- KSA’s PIF and Hyundai Motors form a JV to build a manufacturing plant in Saudi. (Electric Vehicles)

- Acwa Power will explore the feasibility of a KSA-EU green hydrogen corridor via the Port of Amsterdam (Green Hydrogen)

- Algeria is getting a new 50 MW green hydrogen plant with help from Germany. (Green Hydrogen)

- PIF is seeking partnerships with EU-based companies in the green hydrogen and renewables markets. (What We’re Tracking Today)

- 100+ companies including Ikea and Volvo demand a fossil fuels axing deadline as an outcome of COP28. (What We’re Tracking Today)

- UAE startup Terra debuts MENA’s first swappable battery station for EVs. (Green Tech)

- Startups tackle the problem of pricing secondhand EVs with battery health certification tests. (Climate in the News)

Tuesday, 24 October 2023

KSA’s PIF and Hyundai Motors form a JV to build a manufacturing plant in Saudi

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people. We have a compact issue for you this morning after a very busy start to the week with some big news emerging from KSA…

THE BIG CLIMATE STORY- Saudi sovereign wealth fund the Public Investment Fund and Hyundai Motor Company signed a JV agreement to establish a highly automated vehicle manufacturing plant in the kingdom.

^^ We have the details on this story and more in the news well, below.

HAPPENING TODAY- The Future Investment Initiative is kicking off today in Riyadh and running through to Thursday. The event will gather state leaders, policymakers, executives, academics, NGOs, entrepreneurs, and scientists and host panels on how to scale green technologies, mining, AI’s role in the energy revolution, and how geoeconomics will impact critical minerals among other topics.

THE BIG CLIMATE STORY OUTSIDE THE REGION- 100+ companies demand a fossil fuels axing deadline: Ikea, Volvo, Unilever, Vodafone, and 130 other global conglomerates with a combined annual book value of over USD 1 tn signed an open letter ahead of COP28 calling for a timeline on scrapping fossil fuels. The unified front said that corporations are “feeling the effects and cost of increasing extreme weather events resulting from climate change,” the letter read. “We call on all parties attending COP28 to seek outcomes that will lay the groundwork to transform the global energy system towards a full phaseout of unabated fossil fuels and halve emissions this decade,” the letter added. Back in July, a meeting of G20 energy ministers at the Energy Transitions Ministerial Meeting in India failed to reach consensus on a fossil fuel phasedown as several major fossil fuel producers led by Saudi Arabia and Russia blocked the move. Western nations including the EU remain divided on how hard to push for a global agreement to fully phase-out fossil fuels at COP28.

The story got coverage in Reuters and the Financial Times.

WATCH THIS SPACE #1- It’s official for KSA’s hydrogen oasis: KSA Crown Prince Mohammed bin Salman and South Korea’s President Yoon Suk Yeol attended the signing ceremony for the previously announced “Hydrogen Oasis” cooperation initiative, the Saudi Ministry of Energy said yesterday. The joint initiative will work on establishing bilateral committees managing each step of the clean hydrogen value chain from production to storage and distribution, and facilitate partnership agreements between developers from both countries. The statistics agencies of both countries are also expected to ink a knowledge transfer agreement on “material on statistical production” of clean hydrogen.

ALSO- PIF is looking to partner up with the EU on clean energy: Saudi Arabia’s Minister of Investment Khalid Al-Falih says KSA’s sovereign wealth fund The Public Investment Fund (PIF) is seeking partnerships with EU-based companies in the green hydrogen and renewables markets, Asharq Business reports. The kingdom is looking to leverage strong economic cooperation between both sides — as well as the kingdom’s green hydrogen infrastructure — to expand bilateral development, Al-Falih said. The European Commission's Vice President Maroš Šefčovič inked an agreement to establish an EU Chamber of Commerce in KSA to expand cooperation with the kingdom and the wider GCC region, the news outlet notes. Germany’s foreign ministry opened a hydrogen-focused diplomacy office in Riyadh back in 2022 in a bid to provide electrolyzers for Neom’s USD 8.4 bn green hydrogen plant in exchange for green fuel exports to the EU country.

|

***

YOU’RE READING ENTERPRISE CLIMATE, the essential MENA publication for senior execs who care about the world’s most important industry. We’re out Monday through Thursday by 5am Cairo / 5am Riyadh / 6am UAE.

EXPLORE MORE OF ENTERPRISE ON THE WEB — tap or click here to read EnterpriseAM, EnterprisePM, and The Weekend Edition on our powerful new website packed with reader-friendly features.

Were you forwarded this email? Get your own subscription without charge here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

CIRCLE YOUR CALENDAR-

Tunisia will host the International Fair of Energy Transition from Wednesday, 25 October to Friday, 27 October in Tunis. The event will host global stakeholders in the energy sector and will focus on promoting financing energy transition and discussing the challenges of renewables, energy efficiency and storage, and electric mobility.

Cairo Water Week is taking place from Sunday, 29 October to Thursday, 2 November. This year’s event will focus on global green developments in the water sector with sessions discussing the development of scientific solutions, practical tools, policies, and concrete measures to overcome today’s water challenges. The five-day event is organized by Egypt’s Ministry of Water Resources and Irrigation, in partnership with the EU and FAO.

India will host the International Solar Alliance from Monday, 30 October to Thursday, 2 November in New Delhi. Some 96 member countries will participate and discuss mobilizing funds to accelerate solar deployments, the universalization of energy access through solar mini-grids, and diversifying manufacturing and supply chains for solar energy production.

The UAE will host the Forbes Middle East Sustainability Leaders Summit from Wednesday, 1 November to Saturday, 3 November in Abu Dhabi. The summit will gather international leaders in sustainability, technology, finance, and policy to drive green strategies globally. The agenda includes sessions on climate-smart cities, green mobility, sustainable finance, and sustainable tourism. The summit is expected to set the tone for international and regional dialogue and decision-making, including COP28 which will kick off in late November.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

ELECTRIC VEHICLES

KSA’s PIF and Hyundai Motors form a JV to build a manufacturing plant in Saudi

PIF and Hyundai team up to manufacture EVs: Saudi sovereign wealth fund the Public Investment Fund (PIF) and Hyundai Motor Company signed a JV agreement to establish a USD 500 mn highly automated vehicle manufacturing plant in the kingdom, according to a statement. PIF will have a 70% stake in the venture while Huyndai will hold the remaining 30% in addition to providing technical and commercial expertise.

The details: The plant will have a manufacturing capacity of 50k vehicles annually including both internal combustion engines and EVs, without disclosing how much of the annual output will be EVs. Construction is expected to start in 2024 and production in 2026.

We knew this was coming: Hyundai announced in September that it is planning to ink a formal agreement with Saudi Arabia to set up an EV assembly plant in the country. KSA also signed an MoU with Hyundai Motor Company for the construction of an EV and internal combustion engine manufacturing plant in January

What they said: "Our investment in vehicle manufacturing with Hyundai Motor Company is a pivotal milestone, aligning closely with our existing stakes in Lucid and Ceer Motors, and amplifying the breadth of Saudi Arabia's automotive and mobility value chain,” deputy governor and head of MENA Investments at PIF Yazeed A. Al-Humied said.

It’s been a busy month for KSA: PIF and the Saudi Electricity Company (SEC) launched the Electric Vehicle Infrastructure Company earlier this month to expand fast-charging infrastructure across the kingdom. PIF also launched Tasaru Mobility Investments, which focuses on strengthening the local supply chain for electric and autonomous vehicles.

ALSO- Hyundai wants to work on hydrogen-based mobility: Hyundai Moors signed an MoU with Korea Automotive Technology Institute (KATECH), Air Products Qudra (APQ), and the Saudi Public Transport Company (SAPTCO) to establish and develop an ecosystem for hydrogen-based mobility in Saudi, according to a statement. The collaboration will promote demonstration projects for hydrogen-fuel cell commercial vehicles. The partnership will see Hyundai provide hydrogen fuel cell commercial vehicles to SAPTCO, KATECH explore further research and development avenues, and APQ secure the hydrogen supply in the kingdom, the statement notes.

GREEN HYDROGEN

Acwa Power will explore the feasibility of a KSA-EU green hydrogen corridor via the Port of Amsterdam

Acwa Power and friends look into exporting green hydrogen to the EU: KSA renewables giant Acwa Power has signed an agreement with Dutch-based terminals operator Zenith Energy, LNG shipping services GasLog, and the Port of Amsterdam to explore the feasibility of opening a green hydrogen corridor extending from the kingdom to Europe via Amsterdam, according to a statement.

What we know: Under the MoU, all parties will conduct a feasibility study to explore establishing a trade corridor for liquified green hydrogen between Acwa Power’s production sites and the port of Amsterdam, the statement notes. Based on the results, the stakeholders may proceed to sign in a Joint Development Agreement (JDA) to define each of the parties’ roles and responsibilities and engage with offtakers in the EU.

There’s more: The parties will also explore incentives to increase the appetite for green hydrogen including affordable pricing, the statement adds, noting that the Dutch government has earmarked EUR 9 bn for the development of green hydrogen production and distribution with EUR 300 mn is reserved for imports up until 2030.

Acwa’s stakes in Neom will come in handy: 100% of the green hydrogen produced in Neom’s green hydrogen plant — of which Acwa holds a 33.3% stake — is marked for export, with project co-developer US-based Air Products looking to earmark a sizable portion of Neom’s green fuels for Germany.

The Port of Amsterdam has been busy: Last month, Suez Canal Economic Zone (SCZone) signed a cooperation agreement with a consortium of Dutch-based green hydrogen developers to establish subsea interconnectors facilitating the export of green fuels from Egypt to the Port of Amsterdam. Back in January, the Port of Amsterdam and Dutch firms SkyNRG, Evos Amsterdam, and Zenith Energy Terminals signed an agreement with the UAE’s Masdar to similarly explore the possibilities of green fuel exports to Europe. The Dutch government has similar agreements with Oman, Deputy Director at Port of Amsterdam Mark Hoolwerf told us last month.

IN OTHER ACWA NEWS- Acwa Power also inked an agreement during the EU-Saudi Investment Forum with Desolenator — a Dutch company pioneering circular solar thermal water desalination systems — to explore development across MENA’s renewables, desalination, and green hydrogen production sectors, Asharq Business reports. The agreement will see both firms partner on research and development and knowledge transfer programs across the clean energy industry.

GREEN HYDROGEN

Algeria is getting a new 50 MW green hydrogen plant with help from Germany

Germany signs off on EUR 12 mn hydrogen pilot project in Algeria: Algeria and Germany have signed a contract to jointly develop a EUR 12 mn 50 MW green hydrogen project in Algeria, according to a statement.

What we know: The German Development Bank KfW will be extending a portion of the financing for the project, the statement notes. It is unclear whether this is the same 50 MW project Sonatrach and VNG AG agreed to conduct feasibility studies for back in December.

More in the pipeline: Sonatrach — which aims to develop 15 GW of renewables capacity by 2035 to meet national climate targets — and VNG AG also want to expand cooperation on hydrogen-focused knowledge-transfer programs and development projects, Arkab noted in an earlier separate statement.

On the hunt for funds: Algeria — which said in May that it will allocate USD 20-25 bn to boost its green hydrogen production capacity — has been seeking investment and development avenues in the hydrogen sector with Exxon, Chevron, and Eni. The country was recently axed by Spain from the European Hydrogen Backbone (EHB), which aims to transport green hydrogen from North Africa to Europe. Despite diplomatic tensions with Madrid, Algeria is exploring a separate hydrogen interconnector to the EU with Italy.

CLIMATE DIPLOMACY

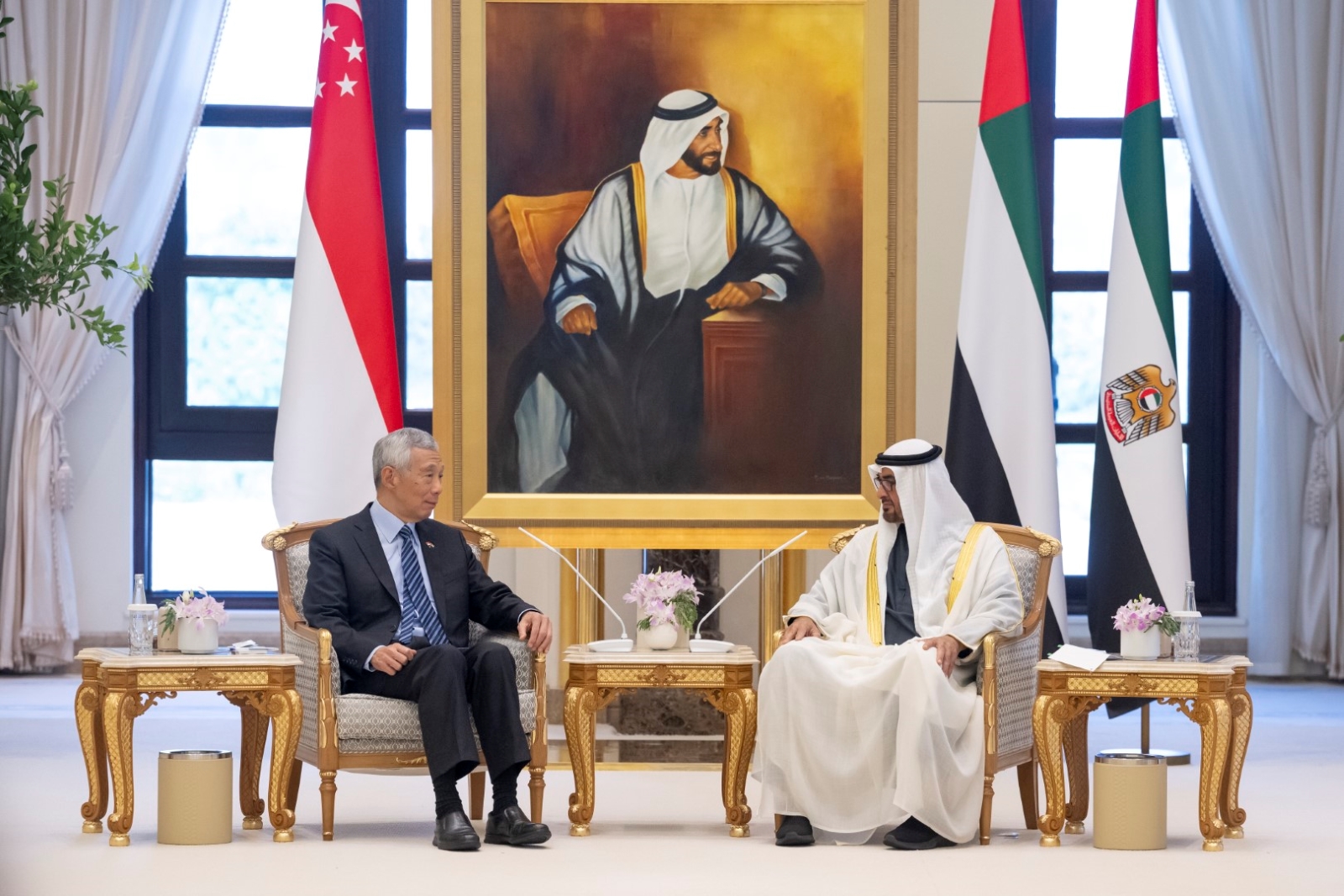

The UAE and Singapore team up on green tech and smart cities

UAE, Singapore partner to cooperate on green tech + smart cities: Singapore’s Prime Minister Lee Hsien Loong and UAE President Mohamed Al Nahyan signed an MoU to increase cooperation on developing carbon reduction tech, smart city construction, and environmental protection partnership, Wam reports. The MoU builds on the Singapore-UAE Comprehensive Partnership signed back in 2019.

Singapore is active in the region’s clean energy market: Singapore’s Sembcorp Utilities was among developers selected for Oman’s 500 MW Manah 2 PV plant. Singapore’s sovereign fund GIC and French hydrogen investor Hy24 also invested USD 115 mn in InterContinental Energy's green hydrogen expansion plans in the Middle East and Australia. Singapore-based carbon trading exchange AirCarbon Exchange also launched the UAE Carbon Alliance with the UAE Independent Climate Change Accelerators in June to set up a framework for carbon markets.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- Dewa and Switzerland explore collaboration on renewable energy: Dubai Electricity and Water Authority CEO Saeed Mohammed Al Tayer and Consul-General of Switzerland in Dubai Angelica Schempp discussed collaboration in developing and deploying clean and renewable energy, energy efficiency, and the water sector. (Wam)

GREEN TECH

UAE startup Terra debuts MENA’s first swappable battery station for EVs

Dead battery? No problem: UAE startup Terra has launched MENA’s first smart battery swapping solution for EVs following the development of its first fleet of all-electric motorbikes in July, according to a statement. The number of battery swapping units at designated gas and EV charging stations was not revealed, nor were the prices for each battery pack or how the depleted battery cells would be repurposed.

Battery swaps provide a solution to poor EV charging infrastructure: The drop-in replacement battery swapping solution — which can be completed in about five minutes depending on EV and battery make — offers a quick fix to poor EV charging infrastructure globally, and can help accelerate the transition to green mobility by enabling replenishment of EV driving range on the go instead of lengthy recharge durations. EV charging durations can take between 30 minutes and 12 hours depending on battery size and charging point speed. The global swappable EV battery market was valued at USD 452.9 mn in 2022, and is forecast to grow at a 22.8% CAGR rate from 2023 to 2030.

What they said: “What sets Terra apart is our vision of a universal swapping network that caters to all-electric vehicles on the road. We are not just making EVs more accessible; we are creating a versatile, all-inclusive swapping network that welcomes all-electric vehicles, further propelling the eco-conscious future of the last-mile delivery Industry,” the company noted.

Two birds, one EV maker? Terra also launched their Reviving Earth initiative which will see the company plant a mangrove tree for each of their electric motorbikes that hits the UAE roads.

ALSO ON OUR RADAR

Oman explores setting up a hydrogen fueling network in Duqm: Omani state-owned gas network operator OQ has signed an agreement with Oman’s Transport, Communication, and Information Technology Ministry, Asyad Group, Oman Oil Marketing Company, and Air Liquide Group to conduct a joint study on the feasibility of establishing hydrogen fuelling stations in the country’s Duqm economic zone, the Oman News Agency (ONA) reported on Sunday. The joint study aims to leverage Oman’s proximity to foreign markets and its high solar and wind power potential to create a centralized hub for hydrogen-powered vehicle recharging, ONA says.

On a roll: Earlier this month, BP Oman and Opaz signed an agreement to set up a green hydrogen plant in Duqm, which is planned to have an annual 150k ton production capacity to be powered by 3.3 GW of renewable power. Oman was the first MENA country to outline a hydrogen production strategy, announcing in November plans to earmark USD 140 bn in investments by 2050 to expand generation of the energy source and produce between 1-1.25 mn metric tonnes of green hydrogen by 2030, rising to 3.25-3.75 mn metric tons by 2040, and 7.5-8.5 mn metric tons by 2050.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- KSA + South Korea agree to swap knowledge: KSA’s state-owned Saline Water Conversion Corporation (SWCC) signed two knowledge-transfer agreements with South Korean firms on desalination, green hydrogen, and carbon capture. (Saudi Press Agency)

AROUND THE WORLD

Power Capital Renewable Energy is up for sale: Power Capital Renewable Energy (PCRE), a big developer of solar energy and battery storage in the UK, is up for sale by its backer Omnes Capital, Bloomberg reports. The valuation of the company came at EUR 400 mn (USD 424 mn). PCRE has a 3.5 GW portfolio of solar and energy storage assets across Ireland and the US. Akereos Capital has been retained to find a buyer, and the sale will either involve a majority stake or 100% of the firm.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- Occidental quietly offloads major CCS plant: Oil giant Occidental sold its Century carbon capture and storage (CCUS) plant last year after a decade of economic issues. The plant was found to have run with less than a third of its capacity since it was established and was sold for USD 200 mn, 4x less than the construction investment alone. (Bloomberg)

CLIMATE IN THE NEWS

Testing EV battery health is essential for the secondhand market: Startups are racing to test and certify battery health and performance for used EVs to help buyers determine their worth in the secondhand market, Reuters reports. The value of used EV batteries — which constitute 40% of an EV’s price tag — depends mainly on its driving range and ability to hold a charge.

Why does this matter? The lack of independent tests for EVs' range has hurt the market and being able to measure the battery's health will help buyers in the second market value their purchases better, the newswire adds. Used EV prices fell drastically last month y-o-y in the US and the UK, according to reports by EV startup Recurrent and Autotrader. Autotrader cited "consumer concerns around battery life in used EVs."

The pressure is on to develop testing methods: UK startup Altelium has developed an EV battery health test and certificate which it's aiming to launch this year to over 7k US car dealers and 5k British dealers. "If the second-hand car market doesn't work properly, the new car market doesn't work properly and the electric transition won't happen," Altelium business development manager Alex Jones told Reuters. Volkswagen-backed Australian startup Aviloo also developed a battery test for dealers and individuals and found that EV battery health can vary up to 30% after 100k km. Consumers looking for used EVs with 90% of the brand-new range can end up with ones at just 70% due to previous bad charging habits that should knock thousands off its value, Aviloo CEO Marcus Berger told the newswire.

CALENDAR

OCTOBER 2023

24-26 October (Thursday-Saturday): Future Investment Initiative, Riyadh, KSA.

25-26 October (Friday-Saturday): Offshore & Floating Wind Europe 2023, London, United Kingdom.

25-27 October (Wednesday – Friday): International Fair of Energy Transition, Tunis, Tunisia.

29 October-2 November (Sunday-Thursday): Cairo Water Week, Cairo, Egypt

29 -31 October (Sunday-Tuesday): Egypt Energy Conference, Egypt International Exhibition Centre, Cairo, Egypt.

30 October – 2 November (Monday-Thursday): International Solar Alliance Assembly, New Delhi, India.

30 October – 1 November (Monday-Wednesday) ISWA 2023 World Congress: Global action towards a net-zero future, Muscat, Oman.

31 October-2 November (Tuesday-Thursday): Financial Times’ Energy Transition Summit, London, UK.

31 October-2 November (Tuesday-Thursday): World Hydropower Congress, Bali, Indonesia.

NOVEMBER 2023

1-3 November (Wednesday-Friday): Forbes Middle East Sustainability Leaders Summit 2023, Abu Dhabi, UAE.

7-8 November (Tuesday-Wednesday): ADIA Lab Symposium on Climate Change and Health Sciences, Abu Dhabi, UAE.

7-8 November (Tuesday-Wednesday): The 2023 US Algeria Energy Forum, Washington DC, USA.

9-10 November (Thursday-Friday): International Renewable Energy Agency Investment Forum, Uruguay.

9-15 November (Thursday-Wednesday): Intra-African Trade Fair 2023, Cairo, Egypt.

11-13 November (Saturday-Monday): GCC-Türkiye Economic Forum, Istanbul, Turkey.

15-17 November (Wednesday-Friday): WETEX and Dubai Solar Show, Dubai, UAE.

15-18 November (Wednesday-Saturday): DEWA’s First MENA Solar Conference, Dubai, UAE.

20-24 November (Monday-Friday) International Civil Aviation Organisation’s Aviation and Alternative Fuels conference, Dubai, UAE.

27-30 November (Monday-Thursday) Abu Dhabi Finance Week (ADFW), Abu Dhabi, UAE.

28-29 November (Tuesday-Wednesday): World Green Economy Summit (WGES), Dubai, UAE.

30 November – 12 December (Thursday-Tuesday): Conference of the Parties (COP 28), Dubai, UAE.

DECEMBER 2023

4 December (Monday): Saudi Green Initiative Forum, Dubai, UAE.

4 December (Monday): Abu Dhabi Sustainability Week (ADSW) summit, Dubai, UAE.

4-7 December (Monday-Thursday): International Conference on Global Warming, Ras Al Khaimah, UAE.

6-7 December (Wednesday-Thursday): Reuters’ Energy Transition MENA conference, Dubai, UAE.

8 December (Friday): Youth for Sustainability Forum (Y4S), Dubai, UAE.

12-14 December (Tuesday-Thursday): Green Hydrogen Summit Oman, Oman Convention and Exhibition Center, Muscat, Oman.

18-20 December (Monday-Wednesday): Saudi Arabia Smart Grid Conference, Hilton Riyadh Hotel & Residences, Riyadh, Saudi Arabia.

JANUARY 2024

9-11 January (Tuesday-Thursday): Future Minerals Forum, Riyadh, Saudi Arabia.

FEBRUARY 2024

26-28 February (Monday-Wednesday): Management and Sustainability of Water Resources, Dubai, UAE.

MARCH 2024

4-6 March (Monday-Wednesday): International Conference on Sand and Dust Storms in the Arabian Peninsula, Riyadh, Saudi Arabia.

APRIL 2024

16-18 April (Tuesday-Thursday): World Future Energy Summit, Abu Dhabi, UAE.

23-25 April (Tuesday-Thursday): Connecting Green Hydrogen MENA, Dubai, UAE.

MAY 2024

19-21 May (Sunday-Tuesday): Saudi Energy Convention, Riyadh, KSA.

JUNE 2024

5 June (Wednesday): World Environment Day, Saudi Arabia.

OCTOBER 2024

10-12 October (Tuesday-Thursday): Autonomous E-Mobility Forum, Doha, Qatar.

DECEMBER 2024

2-13 December (Monday-Friday): Conference of the Parties (COP16) to the United Nation Convention to Combat Desertification, Riyadh, KSA.

EVENTS WITH NO SET DATE

2023

Mid-2023: Oman set to sign contracts for green hydrogen projects.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

2024

12-14 February (Monday-Wednesday): Sustainable Aviation Futures MENA Congress, Dubai, UAE.

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

2025

International Union for Conservation of Nature World Conservation Congress, Abu Dhabi, UAE.

UAE to have over 1k EV charging stations installed.

2026

UITP Global Public Transport Summit, Dubai, UAE.

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2050

Tunisia’s carbon neutrality target.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.