- UAE’s Taqa acquires water solutions firm SWS Holding for USD 463 mn. (M&A Watch)

- Abu Dhabi-backed CYVN Holdings invests USD 739 mn, acquiring 7% of Chinese EV maker Nio. (M&A Watch)

- Saudi Arabia’s first EV brand Ceer secures manufacturing license for EV production factory. (Electric Vehicles)

- Neom, Volocopter announce successful testing of KSA’s first electric air taxi flight. (Electric Vehicles)

- Saudi Arabia and France sign preliminary agreements in a number of sectors including low-carbon energy. (Also on Our Radar)

- Indian companies signal interest in setting up shop in Egypt’s SCZone. (What We’re Tracking Today)

- The revival of a lost coffee strain could pave the way for more climate-resilient java. (On Your Way Out)

Thursday, 22 June 2023

UAE’s Taqa acquires water solutions firm SWS Holding for USD 463 mn

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, lovely people. We have an M&A and EV heavy issue for you this morning as we slide into the weekend.

THE BIG CLIMATE STORIES- The Abu Dhabi National Energy Company will acquire water solutions firm Sustainable Water Solutions Holding Company for AED 1.7 bn (USD 463 mn) and Abu Dhabi-backed investment firm CYVN Holdings is investing USD 738.5 mn in Chinese electric vehicle automaker Nio.

^^ We have the details on these stories and more in the news well, below.

THE BIG CLIMATE STORY OUTSIDE THE REGION- There’s no single climate story dominating international headlines this morning, but the Summit for a New Global Financial Pact, which is kicking off today in Paris and concluding tomorrow, is getting attention. The two-day summit will bring together heads of states and heads of multilateral development banks, international organizations, the private sector, and international NGOs to shape a new finance “toolbox” and “pave the way towards a more balanced financial partnership between the north and south.” It will also see new agreements in a bid to relieve debt distress and allow countries to access additional financing to invest in sustainable development and slash emissions.

What we can expect to see from the talks: US President Joe Biden and 11 other heads of state urged in a statement published in France’s Le Monde yesterday the necessity of a “just and inclusive” transition aimed at backing the most vulnerable nations to tackle development obligations and fight against climate change and poverty. US Treasury Secretary Janet Yellen is also taking part in the summit, where she is expected to “rally world leaders to take concrete actions to partner with developing and emerging economies … to address challenges that threaten all of us, like climate change, pandemics, and fragility”, Reuters reported, citing a senior Treasury Department official.

PSA- It’s time to stop playing with the AC remote: The UAE’s Emirates Central Cooling Systems Corporation (Empower) began its annual “Set and Save 24°C” summer campaign to curb energy consumption, it said in a disclosure (pdf). The campaign encourages customers to control their district cooling consumption by setting the air conditioner thermostat at 24°C on auto mode, which results in lower bills and lower energy consumption.

The Enterprise Finance Forum is our flagship gathering — the one so many of you have been waiting for. The two-day event takes place this September and will be the latest in our must-attend series of invitation-only, C-suite-level gatherings. Stay tuned for more information on the location.

TAP OR CLICK HERE if you want to express interest in attending. We’ll be sending out the first batch of invitations just after the 30 June holiday.

Do you want to become a commercial partner? Please click here.

STAY TUNED for more detail about our exciting agenda in the weeks to come.

ENTERPRISE IS LOOKING FOR SMART, TALENTED PEOPLE of all backgrounds to help us build some very cool new things. Enterprise — the essential morning read on all the important news shaping business and the economy in Egypt and the region — is looking for writers, reporters and editors to help us build out new publications. Today, we run four daily Egypt and MENA-focused publications, five weekly industry verticals, and a weekend lifestyle edition designed to make our readers feel just a bit smarter.

We have tons more in the pipeline — come help us build new publications. We offer the chance to work in a fast-paced newsroom on a broad range of topics and in a variety of formats. Our goal is simple: To create value for our growing community of >250k daily readers by telling stories that matter.

Journalists looking to explore business, finance and economic stories are welcome. So are recent journalism school graduates.

That said, we're looking for gifted story-tellers from all walks of life and across all professions, as long as they show a keen interest in learning to write about the stories, topics, businesses, and figures moving markets. Egyptian and foreign nationals alike are welcome to apply. So are job-switchers: If you’re an equities analyst tired of the rat race, we’re a great place to come work.

NEVER WORKED IN A NEWSROOM BEFORE? We have the Enterprise Business Writing Development Program. Whether you are a recent graduate, an industry vet, or looking to switch careers, the Enterprise Business Writing Development Program will give you the tools you need to tell the most important stories to our audience of C-suite officials, government ministers, diplomats, financiers, investors and entrepreneurs.

During the program you will learn:

- The key news stories and trends shaping business and the economy in Egypt and the region, across various sectors;

- Business and finance for non-finance people: Whether it's industry jargon or key concepts or simply how to read a balance sheet;

- How to construct an Enterprise story: From idea formulation down to the structure, style and tone of writing;

- How to develop sources that will give you the key insights needed to tell a complete story;

- How to communicate these stories with the confidence and language of an insider.

Not an internship program — a career: The three-month program will see full-time, paid participants take part in workshops and lectures from veteran business journalists, while also working on and filing stories that will run on any of our publications. Those who have successfully completed the program, will then be given long-term job offers.

Apply directly to jobs@enterprisemea.com and mention “writing development program” in your subject line.

OVER AT COPLAND- COP28’s Al Jaber wants more tapping into Africa’s renewables potential: COP28 President-Designate Sultan Al Jaber stressed the importance of making climate finance more accessible to allow countries in Africa to realize their renewables potential, Wam reports. During a meeting with Kenya’s President William Ruto on the sidelines of the Africa Energy Forum in Nairobi, Al Jaber agreed on having COP28 and Kenya work together to advocate for tripling the installed renewable energy capacity by 2030. They will also work on policy and scaling finance. A joint working group was also launched through the Africa Climate Summit and COP28 to shed light on a fair energy transition and tapping climate finance to boost green growth in the continent. Clean energy investments account for only 2% of global investments and less than 10% of the USD 120 bn “baseline requirement” needed annually, Al Jaber said.

WATCH THIS SPACE #1- The Indians want to invest big in Egypt: Egypt’s Suez Canal Economic Zone (SCZone) head Walid Gamal El Din held extensive talks with leading Indian corporations operating in renewable energy and electric motorcycles about making investments in the country, according to a statement. Gamal El Din met with representatives from Ocior Energy, which signed a framework agreement in December to develop green hydrogen and green ammonia facilities in the SCZone. Ocior Energy CEO Ranjit Gupta expressed his company’s desire to establish the project in line with the world’s shift to a green economy.

More coming? Indian two-wheeler maker Hero MotoCorp expressed interest in expanding its activities in the SCZone through investments and setting up projects to manufacture electric motorcycles to meet local demand, the statement added. It plans to export some of its output from the zone to African and European markets. The delegation also held talks with representatives from Ador Power to discuss investments by the company in manufacturing electrolyzers and electric vehicle charging station equipment.

|

***

YOU’RE READING ENTERPRISE CLIMATE, the essential regional publication for senior execs who care about the world’s most important industry. Enterprise Climate covers everything from finance and tech to regulation, products and policy across the Middle East and North Africa. In a nod to the growing geographical ambitions of companies in our corner of the world, we also include an overview of the big trends and data points in nearby countries, including Africa and southern Europe.

Enterprise Climate is published by 5am CLT / 5am Riyadh / 6am UAE Monday through Thursday by Enterprise, the folks who bring you Enterprise Egypt, your essential 6am and 3pm read on business, finance, policy and economy in Egypt and emerging markets.

EXPLORE MORE OF ENTERPRISE ON THE WEB — tap or click here to read EnterpriseAM, EnterprisePM, and The Weekend Edition on our powerful new website packed with reader-friendly features.

Subscribe to Enterprise Climate here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

CIRCLE YOUR CALENDAR-

Thailand will host the second workshop on addressing loss and damage from 15-16 July in Bangkok. The workshop will see discussions on pathways to increasing funding for climate-induced loss and damage. The workshop is being held in preparation for the third meeting of the COP27 Transitional Committee in August. The committee is tasked with operationalizing the Loss and Damage Fund, to be approved during the fourth transitional meeting in October.

Check out our full calendar on the web for a comprehensive listing of upcoming news events and news triggers.

M&A WATCH

UAE’s Taqa acquires water solutions firm SWS Holding for USD 463 mn

Taqa to acquire SWS Holding: The Abu Dhabi National Energy Company (Taqa) will acquire water solutions firm Sustainable Water Solutions Holding Company (SWS Holding) for AED 1.7 bn (USD 463 mn), according to a statement. SWS Holding was founded in 2023 and is the parent company of wastewater treatment and repurposing firm Abu Dhabi Sustainable Water Solutions Company (ADSWS).

The details: Per the transaction agreement — expected to be completed later this year — Taqa will acquire all of SWS Holding’s outstanding shares, with half the value to be paid upon completion and the remainder after the transaction is finalized in 2024. The acquisition is expected to add AED 16 bn to Taqa’s pre-existing AED 75 bn regulated asset value.

What they said: "By bringing the management of recycled water together with Taqa’s water desalination activity and our recycled water network, we can do even more to support the net-zero target by 2050,” Taqa group CEO and Managing Director Jasim Husain Thabet noted in the statement.

Taqa has been making moves in the desalination market: Taqa, French utility company Engie, and the Emirates Water and Electricity Company (EWEC) achieved financial close for the AED 2.3 bn (c. USD 620 mn) low-carbon Mirfa 2 Reverse Osmosis (M2 RO) desalination plant earlier this month. M2 RO will produce 120 mn imperial gallons per day (MIGD) of water once fully operational in 4Q 2025, equating to c. 550k cubic meters per day of potable water. This will make it the third largest RO desalination facility in the country.

And is going big on water treatment: Taqa, Orascom Construction (OC), Metito, and the Abu Dhabi National Oil Company (Adnoc) announced in May they will establish a USD 2.4 bn mega seawater treatment and water supply project in the UAE.

Taqa has also been on a sustainability-driven shopping spree: In 2022, the company snapped up a 43% stake in UAE renewables giant Masdar, with the aim of fronting the company’s clean energy projects. In January, it partnered with Adnoc Distribution to establish a joint venture called E2GO to build and operate EV infrastructure in Abu Dhabi and the wider UAE. More recently, the company invested GBP 25 mn in Xlinks’ Morocco-UK Power Project in April, and said in May it is looking for more potential investments in the clean energy sector both in the UAE and beyond.

M&A WATCH

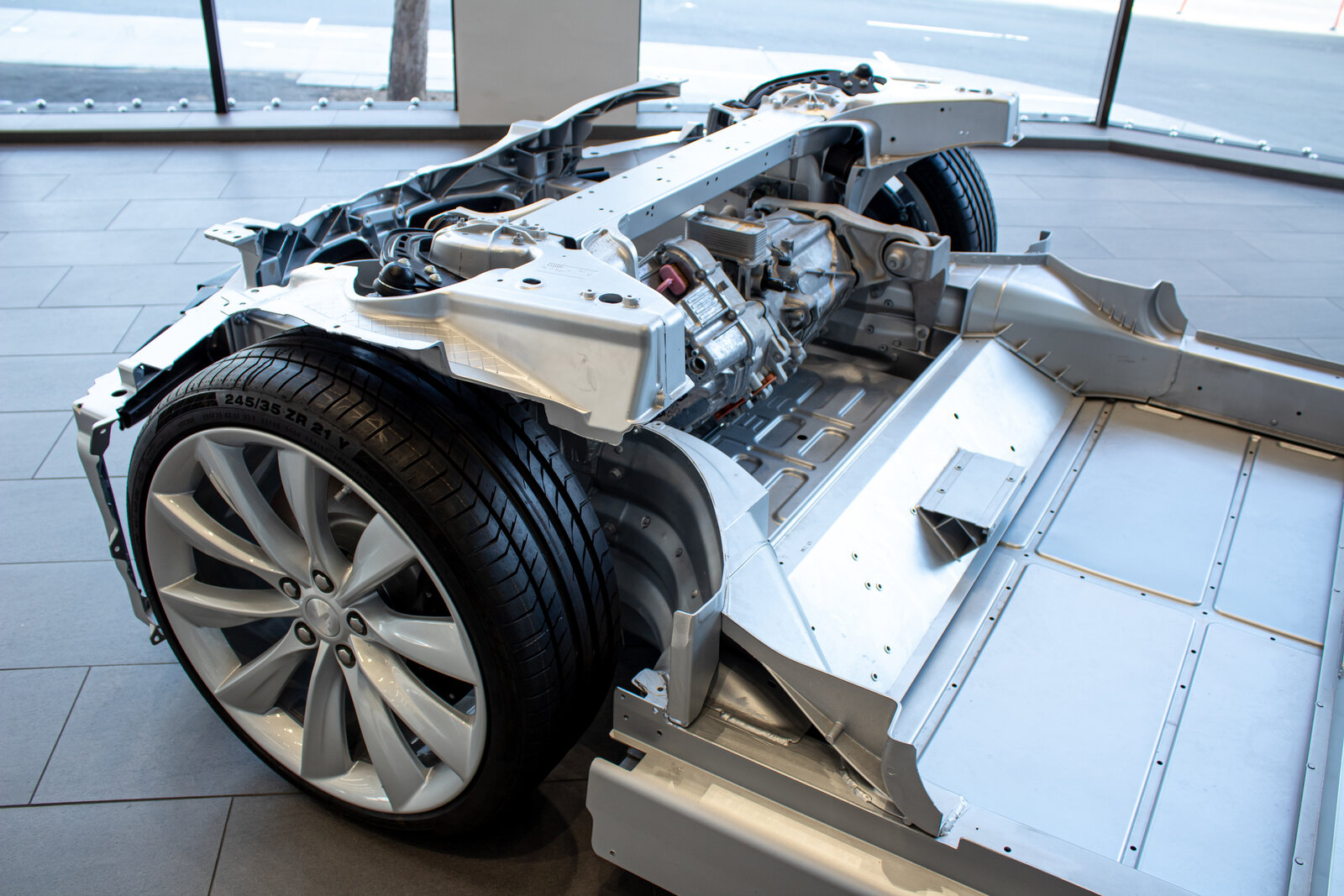

Abu Dhabi-backed CYVN Holdings invests USD 739 mn, acquiring 7% of Chinese EV maker Nio

CYVN Holdings invests in EV maker Nio: Abu Dhabi-backed investment firm CYVN Holdings is investing USD 738.5 mn in Chinese electric vehicle automaker Nio through a share subscription agreement, according to a statement. The agreement will result in CVYN acquiring a 7% stake in the EV firm and grabbing a seat on Nio’s board of directors. The transaction is subject to customary closing conditions, and is expected to close early next month, according to the statement.

The details: CYVN will purchase 85 mn Class A shares issued by Nio for USD 8.72 per share, and another 40 mn shares from an affiliate of Chinese internet giant Tencent, the statement disclosed. Once the transaction is closed, Nio will jointly pursue global business ventures with CYVN, the statement added. Following the announcement, Nio’s US share price fell by around 1%, Reuters reported.

Nio is struggling to compete with dominant EV giant BYD: Nio is looking to grab a larger EV market share in China, the world's largest automotive market that is currently dominated by giant car manufacturer BYD, Reuters said. Nio’s first quarter shipments slumped, and the company saw a worse-than-expected net loss, forcing it to slash prices on all of its models in China as well as delay its goal to break even by the end of the year.

About CYVN: CYVN, which is majority owned by the Abu Dhabi government, specializes in investments in smart and advanced mobility sectors aiming to accelerate the green transition, the statement notes. The fund is working on creating a smart mobility platform by partnering with industry leaders around the world.

About Nio: Nio designs, develops, jointly manufactures, and sells premium smart electric vehicles, including one of the fastest electric cars today. Nio operates in eight European cities and is one of three Chinese EV makers listed in the US. The company’s goal is to deliver more than 20k cars each month in 2H 2023 and to double sales to 250k electric vehicles this year, Bloomberg reports.

ELECTRIC VEHICLES

Saudi Arabia’s first EV brand Ceer secures manufacturing license for EV production factory

Saudi Arabia’s Ceer gets green light for EV production factory: Saudi Arabia’s first electric vehicle brand Ceer — a JV between Saudi Arabia’s sovereign wealth fund the Public Investment Fund (PIF) and Taiwanese multinational electronics contract manufacturer Hon Hai Precision Industry Company (Foxconn) — received a manufacturing license from KSA’s Ministry of Industry and Mineral Resources for its planned EV production plant in Saudi Arabia’s King Abdullah Economic City (KAEC), the Saudi Press Agency reports.

The details: Ceer’s USD 96 mn EV production plant will span 1 mn square meters and will be located in the Industrial Valley of KAEC, the news agency notes. A timeline on when the factory will become operational was not provided.

About Ceer: The company — first established in November last year — is expected to contribute USD 8 bn to Saudi Arabia’s GDP by 2034. Once it kicks off operations, the company is expected to rake in over USD 150 mn in foreign direct investment. Ceer’s EVs are expected to hit the market in 2025. Ceer will license component technology from BMW to use in the development process.

Not the first EV company PIF is throwing its weight behind: PIF invested USD 1 bn in EV manufacturer Lucid Motors — making it a majority shareholder — back in 2018 and said earlier this month it will purchase some 265.7 mn shares in the company in a private placement set to close on 26 June for c. USD 1.8 bn. Construction of Lucid’s Saudi Arabia production plant began in May this year. 80% of all EVs produced by Lucid Motors will be made in Saudi Arabia by 2030 with 155k EVs produced annually in Saudi Arabia by 2025.

ELECTRIC VEHICLES

Neom, Volocopter announce successful testing of KSA’s first electric air taxi flight

W for air e-mobility in Saudi Arabia: KSA’s Neom and German flying taxi maker Volocopter have successfully tested the kingdom’s first electric air taxi, according to a statement. The flight test campaign of the electric vertical take-off and landing aircraft (eVTOL) ran for a week after 18 months of collaboration between Neom, Saudi Arabia’s General Authority of Civil Aviation, and Volocopter to implement an electric urban air mobility (UAM) ecosystem and testbed at Neom.

What were they testing? The one-week campaign focused on the flight performance of the eVTOL in the local environment and its integration into the local unmanned aircraft system traffic management (UTM) system.

Background: The testing comes months after Neom said it was investing USD 175 mn in Volocopter last year as part of a plan to roll out an advanced air mobility industry in the country. The investment gave Neom a “significant stake” in the German company, according to statements at the time.

What are eVTOLs again? These drone-like aircraft use electric propulsion and large omnidirectional fans to allow them to takeoff vertically, making them energy efficient, quiet, environmentally friendly, and eventually pilotless. Beyond their use as air taxis, the vehicles are expected to be able to operate on an inter-city basis and even be used for cargo shipping.

All part of an ambitious plan by Neom: Volocopter’s eVTOLs will be essential to the Saudi mega city’s smart and sustainable multimodal mobility system, which will be fully powered by renewables, the statement read. Their roles will include being used as air taxis and emergency response vehicles.

And the UAE is on an eVTOL drive: The UAE has been marking its eVTOLs debut, with Abu Dhabi-based infrastructure investment company Monarch Holding signing in May an agreement with China-based autonomous and electric air mobility company Ehang Holding to establish a manufacturing facility for eVTOL aircrafts and drones. The facility is set to be one of its kind in the region. The agreement came a few months after Canadian air mobility infrastructure developer Vports signed an agreement with UAE’s Ras Al Khaimah Airport to set up and operate a vertiport designed for eVTOL aircrafts.

HYDROGEN

Global hydrogen transport and storage infrastructure present barriers to the investment ambitions needed

Is hydrogen infrastructure the top barrier to investment globally? Limitations in hydrogen transport and storage infrastructure is the number one reason for the lack of investments, surpassing the lack of profitability, according to a recent survey (pdf) carried out by DNV. Some 71% of respondents of DNVs survey — made up of 1.1k respondents from across the hydrogen economy in 80 countries — believe that current hydrogen ambitions underestimate some of the practical limitations and barriers to adoption.

What makes transporting and storing hydrogen so difficult? Hydrogen's flammable properties and its ability to embrittle materials can easily cause leakages in pipelines and tanks if precautions are not taken, presenting a storage and transport hurdle. Hydrogen also has the lowest energy density of all gasses and is easily lost into the atmosphere; a storage problem rendering it an inefficient energy carrier, according to research by the US Department of Energy (DoE). Currently available storage methods require large-volume systems that see hydrogen stored in its gaseous form, according to a separate report by the DoE. Green hydrogen needs to be kept in subzero, pressurized conditions, making it difficult, expensive, and potentially risky to transport.

Some are forging ahead: Moroccan hydrogen developer Gaia Future Energy and Spanish hydrogen provider HyDeal are partnering up to transport green hydrogen from Gaia Future Energy projects in Morocco and Mauritania to Europe. The hydrogen sourced from North Africa will be transported through a subsea coastal hydrogen pipeline connecting Mauritania and Morocco to Spain, and will leverage the potential avenue provided by the H2Med pipeline project to connect with more by 2030.

Green ammonia to the rescue: Ammonia can act as a carrier for hydrogen, making its transport more energy and size-efficient, and gives the region an advantage in the transition to low-carbon hydrogen given its established infrastructure for ammonia, especially in Egypt, Saudi Arabia, and the UAE. Dozens of regional agreements for green ammonia export to Europe, including the USD 5.5 bn green ammonia plant in Ain Sokhna which relied on two existing ammonia facilities in the Suez Canal Economic Zone owned by Fertiglobe.

Domestic manufacturing using green hydrogen increases export value: Not only does green ammonia offer a solution for a more efficient export of green hydrogen, but it can also help unlock USD 45 bn in foreign direct investment, according to a PwC report (pdf). The report makes the case for how the Middle East can reconfigure its value chain to capitalize on its abundant and cost-competitive supply of green energy and how local manufacturing of steel using green hydrogen as a fuel can unlock another USD 155 bn in investments.

Investor confidence reportedly isn’t strong… : The MENA region scored 2.6 out of 5 in a survey of investors’ opinions on hydrogen production infrastructure carried out by the Global Infrastructure Investor Association (GIIA), which gathered data through in-depth interviews with industry experts. Out of the 10 regions assessed, the Middle East comes in 6th place.

… Despite big potential: On a country level, Oman — which has a target to invest USD 140 bn in green hydrogen by 2050 in a bid to produce 7.5-8.5 mn metric tons annually — is on track to become the sixth-largest exporter of hydrogen globally, according to a recent International Energy Agency report (pdf).

Are LNG pipes the future of transportation? Existing natural gas pipelines may become an essential asset in the green transition as researchers find ways to repurpose natural gas pipelines for hydrogen transportation, with Siemens Energy currently running pilot tests to make the conversion. The region’s extensive natural gas pipeline, including the Arab Gas Pipeline, and the EastMed pipeline, may give it an advantage in the future if the studies were to progress further.

Morocco and Algeria faced technical barriers: Despite Morocco and Algeria announcing plans last year to export hydrogen to Europe using existing natural gas pipelines, former UAE Climate Change and Environment Minister Abdullah Belhaif Al-Nuaimi advised against the proposed plan given the great safety concerns that come with compressing hydrogen, according to Attaqa. Al-Nuaimi said that plans should not move forward until the ongoing research has progressed further.

CLIMATE DIPLOMACY

Morocco, The Netherlands strengthening renewables cooperation

Dutch Prime Minister Mark Rutte says he is “happy” to see the developing cooperation with Morocco in renewable energy, Maghreb Arabe Presse (MAP) reports, citing an interview the premier gave Le Matin. “I’m pleased that projects in this field have already been initiated, such as the cooperation between [the Moroccan Agency for Sustainable Energy], the Port of Rotterdam and the multinational storage company VOPACK, to develop the value chain for green hydrogen,” he said on the sidelines of a visit to Morocco.

Is green hydrogen on the table? Akhannouch and Rutte have reportedly chaired the closing session of a green hydrogen roundtable in Rabat, according to local media. They also signed an MoU and a partnership agreement, local media reported, without providing further details.

REMEMBER- Morocco has been pushing to position itself as a hub for renewable energy due to its major solar and wind capabilities. Morocco aims to have 50-52% of its energy come from renewables by 2030, up from the current 38%, Akhannouch said earlier this year.

The Dutch have been scouting renewables in the region lately: Saudi Arabia and the Netherlands inked an agreement in May to boost cooperation in renewable energy and green hydrogen production. Under the agreement, Saudi Arabia will establish a green hydrogen corridor to Europe with the Netherlands facilitating the entry of green fuels produced in the kingdom.

OTHER DIPLO STORIES WORTH KNOWING ABOUT THIS MORNING-

- Officials from the UAE Energy and Infrastructure Ministry met with Energy China to discuss areas of energy collaboration between the two entities. (Tweet)

ALSO ON OUR RADAR

UAE’s Dewa meets with Hong Kong based investor network: The Dubai Electricity and Water Authority (Dewa) met with a visiting delegation from global investor network the Hong Kong Ambassadors Club to discuss strengthening cooperation between the two countries in smart city technologies and renewable and clean energy among other things, Wam reports. CEO Saeed Mohammed Al Tayer welcomed the delegation and led a meeting on potential joint investments across various sectors, particularly in advanced technologies related to renewable and clean energy, energy storage, smart grids, and water.

Saudi Arabia and France signed 24 preliminary agreements worth USD 2.9 bn in a number sectors including low-carbon energy, the Saudi Press Agency reports. The agreements came on the sidelines of the France-Saudi Arabia Investment Forum, which brought together Saudi and French government officials and private sector companies to discuss major potential investments in tourism, tech ecosystem, and the energy transition. The number of French companies operating in Saudi Arabia has increased by 43% since 2020, reaching more than 110 firms. The individual project types, value, and timelines were not announced.

ALSO- A preliminary agreement was signed between Saudi Arabia’s investment firm Shurfah Holding Company and France’s Hoffman Green Cement to design and produce low-carbon cement, the National reports.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- UAE renewables giant Masdar has signed a MoU with Anwar Gargash Diplomatic Academy to facilitate the exchange of information and research papers. (Tweet)

- Schneider Electric is partnering with Magnom Properties and H2 Enterprises to make Forbes International Tower the first of its kind to run entirely on a Liquid Organic Hydrogen Carrier (LOHC) system. (Statement,pdf)

AROUND THE WORLD

Brazil’s Eve will sell 150 of its “flying cars”: Brazilian electric vertical take-off and landing (eVTOL) aircraft manufacturer Eve — a subsidiary of Embraer — signed letters of intent (LoI) during the Paris Air Show to sell 150 of its eVTOLS to Nordic Aviation, Wideroe Zero, and Voar Aviation, Reuters reports. Nordic Aviation is looking to secure 30 of the aircrafts, Voar is looking to buy 70 to operate in metropolitan areas across Brazil, and Wideroe Zero’s LoI could potentially purchase 50 for operations in Scandinavia. Eve, which expects to kick off commercial operations in 2026, already has a backlog of 2.8k orders, the news outlet notes.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- US-based electric vehicle manufacturer Rivian Automotive plans to install Tesla’s EV charge ports to its vehicles starting 2025. (Statement)

- China has extended tax breaks worth c.USD 72.3 bn for customers purchasing electric vehicles until 2027 in an effort to bolster its faltering EV industry. (Bloomberg)

ON YOUR WAY OUT

Caffeine addicts, rejoice: Stenophylla — a heat-tolerant coffee strain “lost” to commercial production for over 50 years — has been successfully grown in a Sierra Leone pilot project backed by coffee trader Sucafina, Bloomberg reports.

Why is this important? At least 60% of all wild coffee species are at risk of extinction, Sucafina said, explaining that coffee requires very specific temperatures to be able to grow. For example, Arabica coffee has an annual temperature requirement of around 19°C, according to Union coffee roasters. While other coffee species such as Robusta are more resilient to hot temperatures, but much lower in quality.

Enter Stenophylla: The coffee strain can be grown in temperatures 7°C warmer than the similar tasting Arabica bean, so the revived strain may hold the “genetic keys” to making coffee more resilient to climate change while still maintaining premium quality, the coffee trader said in February when the pilot tests were still in progress.

We probably won’t get to taste it for a while: The researchers that rediscovered the forgotten coffee strain have been working with Sucafina to propagate more than 3k stenophylla seedlings in nurseries, but it may take anywhere from 2 to 7 years for the trees to start bearing fruit.

CALENDAR

JUNE 2023

22-23 June (Thursday-Friday) The UN’s Summit for a New Global Financing Pact, Paris, France.

JULY 2023

3-7 July (Monday-Friday): The 36th Conference of the International Association of Climatology, Bucharest, Romania.

15-16 July (Saturday-Sunday): Second COP27 transitional committee workshop, Bangkok, Thailand.

TBD: Egypt’s post-COP27 Environmental and Climate Investment Forum, hosted by Egypt, Switzerland and UNIDO.

AUGUST 2023

20-24 August (Sunday-Wednesday): World Water Week 2023, Stockholm, Sweden.

21-22 August (Monday-Tuesday): International Conference on Recycling and Waste Management, USA.

21-22 August (Monday-Tuesday): International Conference on Environmental Sustainability and Climate Change, USA.

29 August-1 September (Tuesday-Friday): Third meeting of the COP27 Transitional Committee, TBD.

SEPTEMBER 2023

9-10 September (Saturday-Sunday): G20 Heads of State and Government Summit, New Delhi, India.

9-20 September (Saturday-Wednesday): 2023 Sustainable Development Goals Summit, New York, USA.

11-13 September (Monday-Wednesday): Global Congress on Renewable and Non-Renewable Energy, Dubai, UAE.

12-15 September (Tuesday-Friday): WTO Public Forum, Geneva, Switzerland.

19-21 September (Tuesday-Thursday): World Power-to-X Summit, Marrakesh, Morocco.

28 September (Thursday): International Energy Agency Critical Minerals and Clean Energy Summit, Paris, France.

Chariot Limited and Total Eren’s feasibility study on a 10 GW green hydrogen plant in Mauritania to be completed.

Egypt set to launch alliance to shore up climate financing in developing countries

OCTOBER 2023

4 October (Wednesday): Arabia CSR Gala Awarding Ceremony, UAE.

9-15 October (Monday-Sunday): World Bank/IMF 2023 Annual Meetings, Marrakech, Morocco.

16-18 October (Monday-Wednesday): Climate Week, Rome, Italy.

17-20 October (Tuesday-Friday): Fourth meeting of the COP27 Transitional Committee, TBD.

29 October- 2 November (Sunday-Thursday): Cairo Water Week, Cairo, Egypt

31 October – 2 November (Tuesday-Thursday): World Hydropower Congress, Bali, Indonesia.

NOVEMBER 2023

9-10 November (Thursday-Friday): International Renewable Energy Agency Investment Forum, Uruguay.

15-17 November (Wednesday-Friday): WETEX and Dubai Solar Show, Dubai, UAE.

16-17 November (Thursday-Friday): World Green Economy Summit (WGES), Dubai, UAE.

15-18 November (Wednesday-Saturday): DEWA’s First MENA Solar Conference, Dubai, UAE.

30 November – 12 December: Conference of the Parties (COP 28), Dubai, UAE.

FEBRUARY 2024

26-28 February (Monday-Wednesday): Management and Sustainability of Water Resources, Dubai, UAE.

APRIL 2024

16-18 April (Tuesday-Thursday): World Future Energy Summit, Abu Dhabi, UAE.

23-25 April (Tuesday-Thursday): Connecting Green Hydrogen MENA, Dubai, UAE.

EVENTS WITH NO SET DATE

2023

Mid-2023: Oman set to sign contracts for green hydrogen projects.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

2024

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

2025

International Union for Conservation of Nature World Conservation Congress, Abu Dhabi, UAE.

UAE to have over 1k EV charging stations installed.

2026

UITP Global Public Transport Summit, Dubai, UAE.

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2050

Tunisia’s carbon neutrality target.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.