Roger Teoh told Reuters. Other scientists don’t believe the research behind the impact of contrails is robust enough, the newswire notes.

WATCH THIS SPACE #4- Clean tech requirements by the EU? EU member states are considering enforcing requirements that at least half of the critical minerals needed by the bloc be processed domestically, Bloomberg reported last week, citing a document it has seen. An updated proposal by Sweden — which holds the bloc’s rotating presidency — would see the requirement raised 10 percentage points from the 40% initially placed by the European Commission. Under the proposal, member states would be granted flexibility on the timeline for giving out permits for strategic projects in critical raw materials. A 10% target for domestic extractions would remain unchanged, while a recycling capacity target would rise to 20% from a previous 15%. The move comes as the EU tries to shore up critical minerals for clean technologies amid fierce competition with the US and China in low-carbon manufacturing.

WATCH THIS SPACE #5- More funding on the way for Tunisia’s EV infrastructure: The Global Environment Fund is providing Tunisia with USD 13 mn to increase the country’s EV charging points to 500 by 2025, Al Hurra reported last week. It is unclear whether the funding is a loan or a grant. The project will be overseen by a national committee formed by Tunisia’s National Agency for Energy Control and the Environment Ministry to oversee the country’s sustainable mobility strategy, which aims to increase the number of EVs in Tunisia to 5k by 2025. The new committee — which will provide grants up to USD 3k for each EV purchased — will also be tasked with amending existing regulations to accommodate for the transition to electric vehicles.

DATA POINT- Global renewable power capacity to rise by a third this year: Global renewable capacity is expected to surge by 107 GW — the largest absolute increase in a year so far — to reach more than 440 GW in 2023, according to the International Energy Agency’s Renewable Energy Market Update (pdf) released last week. The market update, which outlines the 2023 and 2024 global outlook, said that in 2024 total global renewable electricity capacity will see an even sharper rise to reach 4.5 TW, equivalent to the combined power output of China and the US. China will account for some 55% of global additions of renewable power capacity in both 2023 and 2024, the IEA calculated.

|

***

YOU’RE READING ENTERPRISE CLIMATE, the essential MENA publication for senior execs who care about the world’s most important industry. We’re out Monday through Thursday by 5am Cairo / 5am Riyadh / 6am UAE.

EXPLORE MORE OF ENTERPRISE ON THE WEB — tap or click here to read EnterpriseAM, EnterprisePM, and The Weekend Edition on our powerful new website packed with reader-friendly features.

Were you forwarded this email? Get your own subscription without charge here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

CIRCLE YOUR CALENDAR-

Saudi Arabia will host the Arab-Chinese Business Conference next Sunday, 11 June and Monday, 12 June in Riyadh. The conference will bring together CEOs, business leaders, investors, and entrepreneurs from the Middle East and China to collaborate on new trade and investment initiatives in different sectors, including renewables and minerals. A panel discussion titled Clean Energy and Renewables – Pathways to Emissions Reduction is scheduled on the first day, according to the program (pdf). The second day will focus on the localization of renewable energy and on value chain opportunities in mining.

The UAE will host The Arab Green Summit on Tuesday, 13 June to Wednesday, 14 June in Dubai. The two-day summit will bring together industry players and experts for conversations on climate change and sustainability and solutions for concurrent climate-related issues in the region. Key themes to be addressed during the summit include industry decarbonization, renewable and clean energy potential and implementation, sustainable building and construction and others.

Morocco will host the Bloomberg New Economy Gateway Africa on Tuesday, 13 June to Wednesday, 14 June in Marrakech. The event will bring together stakeholders from the private and public sector to discuss the world’s most pressing topics and assess potential solutions. Those include the impact of a decelerating global economy, spiking food and energy prices, supply-chain shocks and risks of distress among sovereign borrowers.

Check out our full calendar on the web for a comprehensive listing of upcoming news events and news triggers.

DESALINATION

Acwa Power inaugurates KSA’s first large-scale solar-powered desalination plant

Jubail 3A desalination plant goes live: Saudi renewables giant Acwa Power, Gulf Investment Corporation (GIC), and Al Bawani Water and Power Company (AWP) have inaugurated the Jubail 3A independent water desalination plant, according to a statement. The companies received the commercial operation certificate from Saudi Water Partnership Co. (SWPC) to begin operations at the kingdom’s first solar-powered desalination project.

What we know: The USD 650 mn project is the first Independent Water Project in the kingdom’s eastern region with a production capacity of 600k cubic meters (cbm) of desalinated water per day to meet growing water demand. It includes a 45.5 MW solar PV power generation facility, which accounts for 20% of the plant’s total energy consumption, and is set to provide clean water to 3 mn people with a “record-breaking” tariff of 0.41 USD/cbm using reverse osmosis technology.

Who owns what: The Jazlah company project was delivered through a development consortium comprising Acwa Power with 40.2%, GIC with 40%, and AWP at 19.8%. The project was implemented by the Engineering, Procurement and Construction consortium of Power China, Sepco III, Lantania, and Abengoa, while SWPC is the offtaker.

ELECTRIC VEHICLES

Canadian EV company AXL is looking to set up an assembly line in the UAE

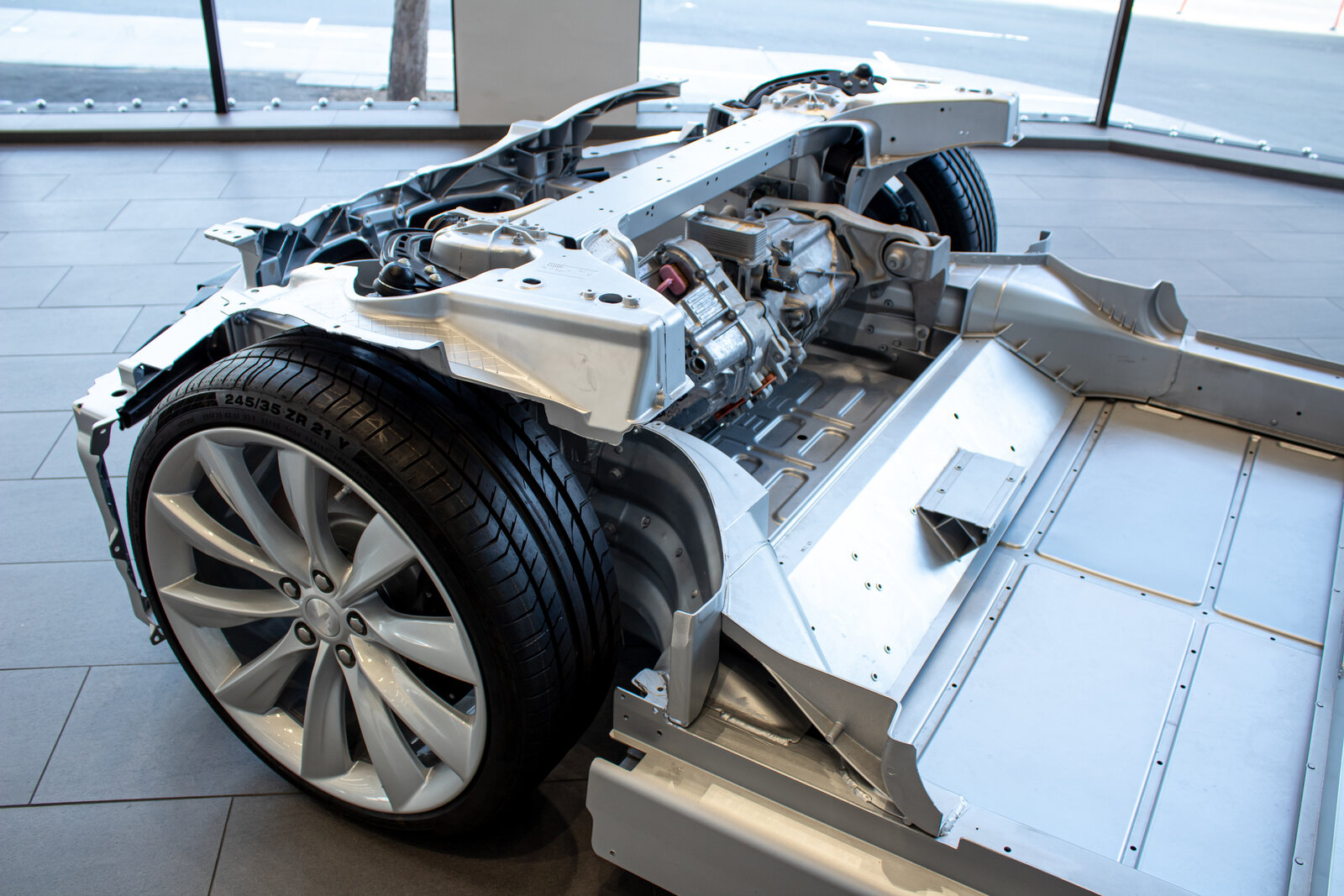

A new EV assembly line coming to UAE: Canadian EV company AXL — which unveiled its all-electric SUV Sharx-5 last month — has plans to establish a UAE-based assembly line with a 50k production capacity either in Dubai or Abu Dhabi, CEO of AXL Electric Vehicles Ali Eslami told Khaleej Times.

Strategic location: The company — which currently has one model priced at some USD 40k, according to the news outlet — is looking to leverage the emirates’ proximity to both the EU and Asian markets to set up its MENA-based assembly unit, Eslami said. The company is currently in talks for land allocation and could start production of its EVs within six to nine months depending on the “availability of the building and infrastructure,” he added..

Not the first company with assembly plans in MENA: UAE-based car manufacturer M Glory Holding plans to establish three electric vehicle production factories across MENA in Egypt, the UAE, and Jordan with an investment ticket of USD 550 mn. Renault and Stellantis already operate EV assembly facilities in Morocco producing 700k cars each year. Citroen also produces around 50k EV buses per year with plans to double that output in two years.

GREEN HYDROGEN

UAE’s Adnoc, Strata, and Belgium’s John Cockerill sign agreement for UAE-based manufacture of hydrogen electrolyzers

The UAE is getting its first hydrogen electrolyzer plant: State-owned Abu Dhabi National Oil Company (Adnoc) signed a strategic collaboration agreement with UAE’s Strata Manufacturing and Belgium’s John Cockerill Hydrogen aiming to manufacture electrolyzers for local use in the UAE and for export, according to a statement released on Thursday. The construction timeline, production capacity, and financial details of the plant were not disclosed.

We knew this was coming: The UAE’s Industry and Advanced Technology Minister Sultan Al Jaber said that the country intends to build its first hydrogen electrolyzer plant last week, as part of over 30 industrial projects worth over AED 6 bn announced during the Make it in the Emirates Forum.

Why is this important? Electrolyzers are the main and most expensive component in a hydrogen facility as it is the device that uses electricity to split water into hydrogen and oxygen. Alkaline and PEM electrolyzers are the most commercially available types, but it’s likely that alkaline designs will have a larger market share than PEM electrolyzers in the short term, the International Energy Agency (IEA) says. It is unclear which technology the new partnership will use.

And it's a cost effective measure: Increases in electrolyzer production volumes globally are expected to reduce costs of electrolyzer technologies, the IEA says. Based on company announcements, the global manufacturing capacity for electrolyzers could reach 65 GW per year by 2030, compared to the 1 GW in play globally by the end of 2022.

REMEMBER- Egypt is getting an electrolyzer plant, too: The European Bank for Reconstruction and Development agreed to provide the Fertiglobe-Scatec-OC-SFE ammonia plant with a USD 80 mn loan in November to build a 100 MW electrolyzer facility powered by renewable energy.

GREEN HYDROGEN

Oman awards three green hydrogen blocks at an estimated investment ticket of USD 20 bn

Oman’s Hydrom selects companies for three green hydrogen production plants: Oman’s state-owned hydrogen company Hydrom — owned by Energy Development Oman — signed three agreements granting the first three blocks of land for planned green hydrogen plants worth USD 20 bn, Oman News Agency (ONA) reported on Thursday. The three projects will have a cumulative production volume of 500k tons annually. The timeline for operational launch and the individual price tags have not been disclosed. Hydrom signed six binding term sheet agreements — which it said were worth in excess of USD 20 bn at the time — with several regional and international developers for the production of green hydrogen back in March.

The details: Each of the production facilities will span some 320 sq km and will be located in Oman’s Al Wusta governorate and will collectively be powered by 12 GW of renewables projects, according to ONA. The first plant was awarded through a public auction last year to a consortium comprising Copenhagen Infrastructure Partners (CIP), Blue Power Partners (BPP) and Al Khadra. The consortium will produce 200k tons of green hydrogen annually to be used for green steel plants in the Port of Duqm, and the facility will be powered by 4.5 GW of renewable energy. The second facility — set to be powered by 3.5 GW of clean energy — has been awarded to a consortium led by BP Oman and will produce 150k tons annually. The third plant has been awarded to the Green Energy Oman consortium which includes Oman’s OQ and Shell Oman. The plant is set to generate c.150k tons and will be powered by 4 GW of renewable energy.

More in the pipeline: Hydrom — which also signed an agreement for the usufruct of concession plots with Oman’s Energy and Minerals Ministry and the Housing and Urban Planning Ministry for the projects— established an advisory board tasked with managing and overseeing of utilities for the plants in coordination with the facilities’ developers and Omani utility provides and undisclosed global hydrogen infrastructure developers, the news agency notes. Hydrom also signed a non-binding collaboration agreement with OQ Gas Networks (OQGN) that will see them both partner on green hydrogen pipelines established, according to ONA. Separately, Energy Development Oman (EDO) signed a knowledge transfer agreement with Siemens Energy that will see them partner on green hydrogen-related research and development projects.

INVESTMENT WATCH

Morocco takes the first step in establishing a USD 6.4 bn EV battery “gigafactory”

Morocco is getting a giant EV battery facility: Morocco has signed an MoU with Chinese battery maker Gotion High Tech to build a roadmap for setting up a gigafactory for EV batteries and energy storage systems, Maghreb Arab Press reported last week. The project is part of an ambitious plan to localize EV battery manufacturing in the country.

What we know: Under the agreement, Gotion High-Tech will set up a “gigafactory” with investments estimated at MAD 65 bn (c. USD 6.4 bn) in Bouknadel. The facility, which will be the first of its kind in Africa, will have a production capacity of 100 GW/h and will create 25k jobs, according to Alsharq Business.

REMEMBER- Morocco has transformed itself into a regional automotive powerhouse through smart incentives and consistent government policy, and it is now a key exporter to Europe as well as to other MENA countries, including Egypt. It has put together a comprehensive agenda, from developing a national master plan for electric mobility, designating zones where fossil-fuel cars are banned, giving tax exemptions on EVs, to developing the infrastructure through an iSmart charging station. Morocco is targeting the production of around 1 mn EVs in the next three to four years, according to statements by officials last year.

CAPITAL MARKETS

EV maker Lucid set to raise USD 3 bn, with KSA’s PIF contributing USD 1.8 bn

Lucid is getting more money from Saudi owners: EV maker Lucid Group plans to raise USD 3 bn through a common stock offering, with most the money coming from Lucid’s majority shareholder KSA’s sovereign wealth fund the Public Investment Fund (PIF), according to a statement released last week. The Saudi sovereign wealth fund owns a 60.46% stake in the California-based EV maker.

What we know: Under an agreement, PIF will purchase some 265.7 mn shares in a private placement set to close on 26 June for c. USD 1.8 bn. The remaining USD 1.2 bn would be raised from a public offering of 173.5 mn shares of common stock, the statement notes. The public offering is expected to close on or around 5 June, it added.

Where the money is going: Lucid plans to use the net proceeds from both the public offering and the private placement by PIF “for general corporate purposes, which may include, among other things, capital expenditures and working capital.”

Lucid hasn’t been doing so well: Lucid’s shares fell more than 7% in extended trading following the announcement on Wednesday, according to Bloomberg. It ended the regular trading day up c. 0.7% to USD 7.76. The company has been struggling on the back of high costs, production hurdles, and EV competition. It reported quarterly revenues of USD 149.4 mn, down from an average estimate by analysts of USD 209.9 mn, according to Refinitv data. Its quarterly losses widened to USD 779.5 mn, up from USD 604.6 mn in the same quarter last year. The disappointing quarterly performance has pushed the EV manufacturer to revise its annual production plan this year to manufacture over 10k of its luxury EV sedans, down from a previous production plan of up to 14k. It remains a priority for Saudi Arabia, however, as the country is looking to become a hub for automakers, with Lucid planning to build its first overseas production facility in the Gulf country.

CLIMATE FINANCE

UAE lines up climate financing from First Abu Dhabi bank + Mashreq

UAE get a climate financing boost: The UAE’s Industry and Advanced Technology Ministry has signed an MoU with First Abu Dhabi Bank (FAB) to unlock AED 5 bn in financing for investors in the industrial and advanced technology sectors, Wam reported on Thursday. FAB will provide financing solutions to back the adoption of advanced technology in the industrial sector including structured financing, capital investments, business expansion financing, green financing, and support for SMEs and startups.

ALSO- The ministry has signed an MoU with Mashreq to establish an AED 1 bn fund for the industrial sector in the UAE, Wam reported on Friday. Under the agreement, Mashreq will provide its financing solutions, including Sharia compliant products, to support the adoption of AI in the industrial sector in a bid to slash its carbon footprint. These include green loans and bonds, sustainability-linked and transitional loans and bonds, social loans, trade finance, structured finance, and capital investments.

DEBT WATCH

The UAE’s First Abu Dhabi Bank issues USD 600 mn five-year green bond

FAB pulls trigger on landmark green bond issuance: First Abu Dhabi Bank— the UAE’s largest bank— has issued a USD 600 mn five-year green bond, the bank said in a statement on Thursday. The issuance was the third successful public issuance in the USD market by the bank and the first by a MENA financial institution this year, it said.

Details: The green bond was upsized to USD 600 mn from an initial target of USD 500 mn on the back of a 2.8x oversubscribed orderbook, the statement notes. The green bond was priced at 5 bps inside FAB's existing USD curve and was sold at 95 bps over US Treasuries. 85% of the allocation went to global investors, and green investors accounted for 34% of the issuance, representing one of the highest proportions in the market.

DEBT WATCH

Spain’s Iberdrola partners with IFC to accelerate renewables roll out in emerging markets including Morocco

Morocco will get a boost in climate financing from Iberdrola + IFC: Spain’s Iberdrola and the World Bank’s International Finance Corporation (IFC) have partnered together to support the clean energy transition and decarbonization in developing economies including Morocco, according to a company statement. As part of the agreement, the two organizations will explore a green loan for the development of Iberdrola’s renewable energy, offshore wind power, and green hydrogen projects located in emerging countries, including Morocco. The expected loan value was not disclosed nor the specific projects being evaluated.

IFC is a big contributor of climate-friendly finance regionally: In May, Coca-Cola’s official bottling partner in Africa signed an agreement with IFC for a EUR 64 mn loan to boost climate-friendly measures and increase plastic recycling across the continent. In the same month, the Sovereign Fund of Egypt said that the World Bank lender will support its new renewable-powered desalination projects. The IFC extended a green loan of EUR 100 mn to Moroccan state-owned fertilizer and phosphate giant OCP Group in April, to help finance the development of four solar plants. The international lender also helped provide USD 500 mn for Amea Power’s 560 MW Abydos solar plant and the 505 MW Amunet wind project in Egypt.

CLIMATE DIPLOMACY

UAE and Brazil talk renewables at BRICS Friends meeting in Cape Town

UAE + Brazil to partner in renewable energy, climate action: Emirati Foreign Affairs Minister Abdullah bin Zayed Al Nahyan and his Brazilian counterpart Mauro Vieira discussed partnerships in renewable energy and climate action during a BRICS meeting in South Africa, Wam reported on Friday. The meeting brought together senior officials from over a dozen countries — including Saudi Arabia and Iran — to consider forging closer links across the BRICS bloc which includes Brazil, Russia, India, China, and South Africa. The UAE has made a number of major contributions as a partner of BRICS including joining the bloc’s multilateral Shanghai-based development bank in 2021 and investing in infrastructure, food security, clean energy, transportation, and industry, according to Wam.

Oman + Malaysia are looking to expand green partnerships: Oman’s Energy and Minerals Minister Mohsin bin Hamad Al Hadhrami held a meeting with the executives of Malaysia’s state oil company Petronas in Kuala Lumpur to discuss increasing investments in the renewable energy and green hydrogen sector, the Oman News Agency reported on Saturday. Hadrami and his accompanying delegation also reviewed potential partnerships for developing carbon capture and storage projects, biofuels, graphene, electric car charging stations, solar panel manufacturing, and exchanging expertise in energy. During his visit, Al Hasrami met with Malaysian Deputy Minister of Foreign Affairs Mohammed Al Amin to discuss mineral and energy cooperation as part of efforts to attract investments in partnership with the Oman Investment Authority and the Public Authority for Special Economic Zones and FreeZones.

ALSO WORTH NOTING-

- Saudi Energy Minister Abdulaziz bin Salman and China's Chairman of the National Energy Authority Zhang Jianhua discussed collaborating on mining, nuclear energy, renewables, hydrogen, and energy supply chains. (Saudi Press Agency)

- Egypt’s Oil Minister Tarek El Molla and Czech Ambassador in Cairo Ivan Yoki discussed potential partnerships in mining, green hydrogen, and renewable energy projects ahead of an upcoming MoU. (Statement)

- UAE Minister of State for Foreign Trade Thani Al Zeyoudi and Secretary-General of the Scottish Cabinet Secretary for Wellbeing Economy, Fair Work and Energy Neil Gray met to discuss potential cooperation in renewables projects. The UAE’s Masdar owns a 25% stake in the 30 MW Hywind Scotland, the world’s first floating wind farm. (Wam)

MOVES

UAE lands WMO presidency: The UAE has been tapped for the presidency of the World Meteorological Organization, with its National Centre of Meteorology (NCM) head Abdulla Al Mandous (LinkedIn) elected as the new head of the WMO for a four-year term, Wam reported on Thursday. Al Mandous, who secured 98 votes from the WMO’s 193 member states and territories, is succeeding Germany’s Gerhard Adrian, who served as WMO president since June 2019. Al Mandous, who is also the UAE's permanent representative to the WMO and president of the WMO’s Regional Association II (Asia), is the first Arab meteorologist from Asia to be elected WMO head.

ALSO ON OUR RADAR

The Suez Canal will be a “green canal” by 2030, Suez Canal Authority (SCA) Chairman Osama Rabie said during a meeting with International Maritime Organization Secretary-General Kitack Lim on Thursday, according to a statement. The SCA intends to power 16 monitoring stations using new and renewable energy and convert its fleet to operate on natural gas instead of gasoline and diesel, Rabie said.

KSA’s RVCMC to hold world’s largest voluntary carbon credit auction next week: The Regional Voluntary Carbon Market Company (RVCMC) — established by Saudi Arabia’s sovereign wealth fund the Public Investment Fund and the Saudi Tadawul Group — will hold the world’s largest voluntary carbon credit auction on Wednesday, 14 June in Nairobi, CNN reported last week. The auction will offer over 2 mn tons of carbon credits to over 15 companies from various countries, including Saudi Arabia. Nairobi was selected to host the auction to signal the importance of bringing investments to emerging economies, according to the news outlet.

The company is beating its own record from last year: RVCMC launched its first auction last year — held in parallel to the company’s launch — for the sale of 1.4 mn tons of carbon credits, which at the time was billed as the world’s largest credit auction.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- APM Terminals Bahrain, the operator of Khalifa bin Salman Port, will select a contractor for its USD 10 mn solar power plant at the port next month. (TradeArabia)

- UAE’s Adnoc has signed agreements with over 60 local and global companies to localize critical non-oil products manufacturing and ramp up decarbonization efforts. (Wam)

- Azerbaijan has discussed new investment opportunities with the UAE’s Adnoc and renewable energy giant Masdar. (Tweet)

- Egypt is in talks with multilateral lender New Development Bank to provide concessional loans to fund developmental projects in energy, transportation and green transition. (Finance Ministry Statement)

- Neom’s water management and utility company Enowa has begun building conversion stations for the 3 GW transmission system connecting the Oxagon to KSA’s port city of Yanbu. (Asharq Business)

- Algeria’s Sonatrach and Brazil’s power manufacturing giant WEG have signed an MoU to expand collaboration in energy and mining, focusing on wind power. (Statement)

- Abu Dhabi’s police, in partnership with Adnoc Distribution, have opened two new avenues for electric vehicle inspection in the emirate. (Wam)

- Several private and public institutions took part in the Saudi-Japanese minerals and mining workshop in Tokyo. (SPA)

AROUND THE WORLD

Solar power exceeds coal in Europe, but not without problems: Solar panels in Europe generated more power in May than all of the bloc’s coal plants for the first time, yet the step forward exposed shortcomings within the bloc, Bloomberg reported on Saturday. An inconsistency between supply and demand during some of the month’s sunniest days led to power prices turning negative as grid operators were unable to keep up with the renewables power surge. The downside of the solar boom is that technologies that store energy in batteries or through creating green hydrogen aren’t advanced enough to help keep lights on at nighttime or help keep homes warm in winter. “This summer will be something we’ll have to look at like it’s a postcard from the future. The biggest message will be: we’re not ready,” an analyst told BloombergNEF.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- India is considering slashing import tax on solar panels to 20% from 40% to make up for a drop in domestic output as demand for renewable energy picks up. (Reuters)

- The EU is set to take Italy to court over its failure to treat urban wastewater properly. (Reuters)

- US lithium giant Albemarle is planning to bring another domestic lithium mine online by 2027. The plant is located in Kings Mountain, North Carolina. Lithium is an essential component for EV battery manufacturing (CNBC)

CALENDAR

MAY 2023

30 May-2 June (Tuesday-Friday): World Circular Economy Forum 2023, Helsinki, Finland.

JUNE 2023

1 June (Thursday): Invest in African Energy Forum, Paris, France.

5-8 June (Monday-Thursday): IDEA2023, Chicago, US

8 June (Thursday): Envirotec and Energie Expo, Tunis, Tunisia.

11-12 June (Sunday-Monday): Arab-Chinese Business Conference, Riyadh, Saudi Arabia.

12-15 June (Monday-Thursday): Saudi Plastics & Petrochem, Riyadh, KSA.

13-14 June (Tuesday- Wednesday): The Arab Green Summit, Dubai, UAE.

13-14 June (Tuesday- Wednesday) Bloomberg New Economy Gateway Africa Conference, Marrakesh, Morocco.

13-14 June (Tuesday- Wednesday): Vision Golfe 2023, French Ministry of the Economy, Finance and Industrial and Digital Sovereignty, Paris, France.

22-23 June (Thursday-Friday) The UN’s Summit for a New Global Financing Pact, Paris, France.

JULY 2023

3-7 July (Monday-Friday): The 36th Conference of the International Association of Climatology, Bucharest, Romania.

22-23 July (Saturday-Sunday): Second COP27 transitional committee workshop, Bangkok, Thailand.

TBD: Egypt’s post-COP27 Environmental and Climate Investment Forum, hosted by Egypt, Switzerland and UNIDO.

AUGUST 2023

20-24 August (Sunday-Wednesday): World Water Week 2023, Stockholm, Sweden.

29 August-1 September (Tuesday-Friday): Third meeting of the COP27 Transitional Committee, TBD.

SEPTEMBER 2023

9-20 September (Saturday-Wednesday): 2023 Sustainable Development Goals Summit, New York, USA.

11-13 September (Monday-Wednesday): Global Congress on Renewable and Non-Renewable Energy, Dubai, UAE.

12-15 September (Tuesday-Friday): WTO Public Forum, Geneva, Switzerland.

28 September (Thursday): International Energy Agency Critical Minerals and Clean Energy Summit, Paris, France.

Chariot Limited and Total Eren’s feasibility study on a 10 GW green hydrogen plant in Mauritania to be completed.

Egypt set to launch alliance to shore up climate financing in developing countries

OCTOBER 2023

4 October (Wednesday): Arabia CSR Gala Awarding Ceremony, UAE.

16-18 October (Monday-Wednesday): Climate Week, Rome, Italy.

17-20 October (Tuesday-Friday): Fourth meeting of the COP27 Transitional Committee, TBD.

29 October- 2 November (Sunday-Thursday): Cairo Water Week, Cairo, Egypt

31 October – 2 November (Tuesday-Thursday): World Hydropower Congress, Bali, Indonesia.

NOVEMBER 2023

9-10 November (Thursday-Friday): International Renewable Energy Agency Investment Forum, Uruguay.

15-17 November (Wednesday-Friday): WETEX and Dubai Solar Show, Dubai, UAE.

15-18 November (Wednesday-Saturday): DEWA’s First MENA Solar Conference, Dubai, UAE.

30 November – 12 December: Conference of the Parties (COP 28), Dubai, UAE.

FEBRUARY 2024

26-28 February (Monday-Wednesday): Management and Sustainability of Water Resources, Dubai, UAE.

EVENTS WITH NO SET DATE

2023

Mid-2023: Oman set to sign contracts for green hydrogen projects.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

2024

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

2025

International Union for Conservation of Nature World Conservation Congress, Abu Dhabi, UAE.

UAE to have over 1k EV charging stations installed.

2026

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2050

Tunisia’s carbon neutrality target.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.