- Neom Investment Fund makes its first two investments in US-based electric seaglider maker Regent and autonomous driving company Pony.ai. (Investment Watch)

- IsDB joins forces with the World Bank to help finance climate-centered regional projects. (Green Finance)

- KSA’s Olayan and LanzaTech form a JV to expand carbon recycling tech offering. (Decarbonization)

- Aramco is planning to launch SAF demo pilots in 2025. (What We’re Tracking Today)

- Bahrain-based Investcorp Capital will IPO on ADX. (What We’re Tracking Today)

- Apple accused of greenwashing over its latest “carbon-neutral” products. (What We’re Tracking Today)

- The energy transition could use a push from the next big tech revolution: Quantum Computing. (Green Tech)

Thursday, 26 October 2023

Neom Investment Fund makes its first two investments in green mobility

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, ladies and gents. The climate sector updates continue to roll in from Saudi Arabia as Davos in the Desert is underway in Riyadh, with a few other bits to note from the wider region. Don’t miss our deep dive into the world of quantum computing and what it means for our industry.

THE BIG CLIMATE STORY- Saudi Arabia’s Neom is investing in US-based electric seaglider manufacturer Regent and US-based autonomous driving company Pony.ai to establish operations for both green vehicles in the smart city and Saudi-based Islamic Development Bank has partnered with the World Bank to help finance climate-centered water, energy, and food projects in the MENA region by 2026.

^^ We have the details on these stories and more in the news well, below.

THE BIG CLIMATE STORY OUTSIDE THE REGION- No single story is dominating the headlines, but concern is growing over high interest rates derailing the ambitions of climate regulators and big auto to accelerate the shift to EVs, Reuters writes. While sales continue to grow, demand is not keeping up with the expectations of players who have invested USD bns in the sector, leaving companies to shift plans ahead of 2024. "EV demand next year could be lower than expectations," CFO at South Korean battery maker LG Energy Solution Lee Chang-sil said. Honda and General Motors also said they were axing a USD 5 bn plan to develop lower-cost EVs together just one year after launching the effort.

WATCH THIS SPACE #1- Aramco will kick off SAF demo pilots by 2025: Saudi oil giant Aramco plans to bring online two SAF demonstration projects in KSA’s Neom by 2025, Asharq Business quotes the company’s CTO Ahmad Al-Khowaiter as saying. The company plans to earmark “hundreds of mns of USD” to build the plants, one of which will be developed in partnership with Spain’s Repsol. Earlier this week, Aramco signed a joint development agreement (JDO) to establish a separate e-fuel demonstration plant with Enowa — Neom’s energy and water utility subsidiary.

Aramco is going big on e-fuels and SAFs: Last year, Aramco and Repsol signed a partnership agreement to similarly establish an e-fuels demonstration plant in Spain that will initially have an 8k liter daily production capacity. The production demonstration of low-carbon synthetic diesel and jet fuel for automobiles and aircraft.

WATCH THIS SPACE #2- Investcorp Capital announces IPO on ADX: Bahrain-based alternative asset manager Investcorp intends to proceed with an IPO of 643 mn shares — around 29% of its issued capital — at USD 0.50 a share on the Abu Dhabi Securities Exchange (ADX), Wam reports. The company will issue 321.5 mn new shares and the selling shareholder, Investcorp S.A., will sell 321.5 mn shares. The subscription period, running from 2 to 9 November, will offer two tranches, and the listing is set for 17 November.

REMEMBER- Investcorp Co-CEO Rishi Kapoor told The National last June that the firm plans to have a new climate-focused investment platform up and running before COP28 kicks off next month. The new investment vehicle will grab stakes in companies operating in various sectors including mobility, climate technology, carbon management, and energy transition and storage industries.

WATCH THIS SPACE #3- Will the UAE strike a net-zero trade agreement with the Scots? Scottish Wellbeing Economy Secretary Neil Grey is heading to the UAE to explore the potential for an agreement between the two countries on renewables projects, according to The National. The conference will host representatives from 19 Scottish companies to boost the county's renewables potential. “We have the resources, skills, and ambition to advance green energy technologies and accelerate decarbonization,” Gray said. “Continuing to build trade and investment will play a vital role in helping Scotland build a greener, fairer well-being economy and all the benefits that will bring to families, communities and businesses across the country.”

WATCH THIS SPACE #4- Shell to trim staff at low carbon solutions unit: Oil giant Shell will axe 15% of its workforce at its Low Carbon Solutions (LCS) unit in 2024, Reuters reports. The move comes a week after CEO Wael Sawan said his company remains committed to zero emissions by 2050, but will change its approach to achieving its planned carbon neutrality to go in line with its “ruthless” focus on performance.

WATCH THIS SPACE #5- Apple accused of greenwashing over its latest “carbon-neutral” products: Apple is facing backlash from European environmental and consumer groups after the iPhone maker claimed its latest products are “carbon neutral,” the Financial Times reports. Last month, Apple put its “environmentally friendly” credentials at the center of its biggest annual product launch, and called some Apple Watch models its “first-ever carbon neutral products'” by buying carbon credits to cancel out the 7 to 12 kg of greenhouse gas emissions behind each watch, and replacing the leather in the watch band with different materials with a “significantly lower” carbon footprint. The tech giant said it is buying carbon credits from timber reforestation projects in Paraguay and Brazil.

Why is buying carbon credits not an effective net-zero claim? Climate campaigners have been questioning whether tracking carbon emissions provides a thorough environmental assessment of small electronic devices such as smartwatches and wireless earbuds, which are difficult to repair and end up as e-waste, FT writes. “Carbon neutral claims are scientifically inaccurate and mislead consumers,” Monique Goyens, the director-general of the European Consumer Organisation (BEUC) told the news outlet. In the days following the Watch launch, EU heads in Brussels said that it would ban “neutrality” claims that are based on the purchase of carbon credits by 2026.

|

***

YOU’RE READING ENTERPRISE CLIMATE, the essential regional publication for senior execs who care about the world’s most important industry. Enterprise Climate covers everything from finance and tech to regulation, products and policy across the Middle East and North Africa. In a nod to the growing geographical ambitions of companies in our corner of the world, we also include an overview of the big trends and data points in nearby countries, including Africa and southern Europe.

Enterprise Climate is published by 5am CLT / 5am Riyadh / 6am UAE Monday through Thursday by Enterprise, the folks who bring you Enterprise Egypt, your essential 6am and 3pm read on business, finance, policy and economy in Egypt and emerging markets.

EXPLORE MORE OF ENTERPRISE ON THE WEB — tap or click here to read EnterpriseAM, EnterprisePM, and The Weekend Edition on our powerful new website packed with reader-friendly features.

Subscribe to Enterprise Climate here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

CIRCLE YOUR CALENDAR-

Cairo Water Week is taking place from Sunday, 29 October to Thursday, 2 November. This year’s event will focus on global green developments in the water sector with sessions discussing the development of scientific solutions, practical tools, policies, and concrete measures to overcome today’s water challenges. The five-day event is organized by Egypt’s Water Resources and Irrigation Ministry, in partnership with the EU and FAO.

India will host the International Solar Alliance from Monday, 30 October to Thursday, 2 November in New Delhi. Some 96 member countries will participate and discuss mobilizing funds to accelerate solar deployments, the universalization of energy access through solar mini-grids, and diversifying manufacturing and supply chains for solar energy production.

The UAE will host the Forbes Middle East Sustainability Leaders Summit from Wednesday, 1 November to Saturday, 3 November in Abu Dhabi. The summit will gather international leaders in sustainability, technology, finance, and policy to drive green strategies globally. The agenda includes sessions on climate-smart cities, green mobility, sustainable finance, and sustainable tourism. The summit is expected to set the tone for international and regional dialogue and decision-making, including COP28 which will kick off in late November.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

INVESTMENT WATCH

Neom Investment Fund makes its first two investments in US-based electric seaglider maker Regent and autonomous driving company Pony.ai

US green mobility sector the first target for Neom’s newly launched investment fund: Saudi Arabia’s Neom is investing in US-based electric seaglider manufacturer Regent and US-based autonomous driving company Pony.ai to establish operations for both green vehicles in the smart city, according to two statements (here and here). The investment is being made through the Neom Investment Fund (NIF) established earlier this week.

First, the seaglider: The investment made by Neom is part of a multi-year partnership with Regent to establish electric seaglider passenger operations in the region, the statement notes. Regent will also establish a Middle East research, development, and training hub to support expansion in seaglider operations and infrastructure and conduct on-site testing to be ready for operational roll-out by 2025. The electric seaglider will be able to service routes up to 180 miles (290 kms) with existing battery technology, and routes up to 500 miles (805 kms) with next-gen batteries, all via existing dock infrastructure, according to their website. Neom’s undisclosed investment in Regent is the largest single contribution in the US company’s latest Series A funding round.

Next, Pony.ai: Neom is investing USD 100 mn in Pony.ai in parallel with setting up a JV to develop, manufacture, and deliver autonomous driving services, advanced vehicles, and smart vehicle infrastructure in Neom and other key markets in the MENA region. The JV will also establish a local autonomous vehicle manufacturing and R&D facility, according to the statement. Pony.ai has developed a wide range of vehicles, from all-electric passenger Robotaxis to long-distance freight trucks, according to its website.

Neom has been planting seeds to deliver its sustainable transport system: On Tuesday, Saudi oil giant Aramco and Enowa — Neom’s energy and water utility subsidiary — signed a joint development agreement to establish an e-fuel demonstration plant in Neom. Neom partnered with Oracle and NVIDIA in AI technology at LEAP23 earlier this year in efforts to incorporate AI and advanced robotics into its DNA, including promises of a fully autonomous transportation system for the smart city.

How can AI help the transport sector become cleaner? As electric and autonomous vehicle adoption increases, AI is increasingly being used to monitor and predict demand and usage of charging terminals, optimize battery usage, and improve safety and efficiency. Dubai’s Roads and Transport Authority (RTA) for example is using AI to improve its public bus service by shortening journeys, reducing fuel consumption, and increasing bus ridership using data gathered from smart cards, buses, and taxis.

GREEN FINANCE

IsDB joins forces with World Bank to help finance climate-centered regional projects

IsDB and World Bank partner on green projects: Saudi-based Islamic Development Bank (IsDB) has partnered with the World Bank to help finance climate-centered water, energy, and food projects in the MENA region by 2026, according to a statement. The partnership aims to support joint operations that could rack up to USD 6 bn in financing through 2026, the statement notes. The World Bank’s political-risk ins. arm Multilateral Investment Guarantee Agency (Miga) will collaborate with the IsDB to mitigate political risk, while another World Bank member, the International Finance Corporation, will work with IsDB to draw in more private sector investment for the bank.

REMEMBER- Political risk is one of the highest barriers to climate-financing: Political (or country) risk was one of three factors that multilateral banks have been urged to reassess and reduce to incentivize developing countries to seek out affordable loans for climate-related projects. The other two risk barriers are exchange rate risk and off-take risks, which also add a premium to the cost of capital and create a high barrier to climate finance, making borrowing for climate projects more expensive.

IsDB is getting on board the energy transition train: IsDB signed a financing agreement with the government of Tajikistan in August to improve water management for the country’s agriculture sector, only a few months after it said it was earmarking USD 403 mn for three sustainable energy and transport projects in Egypt, Kyrgyzstan, and Tajikistan. The bank issued a total of USD 5.1 bn between 2017 and the first half of 2022 in green and sustainable sukuks. The IsDB is committed to a climate finance target of 35% of total financial commitment by 2025, according to a joint report (pdf) by the world’s biggest multilateral lenders.

DECARBONIZATION

KSA’s Olayan and LanzaTech form a JV to expand carbon recycling tech offering

KSA’s Olayan partners up with USA’s Lanzatech on carbon recycling: Saudi Arabian investment firm Olayan Financing Company and US-based carbon recycling company LanzaTech have formed a JV to expand deployment of the latter’s carbon repurposing tech in KSA, according to a statement.

The tech: LanzaTech's carbon capture and utilization technology uses microbial gas fermentation, a process through which CO2 and carbon dioxide are fused with hydrogen via microorganisms to produce low-carbon fuels like SAF, the company notes. Back in 2018, the company operated in partnership with Virgin Atlantic on its first SAF-powered commercial flight using syngas produced from steel mill emissions.

The JV’s mission: The newly formed JV will deploy LanzaTech’s proprietary technology to repurpose industrial gasses as well as solid waste feedstocks from hard-to-abate sectors in KSA as well as undisclosed select markets across MENA, the statement notes. The JV will also look to develop projects that are fully integrated with its patented Alcohol-to-Jet process in a bid to generate SAFs.

Not the company’s first entry into the MENA market: Back in February, LanzaTech signed an MoU with Tadweer in February to explore the possibility of establishing a waste to sustainable aviation fuels conversion plant. The planned conversion facility could also see carbon waste used to produce fabric materials and other applications.

GREEN TECH

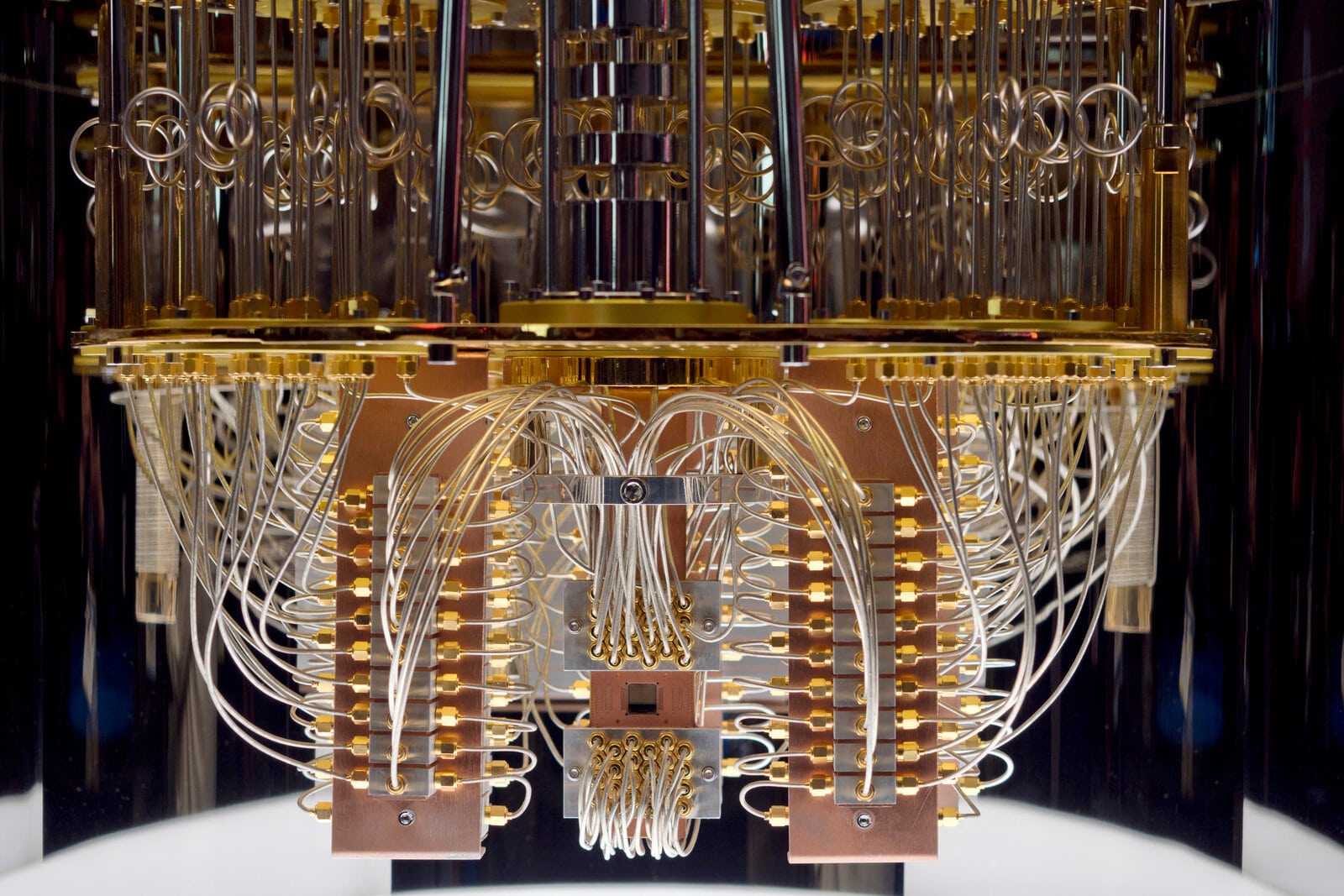

The energy transition could use a push from the next big tech revolution: Quantum Computing

Quantum computing, the next big tech revolution: Quantum computing is creating a major buzz because of its ability to solve extremely complex problems at super speeds, and the energy sector is paying close attention to this tech and exploring possible applications for its operations as the need for a speedy green transition intensifies. A report by Mckinsey Digital identified a long list of quantum-computing applications which could eliminate over 7 gigatons of CO2 equivalent from the atmosphere a year by 2035 if implemented. Quantum computers could also make the operation of multiple conventional supercomputers obsolete in some cases resulting in a smaller CO2 footprint.

SOUNDSMART- How does quantum computing solve complex statistical problems? While digital computers have been making it easier for us to process information for decades, quantum computers are poised to take computing to “a whole new level,” McKinzey explains. Unlike the technology that powers laptops and smartphones, which is built on bits — a unit of information that can store either a zero or a one — quantum computing is built on quantum bits, or qubits, which can store both zeros and ones simultaneously. In other words, classical computers solve a problem with multiple variables by conducting a new calculation every time a variable changes, while quantum computers can explore a massive number of paths simultaneously, making them much faster.

KSA is making moves to explore the new technology: Aramco-backed Wa’ed Ventures invested in a USD 108 mn Series B for French quantum computing startup Pasqal in January. Pasqal said it will use the funding to further develop its quantum computing platform, which it believes will deliver major commercial advantages over classical computers by 2024, as well as expand the development of proprietary algorithms — algorithms that solve specific problems that translate into actions — for customers across key sectors including energy, automotive, mobility, enterprise technology, and finance. A couple of months after Wa’ed’s investment, Aramco signed an MoU with Pasqal to collaborate on accelerating the design and development of quantum based machine learning models for the energy sector. The French company said it aims to establish operations in the Middle East and grow its business in Saudi Arabia.

Optimizing energy consumption: Through a set of partnerships, Pasqal has set out to solve issues in vehicle charging, battery development, hydrogen-powered vehicles, and grid management. With France’s utility giant EDF, Pascal formulated a statistical model to address the problem of minimizing peak demand and stabilizing the grid — which is getting increasingly difficult as renewables that are intermittent in nature are added onto the grid. Optimizing energy demand and supply through the model can also help integrate the growing demand for electric mobility more smoothly. In collaboration with the European Innovation Council, Pascal used quantum computing to build simulations that can test electric battery and hydrogen fuel cell durability, safety, and affordability, removing the need for laboratory experiments. With France’s RTE company, Pascal also used quantum to model electricity grids to identify parts of the grid that have similar “operating modes,” and can serve as a basis for aggregating grid information or reducing the optimization processes.

More pathways to help tackle climate change in MENA: “Water desalination can benefit from quantum simulation since catalysts play an increasingly prominent role in emerging new methods,” professor of mathematics at NYUAD Hisham Sati told Fast Company Middle East. “Another example is the development of new catalysts to make CO2 conversion into hydrocarbons more efficient and selective, which is a key part of climate change mitigation strategies,” head of Science & Technology and lead of IBM Research Quantum Europe Heike Riel said. Trade routes are optimized with the help of quantum computing bringing down these emissions and help solve the maritime pollution problem, he added.

UAE looking into quantum computing to stay ahead of the curve: The Abu Dhabi’s Technology Innovation Institute (TII) announced a research agreement with Amazon Web Services (AWS) in May to explore quantum computing applications. As part of the agreement, TII will gain access to a range of quantum computing technologies via AWS’ managed quantum computing service Amazon Braket, which has worked with renewables giants such as Spain’s Iberdrola, France’s Engie, and the US’ Baker Hughes to build a platform that reduces clients’ energy consumption. In 2018, Dewa began working with Microsoft to develop quantum-based solutions to address energy optimization, making It the first organization outside the US to participate in Microsoft’s Quantum program.

The region needs to stay on top of the game to avoid getting left behind: Other challenges to introducing quantum computing applications relate to the relative speed with which the MENA region economies will be able to exploit the new technology given that it will take time to grasp, shape, and formulate strategies for quantum computing, according to another PwC report (pdf). The report warns that the Middle East may “struggle to maintain or gain ground if it cannot match other parts of the world for analytics immediacy and precision.” The Gulf region should emulate the National Quantum Initiative Act in the US, which has already allocated USD 1.3 bn to train quantum engineers to build a quantum computing workforce, PwC Middle East partner Simnone Vernacchia told ComputerWeekly, adding that a viable quantum computing industry will only be possible in the GCC with a very significant investment in training future quantum engineers.”

And there are some obstacles: Unlike conventional supercomputers which release a lot of heat, quantum computers have an operating temperature of -273°C, meaning that it will operate at its peak energy-efficiency at that temperature, PwC explains. As a result, major steps in the commercialization of quantum computers are expected to come in parallel with finding cost-effective and energy-efficient ways to cool the super systems. Preparing cyber strategies for quantum computers will also be one of the top priorities before it can be commercialized, PwC emphasizes in its report, adding that a 2016 regional survey for security exposure and protection found the Middle East to be at higher risk of attack than other regions.

ALSO ON OUR RADAR

RENEWABLES-

Egypt agrees on MoU to export electricity: Egypt inked an agreement with Belgian firm Jan De Nul to conduct feasibility studies on the possibility of building a Mediterranean subsea powerline with a capacity of 2 GW to export renewable electricity to Europe, according to a statement. No further details on the agreement were disclosed.

This has been in the works: Egyptian Electricity Minister Mohamed Shaker met with Belgian company Jan De Nul’s Managing Director Jan Pieter De Nul in May to discuss expanding cooperation in Egypt’s renewable energy sector.

RECYCLING-

EGA will build an aluminum recycling factory: UAE’s aluminum manufacturer Emirates Global Aluminium (EGA) is working on setting up the country’s first aluminum recycling factory, Wam reports. EGA is trying to reduce energy consumption as demand is expected to increase by 50 to 80% by 2050. Recycled aluminum consumes up to 95% less energy than new metal production.

EGA’s green portfolio: EGA launched a supply chain finance (SCF) program with Emirates NBD earlier this month to help aluminum producers green their UAE operations. It also partnered with BP in May to explore cutting emissions from the company’s calcined petroleum coke (CPC) supply chain. It was also the first in the UAE to join the First Movers Coalition by committing to sourcing the materials it needs for aluminum production from low-carbon sources.

EMISSIONS-

CCED and Aggreko collaborate to cut emissions: CC Energy Development (CCED) launched an initiative with energy solutions provider Aggreko to reduce greenhouse gas emissions by 30% in CCED's operations in Oman, according to a statement released earlier this week. The initiative will see CCED establish a flare gas-to-power project within its operations and work towards eliminating gas flaring by 2027. The oil and gas operator will also replace diesel with unused associated gas, which is a crude oil production byproduct, to generate electricity to power the company's operations.

AROUND THE WORLD

Australia announces AUD 2 bn expansion in mining: Australia’s Prime Minister Anthony Albanese said his country will channel an additional AUD 2 bn (USD 1.3 bn) toward investments for its mining sector in a bid to secure rare earths needed for its transition to green energy and sustainable mobility, according to a statement. The new financing program — disbursed in the form of low-interest loans for miners and processors of critical minerals — is aimed at attracting US-based mining firms to tap into the country’s “vast” mineral deposits, and would help minimize dependency on China in the green energy transition, ABC notes.

Taking on China: China now processes more than 70% of the world’s graphite, and refines more than 90% of the mineral into the material used in EV battery anodes. Along with graphite, China processes more than half the world’s lithium, about two-thirds of its cobalt, and about one-third of the global supply of nickel, and has begun enforcing export restrictions on rare earths including graphite. The US began talks with the EU on a transatlantic bargain on minerals back in March in a bid to counter Chinese dominance in the mining and EV sectors.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- New York is getting some offshore wind action: New York awarded contracts for three offshore wind farms as it shoots for its target of generating 9 GW of wind power by 2035. (Bloomberg)

- Ireland can start SAF production by the end of the decade: Ireland will be able to produce sustainable aviation fuel (SAF) using offshore wind power from 2030 and has the most likely chance to produce synthetic e-fuels or eSAFs, made with captured carbon and green hydrogen. (Reuters)

- Brazil’s food sector contributes three-quarters of its emissions: 74% of the total greenhouse gas output of Brazil in 2021 was attributable to its food production sector. Of the 1.8 bn tons of CO2 emitted that year, 78% were attributable to the beef production industry. Brazil is the world’s top exporter of beef and the fourth largest grain supplier. (Reuters)

CLIMATE IN THE NEWS

The manufacturing industry can save USD bns through energy efficiency: Global industry players across various manufacturing sectors can offset an estimated four mn metric tons of greenhouse gas emissions annually — almost a third of current global CO2 output — and save as much as USD 437 bn yearly by 2030 if they implement 10 simple energy efficiency measures, Reuters writes, citing to a report by the Energy Efficiency Movement. Suggested measures in the report include efficient power audits, the incorporation of low-carbon production techniques for hard-to-abate sectors, adequate infrastructure connecting industrial plants and machines, and a thorough analysis of targeted industrial assets. The measures translate to 1.5 mn metric tons of carbon savings by 2024, two mn metric tons by 2025, and four mn metric tons by the end of the decade. The doubling down on energy efficiency measures spotlighted by EEM would be equivalent to taking 60% of combustion engine vehicles off roads, the report notes.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- A smashing new industry for old solar panels: A US startup is processing and recycling up to 7.5k solar panels a day by smashing and extracting bits of silver, copper, and aluminum. The market for recycled material can reach USD 2.7 bn by 2030 and USD 80 bn by 2050. (Bloomberg)

CALENDAR

OCTOBER 2023

24-26 October (Tuesday-Saturday): Future Investment Initiative, Riyadh, KSA.

25-26 October (Friday-Saturday): Offshore & Floating Wind Europe 2023, London, United Kingdom.

25-27 October (Wednesday – Friday): International Fair of Energy Transition, Tunis, Tunisia.

29 October-2 November (Sunday-Thursday): Cairo Water Week, Cairo, Egypt

29 -31 October (Sunday-Tuesday): Egypt Energy Conference, Egypt International Exhibition Centre, Cairo, Egypt.

30 October – 2 November (Monday-Thursday): International Solar Alliance Assembly, New Delhi, India.

30 October – 1 November (Monday-Wednesday) ISWA 2023 World Congress: Global action towards a net-zero future, Muscat, Oman.

31 October-2 November (Tuesday-Thursday): Financial Times’ Energy Transition Summit, London, UK.

31 October-2 November (Tuesday-Thursday): World Hydropower Congress, Bali, Indonesia.

NOVEMBER 2023

1-3 November (Wednesday-Friday): Forbes Middle East Sustainability Leaders Summit 2023, Abu Dhabi, UAE.

7-8 November (Tuesday-Wednesday): ADIA Lab Symposium on Climate Change and Health Sciences, Abu Dhabi, UAE.

7-8 November (Tuesday-Wednesday): The 2023 US Algeria Energy Forum, Washington DC, USA.

9-10 November (Thursday-Friday): International Renewable Energy Agency Investment Forum, Uruguay.

9-15 November (Thursday-Wednesday): Intra-African Trade Fair 2023, Cairo, Egypt.

11-13 November (Saturday-Monday): GCC-Türkiye Economic Forum, Istanbul, Turkey.

15-17 November (Wednesday-Friday): WETEX and Dubai Solar Show, Dubai, UAE.

15-18 November (Wednesday-Saturday): DEWA’s First MENA Solar Conference, Dubai, UAE.

20-24 November (Monday-Friday) International Civil Aviation Organisation’s Aviation and Alternative Fuels conference, Dubai, UAE.

27-30 November (Monday-Thursday) Abu Dhabi Finance Week (ADFW), Abu Dhabi, UAE.

28-29 November (Tuesday-Wednesday): World Green Economy Summit (WGES), Dubai, UAE.

30 November – 12 December (Thursday-Tuesday): Conference of the Parties (COP 28), Dubai, UAE.

DECEMBER 2023

4 December (Monday): Saudi Green Initiative Forum, Dubai, UAE.

4 December (Monday): Abu Dhabi Sustainability Week (ADSW) summit, Dubai, UAE.

4-7 December (Monday-Thursday): International Conference on Global Warming, Ras Al Khaimah, UAE.

6-7 December (Wednesday-Thursday): Reuters’ Energy Transition MENA conference, Dubai, UAE.

8 December (Friday): Youth for Sustainability Forum (Y4S), Dubai, UAE.

12-14 December (Tuesday-Thursday): Green Hydrogen Summit Oman, Oman Convention and Exhibition Center, Muscat, Oman.

18-20 December (Monday-Wednesday): Saudi Arabia Smart Grid Conference, Hilton Riyadh Hotel & Residences, Riyadh, Saudi Arabia.

JANUARY 2024

9-11 January (Tuesday-Thursday): Future Minerals Forum, Riyadh, Saudi Arabia.

FEBRUARY 2024

26-28 February (Monday-Wednesday): Management and Sustainability of Water Resources, Dubai, UAE.

MARCH 2024

4-6 March (Monday-Wednesday): International Conference on Sand and Dust Storms in the Arabian Peninsula, Riyadh, Saudi Arabia.

APRIL 2024

16-18 April (Tuesday-Thursday): World Future Energy Summit, Abu Dhabi, UAE.

23-25 April (Tuesday-Thursday): Connecting Green Hydrogen MENA, Dubai, UAE.

MAY 2024

19-21 May (Sunday-Tuesday): Saudi Energy Convention, Riyadh, KSA.

JUNE 2024

5 June (Wednesday): World Environment Day, Saudi Arabia.

OCTOBER 2024

10-12 October (Tuesday-Thursday): Autonomous E-Mobility Forum, Doha, Qatar.

DECEMBER 2024

2-13 December (Monday-Friday): Conference of the Parties (COP16) to the United Nation Convention to Combat Desertification, Riyadh, KSA.

EVENTS WITH NO SET DATE

2023

Mid-2023: Oman set to sign contracts for green hydrogen projects.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

2024

12-14 February (Monday-Wednesday): Sustainable Aviation Futures MENA Congress, Dubai, UAE.

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

2025

International Union for Conservation of Nature World Conservation Congress, Abu Dhabi, UAE.

UAE to have over 1k EV charging stations installed.

2026

UITP Global Public Transport Summit, Dubai, UAE.

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2050

Tunisia’s carbon neutrality target.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.