- Petrojet reportedly tapped as contractor for two concentrated solar power plants in Egypt. (Solar)

- Jordan + World Bank undertake studies for smart grid infrastructure to accommodate more renewables. (What We’re Tracking Today)

- Oman-UAE-Saudi Arabia electrical interconnection moves to planning phase. (Also on Our Radar)

- A big step forward for ocean energy as a renewable energy source. (Green Tech)

- Why a clean energy transition is the only way forward for climate resilience in MENA. (Macro Picture)

- Swedish EV battery maker Northvolt raises USD 1.2 bn to fund expansion. (Around the World)

Thursday, 24 August 2023

Petrojet reportedly tapped as contractor for two concentrated solar power plants in Egypt

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, ladies and gents. The news cycle remains slow as people enjoy the last stretch of summer, but there are still some updates trickling in from around the region and abroad.

OUR TOP STORY TODAY- A consortium of Egypt’s Smart Engineering Solutions and Germany’s Frenell have reportedly selected Egypt’s Petrojet to be the contractor for two concentrated solar power stations in Egypt’s New Valley.

^^ We have all the details on this story and more in the news well, below.

THE BIG CLIMATE STORY OUTSIDE THE REGION- Greece continues to battle raging wildfires: Wildfires near Greece’s Athens continued to spread as powerful winds continued to fan flames. At least 20 people have been killed due to the blazes breaking out across the country amid an unprecedented summer that saw record-breaking temperatures, flooding and wildfires in Europe and North America. “It’s a not-seen-before situation,” Greek Civil Protection minister Vasilis Kikilias said, saying that around 355 new fires broke out in the past five days with 209 in the last 24 hours alone. He deemed this year’s summer as the first to have so many regions put on highest level of fire alert. Several European nations are helping Greek authorities contain the fires, with firefighters and helicopters dispatched from Croatia, Cyprus, Czech Republic, Germany, Romania and Sweden.

The spreading wildfires is dominating coverage in the international press: Reuters | Bloomberg | The Financial Times | AFP | The Associated Press | BBC | The New York Times

WATCH THIS SPACE #1- Jordan makes a bid for smart grid infrastructure: The Jordanian government is undertaking studies with the World Bank on smart grid infrastructure in a bid to accommodate the expected influx of renewables capacity in coming years, push down power losses, and boost the country’s electrical transmission capacity, according to a statement. Jordan is also drawing up a plan to increase dependence on local power assets, especially on the clean energy front as part of its target to have renewables comprise 50% of its electricity mix by 2030.

A new renewables strategy soon? The kingdom is expected to announce its green hydrogen strategy this quarter, Assistant Secretary-General of the Energy and Mineral Resources Ministry Hassan Al-Hayari said in June. The government will also reportedly launch its long-term energy strategy in 2024, with incentives geared at boosting renewable energy, power storage, and green hydrogen production expected to be central to the plan.

WATCH THIS SPACE #2- Extending operations of existing nuclear reactors requires bns: Creating a global net-zero pathway by 2050 will require USD 50-100 bn in investments to extend the operations of existing nuclear reactors, according to the latest Supply Chain Report by the World Nuclear Association (WNA). Global nuclear generation capacity could reach as much as 839 GW by 2040 through new reactor deployments, but would require between USD 900 bn to USD 1.8 tn in financing, the report says. The global capacity of operable nuclear power reactors reached 437 units generating 394 GW as of the end of 2022, the WNA notes, adding that an additional 60 units were under construction and over 400 more reactors were at various stages of planning. To reach carbon neutrality, international procurement investments should reach around USD 3-4 bn annually.

REMEMBER- MENA is going big on nuclear: The Emirates Nuclear Energy Corporation began operational readiness procedures for the fourth and final unit of Abu Dhabi’s Barakah Nuclear Energy Plant last month. The third unit added 1.4 GW to the UAE grid back in February, and the fourth phase is set to increase the plant’s full production volume to 5.6 GW of clean energy once fully operational — meeting some 25% of the UAE’s total energy needs. Over in Egypt, Russia’s state-owned Rosatom nuclear power company is building the country’s 4.8 GW Dabaa nuclear plant. Egypt and Rosatom began construction on the USD 30 bn plant in July 2022 and it should come online at the start of the next decade.

WATCH THIS SPACE #3- G20 countries doubled their fossil fuel spending in 2022 compared to pre-covid figures: Public spending on coal, oil, and gas in 20 of the world’s biggest economies doubled since 2019 reaching a record USD 1.4 tn in 2022, a report by Canadian think tank International Institute for Sustainable Development (IISD) found. G20 countries paid USD 1 tn in subsidies, USD 322 bn in investments by state-owned enterprises, and USD 50 bn in loans from public finance institutions, the report notes. IISD called on G20 leaders to end fossil fuel subsidies in developed countries by 2025, and by 2030 for the rest of the world.

Subsidies have a huge potential for reform: The IISD found that by setting a higher carbon tax of USD 25 to 75 per ton of greenhouse gasses, G20 governments can raise an extra USD 1 tn a year, which can open up “significant sums that could instead be used to address some of the planet’s most pressing challenges,” chief economist of a sustainability group at the World Bank and one of the lead authors of the study Richard Damania told The Guardian.

REMEMBER- A meeting of G20 energy ministers held in India last month failed to reach consensus on a fossil fuel phasedown as several major fossil fuel producing nations led by Saudi Arabia blocked the move. The IISD report comes ahead of a meeting of G20 countries in Delhi next month which is expected to set the tone for the UAE’s COP28 in November.

Can we expect better at COP28? While world leaders had agreed to phase out “inefficient” fossil fuel subsidies at the COP26 climate summit in Glasgow two years ago, last year’s COP27 failed to make further progress. Whether COP28 will be able to deliver a more tangible action plan for phasing out fossil fuels has been questioned by some groups who say the UAE has conflicting interests as both the summit host and a top oil producing country.

DATA POINT- Global investments in renewable energy are doing really well: New global investment in renewable energy soared 22% y-o-y in the first half of 2023 to USD 358 bn, reaching a record high for any six-month period, data published by BloombergNEF showed earlier this week. Most of the investments were for project deployments through asset finance and small-scale solar, representing a 14% y-o-y rise. China still maintained its position as the largest market during this period with USD 177 bn of new investments, while the US and Germany drew USD 36 bn and USD 11.9 bn in investments respectively.

We’re still far off mark: Spending rates on renewable energy deployment across asset finance and small-scale solar still needs to accelerate by 76% to align with the net-zero path, according to BNEF. The world needs to allocate a total of USD 8.3 tn in renewable energy deployment between 2023 and 2030 to stay in path with the global net-zero trajectory by 2050. This means that the world still needs to see investments of USD 590 bn through asset finance and small-scale solar per six-month period.

|

The Enterprise Finance Forum is taking place on 18-19 September at the St. Regis Hotel in Cairo. This flagship forum is the latest in our must-attend series of invitation-only, C-suite-level gatherings that allow senior members of our community to openly and frankly discuss critical issues in key sectors of the economy.

This is our first two-day event, which should give us plenty of time to dive into the nitty gritty of this industry we love. Our panels will see CEOs, bankers, investors and founders gather to discuss the future and trends shaping banking, finance, fintech and NBFS.

Our full agenda will be out at month’s end. Among the topics we’ll be discussing:

- Looking into the crystal ball: Top industry CEOs will join us on stage to answer tough questions on where we are as an industry, the forces that will shape all of our businesses going forward, and their views on dealflow in the year ahead.

- Surviving nuclear winter: We discuss how private equity and venture capital players are tackling challenges including fundraising and deployment in an environment in which it’s awfully difficult to price your local asset in USD terms.

- The robots are coming: We explore what the coming AI and big data means for the industry in our part of the world and what can bankers, NBFI, and fintech players do to capitalize on them.

- What do you do when nobody wants to be a banker — and when those who are already (investment or commercial) bankers are either (a) dreaming of doing their own startup or (b) moving to Dubai (or, increasingly, Riyadh)? We go deep into the weeds with industry leaders on how they’re building talent for tomorrow.

- NBFIs are a bubble. Prove me wrong: We chart the explosive rise of NBFIs and ask whether the industry is ready for a wave of consolidation. We’ll dive into whether consumer finance is starting to mature as a segment — and ask which sector is next.

- Handicapping fintech in 2024: We dive deep into which categories are getting traction, where the untapped potential is, what business they would start today if they could, and what we can expect of the sector in the year ahead.

- What’s a bank, anyway? Wherein we talk challenger and neobanks with the players looking to shake up the brick-and-mortar industry.

** NEW: MORE NETWORKING TIME- Our agenda includes expanded networking time, including an expanded coffee break and a post-event networking room for you to interact with your peers and speak one-on-one with the team at Enterprise.

STAY TUNED for more detail about our exciting agenda in the weeks to come.

TAP OR CLICK HERE if you want to express interest in attending. We’ll be sending out the first batch of invitations soon.

Do you want to become a commercial partner? Ping a note to Moustafa Taalab, our head of commercial.

***

YOU’RE READING ENTERPRISE CLIMATE, the essential regional publication for senior execs who care about the world’s most important industry. Enterprise Climate covers everything from finance and tech to regulation, products and policy across the Middle East and North Africa. In a nod to the growing geographical ambitions of companies in our corner of the world, we also include an overview of the big trends and data points in nearby countries, including Africa and southern Europe.

Enterprise Climate is published by 5am CLT / 5am Riyadh / 6am UAE Monday through Thursday by Enterprise, the folks who bring you Enterprise Egypt, your essential 6am and 3pm read on business, finance, policy and economy in Egypt and emerging markets.

EXPLORE MORE OF ENTERPRISE ON THE WEB — tap or click here to read EnterpriseAM, EnterprisePM, and The Weekend Edition on our powerful new website packed with reader-friendly features.

Subscribe to Enterprise Climate here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

CIRCLE YOUR CALENDAR-

The Dominican Republic will host the COP27 Transitional Committee from Tuesday, 29 August to Friday, 1 September. The meeting aims to establish institutional arrangements, modalities, governance structures, and terms of reference for the landmark Loss and Damage Fund. It also wants to expand sources for climate funding under the program.

Saudi Arabia will host the Sustainable Maritime Industry Conference from Monday, 4 September to Wednesday, 6 September in Jeddah. Organized by KSA’s Transport and Logistic Services Ministry, the event will feature over 50 speakers to spotlight sustainability, new technologies, and digitization efforts in the maritime industry. Speakers will include International Maritime Organization Secretary General Kitack Lim and World Ocean Council CEO Paul Holthus.

Kenya will host the Africa Climate Summit from Monday, 4 September to Wednesday, 6 September in Nairobi. The event will bring together government leaders and investors to share pathways to increasing Africa’s climate resilience and serve as a platform to inform and frame commitments, pledges, and outcomes, ultimately leading to the development of the Nairobi Declaration on Climatic Change.

India will host the G20 Heads of State and Government Summit from Saturday, 9 September to Sunday, 10 September in New Delhi. A G20 Leaders’ Declaration will be adopted at the conclusion of the summit, stating commitment towards priorities discussed and agreed upon during previous ministerial and working group meetings through the year, the organizers note. The last meeting of G20 energy ministers in July failed to reach consensus on a fossil fuel phasedown as several major producing nations, led by Saudi Arabia, blocked the move. Among other expected announcements, the Global Biofuels Alliance is scheduled to be launched at the summit.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

SOLAR

Petrojet tapped as contractor for two CSP plants in Egypt’s New Valley

Petrojet tapped for New Valley’s solar plants: A consortium comprising of Egypt’s Smart Engineering Solutions (SES) and German renewable energy firm Frenell has selected Cairo-based Petrojet to be the contractor for two concentrated solar power (CSP) plants in Egypt’s New Valley, Al Mal reports, citing sources it says have knowledge of the matter. The two plants — the first of their kind in Egypt to employ such technology — will have a capacity of up to 70 MW.

What we know: The sources valued the project’s investments at up to EUR 340 mn (c. EGP 12 bn), adding that the funding will be sourced from Frenell. The construction phase will reportedly last 20 months, SES Egypt’s CCO Ahmed Naguib said, adding that SES is working on securing the necessary plots for the project to kick off construction.

A bid for local manufacturing? Petrojet is currently in talks with the consortium to manufacture some of the equipment needed for the project locally instead of relying on imports in a bid to lower costs, they said.

It's been an eventful week for CSP: The Egyptian Electricity Holding Company (EEHC) launched this week a global tender for the construction and operation of five CSP plants that will generate electricity to desalinate water on Egypt’s North Coast. The facilities will be constructed under a 25-year BOO structure, with bidders asked to submit their offers by no later than 27 September, according to the notice. The five CSP plants — which will see investments of USD 270 mn — will have an overall capacity of 250 MW. The BOO structure would see the Electricity Ministry purchase electricity from the plants and feed it into the national grid, they said, adding that the facilities should help desalinate over 400k cubic meters per day.

GREEN TECH

A major ocean energy agreement signals potential for the nascent renewables source

A big step toward for ocean energy in West Africa: Plans to install the first 1.5 MW commercial-scale ocean thermal energy conversion (OTEC) floating platform seem to be moving forward, with UK-based ocean energy company Global OTEC signing an MoU with France-based heat-to-electricity provider Enogia to develop key subsystems for the project, according to a statement. The station will be located in the small island county of São Tomé and Príncipe off the coast of West Africa, where more commercial solutions such as solar and wind energy are less viable due to land scarcity. The project — scheduled for operation in 2025 — signals a new era for the nascent renewable energy source.

Types of ocean energy: Some ocean energy technologies rely on the movement of currents such as tidal steam, tidal barrage, and waves, a recent report (pdf) by the International Renewable Energy Agency (Irena) and Ocean Energy Europe (OEE) said. While tidal stream technologies have electrical generators installed directly into them, tidal barrages do not, and instead require a wall to obstruct the flow and generate energy. Other technologies like OTEC and salinity gradients are able to extract energy from temperature changes and differences in salinity concentration respectively, the report explains.

A host of benefits: Ocean energy can work harmoniously with the blue economy, contribute to climate change mitigation, and create jobs, all while supporting overall grid resilience, the report shows. It is also a relatively predictable source that can easily integrate other renewables and energy storage, in addition to its potential to combine with water desalination. Some 680k direct jobs could be created globally by 2050 if the nascent sector continues to grow, according to IRENA.

Ocean energy could hold a global market potential of 350 GW by 2050 for coastal and island countries, according to the report. The study stresses on the necessity of scaling up investments in the technology to help with decentralization and decarbonization efforts, especially in the face of energy insecurity heightened by Covid and the Russia-Ukraine conflict.

The current global potential isn’t matching deployment: While tidal stream and wave energy converters are the most mature solutions applicable across different geographies, only 10.6 MW are installed globally, according to 2020 figures. Instead, tidal barrages — which are often more intrusive to the environment and have a lower energy potential — represent more than 95% of all ocean energy installed. OTEC has the highest energy potential, but one of the lowest deployment rates.

Island and coastal countries will be the most to benefit: Coastal countries and island communities have strong potential to bring together a “blue economy” — one which sees energy channeled from the ocean to back the decarbonization of vital marine activities like shipping, power generation, cooling, aquaculture, and water desalination. Such a blue economy is needed due to the lack of inland space to deploy onshore renewables and costly fossil fuel imports and electricity generation, the report explains. The deployment of the technology could help bring in new revenue streams and higher cashflows for such areas, while slashing the levelized cost of electricity (LCOE).

But MENA is also interested: Oman’s Transport Ministry and a consortium of companies inked an agreement back in March to extend feasibility studies for tidal power at the Masirah sea bridge, with the results expected by the end of the year to guide the investment decision. Some see growing potential near Abu Dhabi, where there are habitual tidal creeks and lagoons, according to Energy Dubai. Dubai’s Palm Islands could also help the Gulf country build on tidal energy too.

But investments are needed: To reach appropriate volumes of renewable energy and facilitate cost reductions, ocean energy will need to develop utility-scale projects, the Irena and OEE report said. Steps like introducing joint tenders with other renewable installations and promoting application on islands and in coastal countries will require “clear signals from governments to provide visibility about the future market to private investors,” the report added. Other measures like feed-in tariffs with clear targets for energy generation and dedicated deployment zones like wind energy and solar PV projects are also suggested.

MACRO PICTURE

A climate-resilient energy transition is inevitable for MENA as warmer planet spells trouble

Why a clean energy transition is the only way forward for climate resilience in MENA: As the MENA region continues to be one of the world’s regions most vulnerable to the hazardous effects of climate change, an urgency emerges to push with energy transition to help alleviate the impact of the ongoing crisis, a recent IEA report on MENA climate resilience showed. A warmer planet has pushed temperatures across the region up 0.46 C per decade, which is well above the world average of 0.18 C. A significant shift in rainfall patterns has also worsened an existing water scarcity in some nations, with droughts in Morocco and Tunisia. The UAE, Iran, KSA, Qatar, Oman and Yemen have also experienced intense flooding.

Water scarcity is a major culprit: The total rainfall fell by c. 8.3% per decade in the period between 1980-2022, and a further decrease in rainfall is projected while increasing in the Arabian Peninsula. A scarcity of water from the drop in rainfall in southern and eastern Mediterranean countries is set to negatively affect fossil-fueled power plants, which account for 91% of their electricity and generation and depend on freshwater for cooling. Most of the fossil-power plants in those regions are forecast to see a drier climate in the coming decade.

Extreme heatwaves will pose a challenge to energy resilience: Soaring temperatures are fuelling fears over energy system resilience in the region, with temperatures in MENA by 2081-2100 in the region would still go beyond global averages in a low-emissions and high-emissions scenario. Peak electricity demand triggered by soaring temperatures could also cut back on the efficiency of power generation and networks and increase pressure on electricity supply. The operations of natural gas-fired power plants, which hold the largest share of electricity generation in the region at 74% could take a hit due to warmer air mass flow entering the gas turbine compressor. The susceptibility could be even higher in the Arabian Peninsula, with 90% of installed gas-fired capacity set to be impacted.

Solar and wind could take a hit from the heat: Solar and wind power generation become less efficient during extreme heat events due to the equipment in panels and turbines are designed to operate in temperatures of around 25C. High temperatures also impact output, power lines, transmission capacity, and trigger losses. Around 90% of wind power plants would be vulnerable to an increase of 40 hot days annually under a high-emissions scenario.

What needs to happen: Energy suppliers need to rethink their designs for wind power plants and pursue innovative cooling technologies for solar PV to help push climate resilience in the region, according to the IEA. Both governments and consumers need to shift towards energy efficient improvements in used cooling devices to help accommodate growing electricity peak demand.

Some country specifics: Rising temperatures in Egypt — where the IEA sees a higher level of warming than the world average by 2100 — could exert stress on power generation from solar PV and wind and natural gas, according to a separate IEA report. In Morocco, soaring temperatures could also pressure the country’s capacity for power generation and distribution, according to a country-specific IEA report. It outlined several measures to ensure a climate-resilient energy transition in the country, including a dedicated sectoral plan for the energy sector and specific strategies for the sector against climate-driven catastrophes.

AROUND THE WORLD

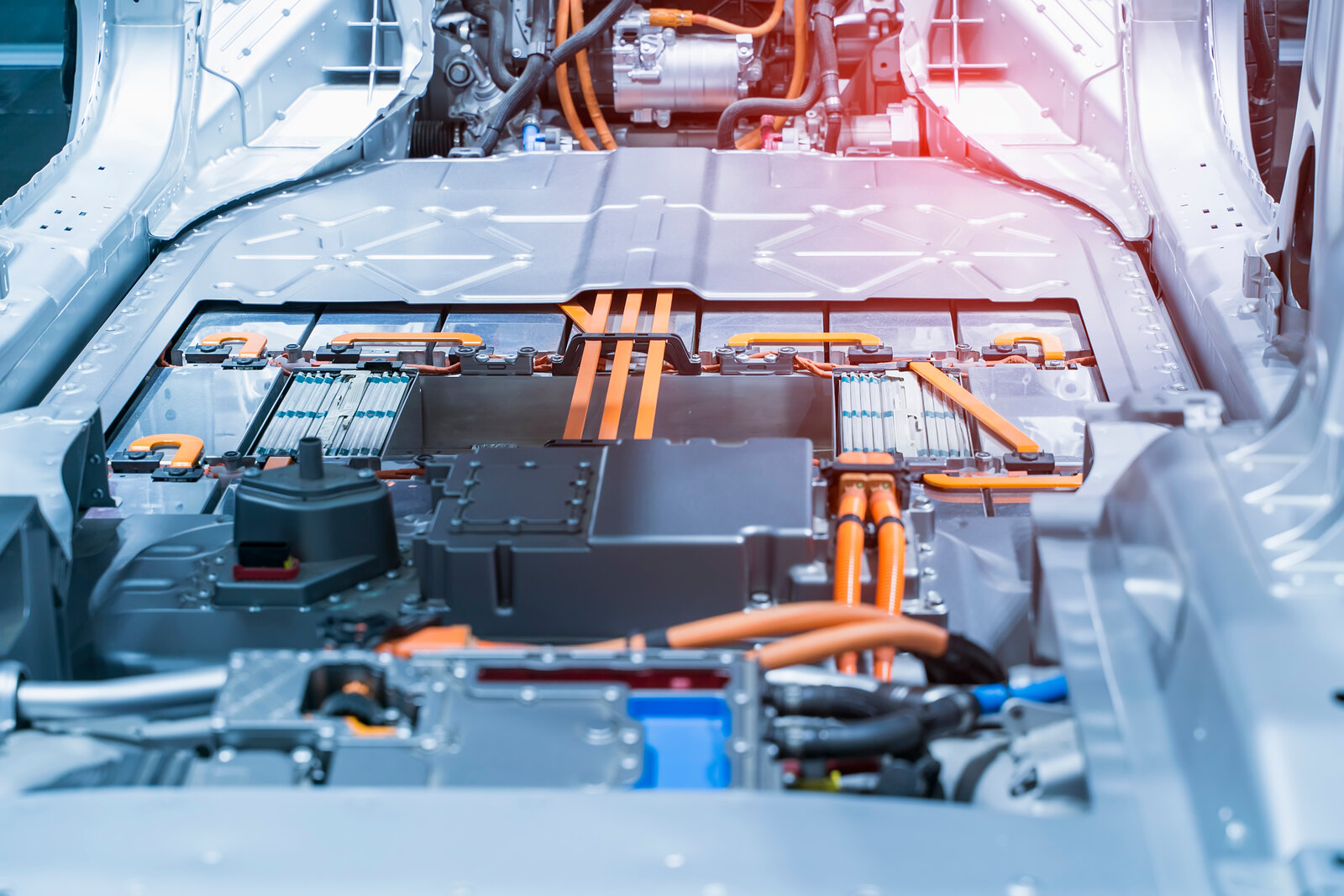

Northvolt raises over USD 1 bn to fund new Europe, North America factories: Swedish electric battery maker Northvolt has raised USD 1.2 bn from international investors — including BlackRock and Goldman Sachs — and Canadian pension funds in preparation for expanding in Europe and North America, CFO Alexander Hartman told Reuters. The latest round brings Northvolt’s total debt and equity financing to USD 9 bn as it aims to become Europe's biggest battery manufacturer. Some sources revealed Northvolt is planning to go public at a valuation of more than USD 20 bn earlier this year.

The company has a Germany and Canada plan in the works: Northvolt is planning to build a EUR 600 mn plant in Germany, according to the newswire, with rumors circulating the company is also close to finalizing an agreement to build a multi bn USD battery factory in Canada. Currently Northvolt has plants in Sweden, Portugal, Germany, Poland, Norway, and the US, according to their website.

REMEMBER- Northvolt wants to take over the EV market by thinking outside the box: Northvolt partnered with Norwegian aluminum giant Norsk Hydro to build a recycling plant that turns used and defective EV batteries into mineral powder used in battery manufacturing. The plant is expected to process 25k electric car batteries within the next months, to become the largest battery recycling plant in Europe.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- Nissan EV sales surpass 1 mn unit milestone: Japanese automaker Nissan has sold more than 1 mn EVs since it launched its first all-electric car in 2010. (Statement)

ALSO ON OUR RADAR

Oman-UAE-Saudi Arabia electrical interconnection in the works: A 400 KV electrical interconnection extending from Ibri in northwest Oman to the UAE’s Silaa border with Saudi Arabia and linking to the Gulf Cooperation Council Interconnection Authority (GCCIA) grid is currently in the planning phase following completion of an evaluation study, Oman's Power and Water Procurement Company (Nama) said in its 2023-2029 power outlook report (pdf). The expected price tag for the project was not disclosed.

The details: Spanning 500 kilometers, the interconnector will have a 400 MW transfer capacity and will be able to carry up to 800 MW in emergencies. The interconnector is expected to increase Oman’s net electrical transfer up to 1.3 GW. The 400 KV link will enable GCCIA members to improve transmission stability, generation planning, and trade potential relative to the pre-existing 220 KV (pdf) link via UAE, the report adds.

CLIMATE IN THE NEWS

Can new tech improve ocean carbon capture? US startup Ebb Carbon is developing ocean-based CO2 removal tech in a bid to capture up to 1 mn tons of carbon from waterways annually to alleviate the climate-driven acidification of oceans, CNBC writes. Oceans are nature’s largest carbon sink, absorbing a quarter of global CO2 emissions and generating half of the world’s oxygen supply, but rising global temperatures coupled with an excess of CO2 levels are weakening its natural ability to capture emissions and pump out air. Ocean oxygen levels are expected to drop between 3-4% on average by 2100 overall due to climate change, according to the International Union for Conservation of Nature.

How it works: The Ebb system incorporated into the company’s CO2 removal modules uses an electrochemical process to remove acid from seawater, which is then returned to the ocean with heightened CO2 absorption capabilities, the news outlet explains. The company’s first carbon capturing units at the marine labs in the US Department of Energy’s Pacific Northwest National Laboratory in Washington state have a collective annual carbon capture capacity of 100 tons. The company’s technology costs are over USD 100 per ton of CO2 captured, but as the startup continues to expand to more locations and couple their systems with existing infrastructure like desalination facilities and coastal power plants, carbon removal price tags are expected to dramatically fall, co-founder and CEO of Ebb Carbon Ben Tarbell told CNBC. The company has raised a total of USD 27.75 mn so far, he added.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- Climate-linked disasters are spiking ins. claims: Ins. claims are set to exceed USD 100 bn for the third consecutive year as climate change continues to exacerbate weather-related incidents, including wildfires, hail, and floods. Munich Re estimates global natural disaster ins. costs totalled USD 43 bn in 1H 2023, while Swiss Re has pegged it at USD 50 bn. (Bloomberg)

CALENDAR

AUGUST 2023

20-24 August (Sunday-Wednesday): World Water Week 2023, Stockholm, Sweden.

29 August-1 September (Tuesday-Friday): Third meeting of the COP27 Transitional Committee, Dominican Republic.

SEPTEMBER 2023

4-5 September (Monday-Tuesday): GCF Private Investment for Climate Conference, Nairobi, Kenya.

4-6 September (Monday-Wednesday): Sustainable Maritime Industry Conference, Jeddah, Saudi Arabia.

4-6 September (Monday-Wednesday): Africa Climate Summit, Nairobi, Kenya.

5-7 September (Tuesday-Thursday): Global Water, Energy and Climate Change Congress (GWECCC), Manama, Bahrain.

7-8 September (Thursday-Friday): Annual Regional Sustainability and Development Forum, Cairo, Egypt.

9-10 September (Saturday-Sunday): G20 Heads of State and Government Summit, New Delhi, India.

9-20 September (Saturday-Wednesday): 2023 Sustainable Development Goals Summit, New York, USA.

11-13 September (Monday-Wednesday): Global Congress on Renewable and Non-Renewable Energy, Dubai, UAE.

12-13 September (Tuesday-Wednesday): Industry Transition 2023, Pittsburgh, USA.

12-15 September (Tuesday-Friday): WTO Public Forum, Geneva, Switzerland.

13-14 September (Wednesday-Thursday): Hydrogen Egypt Summit, Nile Ritz Carlton, Cairo.

18-19 September (Monday-Tuesday): The Enterprise Finance Forum, Cairo, Egypt.

19-21 September (Tuesday-Thursday): World Power-to-X Summit, Marrakesh, Morocco.

28 September (Thursday): International Energy Agency Critical Minerals and Clean Energy Summit, Paris, France.

Chariot Limited and Total Eren’s feasibility study on a 10 GW green hydrogen plant in Mauritania to be completed.

Egypt set to launch alliance to shore up climate financing in developing countries

OCTOBER 2023

4 October (Wednesday): Arabia CSR Gala Awarding Ceremony, UAE.

4-5 October (Wednesday-Thursday): Future Sustainability Forum, Dubai, UAE.

8-10 October (Sunday-Tuesday): Saudi Green Building Forum, Riyadh, Saudi Arabia.

10-11 October (Tuesday-Wednesday): Green Energy Africa Summit, Cape Town International Convention Centre 2, Cape Town, South Africa.

8-12 October (Sunday-Thursday): MENA Climate Week, Riyadh, Saudi Arabia.

9-15 October (Monday-Sunday): World Bank/IMF 2023 Annual Meetings, Marrakech, Morocco.

10-12 October (Tuesday-Thursday): Autonomous E-Mobility Forum, Doha, Qatar.

16-18 October (Monday-Wednesday): Climate Week, Rome, Italy.

18-20 October (Wednesday-Friday): Morocco and Belgium business meeting on green hydrogen, Tangiers, Morocco.

17-18 October (Tuesday- Wednesday): Critical Minerals Africa Summit, Cape Town, South Africa.

17-20 October (Tuesday-Friday): Fourth meeting of the COP27 Transitional Committee, TBD.

25-26 October (Friday-Saturday): Offshore & Floating Wind Europe 2023, London, United Kingdom.

29 October- 2 November (Sunday-Thursday): Cairo Water Week, Cairo, Egypt

31 October – 2 November (Tuesday-Thursday): World Hydropower Congress, Bali, Indonesia.

NOVEMBER 2023

1-3 November (Wednesday-Friday): Forbes Middle East Sustainability Leaders Summit 2023, Abu Dhabi, UAE.

9-10 November (Thursday-Friday): International Renewable Energy Agency Investment Forum, Uruguay.

9-15 November (Thursday-Wednesday): Intra-African Trade Fair 2023, Cairo, Egypt.

15-17 November (Wednesday-Friday): WETEX and Dubai Solar Show, Dubai, UAE.

16-17 November (Thursday-Friday): World Green Economy Summit (WGES), Dubai, UAE.

15-18 November (Wednesday-Saturday): DEWA’s First MENA Solar Conference, Dubai, UAE.

20-24 November (Monday-Friday) International Civil Aviation Organisation’s Aviation and Alternative Fuels conference, Dubai, UAE.

27-30 November (Monday-Thursday) Abu Dhabi Finance Week (ADFW), Abu Dhabi, UAE.

30 November – 12 December (Thursday-Tuesday): Conference of the Parties (COP 28), Dubai, UAE.

DECEMBER 2023

4 December (Monday): Saudi Green Initiative Forum, Dubai, UAE.

12-14 December (Tuesday-Thursday): Green Hydrogen Summit Oman, Oman Convention and Exhibition Center, Muscat, Oman.

18-20 December (Monday-Wednesday): Saudi Arabia Smart Grid Conference, Hilton Riyadh Hotel & Residences, Riyadh, Saudi Arabia.

FEBRUARY 2024

26-28 February (Monday-Wednesday): Management and Sustainability of Water Resources, Dubai, UAE.

APRIL 2024

16-18 April (Tuesday-Thursday): World Future Energy Summit, Abu Dhabi, UAE.

23-25 April (Tuesday-Thursday): Connecting Green Hydrogen MENA, Dubai, UAE.

DECEMBER 2024

2-13 December (Monday-Friday): Conference of the Parties (COP16) to the United Nation Convention to Combat Desertification, Riyadh, KSA.

EVENTS WITH NO SET DATE

2023

Mid-2023: Oman set to sign contracts for green hydrogen projects.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

2024

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

2025

International Union for Conservation of Nature World Conservation Congress, Abu Dhabi, UAE.

UAE to have over 1k EV charging stations installed.

2026

UITP Global Public Transport Summit, Dubai, UAE.

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2050

Tunisia’s carbon neutrality target.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.