- Aramco gets busy with emissions reduction projects and dips its toe in geothermal energy. (Carbon Emissions)

- Masdar inks mega renewable projects in Malaysia under USD 8 bn agreement. (Renewables)

- Dubai-based NWTN reveals the UAE’s first locally manufactured EV. (Electric Vehicles)

- Saudi Arabia expands fast-charging infrastructure presence with the launch of Electric Vehicle Infrastructure Company. (Electric Vehicles)

- Saudi Arabia is set to roll out a greenhouse gas credits scheme early next year. (What We’re Tracking Today)

- Morocco’s era of water scarcity intensifies as it enters a fifth consecutive year of drought. (What We’re Tracking Today)

- Siemens Gamesa may shut down factories and sales offices in efforts to curb fallout from EUR 2.2 bn losses. (What We’re Tracking Today)

- Single-species plantations are doing more harm than good for the environment. (On Your Way Out)

Tuesday, 10 October 2023

Aramco gets busy with emissions reduction projects and dips its toe in geothermal energy

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends. It’s another busy morning with some big EV updates from UAE and KSA and more detail on Masdar’s sizable renewables agreement with Malaysia, but first…

THE BIG CLIMATE STORY- Saudi Arabia’s oil giant Aramco is working with Danish firm Topsoe and Siemens Energy on projects to reduce emissions, and will also explore tapping into geothermal energy in a bid to expand its renewable energy portfolio.

^^ We have the details on this story and more in the news well, below.

THE BIG CLIMATE STORY OUTSIDE THE REGION- There’s no single story grabbing the headlines this morning, but investors have turned their back on renewable energy funds in the third quarter of the year on the back of higher interest rates and surging material costs, Reuters reports, citing data by LSEG Lipper. Renewable energy funds globally were hit by a net outflow of USD 1.4 bn during the three months to end-September in a record quarterly outflow. Yet, the outflows only partially offset a trend in the first half of the year seeing investors pour USD 3.4 bn into renewables funds, according to the data. The sector’s total assets under management are currently estimated at USD 65.4 bn, representing a 24% fall from end-June, the data showed.

What the experts are saying: “Renewable energy funds have faced weakened sentiment due to company performances in recent quarters and a shift in investor attention this year towards other themes like AI and US Infrastructure,” Global X research analyst Madeline Ruid said. She said that lengthy timelines, project delays, high interest rates and higher material costs, especially for wind and solar power projects have put their toll on firms in the sector.

WATCH THIS SPACE #1- Saudi Arabia’s domestic GHG credits scheme is coming soon: Saudi Arabia will roll out a greenhouse gas credits scheme that would allow firms to offset their emissions by purchasing credits from projects that voluntarily slash or remove carbon emissions in early 2024, Reuters reports. The Greenhouse Gas Crediting and Offsetting Mechanism (GCOM) — launched during the UN’s MENA Climate Week — “aims to act as an incentive to develop emission reduction and removal activities to achieve the kingdom’s ambitious target to reach carbon neutrality by 2060,” a statement by the Saudi Energy Ministry read. Taking part in the scheme is voluntary and project-based and would include greenhouse gas and non-greenhouse gas "metrics across all sectors,” according to its website. Public and private sectors and foreign companies’ subsidiaries will be allowed to participate in the domestic scheme.

REMEMBER- The voluntary carbon market has been of interest to the Saudis: Saudi Arabia’s Regional Voluntary Carbon Market Company (RVCMC) — established by the Saudi sovereign wealth fund and the Saudi Tadawul Group — plans to launch a carbon trading exchange early next year. The announcement came as the RVCMC sold 2 mn tons of carbon credits in June in what the company described as the largest-ever voluntary carbon credit auction.

WATCH THIS SPACE #2- Adnoc is stepping up the game for global expansion: Abu Dhabi oil giant Adnoc says it is seeking potential investments in renewable energy, petrochemicals, LNG, and gas under a global expansion plan, Reuters reports. Adnoc did not provide details on the countries it is considering, but two sources with knowledge of the matter say the company is seeking investments in LNG assets in Africa and is looking into acquiring Galp’s 10% stake in a multi bn USD natgas project in the Rovuma Basin north of Mozambique. Adnoc is also investing in energy trading, the company told the newswire, without providing further details.

REMEMBER- Adnoc wants to accelerate its roadmap to carbon neutrality: Adnoc recently said it is planning to reach net zero by 2045, instead of its originally planned 2050, and double its carbon capture capacity by 2030.

WATCH THIS SPACE #3- Morocco’s ongoing drought shows no signs of improvement: Morocco is entering a fifth consecutive year of drought, shifting the country into an era of water scarcity that officials say is one of the biggest threats facing the kingdom, The Financial Times reports. Morocco’s Minister for Public Works and Water Nizar Baraka said that reservoirs are currently only 26% full as the annual average water inflow fell from 22 bn cbm to 14 cbm in parallel to losses from increased evaporation due to rising temperatures.

The agricultural + economic impact is major: While agriculture contributes only 12% of Morocco’s GDP on average, 39% of the labor force works in agriculture resulting in reduced incomes for most rural inhabitants, FT writes. A recent World Bank report found that rain-fed agriculture represents 80% of Morocco’s cultivated area — including the country’s crucial cereal crops such as wheat and barley — and employs most of the agricultural workforce.

What can be done? Morocco is working on projects for recycling wastewater, building more desalination plants, expanding the more efficient drip irrigation methods of cultivation, and building channels to connect rivers and supply more regions with water, the FT writes.

REMEMBER- The IMF just threw Morocco a lifeline: The IMF’s Executive Board signed off on a USD 1.3 bn Resilience and Sustainability Facility for Morocco last week. The arrangement follows a separate USD 5 bn Flexible Credit Line arrangement approved in April 2023 in response to slowed growth and raised inflation due to severe drought and spillovers from Russia’s invasion of Ukraine.

WATCH THIS SPACE #4- Siemens Gamesa’s troubles deepen: Siemens Energy’s wind turbine unit Siemens Gamesa may shut down factories and sales offices in efforts to curb losses after technical faults cost the wind company EUR 2.2 bn earlier this year, Reuters reports, citing sources with knowledge of the matter. The spillovers from the losses are expected to continue up to 2026. If implemented, the layoffs should provide long-term relief for Siemens Gamesa by outsourcing production of some key components, such as blades, in order to raise margins. Details of the wind division's restructuring are expected to materialize next month when Siemens Energy releases annual results and holds a capital markets day.

REMEMBER- Siemens Gamesa is a major player in Egypt’s wind energy sector, and is involved in the 500 MW Gulf of Suez wind farm — formerly known as the Ras Gharib wind plant — the 250 MW West Bakr wind farm, and the 220 MW Gabal El Zeit 2 wind project in the Gulf of Suez.

THE DANGER ZONE #1- Bad news for EVs? A new study (pdf) published in Nature — using Qatar as a case study — found that when examining the entire life cycle, autonomous electric vehicles might emit 8% more greenhouse gas emissions on average compared to non-autonomous electric vehicles. The results show that while autonomy introduces an average 21.2% decrease in operation phase emissions due to improved fuel economy, the manufacturing phase emissions can surge up to 40%, compared to non-autonomous vehicles. To make autonomous vehicles more climate-friendly, the researchers suggest cleaner and more efficient manufacturing technologies, ongoing fuel efficiency improvements in autonomous driving, renewable energy adoption for charging, and circular economy initiatives targeting the complete life cycle.

THE DANGER ZONE #2- Lack of copper mines spells trouble for energy transition: Copper producers globally say the number of mines currently under development is not enough to support the clean energy transition, The Financial Times reports. The warning comes as miners continue to be pressed by a decline in metal prices due to a fragile global economy and cost inflation. Labour shortages are also hampering new supplies, raising concerns over a transition to carbon-free energy. Higher copper prices alone will not be sufficient to secure the metal required for the energy transition globally, said Kathleen Quirk, the head of leading US copper producer Freeport-McMoran. “Now it’s not just price. It’s these other factors that really are going to limit how quickly we can develop supplies,” she said. “What may end up happening is that this [energy transition] gets extended out longer.”

Copper is a gem: Copper — a critical mineral for EV and battery storage production among other green applications — has been dubbed the “metal of electrification”, with forecasts it will grow twofold to reach a 50 mn ton market by 2035 in comparison with 2021 levels, FT writes, citing forecasts by S&P Global. The credit rating agency also expects a “chronic gap” between supply and demand for the critical mineral.

|

***

YOU’RE READING ENTERPRISE CLIMATE, the essential MENA publication for senior execs who care about the world’s most important industry. We’re out Monday through Thursday by 5am Cairo / 5am Riyadh / 6am UAE.

EXPLORE MORE OF ENTERPRISE ON THE WEB — tap or click here to read EnterpriseAM, EnterprisePM, and The Weekend Edition on our powerful new website packed with reader-friendly features.

Were you forwarded this email? Get your own subscription without charge here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

CIRCLE YOUR CALENDAR-

The UAE will host the UNCTAD World Investment Forum from Monday, 16 October to Friday, 20 October in Abu Dhabi. This year’s theme focuses on sustainable investments, with a diverse range of climate financing sessions on promoting investments in the blue economy, agrifood systems, sustainable infrastructure, carbon markets, the circular economy, strategic minerals for decarbonization, and sustainable tourism. Some sessions will tackle reform of financial institutions needed to reach net zero, such as a session on integrating nature-related risk into capital markets and financing an equitable nature economy. Public sector investments and stock exchange action on climate disclosures will also be discussed.

Oman will host the Duqm Economic Forum from Monday, 16 October to Tuesday, 17 October in Duqm. The two-day event — organized by the Public Authority for Special Economic Zones and Free Zones — will showcase green investment windows and possible partnerships at the Special Economic Zone at Duqm.

Egypt will host the fourth meeting of the COP27 Transitional Committee from Tuesday, 17 October to Friday, 20 October in Aswan. The meeting aims to establish institutional arrangements, modalities, governance structures, and terms of reference for the landmark Loss and Damage Fund while expanding sources for climate funding under the program.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

CARBON EMISSIONS

Aramco gets busy with emissions reduction projects and dips its toe in geothermal energy

Saudi Arabia’s oil giant Aramco is working with Danish firm Topsoe and Siemens Energy on projects to reduce emissions, according to a statement. The agreements were revealed on the sidelines of MENA Climate Week in Riyadh under its lower CO2 push.

First up, a low carbon hydrogen plant: Aramco is in the process of finalizing an agreement with decarbonisation firm Topsoe to set up a lower-carbon hydrogen demonstration plant in the kingdom, the statement notes. The demonstration plant, which will be set up at the Shaybah Natural Gas Liquids (NGL) recovery plant, will have a production capacity of six tons of hydrogen per day. It will use renewable energy to produce lower-carbon hydrogen for use in power generation, resulting in having CO2 captured and sequestered.

Next, a DAC project: Aramco is also joining forces with Siemens Energy to develop a direct air capture (DAC) test unit in the country’s Dharan city, according to the statement. The test unit will have the capture capacity of up to 12 tons of CO2 annually and is set to be completed next year, paving the way for a larger pilot facility that will have a CO2 capture capacity of 1.25k tons per year.

A new sequestration method? Aramco said it has successfully piloted a novel CO2 sequestration method using in situ mineralization, which involves “dissolving CO2 in water and injecting it into volcanic rocks” in Jazan. It said that the method permanently converts CO2 into carbonate rocks.

And that’s not all: Aramco said it is also considering tapping into geothermal energy, with three potential areas on the west coast of the kingdom identified and mapped for the technology, according to the statement. It added that steps were currently underway to determine the geothermal resources at each of the selected areas.

All under one big plan: The announced projects come under Aramco’s target to reach net-zero Scope 1 and Scope 2 greenhouse gas emissions across its operations by 2050 and the kingdom’s 2060 carbon neutrality goal, according to the statement.

RENEWABLES

Masdar inks mega renewable projects in Malaysia under USD 8 bn agreement

More details on Masdar’s mega Malaysian MoU: UAE renewables giant Masdar will invest USD 8 bn for up to 10 GW of renewables projects in Malaysia by 2035 including grounded and floating solar, wind and battery energy storage systems (BESS), according to a statement.

What we know: The projects will include ground mounted, rooftop and floating solar power plants, onshore wind farms and BESS, according to the statement. It comes under efforts by Malaysia to achieve its target of 70% renewable energy in installed capacity and net-zero emissions by 2050, it added.

Masdar has been tapping on Malaysia’s potential: Masdar inked an MoU with Malaysian investment holding company Citaglobal Berhad last July to jointly develop 2 GW worth of renewable energy projects in Malaysia. The agreement allows both parties to explore solar plants, BESS, wind farms, and other renewable energy technologies.

Pushing into Southeast Asia: The UAE renewables giant has heavily invested in renewable energy projects in Southeast Asia in recent months, including Indonesia. Last month, Masdar signed an agreement with Indonesia’s utility company PLN Nusantara Power to develop a 500 MW floating solar photovoltaic plant (FPV) in Indonesia. Earlier in February, Masdar acquired shares in the geothermal unit of Indonesian government-owned geothermal utility Pertamina, which controls 82% of Indonesia's installed geothermal energy capacity, and manages 13 geothermal energy projects generating 1.87 GW of electricity.

ELECTRIC VEHICLES

Dubai-based NWTN reveals the UAE’s first locally manufactured EV

The UAE’s first EV — The Rabdan One — will advance the Emirati industrial sector and boost its net zero commitments, UAE’s Minister of Industry and Advanced Technology Sultan Al Jaber said in a statement during a site visit to NWTN Motors’ car assembly facility in Abu Dhabi. Rabdan One is the first to be developed under the NWTN’s Rabdan brand.

More details: The EV boosts a dual-motor drive system, packs a 510 KW battery with a range of up to 860 KM, 1.04k horsepower, and can reach 100 km/h in 4.5 seconds, according to a previous statement published last May. The EV also features a level 2 autonomous driving system (out of 5) and multiple intelligent human-machine interactive systems. Pricing for the vehicle has not yet been revealed, but sign-up registration for interest in the car is possible on NWTN’s website. The carmaker has also indicated that it expects sales of the Rabdan One to exceed 5k vehicles over a five-year period.

NWTN is also shaking hands with auto traders: NWTN signed an MoU with Al Khalid Auto in April for the delivery of over 1k Rabdan One vehicles over the next two years, kicking off the development of its sales and distribution network in the GCC countries, according to Trade Arabia. Under the MoU, Al Kalid became the exclusive distributor of vehicles for the Rabdan brand, enabling the sale of Rabdan vehicles, parts, and accessories together with the provision of after-sales services within Kuwait. NWTN also signed an MoU with Elfaba Investment and Advisory for the sale and purchase of 5k NWTN and Rabdan brands across more than seven countries for 5 years.

All part of bigger moves: The company inked an agreement with the Abu Dhabi Department of Economic Development in July to establish a new integrated electric vehicle production line in the UAE, and expand its existing EV factory in Khalifa Economic Zones Abu Dhabi (Kezad). In its initial phase, NWTN’s EV plant will have an annual production capacity of 5-10k semi-knocked-down EVs. In its second phase, NWTN wants to introduce several new EV models and expand the 25k sqm facility’s capacity to 50k units per year.

And expansions: NWTN Motors acquired a 27.5% stake in EV manufacturer China Evergrande New Energy Vehicle Group (EVGRF) last August at an equity investment of USD 500 mn, with the goal of capitalizing on EVGRF’s research and development and production capacity to meet MENA’s EV demands. Trading in shares between NWTN and EVGRF resumed yesterday after a 10-day suspension triggered by “significant uncertainties” tied to the Chinese firm amid investigations initiated against it and a derailed debt restructuring plan, according to Reuters.

About NWTN: Headquartered in Dubai, NWTN has a full vehicle assembly facility in Abu Dhabi — completed at the end of last year in Kezad — and a supply chain manufacturing base in Jinhua, China. NWTN is also exploring avenues in the entire clean energy value chain, including photovoltaics, green hydrogen power, and energy storage in the UAE, the Middle East, North Africa, China, other Asian countries and Europe.

ELECTRIC VEHICLES

Saudi Arabia expands fast-charging infrastructure presence with the launch of Electric Vehicle Infrastructure Company

KSA is ramping up its EV charging infrastructure: Saudi Arabia’s sovereign wealth fund the Public Investment Fund (PIF) and the Saudi Electricity Company (SEC) have launched the Electric Vehicle Infrastructure Company to expand fast-charging infrastructure across the kingdom, according to a statement. PIF will own a majority 75% stake in the newly-formed company while SEC will hold the remaining 25%, the statement notes.

What we know: The new company will set up over 5k fast chargers in over 1k locations in cities across the country, according to the statement. It will also explore collaboration with EV companies by providing required charging stations to meet future demand and “promote private sector participation in the development of its network of charging stations and support the localization of R&D and manufacturing of technologically advanced materials.”

KSA is all in for EVs: EV maker Lucid Group — which is backed by the PIF — inaugurated its first overseas production facility late last month in Jeddah’s King Abdullah Economic City after obtaining the operating license for its manufacturing unit. The Advanced Manufacturing Plant will contribute to Saudi Arabia’s target of having EVs make up 30% of new car sales in the kingdom by 2030. Earlier this year, the kingdom’s first EV brand Ceer — a JV between PIF and Taiwanese multinational electronics contract manufacturer Hon Hai Precision Industry Company (Foxconn) — received a manufacturing license from KSA’s Ministry of Industry and Mineral Resources last June for its planned EV production plant in KAEC.

CLIMATE DIPLOMACY

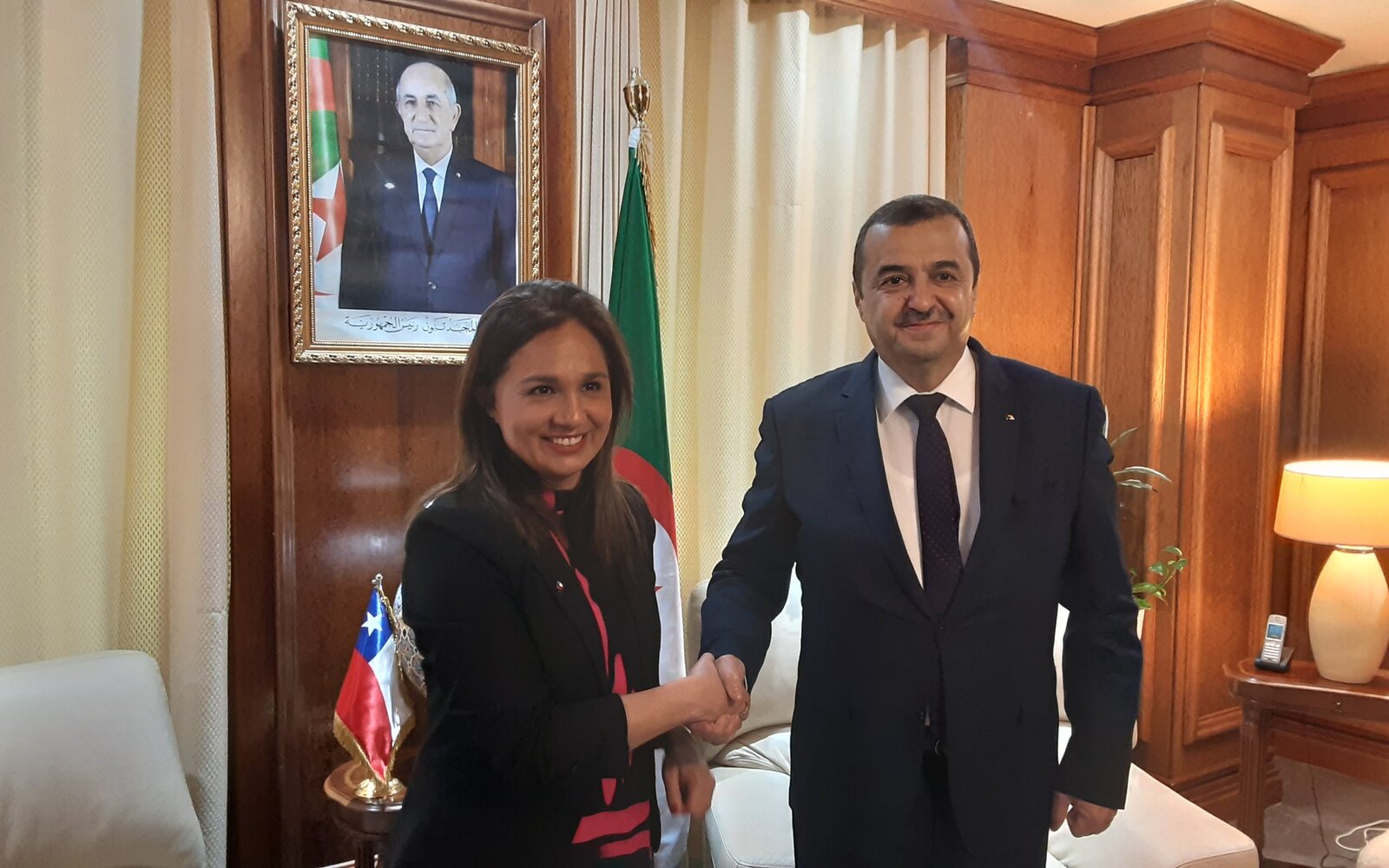

Algeria and Chile explore partnerships in renewables and mining

Algeria, Chile agree to increase cooperation in renewables + mining: Algeria’s Minister of Energy and Mines Mohamed Arkab met with a Chilean delegation headed by Deputy Minister of Foreign Affairs Gloria Gonzalez to review potential partnerships in renewable energy and mining projects, according to a statement. Cooperation in mining could include “research, utilization, transformation and production” of mining resources, the statement notes. The two parties agreed to form working teams to identify investments in those sectors.

Mining is central to Chile’s economy: Chile is one of the leading countries in mineral exploration — including in critical minerals needed for battery making such as lithium and copper — and the production and processing of phosphate fertilizers, the statement said. In 2021, Chile’s mining sector contributed USD 317 bn — or 15% — to Chile's GDP, with mining exports exceeding 62% of the country's total exports, according to data collected by the International Trade Organization.

FROM THE CLIMATE STORE

Kia debuts the EV9 and EV6 in Doha prior to a 4Q release regionally

Kia debuts its first dedicated EVs to the MEA region: South Korean carmaker Kia Motors — a subsidiary of Hyundai Motor Company — has showcased its soon-to-be launched EV9, EV6, and concept EV5 at the Geneva International Motor Show in Doha, according to a press release. The Kia EV9 and EV6 will be available in 4Q 2023 across the Middle East and Africa region.

The EV9 specs: The 7-seater EV9 SUV can deliver a peak power performance of 7.8k rpm and up to 541 km by range. The car can go from 10% to 80% charge in just 20 minutes. There's no official pricing available yet for the Kia EV9, but Car and Driver predict the base model to start at roughly USD 56k.

The EV6 specs: Kia’s five-seater mid-size SUV the EV6 is equally, if not more powerful, according to the statement. The EV packs a 77.4kWh battery with a range of up to 528 km, a 320 horsepower, and can reach 97 kms per hour in 3.5 seconds, according to Kia’s official website. The model has been named the 2023 World Performance Car in global markets and the first vehicle to utilize the E-GMP architecture with ultra-fast charging capabilities, going from 10% to 80% in just 18 minutes. The EV6 also features an advanced Vehicle-to-Load (V2L) function, allowing your Kia electric vehicle to power home appliances and electronic devices using an internal or external socket. Car and Driver predict the price to begin from USD 44k.

ALSO ON OUR RADAR

ELECTRIC VEHICLES-

Mercedes’ first battery-electric truck will make its debut in Saudi Arabia this week, according to a statement. The eActros 300 L 4×2 will be powered by the eAxle, housing two integrated electric motors and a two-speed transmission. The truck’s battery capacity of 336 kWh will have a range of up to 300 km and charge up to 80% in over an hour. Juffali Commercial Vehicles, the authorized general distributor for Mercedes-Benz Trucks, will showcase the vehicle during the EV Auto Show Riyadh taking place this week, the statement notes.

Iran is stepping up its EV game: Some 1k electric cars will be added to Iran's transportation fleet next month, Tasnim News Agency reports, citing statements by Iranian Deputy Industry, Mining, and Trade Minister Manouchehr Manteghi. Fifteen stations housing 78 charging devices have been set up in the country under plans to design and manufacture EVs locally by 2025.

GREEN HYDROGEN-

Egypt is set to conduct a study to determine the best locations to build green hydrogen hubs in the country, Oil Minister Tarek El Molla said in a statement. He highlighted a recent decision by PM Moustafa Madbouly to set up a council for green hydrogen in a bid to unify the state’s efforts in incentivizing investments in the sector. El Molla also said that Egypt has signed a MoU with the European Union on the production and trading of green hydrogen and its derivatives under efforts by the country to become a global hub for the production of the clean hydrogen.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- Oman preps for tsunami exercise: Oman will participate in the Indian Ocean Wave tsunami exercise tomorrow to test readiness for tsunamis caused by seismic and non-seismic events. (Muscat Daily)

- Egypt’s Nile Air is joining in IATA’s emissions calculator: Egypt’s private airline Nile Air, among other airlines, has been added by the International Air Transport Association (IATA) as a data contributor to its CO2 Connect emissions calculator. (Statement)

AROUND THE WORLD

Sweden’s H2GS looks to Canada as it lines up a mega green steel plant: Swedish metal and hydrogen company H2 Green Steel (H2GS) is in negotiations with Canada to set up a mega green steel plant in northern Quebec, CEO Henrik Henriksson told Bloomberg in an interview. He said the proposed 500 acre project will need an investment ranging between EUR 3 and EUR 6 bn. A proposed plan sees the Swedish company building a “green iron” facility and a mega electrolyzer powered by renewable energy to supply the project with hydrogen instead of coal. Another plan sees a full steel mill that would require 2k workers, a workforce similar to that of the company’s first under-construction plant in Sweden’s Boden. “It will depend on the dialogue we have with authorities in Canada regarding power allocation,” he said.

Electricity could be a barrier: H2GS will need as much as 700 MW of electricity, which represents 1.5% of Quebec’s actual capacity, which could be risky during winter as demand peaks. Electricity barriers have forced state-owned utility Hydro-Quebec to become cautious about projects as demand grows, Bloomberg notes.

And that’s not all: The Swedish company is also carrying out a feasibility study on Texas as it explores wind and solar development. “Canada is definitely ahead, but Texas has a very progressive view on creating business,” H2GS Executive Vice-President Kajsa Ryttberg-Wallgren said. “There are not many places in the world where you actually have optimal conditions,” Ryttberg-Wallgren added. The firm’s future pipeline also includes projects in Brazil and Portugal with partners Vale and Iberdrola.

The UK is providing GBP 89 mn to 20 net zero tech projects: The UK has awarded GPB 89 mn in funding to 20 green tech projects including hydrogen-powered off-road vehicles, a new lithium scale-up plant and revolutionary new EV battery systems, according to a statement. The funding package includes four collaborative R&D projects, five scale-up assessments projects to explore if businesses in the automotive sector are ready for growth, and seven feasibility studies to prepare projects to develop large-scale manufacturing facilities in the UK, the statement notes. GPB 45.2 mn of this investment comes from the UK government and the other GBP 42.7 mn is funded by the automotive industry.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- Japan’s electric aircraft industry gets a boost: Japan will allocate USD 205 mn in subsidies for hydrogen fuel cell systems and other components required to manufacture electric aircrafts. (Reuters)

- LG Energy is spending big after Toyota EV agreement: South Korea’s battery manufacturer LG Energy will pour USD 3 bn to expand its factory in Michigan after securing an agreement to supply 20 GWh of high nickel-cobalt-manganese-aluminum battery modules to Toyota annually starting 2025. (Bloomberg)

CLIMATE IN THE NEWS

Fifa pledges eco-friendly World Cup as criticism grows: Football governing body Fifa said it will undertake necessary measures to “mitigate the environmental impact” of the three-continent 2030 World Cup, Reuters reports. The statements came in response to criticism by climate activists who expressed concern about higher emissions due to increased travel during the tournament.

Tri-continent? The governing body selected last week Morocco, Spain, and Portugal as hosts of the 2030 tournament. It said Uruguay, Argentina, and Paraguay will also host the inaugural matches to mark the centennial of the tournament.

REMEMBER- Not the first time the games come under fire: Earlier this year, Swiss regulator Swiss Fairness Commission said Fifa made flawed and inaccurate statements on a reduced environmental impact of the 2022 World Cup tournament which was hosted in Qatar. The statements by the regulatory body came after it looked into five claims that Fifa marketed the tournament as being carbon neutral.

ON YOUR WAY OUT

Monoculture plantations are bad news for biodiversity: Single-species plantations can endanger biodiversity with limited climate gains, The Guardian reported last week, citing a paper published in Trends in Ecology & Evolution. Tropical regions like the Amazon are the most susceptible to such non-native tree-planting schemes, threatening the flora and fauna in such regions.

What’s at risk here? Ecologists have warned that the rising plantations of commercial pine, eucalyptus, and teak in tropical forests are causing more harm than good leading to the drying out of native ecosystems, acidifying soils, forcing out native plants, and igniting wildfires, the paper notes.

It’s not all about carbon: “Despite the broad range of ecosystem functions and services provided by tropical ecosystems, society has reduced the value of these ecosystems to just one metric – carbon,” according to the paper. “It is broadly assumed that maximizing standing carbon stocks also benefits biodiversity, ecosystem function and enhances socioeconomic co-benefits – yet this is often not the case.”

False beliefs: Tree-planting schemes have been seen as vital to help alleviate global heating, with governments and the private sector working together on boosting forest areas globally to help achieve carbon neutrality. However, research shows that benefits for the climate are largely dependent on the scale and type of restoration being made, The Guardian writes. Giving room for natural forests to regenerate could help achieve more benefits than plantations, according to a cited 2019 study.

CALENDAR

OCTOBER 2023

8-12 October (Sunday-Thursday): MENA Climate Week, Riyadh, Saudi Arabia.

9-15 October (Monday-Sunday): World Bank/IMF 2023 Annual Meetings, Marrakech, Morocco.

10-11 October (Tuesday-Wednesday): Green Energy Africa Summit, Cape Town, South Africa.

10-12 October (Tuesday-Thursday): Autonomous E-Mobility Forum, Doha, Qatar.

16-17 October (Monday-Tuesday): Duqm Economic Forum, Duqm, Oman.

16-18 October (Monday-Wednesday): Climate Week, Rome, Italy.

16-20 October (Monday-Friday): UNCTAD World Investment Forum, Abu Dhabi, UAE.

18-20 October (Wednesday-Friday): Morocco and Belgium business meeting on green hydrogen, Tangiers, Morocco.

17-18 October (Tuesday- Wednesday): Critical Minerals Africa Summit, Cape Town, South Africa.

17-19 October (Tuesday-Thursday): Energy Intelligence Forum, London, UK.

17-20 October (Tuesday-Friday): Fourth meeting of the COP27 Transitional Committee, Aswan, Egypt.

25-26 October (Friday-Saturday): Offshore & Floating Wind Europe 2023, London, United Kingdom.

29 October-2 November (Sunday-Thursday): Cairo Water Week, Cairo, Egypt

30 October – 1 November (Monday-Wednesday) ISWA 2023 World Congress: Global action towards a net-zero future, Muscat, Oman.

31 October-2 November (Tuesday-Thursday): Financial Times’ Energy Transition Summit, London, UK.

31 October-2 November (Tuesday-Thursday): World Hydropower Congress, Bali, Indonesia.

NOVEMBER 2023

1-3 November (Wednesday-Friday): Forbes Middle East Sustainability Leaders Summit 2023, Abu Dhabi, UAE.

7-8 November (Tuesday-Wednesday): ADIA Lab Symposium on Climate Change and Health Sciences, Abu Dhabi, UAE.

7-8 November (Tuesday-Wednesday): The 2023 US Algeria Energy Forum, Washington DC, USA.

9-10 November (Thursday-Friday): International Renewable Energy Agency Investment Forum, Uruguay.

9-15 November (Thursday-Wednesday): Intra-African Trade Fair 2023, Cairo, Egypt.

11-13 November (Saturday-Monday): GCC-Türkiye Economic Forum, Istanbul, Turkey.

15-17 November (Wednesday-Friday): WETEX and Dubai Solar Show, Dubai, UAE.

15-18 November (Wednesday-Saturday): DEWA’s First MENA Solar Conference, Dubai, UAE.

20-24 November (Monday-Friday) International Civil Aviation Organisation’s Aviation and Alternative Fuels conference, Dubai, UAE.

27-30 November (Monday-Thursday) Abu Dhabi Finance Week (ADFW), Abu Dhabi, UAE.

28-29 November (Tuesday-Wednesday): World Green Economy Summit (WGES), Dubai, UAE.

30 November – 12 December (Thursday-Tuesday): Conference of the Parties (COP 28), Dubai, UAE.

DECEMBER 2023

4 December (Monday): Saudi Green Initiative Forum, Dubai, UAE.

4 December (Monday): Abu Dhabi Sustainability Week (ADSW) summit, Dubai, UAE.

8 December (Friday): Youth for Sustainability Forum (Y4S), Dubai, UAE.

12-14 December (Tuesday-Thursday): Green Hydrogen Summit Oman, Oman Convention and Exhibition Center, Muscat, Oman.

18-20 December (Monday-Wednesday): Saudi Arabia Smart Grid Conference, Hilton Riyadh Hotel & Residences, Riyadh, Saudi Arabia.

JANUARY 2024

9-11 January (Tuesday-Thursday): Future Minerals Forum, Riyadh, Saudi Arabia.

FEBRUARY 2024

26-28 February (Monday-Wednesday): Management and Sustainability of Water Resources, Dubai, UAE.

MARCH 2024

4-6 March (Monday-Wednesday): International Conference on Sand and Dust Storms in the Arabian Peninsula, Riyadh, Saudi Arabia.

APRIL 2024

16-18 April (Tuesday-Thursday): World Future Energy Summit, Abu Dhabi, UAE.

23-25 April (Tuesday-Thursday): Connecting Green Hydrogen MENA, Dubai, UAE.

MAY 2024

19-21 May (Sunday-Tuesday): Saudi Energy Convention, Riyadh, KSA.

JUNE 2024

5 June (Wednesday): World Environment Day, Saudi Arabia.

DECEMBER 2024

2-13 December (Monday-Friday): Conference of the Parties (COP16) to the United Nation Convention to Combat Desertification, Riyadh, KSA.

EVENTS WITH NO SET DATE

2023

Mid-2023: Oman set to sign contracts for green hydrogen projects.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

2024

12-14 February (Monday-Wednesday): Sustainable Aviation Futures MENA Congress, Dubai, UAE.

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

2025

International Union for Conservation of Nature World Conservation Congress, Abu Dhabi, UAE.

UAE to have over 1k EV charging stations installed.

2026

UITP Global Public Transport Summit, Dubai, UAE.

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2050

Tunisia’s carbon neutrality target.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.