- KSA’s SEC grabs 25% stake in Electric Vehicle Infrastructure Company. (Electric Vehicles)

- Masdar partners with Boeing on sustainable aviation fuel projects + policies. (Aviation)

- Dubai’s green city developer SEE Holding eyes IPO. (IPO Watch)

- UAE’s Emirati CO2 + Oxygenate Bamboo shortlisted as finalists for Adnoc’s Decarbonization Technology Challenge. (Startup Watch)

- EU designs EUR 15 mn cooperation program for Algeria’s renewable energy sector. (Climate Diplomacy)

- Oman Investment Authority invests in green hydrogen unicorn EH2. (Also on Our Radar)

- KSA and India sign MoU on green hydrogen. (Climate Diplomacy)

- The Middle East’s first hydrogen train trial begins in KSA next week. (What We’re Tracking Today)

- Developing countries are getting USD 9.3 bn in green investments from rich nations. (What We’re Tracking Today)

Monday, 9 October 2023

Saudi’s SEC acquires 25% stake in Electric Vehicle Infrastructure Company

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, ladies and gentlemen. We have a brisk but interesting issue this morning, bringing us a little bit of everything to kick off a fresh week.

THE BIG CLIMATE STORY- The Saudi Electricity Company (SEC) — which is majority owned by the kingdom’s sovereign Public Investment Fund (PIF), has acquired a 25% stake in Electric Vehicle Infrastructure Company in a transaction valued at SAR 254 mn.

HAPPENING TODAY- It’s the second day of MENA Climate Week in Riyadh: The second day of MENA Climate Week 2023 is kicking off today in Riyadh with a focus on challenges and solutions for the MENA region, which is the world’s most vulnerable to the effects of climate change. The week-long climate event, which runs until Thursday, opened yesterday with keynote speeches by UNFCCC Executive Secretary Simon Stiell and COP27 President and Egyptian Foreign Minister Sameh Shoukry.

IMF + WB annual meeting kicks off in Morocco today and will continue until Sunday: The Annual Meetings of the World Bank and the International Monetary Fund (IMF) are kicking off in Marrakesh today, in one of the largest economic events of the year with over 14k participants. The meetings bring together central bankers, ministers of finance and development, private sector executives, civil society, media, and academics to discuss issues of global concern, including climate change. Some of the climate related sessions outlined in the schedule include Energizing Change — Firm Resilience and the Green Transition during the Recent Energy Crisis, Climate Challenges in Fragile and Conflict-Affected States, Capacity Development Talk on Environmental and Climate Change Statistics: Building Statistical Capacity to Support Climate Resilience Policy, and Financing a Just Transition for Africa. This is the first time the annual meetings are held outside the US in four years.

REMEMBER- Multilateral banks hold the key to ramping up green funding: The need for multilateral banks to reform their strategy and facilitate more green financing to developing countries has been a major discussion point in recent climate talks, and is expected to be a central theme in the upcoming COP28 in the UAE. COP28 President Designate Sultan Al Jaber expressed his support for the Bridgetown Initiative, a push by developing countries to have the West reform multilateral institutions to reduce excessive risk and unlock crucial green funds. The UN Climate Change High-Level Champions launched two papers last month outlining recommendations on how to break financing barriers for the climate transition in emerging economies, with the provision of a 1% interest rate loan with a 10-year grace period and a 20-year repayment period through multilateral banks being one of the main suggestions in the paper.

THE BIG CLIMATE STORY OUTSIDE THE REGION- There’s no single climate story grabbing headlines this morning, but a flash flooding in India’s north-eastern state of Sikkim has killed at least 44 people, Reuters reports. Over 140 people continue to be missing due to the heavy rainfall as rescue teams struggle to reach the flood-hit areas. “We are waiting for weather conditions to improve as only then air force and other rescue teams could venture into the flood-hit areas,” V.B. Pathak, the state’s chief secretary, said. The flash flooding is one of the worst disasters in the region in over 50 years, and the latest of weather calamities which scientists have associated with climate change.

The flash flooding also got ink over the weekend from: Bloomberg | The Associated Press | The New York Times | CNN | The Guardian | BBC

OVER IN COPLAND- Al Jaber hints at slow fossil fuel phase-out goals once again: “We cannot unplug the energy system of today before we build the new system of tomorrow,” COP28 President-Designate Sultan Al Jaber said yesterday during his keynote speech at the MENA Climate Week in Riyadh, Al Arabiya reported. “It is simply not practical or possible. We must meet the energy demands of our growing populations while providing access to the 8.3 bn people that don't have access to energy today. And we must rapidly build the system of the future while we decarbonize the system of today,” Al Jaber added.

And oil-rich KSA was quick to jump on Al Jaber’s bandwagon: “There is a good reason for us to continue producing oil and gas, and also, as we said, even though the share of oil and gas in the energy mix may decrease, but that is within the framework of an integrated energy system up to the year 2050,” Saudi Energy Minister Abdulaziz bin Salman said in a dialogue session at Climate Week, according to Asharq Business.

But experts have warned that today’s energy system needs to transform at a faster pace than current projections: While Al Jaber called for separating “facts from fiction” and “reality from fantasies” during his speech, the most recent UNFCCC report published last week (pdf) said that possible elements of the global stocktake outcome could include a call to parties on “phase-out of fossil fuels, support global commitment to accelerate the phase-out of unabated fossil fuels, and efforts to phase out inefficient fuel subsidies by 2025, supported by enabling environments and upscaling investments in renewable energy.” The International Energy Agency said in September that global demand for oil, natural gas and coal is likely to peak by 2030, which Saudi Aramco pushed back against, claiming that demand for both oil, gas, and coal remain strong while calling for more investments into the carbon-intensive sources. The IEA said that even the prediction that fossil fuel demand will peak by 2030 is “not nearly enough” to limit the rise in global average temperatures to 1.5°C.

WATCH THIS SPACE #1- Saudi Arabia will begin trials for the Middle East’s first hydrogen train next week, Energy Minister Prince Abdulaziz bin Salman said during MENA Climate Week in Riyadh, according to Reuters. “It will be on trial for next week, hopefully for the next few months. We will have the first hydrogen train in the Middle East,” he said. Saudi Arabia will launch a “credible, transparent and adaptable domestic market mechanism” today, the minister said, without providing further details. His statements come hours after state-owned Saudi Arabia Railways (SAR) said it signed an agreement with French train manufacturer Alstom to carry out hydrogen train trials this month. The trials will be the first of their kind in Saudi Arabia and the wider MENA region, SAR said.

We already knew something of the sort was happening: Alstom said that it is looking to bring its hydrogen-powered Coradia iLint train to Saudi Arabia before the end of 2023, the company’s Managing Director for the GCC Tamer Salama told Zawya in May. The increase in hydrogen projects in the region could also see the company deploy more of its hydrogen trains in neighboring countries, Salama added.

WATCH THIS SPACE #2- A global initiative for decarbonization by the UAE ahead of COP28: The UAE’s Climate Change and Environment Ministry (MOCCAE) has signed an MoU with Abu Dhabi Waste Management Company (Tadweer) to launch a global initiative to mobilize and accelerate waste decarbonization and set up a circular economy platform, Wam reported on Saturday. The “Waste to Zero” initiative will focus on the challenges faced by the waste management sector and promote solutions for the decarbonization of waste management globally.

WATCH THIS SPACE #3- Masdar going big on Malaysia’s renewables potential: The UAE’s state-owned clean energy producer Masdar has signed an agreement with Malaysia’s Investment and Development Authority (MIDA) to develop 10 GW of renewable energy projects in the country by 2035, Masdar said on Saturday. It did not provide further details on the projects; however, Malaysian PM Anwar Ibrahim said in a Facebook post that the projects will cost USD 8 bn.

WATCH THIS SPACE #4- Tunisia-Italy interconnector is getting some funds from the EBRD: The EBRD is set to sign off in December on a sovereign-backed senior loan of up to EUR 45 mn to Tunisia’s state electricity company STEG for the planned Elmed electrical interconnection project with Italy, according to the EBRD website. The 200-km 600 MW high-voltage direct current (HVCD) submarine transmission cable connecting the two countries will be operated and jointly owned by STEF and Italian transmission system operator Terna.

Others are helping: The EU’s Connecting Europe Facility (CEF) is contributing a grant of EUR 307.6 mn for the project. Other lenders include the EIB, KfW, and the World Bank.

WATCH THIS SPACE #5- Hy24 to establish fund for hydrogen investments, and MENA is a top destination: Paris-based hydrogen fund manager Hy24 hopes to raise EUR hundreds of mns to invest in hydrogen equipment and technology companies, including in the MENA region, CEO Pierre-Etienne Franc told The National on Thursday. “We will support any initiatives that those [MENA] countries push for the development of hydrogen … because this is a place where you can get a lot of investment appetite,” Franc said, adding that the fund’s strategy is to build a multi local manufacturing strategy for electrolyzers, rather than a centralized one.

REMEMBER- Together with Singapore’s sovereign fund GIC, Hy24 raised USD 115 mn in equity last week to help Hong Kong-based InterContinental Energy’s finance its green hydrogen expansion plans in the Middle East and Australia.

WATCH THIS SPACE #6- Developing countries are getting USD 9.3 bn in green investments from rich nations: Twenty-five developed countries have pledged USD 9.3 bn to help poor nations tackle climate change through the UN-backed Green Climate Fund (GCF) between 2024 and 2027, according to a statement released on Thursday on the sidelines of a conference in Bonn, Germany. “It [the GCF] will be able to invest in climate-friendly agriculture, coastal protection, reforestation and the energy transition in Asia, Africa, Eastern Europe, Latin America and the islands of the Caribbean and Pacific,” a German minister said, according to the statement. Among those donating are Japan, which said it would contribute up to USD 1.1 bn over the next four years, and Norway, which offered some USD 300 mn, Reuters reported. The German government alone pledged EUR 2 bn (USD 2.1 bn).

But the Fund fell short of the targeted USD 10 bn as some wealthy nations failed to pay up: The US and China — the most polluting nations in the world — failed to to make new funding pledges, with the former stating it is not “in a position to pledge due to uncertainty in its domestic budget process, but was working on an announcement,” while the latter has yet to agree to provide climate finance through the UN path, the newswire said. Australia, Italy, and Sweden also declined to make pledges on Thursday, stating that their contribution is still in progress. The Green Climate Fund is aiming to exceed the USD 10 bn in contributions it raised in its last three-year round, which is likely to be comfortably surpassed once the countries that promised funds announce their pledges, the fund’s facilitator Mahmoud Mohieldin told Reuters.

Still peanuts compared to funds needed for effective and just energy transition: The current goal represents just a fraction of the USD 200 bn to USD 250 bn that developing countries will need every year by 2030 to adapt to climate change, Reuters said, citing an estimate from a report published last week by the UN Framework Convention on Climate Change (UNFCCC).

THE DANGER ZONE- Higher temperatures deemed culprit behind deadly floods globally: Record heatwaves this year were behind deadly flooding across five continents, Bloomberg reports, citing climate scientists. Cities around the world saw record rainfall 139 times this year, including a flood disaster in Libya last month that killed thousands. Over 100 people were killed across Asia in July during a severe monsoon season, while New York was hit with crippling torrential rain last week.

The physics behind it: Higher temperatures allow the atmosphere to hold more moisture, causing heavier downpours and therefore floods. “We are now seeing record-smashing ocean temperatures, record-smashing global temperatures and record-smashing floods,” Jennifer Francis, a climate scientist at the Woodwell Climate Research Center. “It’s all connected,” she said.

|

***

YOU’RE READING ENTERPRISE CLIMATE, the essential MENA publication for senior execs who care about the world’s most important industry. We’re out Monday through Thursday by 5am Cairo / 5am Riyadh / 6am UAE.

EXPLORE MORE OF ENTERPRISE ON THE WEB — tap or click here to read EnterpriseAM, EnterprisePM, and The Weekend Edition on our powerful new website packed with reader-friendly features.

Were you forwarded this email? Get your own subscription without charge here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

ELECTRIC VEHICLES

KSA’s SEC grabs 25% stake in Electric Vehicle Infrastructure Company

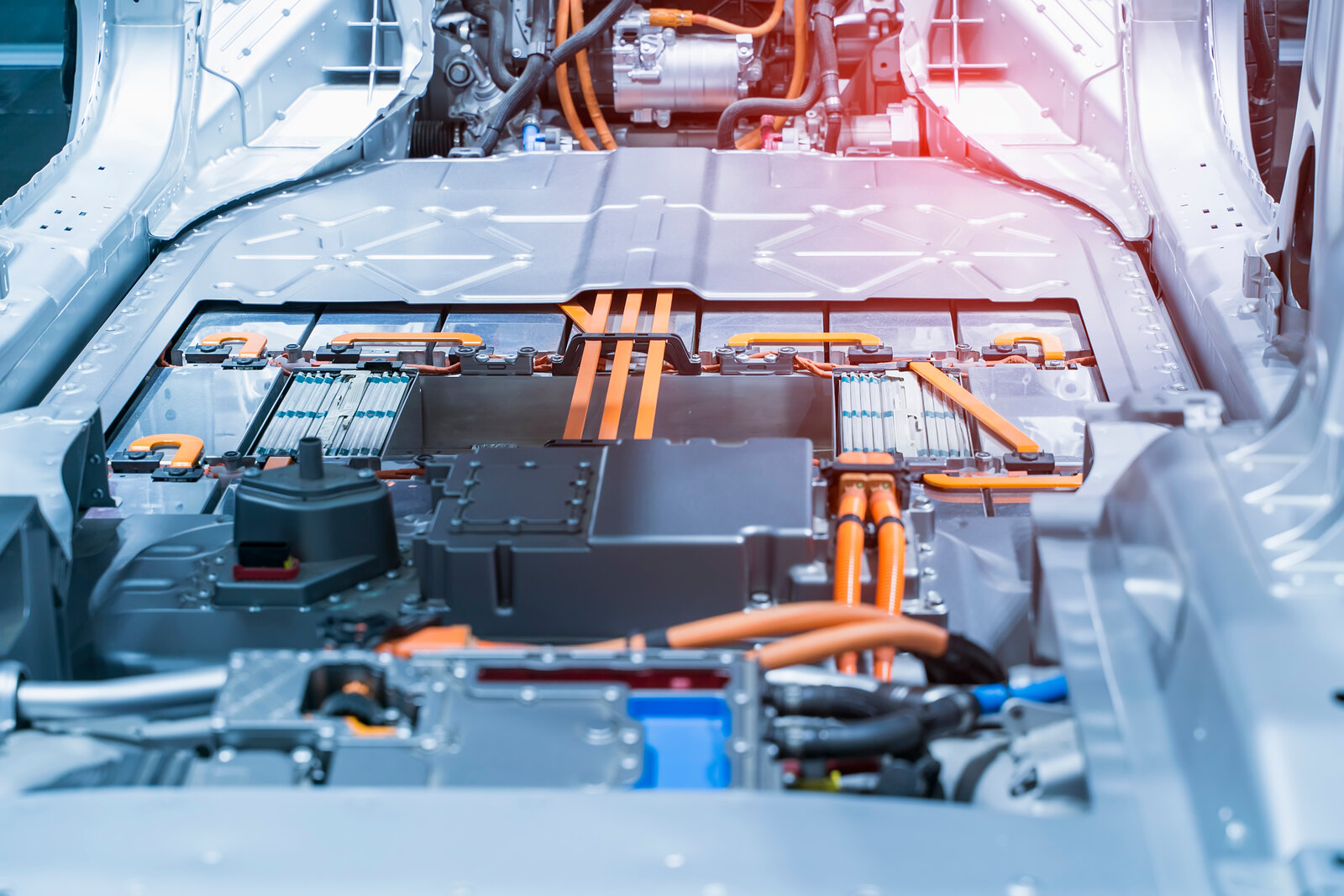

KSA’s SEC taps into EVs: The Saudi Electricity Company (SEC) — which is majority owned by the kingdom’s sovereign Public Investment Fund (PIF), has acquired a 25% stake in Electric Vehicle Infrastructure Company in a transaction valued at SAR 254 mn (c. USD 67.7 mn), SEC said in a disclosure to Tadawul yesterday. The EV-focused company is a joint stock company that is wholly owned by the PIF, according to the disclosure.

The rationale: The move will pave the way for SEC to “operate and create partnerships to provide alternate current (AC) and direct current (DC) power charging infrastructure for EVs,” the disclosure said.

It’s been an eventful run for EVs in the kingdom: EV maker Lucid Group — which is backed by the PIF — inaugurated late last month its first overseas production facility in Jeddah’s King Abdullah Economic City (KAEC) after obtaining the operating license for its manufacturing unit. The Advanced Manufacturing Plant (AMP-2) will contribute to Saudi Arabia’s target of having EVs make up 30% of new car sales in the kingdom by 2030. Earlier this year, the kingdom’s first EV brand Ceer — a JV between PIF and Taiwanese multinational electronics contract manufacturer Hon Hai Precision Industry Company (Foxconn) — received in June a manufacturing license from KSA’s Ministry of Industry and Mineral Resources for its planned EV production plant in KAEC.

AVIATION

Masdar partners with Boeing on sustainable aviation fuel projects + policies

Masdar is teaming up with Boeing to propel the SAF industry in the UAE and beyond: UAE renewables giant Masdar has signed an MoU with US aircraft maker Boeing to advance and support the development and adoption of sustainable aviation fuel (SAF) policies and projects locally and abroad, according to a company statement published on Thursday. The companies will also explore advancing SAF accounting principles to help the SAF sector overcome geographical barriers as it scales up, the statement added. The agreement was signed by Masdar’s Chief Green Hydrogen Officer Mohammad El Ramahi and Boeing president Middle East, Turkey, and Africa Kuljit Ghata-Aura on the sidelines of the Abu Dhabi International Petroleum Exhibition and Conference (Adipec), which concluded on Thursday.

What they said: “We are excited to team up with Masdar to spearhead the growth of the sustainable aviation fuel industry, both locally and globally, which will enable job creation, economic growth and significant business opportunities. Adopting SAF is going to be aviation's most powerful decarbonization lever,” Ghata-Aura said in the statement.

Masdar signed a similar agreement with France’s Airbus in May: Masdar and French aircraft manufacturer Airbus signed an agreement in May to jointly develop sustainable aviation fuels, green hydrogen, and direct air capture technologies. The agreement also involves jointly launching a book and claims framework that would enable aircraft operators to source their SAF supplies without being geographically connected to a stockpile site.

And is working with others to certify a new production pathway for SAF from methanol: Masdar partnered with Siemens Energy, Marubeni, and TotalEnergies in January to obtain licenses certifying the feasibility of producing sustainable aviation fuel from methanol gas. The Masdar-led consortium is working with the Abu Dhabi Department of Energy, Lufthansa, Khalifa University of Science and Technology, and Emirates Airways in parallel to launch a pilot project to produce SAF and green aviation fuel.

But Adnoc beat Masdar to it last week: Adnoc’s Ruwais Refinery has received International Sustainability Carbon Certification (ISCC) for the production of SAF. The certification allows Adnoc, the first in the Middle East to earn the certification, to supply international airlines with its SAF at Abu Dhabi Airport. The first batch of the fuel will be available later this month.

Masdar has big SAF dreams: Masdar is looking to capture as much as it can of the global SAF market, which is expected to grow at a CAGR rate of 42.39% to USD 14 bn by 2032, the company said earlier this year, citing market forecasts by Precedence Research.

IPO WATCH

Dubai’s green city developer SEE Holding eyes IPO

Another day, another IPO: SEE Holding — the developer behind the region’s first residential community to achieve net zero — is set to hire banks including Barclays and Citigroup to work on its planned initial public offering of its businesses and The Sustainable City brand, Bloomberg reported on Thursday, citing people in the know.

What we know: The banks also include Emirates NBD and First Abu Dhabi Bank (FAB) for the IPO in the UAE, the sources said. SEE Holding is yet to decide which exchange it will list on, but the IPO could be happening next year. The listing would include its engineering, design, and advisory businesses along with its sustainability city development business.

About the company: SEE Holding describes itself on its website as a “sustainably focused global holding group that is spearheading a net zero emissions future.” It launched The Sustainable City — a benchmark city for achieving net zero emissions by 2050 — in Dubai in 2013. It is working on similar projects in Abu Dhabi, Sharjah, and Oman, according to its website.

An IPO bonanza: SEE Holding is joining several firms considering a listing in the UAE, including Advanced Inhalation Rituals, which owns shisha brand Al Fakher and Dubizzle Group, according to Bloomberg. The state-owned entity-dominated IPO scene saw exchange firm Al Ansari Financial Services as the only privately-owned firm going public with a listing in the UAE this year.

STARTUP WATCH

UAE’s Emirati CO2 + Oxygenate Bamboo shortlisted as finalists for Adnoc’s Decarbonization Technology Challenge

Two UAE startups selected as finalists in Adnoc’s global Decarbonization Technology Challenge: UAE startups Emirati CO2 Group and Oxygenate Bamboo were among 10 finalists selected for a chance to earn USD 1 mn in pilot prizes as part of Adnoc’s Decarbonization Technology Challenge, according to a company statement published on Thursday. The finalists — who were selected from among 650 entries — will make the last pitch for their innovations in December. Adnoc’s Challenge — launched in collaboration with Amazon Web Services (AWS), BP, Hub71, and Net Zero Technology Centre in May — invited startups specializing in carbon capture and utilization (CCU), AI, hydrogen, renewables, batteries, and nature-based solutions to pitch their innovations for a cash prize along with access to the Adnoc’s Research and Innovation Center.

About Emirati CO2 Group: Emirati CO2 Group specializes in direct air capture coupled with desalination plants for CO2 mineralization, the statement explained. The group uses solid material to capture CO2 from the air, then utilizes waste-reject brine from desalination plants to remove CO2 from the system and mineralize it into a valuable product, according to a statement. The team was formed last year with the goal of participating in the XPrize Carbon Removal Competition — funded by Elon Musk and the Musk Foundation — in which their project was ranked in the top 35 among around 1.2k participants worldwide.

About Oxygenate Bamboo: Oxygenate Bamboo works on building plantations with genetically modified bamboo saplings to maximize CO2 sequestration. Oxygenate Bamboo reduces both atmospheric temperature by 5-7°C, and wind speeds and dust levels by 60-90%, according to a company statement. It also sequesters as much as four times more carbon dioxide and releases 35% more oxygen than wild bamboo, absorbing as much as 400 kg of CO2 and releasing 320 kg of oxygen annually per bamboo. The UAE company uses native bamboo species due to their ability to grow faster than any other plant on Earth. Last month, Oxygenate was selected for the Irena NewGen Renewable Energy Accelerator Programme for Youth 2023 edition.

The remaining spots went to startups from the UK, US, Canada, and the Netherlands: The other eight startups selected were CCU International, a British company developing a pressure-swing adsorption-based CCU technology for industrial facilities; CO2CirculAir, a Dutch company pioneering the capture of CO2 from the air using natural wind; Active Surfaces, a US company producing ultra-light-weight flexible solar films; Desolenator, a Dutch company pioneering a circular solar thermal water desalination system; Basetwo AI, a Canadian company using cognitive AI to reduce emissions from downstream oil and gas operations; Oxford Flow, a British company producing control and stemless valves to eliminate fugitive emissions; Revterra, a US company producing kinetic batteries to help decarbonize remote operations; and Nunafab Corp, a Canadian company innovating composite pipe technology for hydrogen transportation.

CLIMATE DIPLOMACY

EU designs EUR 15 mn cooperation program for Algeria’s renewable energy sector

Big funds from the EU to Algeria: The European Union says it has designed a EUR 15 mn cooperation program for the renewable energy sector in Algeria during the annual meeting of the high-level political dialogue on energy between the two parties, according to a joint statement on Thursday. The program focuses on the development of renewable energy projects, the integration of renewables through new technologies, electrical interconnection, and setting up a green hydrogen economy.

And more: During the dialogue, officials discussed cooperation in renewable hydrogen and the reduction of methane emissions in the oil and gas industry, according to the statement. The two parties also agreed to work on reducing methane emissions and hydrogen by opening the door for pilot industrial projects bringing together EU and Algerian public and private companies. They also expressed readiness to “explore the possibility to establish an agreement in the hydrogen cooperation in order to identify concrete actions and projects.” They also said they are eyeing extended cooperation in the exploration, production, and utilization of rare materials, including inputs used in the installation component industry for the production or storage of renewable energy. They also agreed to advance talks on the interconnection of Europe and Algeria’s electricity networks and cross-border exchanges.

Big news from KSA, India: Saudi Arabia has inked with India an MoU in green hydrogen, supply chains, and electrical interconnection between the two countries, according to a Saudi Energy Ministry statement. The MoU was signed by Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman and Indian counterpart Raj Kumar Singh during the MENA Climate Week in Riyadh. The MoU aims to set up a framework for the co-production of green hydrogen and renewable energy in both nations. It aims to establish a solid and secure supply chain for materials used in both sectors, according to SPA.

And more: The MoU also paves the way for carrying out necessary studies for electrical interconnection and the co-development of green hydrogen and renewable hydrogen projects, according to SPA.

REMEMBER- Saudi and India have been bffs: Several KSA-based renewables companies, including Desert Technologies and Tadawul-listed Al Jomaih Energy and Water company, signed last month MoUs with Indian companies on the sidelines of the India-Saudi Investment Forum to invest in the region’s renewables sector.

ALSO ON OUR RADAR

GREEN HYDROGEN-

A push by Oman for green hydrogen: The Oman Investment Authority (OIA) — the sultanate’s sovereign wealth fund — has announced an undisclosed investment in US hydrogen technology startup Electric Hydrogen (EH2), The Times of Oman reported on Saturday, citing a statement by OIA. “At a time when the Sultanate of Oman is taking its first steps in its journey to produce green hydrogen, we believe that it is necessary to establish strategic partnerships with partners who have experience and advanced technical capabilities in this field. Our investment in this company reflects our interest in supporting the development of the green hydrogen sector in the Sultanate of Oman,” said OIA’s Senior Director of Economic Diversification Investments Alwaleed bin Saeed Al Shukaili.

E2H has some big news of its own: E2H was valued at USD 1 bn following an oversubscribed financing round. The company raised USD 380 mn in a series C financing round that included Fortescue, Fifth Wall, Energy Impact Partners, OIA, and BP Ventures.

WIND-

UAE launches first utility-scale wind program: The UAE has launched its first wind program under a bid to diversify its energy mix and accelerate energy transition, state-owned renewables developer Masdar said in a statement on Thursday. The 103.5 MW landmark project developed by Masdar spans four locations, including the Sir Bani Yas Island in Abu Dhabi, where a 45 MW capacity wind farm and a 14 megawatt peak (MWp) solar farm has been developed. Other wind farm locations include Delma Island with 27 MW, Al Sila with 27 MW and Al Halah in Fujairah with 4.5 MW, according to the statement. The statement said PowerChina was the project’s main engineering, procurement and construction contractor while GoldWind Group was the main supplier of equipment.

Big benefits…: The ambitious program is expected to provide electricity to over 23k households annually. It will also remove 120k tons of carbon dioxide from the atmosphere annually, according to the statement.

…That are luring in EWEC: The Emirates Water and Electricity Company (EWEC) has signed a power purchase agreement (PPA) for power generated from the UAE’s first wind program, a statement by EWEC read on Thursday. The agreement will allow EWEC to procure power from the wind farms in Al Sila, Sir Bani Yas Island and Felma Island. It will draw power from 22 wind turbines standing at 95-meters high with a 155-meter wingspan, according to the statement.

More to come? The UAE plans to build up wind capacity as part of a potential second phase of its wind energy program, which will be “commercially driven,” Mohammad El Ramahi, chief green hydrogen officer at Masdar told The National on Thursday. He said his company seeks bringing together an international consortium for the second phase of the project. “The winning consortium with the lowest levelized cost of electricity will enter into a special purpose vehicle (SPV), with the shareholding represented by the economic interests of the respective shareholders,” El Ramahi said.

DECARBONIZATION-

Adnoc spends big for decarbonization drive: Abu Dhabi oil giant Adnoc has announced new agreements worth up to AED 10 bn (c. USD 2.7 bn) with 30 companies for the local manufacturing of critical non-oil products in its supply chain under a decarbonization push, a statement by Adnoc read on Thursday. The agreements back its goal to locally manufacture AED 70 bn (c. USD 19 bn) worth of products by 2027 as part of the wider Make it in the Emirates initiative. The products include locally-manufactured battery energy storage systems, uninterrupted power supply (UPS) equipment, and personal protection equipment, according to the statement.

REMEMBER- Adnoc wants to speed up its roadmap to carbon neutrality: Adnoc recently said it is planning to reach net zero by 2045, instead of its originally planned 2050, and double its carbon capture capacity by 2030.

POLICY-

UAE adopts new incentives for green businesses: The UAE’s Industry and Advanced Technology Ministry has adopted new incentives under the National In-Country Value (ICV) program to encourage green investments. The incentives include a bonus of up to 3% on a company’s overall ICV score if it proves commitment to sustainability-related standards and policies. The higher a company’s overall ICV score, the more access it has to cheaper materials in the procurement process. The commitments are measured based on the company’s practices in sustainability, water management, circularity, emissions reduction, and obtaining green certificates or labeling from the Environment Agency in Abu Dhabi. The ICV program aims to enhance the competitiveness of UAE products, strengthen local supply chains, and attract investment. Only ICV-certified companies can apply for the new criteria. (Wam)

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- Italy to allocate portion of USD 34 mn Egypt grant to climate initiatives: Italy has signed seven grant agreements — six with UN agencies and another with the World Bank — worth USD 34 mn to finance development projects in Egypt, including in the climate sector. (Statement)

- A push for hydrogen mobility in the UAE: Emirati EPC contractor MMEC Mannesmann has signed an agreement with German gas giant Linde for the supply and operation of a manual hydrogen refueling station in Dubai. (Statement)

- More recycling in Abu Dhabi: Abu Dhabi-based petrochemicals company Borouge has signed an agreement with Abu Dhabi Waste Management Company (Tadweer) to explore recycling opportunities in Abu Dhabi. (Twitter)

CALENDAR

OCTOBER 2023

9 October (Monday): ِAhram newspaper annual energy conference, Cairo, Egypt.

9-10 October (Monday-Tuesday): Saudi Green Building Forum, Riyadh, Saudi Arabia.

10-11 October (Tuesday-Wednesday): Green Energy Africa Summit, Cape Town International Convention Centre 2, Cape Town, South Africa.

8-12 October (Sunday-Thursday): MENA Climate Week, Riyadh, Saudi Arabia.

9-15 October (Monday-Sunday): World Bank/IMF 2023 Annual Meetings, Marrakech, Morocco.

10-12 October (Tuesday-Thursday): Autonomous E-Mobility Forum, Doha, Qatar.

16-17 October (Monday-Tuesday): Duqm Economic Forum, Duqm, Oman.

16-18 October (Monday-Wednesday): Climate Week, Rome, Italy.

16-20 October (Monday-Friday): UNCTAD World Investment Forum, Abu Dhabi, UAE.

18-20 October (Wednesday-Friday): Morocco and Belgium business meeting on green hydrogen, Tangiers, Morocco.

17-18 October (Tuesday- Wednesday): Critical Minerals Africa Summit, Cape Town, South Africa.

17-19 October (Tuesday-Thursday): Energy Intelligence Forum, London, UK.

17-20 October (Tuesday-Friday): Fourth meeting of the COP27 Transitional Committee, Aswan, Egypt.

25-26 October (Friday-Saturday): Offshore & Floating Wind Europe 2023, London, United Kingdom.

29 October-2 November (Sunday-Thursday): Cairo Water Week, Cairo, Egypt

30 October – 1 November (Monday-Wednesday) ISWA 2023 World Congress: Global action towards a net-zero future, Muscat, Oman.

31 October-2 November (Tuesday-Thursday): Financial Times’ Energy Transition Summit, London, UK.

31 October-2 November (Tuesday-Thursday): World Hydropower Congress, Bali, Indonesia.

NOVEMBER 2023

1-3 November (Wednesday-Friday): Forbes Middle East Sustainability Leaders Summit 2023, Abu Dhabi, UAE.

7-8 November (Tuesday-Wednesday): ADIA Lab Symposium on Climate Change and Health Sciences, Abu Dhabi, UAE.

7-8 November (Tuesday-Wednesday): The 2023 US Algeria Energy Forum, Washington DC, USA.

9-10 November (Thursday-Friday): International Renewable Energy Agency Investment Forum, Uruguay.

9-15 November (Thursday-Wednesday): Intra-African Trade Fair 2023, Cairo, Egypt.

11-13 November (Saturday-Monday): GCC-Türkiye Economic Forum, Istanbul, Turkey.

15-17 November (Wednesday-Friday): WETEX and Dubai Solar Show, Dubai, UAE.

15-18 November (Wednesday-Saturday): DEWA’s First MENA Solar Conference, Dubai, UAE.

20-24 November (Monday-Friday) International Civil Aviation Organisation’s Aviation and Alternative Fuels conference, Dubai, UAE.

27-30 November (Monday-Thursday) Abu Dhabi Finance Week (ADFW), Abu Dhabi, UAE.

28-29 November (Tuesday-Wednesday): World Green Economy Summit (WGES), Dubai, UAE.

30 November – 12 December (Thursday-Tuesday): Conference of the Parties (COP 28), Dubai, UAE.

DECEMBER 2023

4 December (Monday): Saudi Green Initiative Forum, Dubai, UAE.

4 December (Monday): Abu Dhabi Sustainability Week (ADSW) summit, Dubai, UAE.

8 December (Friday): Youth for Sustainability Forum (Y4S), Dubai, UAE.

12-14 December (Tuesday-Thursday): Green Hydrogen Summit Oman, Oman Convention and Exhibition Center, Muscat, Oman.

18-20 December (Monday-Wednesday): Saudi Arabia Smart Grid Conference, Hilton Riyadh Hotel & Residences, Riyadh, Saudi Arabia.

JANUARY 2024

9-11 January (Tuesday-Thursday): Future Minerals Forum, Riyadh, Saudi Arabia.

FEBRUARY 2024

26-28 February (Monday-Wednesday): Management and Sustainability of Water Resources, Dubai, UAE.

MARCH 2024

4-6 March (Monday-Wednesday): International Conference on Sand and Dust Storms in the Arabian Peninsula, Riyadh, Saudi Arabia.

APRIL 2024

16-18 April (Tuesday-Thursday): World Future Energy Summit, Abu Dhabi, UAE.

23-25 April (Tuesday-Thursday): Connecting Green Hydrogen MENA, Dubai, UAE.

MAY 2024

19-21 May (Sunday-Tuesday): Saudi Energy Convention, Riyadh, KSA.

JUNE 2024

5 June (Wednesday): World Environment Day, Saudi Arabia.

DECEMBER 2024

2-13 December (Monday-Friday): Conference of the Parties (COP16) to the United Nation Convention to Combat Desertification, Riyadh, KSA.

EVENTS WITH NO SET DATE

2023

Mid-2023: Oman set to sign contracts for green hydrogen projects.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

2024

12-14 February (Monday-Wednesday): Sustainable Aviation Futures MENA Congress, Dubai, UAE.

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

2025

International Union for Conservation of Nature World Conservation Congress, Abu Dhabi, UAE.

UAE to have over 1k EV charging stations installed.

2026

UITP Global Public Transport Summit, Dubai, UAE.

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2050

Tunisia’s carbon neutrality target.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.