- Egypt’s Orascom Investment Holding is exploring investments in Uzbekistan’s renewables. (Investment Watch)

- The UAE’s First Abu Dhabi Bank is lining up a USD 600 mn green bond issuance. (Debt Watch)

- The UAE’s Tabreed expands into India with its first district cooling transaction. (Investment Watch)

- Oman has reportedly begun talks with Egypt to explore developing a large-scale green hydrogen project. (What We’re Tracking Today)

- Masdar explores renewables collaboration with the US and Indonesia. (On Our Radar)

- You have 40 minutes to eat this edible coffee cup. (Climate in the News)

- Climate-induced drought in Central America is diverting ships from Panama to the Suez Canal. (On Your Way Out)

Wednesday, 31 May 2023

Egypt’s Orascom Investment Holding is exploring investments in Uzbekistan’s renewables

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, ladies and gents. The climate news cycle remains calm as we near the weekend, but we have a couple of big stories making headlines this morning.

THE BIG CLIMATE STORY- Orascom Investment Holding is exploring investments in Uzbekistan’s renewables and the hospitality sector, as part of a USD 1.2 bn investment plan discussed by OIH Chairman Naguib Sawiris during a meeting with Uzbekistan President Shavkat Mirziyoyev to “implement large investment projects” in the Central Asian country. Closer to home, the First Abu Dhabi Bank is set to raise c.USD 600 mn from a fresh five-year green bond issuance at 95 basis points (bps) above US Treasuries.

^^ We have the details on these stories and more in the news well, below.

THE BIG CLIMATE STORY OUTSIDE THE REGION- The UN’s Net Zero Ins. Alliance loses a fifth of its members in a week: UK ins. firm Lloyd’s of London joined ins. giants QBE Ins., Allianz, AXA, SCOR, and SOMPO Holdings in their withdrawal from world’s largest climate association for ins. companies, the UN’s Net Zero Ins. Alliance — a subunit of the Glasgow Financial Alliance for Net Zero. The group warned that political attacks from US lawmakers on antitrust concerns would drive more exits from the climate alliance. The UN-backed ins. coalition held an emergency meeting last week after Zurich-based reins. firm Zurich RE, Hannover Re, Zurich Ins. Group, and Munich RE withdrew from the group. While Zurich RE said the reason for its departure was to focus on helping its clients transition to a low carbon economy, Munich Re explicitly noted antitrust concerns led to its withdrawal from the climate alliance. The exits are drawing skepticism among industry leaders on the utility of voluntary industry associations aiming to slash carbon output.

The story made the rounds in the international press yesterday: Reuters | Bloomberg | Financial Times

WATCH THIS SPACE #1- Oman wants in on Egypt’s green hydrogen bonanza: The Oman Investment Authority (OIA) has reportedly begun talks with the Sovereign Fund of Egypt (SFE) and Egypt’s Electricity Ministry to explore developing a large-scale green hydrogen project in the country, Attaqa reported on Monday, citing people it says have knowledge of the matter. The sources estimated the project’s cost at USD 3-5 bn, and discussions are still underway over the potential project’s site, which could be in the Suez Canal Economic Zone (SCZone). The Omani sovereign wealth fund and the Egyptian government could disclose more details about the project when it is officially announced before the end of 3Q 2023, the sources added.

REMEMBER- The Egyptian government signed several framework agreements during COP27 with foreign companies to construct several green hydrogen and ammonia facilities in the SCZone. The facilities would cost a combined USD 83 bn and collectively produce up to 7.6 mn tons of green ammonia and 2.7 mn tons of hydrogen a year. Egypt also approved incentives earlier this month to boost the country’s green hydrogen sector and lure in much-needed foreign exchange inflows.

OIA’s not just interested in hydrogen: Saudi Arabia’s Acwa Power signed an MoU with OIA on the sidelines of COP27 last year to discuss bringing in OIA as an investor for Egypt’s 1.1 GW Suez Wind Energy project. Under the terms of the agreement, OIA will assess the possibility of owning up to 10% of the USD 1.5 bn project. The project is slated to be the largest single contracted wind farm in the Middle East upon completion in 2026.

ALSO- Oman’s state-owned Hydrom will sign agreements for the Phase A in Round 1 of its planned green hydrogen projects on 1 June, Zawya reports. Hydrom will ink several MoUs for the first phase of its planned green hydrogen plants and sign an agreement for the usufruct of concession plots in Duqm where the projects will be located with Oman’s Energy and Minerals Ministry and Housing and Urban Planning Ministry. Back in March, Hydrom signed six binding term sheet agreements worth a combined USD 20 bn with several regional and international developers for the production of green hydrogen. The company plans to invest USD 140 bn by 2050 to meet its target of generating between 7.5-8.5 mn tons of green hydrogen annually by mid-century.

|

ENTERPRISE IS LOOKING FOR SMART, TALENTED PEOPLE of all backgrounds to help us build some very cool new things. Enterprise — the essential morning read on all the important news shaping business and the economy in Egypt and the region — is looking for writers, reporters and editors to help us build out new publications. Today, we run four daily Egypt and MENA-focused publications, five weekly industry verticals, and a weekend lifestyle edition designed to make our readers feel just a bit smarter.

We have tons more in the pipeline — come help us build new publications. We offer the chance to work in a fast-paced newsroom on a broad range of topics and in a variety of formats. Our goal is simple: To create value for our growing community of >250k daily readers by telling stories that matter.

Journalists looking to explore business, finance and economic stories are welcome. So are recent journalism school graduates.

That said, we're looking for gifted story-tellers from all walks of life and across all professions, as long as they show a keen interest in learning to write about the stories, topics, businesses, and figures moving markets. Egyptian and foreign nationals alike are welcome to apply. So are job-switchers: If you’re an equities analyst tired of the rat race, we’re a great place to come work.

NEVER WORKED IN A NEWSROOM BEFORE? We have the Enterprise Business Writing Development Program. Whether you are a recent graduate, an industry vet, or looking to switch careers, the Enterprise Business Writing Development Program will give you the tools you need to tell the most important stories to our audience of C-suite officials, government ministers, diplomats, financiers, investors and entrepreneurs.

During the program you will learn:

- The key news stories and trends shaping business and the economy in Egypt and the region, across various sectors;

- Business and finance for non-finance people: Whether it's industry jargon or key concepts or simply how to read a balance sheet;

- How to construct an Enterprise story: From idea formulation down to the structure, style and tone of writing;

- How to develop sources that will give you the key insights needed to tell a complete story;

- How to communicate these stories with the confidence and language of an insider.

Not an internship program — a career: The three-month program will see full-time, paid participants take part in workshops and lectures from veteran business journalists, while also working on and filing stories that will run on any of our publications. Those who have successfully completed the program, will then be given long-term job offers.

Apply directly to jobs@enterprisemea.com and mention “writing development program” in your subject line.

***

YOU’RE READING ENTERPRISE CLIMATE, the essential MENA publication for senior execs who care about the world’s most important industry. We’re out Monday through Thursday by 5am Cairo / 5am Riyadh / 6am UAE.

EXPLORE MORE OF ENTERPRISE ON THE WEB — tap or click here to read EnterpriseAM, EnterprisePM, and The Weekend Edition on our powerful new website packed with reader-friendly features.

Were you forwarded this email? Get your own subscription without charge here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

CIRCLE YOUR CALENDAR-

Saudi Arabia will host the Arab-Chinese Business Conference on Sunday, 11 June and Monday, 12 June in Riyadh. The conference will bring together CEOs, business leaders, investors, and entrepreneurs from the Middle East and China to collaborate on new trade and investment initiatives in different sectors, including renewables and minerals. A panel discussion titled Clean Energy and Renewables – Pathways to Emissions Reduction is scheduled on the first day, according to the program (pdf). The second day will focus on the localization of renewable energy and on value chain opportunities in mining.

The UAE will host The Arab Green Summit on Tuesday, 13 June to Wednesday, 14 June in Dubai. The two-day summit will bring together industry players and experts for conversations on climate change and sustainability and solutions for concurrent climate-related issues in the region. Key themes to be addressed during the summit include industry decarbonization, renewable and clean energy potential and implementation, sustainable building and construction and others.

Morocco will host the Bloomberg New Economy Gateway Africa on Tuesday, 13 June to Wednesday, 14 June in Marrakech. The event will bring together stakeholders from the private and public sector to discuss the world’s most pressing topics and assess potential solutions. Those include the impact of a decelerating global economy, spiking food and energy prices, supply-chain shocks and risks of distress among sovereign borrowers.

Check out our full calendar on the web for a comprehensive listing of upcoming news events and news triggers.

INVESTMENT WATCH

Egypt’s Orascom Investment Holding is exploring investments in Uzbekistan’s renewables

Orascom Investment Holding (OIH) is exploring investments in Uzbekistan’s renewables and the hospitality sector, OIH CEO Marwan Hussein told Enterprise Climate on Tuesday. The potential investments are part of a USD 1.2 bn investment plan discussed by OIH Chairman Naguib Sawiris during a meeting on Monday with Uzbekistan President Shavkat Mirziyoyev to “implement large investment projects” in the Central Asian country, according to a statement released by the Uzbekistani presidency.

The details: OIH will only be concerned with the potential investments in wind and solar power plants and the hospitality sector, Hussein said. The remaining investments — which the Uzbekistani presidency said will be in food products, geological exploration, and developing metal deposits — will be funded by the Sawiris family, Hussein explained. Talks are still in an early stage, and OIH is “examining the potential projects and announcing it in due course,” he said.

We knew something of the sort was in the works: Uzbekistan’s Mirziyoyev visited Egypt in February to meet with members of the country’s business community, including Orascom Construction, which expressed interest in building a 100 MW wind farm and an industrial park that would house paint, varnish, and chemical facilities, according to a statement released by Uzbekistan’s government at the time.

All part of Uzbekistan’s renewables push: Uzbekistan aims to source 35% of its electricity from renewables by 2035. It plans to establish wind energy plants totaling 10 GW and solar energy farms that would generate 5 GW of clean power by 2030 to offset a total of 16 mn tons of CO2 per annum.

Getting lots of love from the region: Uzbekistan’s growing renewables sector has been getting attention from several regional players, with Masdar signing a joint development agreement with Uzbekistan earlier this month to develop renewables projects worth some 2 GW and 500 MW of battery energy storage system (BESS) facilities across multiple locations. It also achieved financial close on three solar plants last month to be set up in Uzbekistan’s Sherabad, Samarkand, and Jizzakh that would yield c. 900 MW. Masdar also actively contributed to Uzbekistan’s first 100 MW IPP solar project Nur Navoi, which has been operational since 2021. Back in September, Masdar achieved financial close on the USD 600 mn 500 MW Zarafshan wind project in Uzbekistan — Central Asia’s largest wind farm. The company was also awarded the 250 MW Bukhara Solar PV project, which includes a 62 MW battery energy storage system in late 2022.

And especially from the Saudis: Saudi Arabian renewables giant Acwa Power signed financing agreements worth USD 120 mn earlier this month for the 100 MW Karatau wind farm — formerly known as Nukus Wind IPP. It also signed three power purchase agreements totaling USD 2.5 bn in March with the National Electric Grid of Uzbekistan and the country’s Investment, Industry, and Trade Ministry for 1.4 GW worth of solar projects and three battery energy storage (BESS) units totalling a capacity of 1.5 GWh. It plans to invest c. USD 10 bn in Uzbekistan’s renewables projects through to 2028 beyond the USD 5 bn it has already poured in to fund five clean energy projects it owns and operates in the country, which include the USD 658 mn 500 MW Dzhankeldy Wind Farm and the USD 690 mn 500 MW Bash Wind Plant.

DEBT WATCH

The UAE’s First Abu Dhabi Bank is lining up a USD 600 mn green bond issuance

First Abu Dhabi Bank (FAB) is reportedly set to raise c.USD 600 mn from a fresh five-year green bond issuance, Reuters reports, citing a bank document it has seen. FAB sold the bonds at 95 basis points (bps) above US Treasuries after tightening 25 bps from initial guidance in the wake of high demand in excess of USD 1.4 bn, the newswire notes. Proceeds from the green bond would be channeled toward environmental projects in line with FAB’s Sustainable Finance Framework.

Advisors: FAB will act as the debt instrument’s green structuring agent, while New York-headquartered investment banking firm Citi Credit Agricole, HSBC and Standard Chartered will serve as bookrunners and lead managers for the issuance, according to Reuters.

First Abu Dhabi Bank is a major player in the GCC’s green bond scene: The bank raised USD 1.49 bn through three green bond issuances in 2022 alone. Most recently, FAB acted as one of the lead managers for Majid Al Futtaim’s most recent green sukuk issuance, which saw the UAE retailer raise USD 500 mn earlier this week. The bank also acted as an advisor on Abu Dhabi National Energy Company’s shariah-compliant USD 1.5 bn dual-tranche green bond issuance, and Dubai Islamic Bank’s second green sukuk issuance, which saw it raise USD 1 bn, and was also an advisor on Saudi Electricity Company’s USD 2 bn green bond.

INVESTMENT WATCH

Tabreed expands into India with first district cooling transaction

Tabreed makes grand entry in India: The UAE’s National Central Cooling Company (Tabreed) has achieved its first district cooling transaction in India under a partnership with Tata Realty and Infrastructure Limited (TRIL) in a multi mn AED agreement, it said in a statement (pdf) to DFM. The agreement with the real estate and infrastructure development arm of Indian conglomerate Tata Sons includes a AED 44.34 mn investment in TRIL’s Intellion Park special economic zone development in Gurugram.

What we know: The investment will allow Tabreed to acquire the existing cooling infrastructure at the park — spanning a total area of 3.5 mn square feet — and develop additional capacity to meet rising demand for cooling services at the zone and residential tenants in the area, the statement notes. Tabreed also plans to bolster and support the adoption of district cooling for developers amid a forecasted uptick in need for district cooling in the Indian real estate sector in the coming decades.

Right place, right time: India expects aggregated cooling demand to grow eightfold by 2037-2038, with cooling accounting for 45% of peak energy demand nationwide by 2050, the statement said, citing data from India’s Environment, Forest, and Climate Change Ministry. The ambitious targets come a few years after the ministry set up the India Cooling Action Plan to back the growth of sustainable district cooling across the country.

What they said: “As the world’s most populous country and one of the fastest growing economies, India will be a key strategic market and important partner for Tabreed as we expand our international presence,” Tabreed Chairman Khaled Abdulla Al Qubaisi said in the statement. “We expect to see large-scale adoption of district cooling in India as demand for real estate and cooling grows at a rapid pace.”

CLIMATE IN THE NEWS

You have 40 minutes to eat this edible coffee cup: Australian startup and maker of edible, biodegradable, and plastic-free coffee cups Good-Edi is looking to expand its sales to international markets this year, Bloomberg reports. The cups — made from a mixture of rye flour, wheat bran, oat bran, sugar, salt, coconut oil and water — can hold a hot drink for about 40 minutes and a cold one for about eight hours. The startup — founded in 2021 by a team of bakers — produces about 500 cups a day for clients across Australia, including coffee shops, roasteries, and concert venues, in an effort to put a dent in the 2.7 mn disposable cups that pile up each day in the country’s landfills. According to their own analysis, one of Good-Edi’s edible cups generates 0.08 kg of CO2 equivalent over its lifetime, 27% lower than the 0.11 kgs produced from a standard paper cup imported from overseas.

ALSO ON OUR RADAR

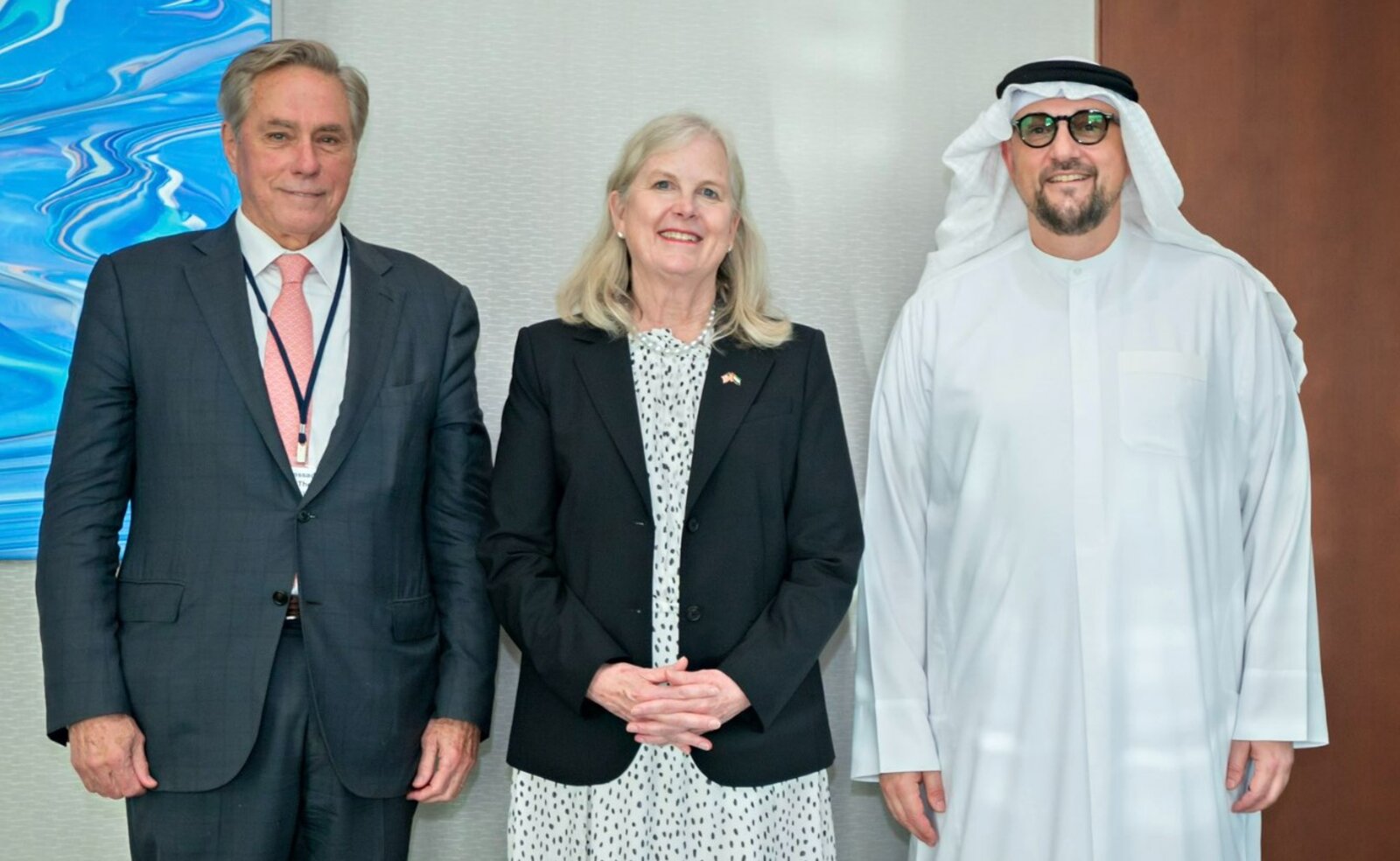

Masdar continues to seek global partnerships in meetings with Indonesia, US: UAE’s renewable energy giant Masdar explored potential cooperation on clean energy initiatives in a meeting with US Deputy Undersecretary for the International Trade Administration Diane Farrell and during a UAE-Indonesia networking event in Jakarta, the company said (here and here). Masdar CEO Mohamed Jameel Al Ramahi expressed the company’s dedication to the US clean energy sector to Farell, while another Masdar delegation co-hosted a business event with a ADX-listed global satellite services operator Yahsat under the theme “Growing UAE-Indonesia Bonds on Green Economy and Space.” Yahsat’s fleet of five satellites reaches more than 80% of the world’s population, across 150 countries.

Hydrogen infrastructure investments are also on the radar: Hydrogen hubs are “not silver bullets, but silver linings,” Masdar Director of Business Development and Commercial Andreas Bieringer said in a live discussion Enterprise Climate attended, hosted by Abu Dhabi Sustainability Week. In a discussion with Port of Amsterdam Managing Director Get-Jan Nieuwenhuizen and Senior Advisor to the Undersecretary of Infrastructure at the US Department of Energy Leslie Biddle, Bieringer explained that hubs do not only unlock access to multiple uses for the fuel — like producing steel or iron — but also reduce offtaker risk given that hydrogen producers can sell to multiple users, helping to attract investments and bring down costs.

Masdar’s foray into SAF production is coming soon: Announcements on developments in Abu Dhabi’s sustainable aviation fuel (SAF) sector to be expected ahead of COP28, Bieringer said, pointing to recent partnerships between Masdar and Airbus and another with Adnoc. Abu Dhabi’s strategic location and ability to scale up renewables makes it the ideal spot to pilot SAF projects according to Bieringer, who added “if it’s not happening here first, I wouldn't know where else.”

Hitachi Energy to build electricity link between Neom’s Oxagon and Yanbu: Zurich-based tech company Hitachi Energy has signed agreements with the Saudi Electricity Company and Neom’s water management and utility company Enowa to build a 3 GW high voltage direct current (HVDC) transmission system connecting Neom’s floating industrial complex Oxagon to the country’s port city of Yanbu across 650 km, according to a statement. Hitachi has also signed a separate early works and capacity reservation agreement with Enowa for two additional HVDC transmission lines with a 3 GW capacity each.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- Saudi Arabia’s General Authority of Civil Aviation has signed two MoUs with Chinese digital tech company Hikvision and a JV between Swiss precious metals refiner Valcambi and private sector conglomerate Ajlan & Bros to establish centers for assembly, distribution, and recycling for the two companies at the kingdom’s Special Integrated Logistics Zone. (SPA)

- Electric vehicles in the UAE currently make up 1% of the overall car market in the country and the country has increased the number of EV charging stations to 800 over the past three years. (CNBC Arabia)

- French car maker Renault’s Dacia Sandero — manufactured at a zero carbon facility in Tangier, Morocco — was the top selling car in Europe in April with 18k units sold. (Morocco World News)

- UAE telecom giant Du has committed to reaching net zero scope 1 and 2 emissions by 2030 and scope 3 by 2050. Scope 1 and 2 represent direct emissions, while scope 3 considers all components of the value chain. (Wam)

- Oman’s Energy and Minerals Ministry signed three agreements for the exploration and mining of potash and lithium in the Dhahirah and Al Wusta governorates. Lithium is a key mineral for the production of EV batteries and potash has recently been considered as an alternative. (Oman News Agency)

AROUND THE WORLD

India’s Oil and Natural Gas Corp earmarks INR 1 tn for green energy projects: Indian oil company Oil and Natural Gas Corp (ONGC) is allocating INR 1 tn (USD 12.1 bn) to grow its clean energy generation to 10 GW by the end of the decade from its current production volume of 189 MW, Bloomberg quoted ONGC Chairman Arun Kumar Singh saying earlier this week. The company — which produces around half of India’s oil and gas — may become carbon neutral by 2038, according to Singh, but its greenhouse gas slashing plan excludes carbon generated from its oil and gas sales.

A French “battery valley”: France inaugurated its first EV battery plant on Tuesday under a plan to turn the Hauts-de-France region into a “battery valley,” AFP reports. The “gigafactory” in Billy-Berclau is owned by Automotive Cells Company (ACC), a joint venture between French TotalEnergies, Germany’s Mercedes-Benz, and US-European car maker Stellantis. It is the first of four factories set to open in the next three years in the area as demand for EVs grows. Production at the factory is set to begin this summer, with the facility set to supply 500k per year by 2030 under the French government’s plan to manufacture 2 mn EVs per year by then.

The more, the merrier: Two other ACC-owned factories are set to open in Germany and Italy, German Transport Minister Volker Wissing said, stressing that "Europe remains at the forefront of global progress tomorrow."

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- US car maker General Motors and South Korean chemical company Posco Future have secured USD 221 mn from Canada's provincial and federal governments for an EV battery plant in Quebec, Canada, covering 50% of the facility’s cost. (Bloomberg)

ON YOUR WAY OUT

The Panama Canal’s water shortage spells a boon for Egypt’s Suez Canal: Climate-driven water scarcity in Central America has driven the Panama Canal Authority to mandate that shipping vessels decrease their payloads, driving freight ship traffic to Egypt’s Suez Canal, Asharq Business writes. The operators of the 64-km-long Panama Canal — where the Pacific and Atlantic oceans connect and through which c.5% of the world’s trade passes — unload some 200 mn liters of fresh water whenever any ship passes through the channel to enable it to pass through the Canal’s locks, Deutsche Welle writes. However, the water shortage has forced the Panama Canal Authority to restrict ships that are larger than a certain size from transiting through the canal.

What does this mean for the Suez Canal? This development is expected to have a “significantly positive impact” on Suez Canal traffic, President of the Suez Canal Authority Osama Rabea told Asharq Business. Traffic through the Suez Canal is expected to grow 10% y-o-y in 2023, raking in some USD 8.8 bn, according to Rabea. Almost 12% of global trade flows through Egypt’s Suez Canal.

CALENDAR

MAY 2023

30 May-1 June (Tuesday-Thursday): Global Sustainable Development Congress, King Abdullah University of Science and Technology (KAUST), KSA.

30 May-2 June (Tuesday-Friday): World Circular Economy Forum 2023, Helsinki, Finland.

JUNE 2023

1 June (Thursday): Invest in African Energy Forum, Paris, France.

5-8 June (Monday-Thursday): IDEA2023, Chicago, US

8 June (Thursday): Envirotec and Energie Expo, Tunis, Tunisia.

11-12 June (Sunday-Monday): Arab-Chinese Business Conference, Riyadh, Saudi Arabia.

12-15 June (Monday-Thursday): Saudi Plastics & Petrochem, Riyadh, KSA.

13-14 June (Tuesday- Wednesday): The Arab Green Summit, Dubai, UAE.

13-14 June (Tuesday- Wednesday) Bloomberg New Economy Gateway Africa Conference, Marrakesh, Morocco.

13-14 June (Tuesday- Wednesday): Vision Golfe 2023, French Ministry of the Economy, Finance and Industrial and Digital Sovereignty, Paris, France.

22-23 June (Thursday-Friday) The UN’s Summit for a New Global Financing Pact, Paris, France.

JULY 2023

3-7 July (Monday-Friday): The 36th Conference of the International Association of Climatology, Bucharest, Romania.

22-23 July (Saturday-Sunday): Second COP27 transitional committee workshop, Bangkok, Thailand.

TBD: Egypt’s post-COP27 Environmental and Climate Investment Forum, hosted by Egypt, Switzerland and UNIDO.

AUGUST 2023

20-24 August (Sunday-Wednesday): World Water Week 2023, Stockholm, Sweden.

29 August-1 September (Tuesday-Friday): Third meeting of the COP27 Transitional Committee, TBD.

SEPTEMBER 2023

9-20 September (Saturday-Wednesday): 2023 Sustainable Development Goals Summit, New York, USA.

11-13 September (Monday-Wednesday): Global Congress on Renewable and Non-Renewable Energy, Dubai, UAE.

12-15 September (Tuesday-Friday): WTO Public Forum, Geneva, Switzerland.

28 September (Thursday): International Energy Agency Critical Minerals and Clean Energy Summit, Paris, France.

Chariot Limited and Total Eren’s feasibility study on a 10 GW green hydrogen plant in Mauritania to be completed.

Egypt set to launch alliance to shore up climate financing in developing countries

OCTOBER 2023

4 October (Wednesday): Arabia CSR Gala Awarding Ceremony, UAE.

16-18 October (Monday-Wednesday): Climate Week, Rome, Italy.

17-20 October (Tuesday-Friday): Fourth meeting of the COP27 Transitional Committee, TBD.

29 October- 2 November (Sunday-Thursday): Cairo Water Week, Cairo, Egypt

31 October – 2 November (Tuesday-Thursday): World Hydropower Congress, Bali, Indonesia.

NOVEMBER 2023

9-10 November (Thursday-Friday): International Renewable Energy Agency Investment Forum, Uruguay.

15-17 November (Wednesday-Friday): WETEX and Dubai Solar Show, Dubai, UAE.

15-18 November (Wednesday-Saturday): DEWA’s First MENA Solar Conference, Dubai, UAE.

30 November – 12 December: Conference of the Parties (COP 28), Dubai, UAE.

FEBRUARY 2024

26-28 February (Monday-Wednesday): Management and Sustainability of Water Resources, Dubai, UAE.

EVENTS WITH NO SET DATE

2023

Mid-2023: Oman set to sign contracts for green hydrogen projects.

Mid-2023: Sale of Sembcorp Energy India Limited to consortium of Omani investors to close.

Phase C of the 900-MW of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai to be completed.

Saudi Basic Industries Corporation (Sabic) steam cracker furnace powered by renewable energy to come online.

2024

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

2025

UAE to have over 1k EV charging stations installed.

2026

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2050

Tunisia’s carbon neutrality target.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.