- Infinity Power signs a 20-year battery energy storage contract in Senegal. (Battery Storage)

- KSA’s Desert Technologies and Elsewedy Electric ink an agreement to boost exports. (Renewables)

- DP World lists its USD 1.5 bn green sukuk issuance on Nasdaq Dubai. (Capital Markets)

- UAE’s Taqa has a rocky 3Q with a 30% y-o-y drop in net income. (Earnings Watch)

- Jordan explores the feasibility of new green hydrogen projects. (What We’re Tracking Today)

- 60 countries are on board with the pledge to triple renewables and phase down coal by 2030. (What We’re Tracking Today)

- The rate of melting glaciers in Greenland has entered a new phase over the last two decades, scientists warn. (Climate in the News)

Tuesday, 14 November 2023

Infinity Power signs a 20-year battery energy storage contract in Senegal

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends. We have a compact issue for you this morning with some significant news from our friends at Infinity…

THE BIG CLIMATE STORY- Egypt-based renewable energy developer Infinity Power — a joint venture between Infinity and UAE renewables player Masdar — has signed a 20-year Capacity Change Agreement agreement with Senegalese national utility Senelec to supply 40 MW of clean energy to the country’s grid through a battery energy storage system.

^^ We have the details on this story and more in the news well, below.

THE BIG CLIMATE STORY OUTSIDE THE REGION- The US and Indonesia explore partnering on minerals: The US and Indonesia discussion over a potential minerals partnership made headlines yesterday ahead of a meeting between US President Joe Biden and his Indonesian counterpart Joko Widodo. The talks will reportedly focus on reducing the environmental impact of nickel supply — a critical metal needed for the production of EV batteries — from Indonesia, which has one of the world's biggest nickel ore reserves. This also comes as the only nickel mine in the US is expected to close in a few years, posing a risk to EV production in the country. The US — which alongside the EU is looking to counter Chinese dominance in the mining and EV sectors — struck a similar trade agreement with Japan in March that will see minerals critical to EV battery production extracted in the East Asian country including nickel count toward the USD 7.5k EV tax credits of the Inflation Reduction Act.

The story made headlines in the international press: Reuters | New York Times | Washington Post | CNBC | AP News | Euronews

OVER IN COPLAND- 60 states are on board with the pledge to triple renewables and phase down coal by 2030, two officials familiar with the matter told Reuters in exclusive statements. While the draft pledge seen by Reuters says that unabated coal power is included in the phasedown — leaving room for increased coal production on the condition that carbon capture and storage are utilized — the proposal includes a commitment to end the financing of new coal-fired power plants. Doubling the world's annual rate of improvements in energy efficiency to 4% per year until 2030 is also a goal set out by the pledge, the newswire reports. The three countries spearheading the pledge will call for its inclusion in the final outcome of COP28’s World Climate Action Summit concluding on December 2, the officials added.

Who’s in? Some significant economies have already expressed support and said they will join the pledge, including Nigeria, South Africa, Vietnam, Australia, Japan and Canada, Peru, Chile, Zambia and Barbados, the officials told Reuters. Additionally, negotiations with China and India to sign onto the pledge are at an advanced stage but are both yet to agree, one of the officials told Reuters.

ALSO- The EU will contribute big to the loss and damage fund: The EU claims it's ready to make “substantial” contributions to the loss and damage fund scheduled to launch at COP28, according to a joint statement. Climate Commissioner Wopke Hoekstra and the UAE's COP28 President-Designate Sultan Al Jaber highlighted the EU’s plans to put in big money in efforts to push for an “ambitious” outcome at COP28 and emphasized the importance of ensuring the loss and damage fund is operationalized. So far, no country has announced a specific financial pledge to the fund, though some have signaled their intent or interest, Reuters writes.

And there’s more EU funds on the way: The EU Commission is also planning to make financial contributions in support of the COP28 Renewable Energy and Energy Efficiency pledge — tripling renewables and doubling both energy efficiency and hydrogen by 2030 — and invites countries to do the same during the World Climate Action Summit at the climate summit, Hoekstra and Al Jaber said in the statement.

WATCH THIS SPACE #1- Jordan explores the feasibility of new green hydrogen projects: The Jordanian Ministry of Energy and Mineral Resources signed four MoUs with Jordan’s Kawar Energy, Philadelphia Solar, Amarenco, and the German renewables firm Enertrag to carry out feasibility studies for potential green hydrogen projects in the kingdom, according to a statement. The kingdom has a potential to become a significant player in the global green hydrogen market given that 27% of its energy is already sourced from renewables, Energy Minister Saleh Al-Kharabsheh said in the statement.

The details: Under the agreements, Jordan aims to generate 100k tons of green ammonia per year with Kawar Energy, 100k to 200k tons with Philadelphia Solar, 200k tons with Enertag, and 1 mn tons with Amarenco.

There’s more deals coming at COP: Five MoUs are scheduled for signature at the COP28 climate summit later this month, paving the way for companies to conduct one-year preliminary feasibility studies for new green hydrogen projects in the country.

The kingdom’s on a roll: Jordan’s Energy Ministry also signed an MoU with Jordan Green Ammonia last month to conduct feasibility studies on developing green hydrogen projects in the country. Kharabsheh said at the time that 12 unnamed companies have expressed interest in signing agreements with the ministry on green hydrogen, adding that it plans to release its green hydrogen strategy soon.

WATCH THIS SPACE #2- Boeing and UK’s Zero Petroleum partner up on SAFs: US aircraft manufacturer Boeing has signed an agreement with British net zero e-fuels producer Zero Petroleum that will see both parties partner on research and development to accelerate the transition to sustainable aviation fuels (SAFs), according to Time Aerospace. The partnership also aims to expedite certification of Zero Petroleum’s SAF blends.

Both sides have big plans: Earlier this year, Boeing said it plans to double its SAF purchases in 2023 and signed an agreement with the UAE’s Masdar last month to advance and support the development and adoption of SAF projects in the Emirates and globally. Last month, Zero Petroleum signed an agreement with Adnoc to establish a synthetic fuels production plant in the UAE.

IN OTHER AVIATION NEWS- The Emirates National Oil Company plans to supply SAF to Dubai Airports starting 2024 and is currently exploring SAF production both domestically and abroad, according to a statement.

|

***

YOU’RE READING ENTERPRISE CLIMATE, the essential MENA publication for senior execs who care about the world’s most important industry. We’re out Monday through Thursday by 5am Cairo / 5am Riyadh / 6am UAE.

EXPLORE MORE OF ENTERPRISE ON THE WEB — tap or click here to read EnterpriseAM, EnterprisePM, and The Weekend Edition on our powerful new website packed with reader-friendly features.

Were you forwarded this email? Get your own subscription without charge here or reach out to us on climate@enterprisemea.com with comments, suggestions and story tips.

***

CIRCLE YOUR CALENDAR-

The UAE will host the MENA Solar Conference from Wednesday, 15 November to Saturday, 18 November in Dubai. The event will focus on all things photovoltaic, with a full programme on PV materials and devices, future technologies, PV reliability, and forecasting for performance assessment. The conference will also touch on how developments in system operations, concentrated solar power, and grid integration are necessary for the green transition. This will be the first scientific and technical conference specializing in solar energy systems in the region.

The UAE will host the Aviation and Alternative Fuels conference from Monday, 20 November to Friday, 24 November in Dubai. The event will bring together senior government officials and international organizations to assess progress in the development and deployment of sustainable aviation fuels (SAFs) and lower-carbon aviation fuel (LCAF) measured according to the targets outlined in the 2050 Vision for SAF, agreed upon at the last Aviation and Alternative Fuels conference in 2017.

The UAE will host the Abu Dhabi Finance Week (ADFW) from Monday, 27 November to Thursday, 30 November in Abu Dhabi. The event will gather government officials, banks, financial institutions, and VCs to delve into today’s economic, technological, and sustainability conversations.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

BATTERY STORAGE

Infinity Power signs a 20-year battery energy storage contract in Senegal

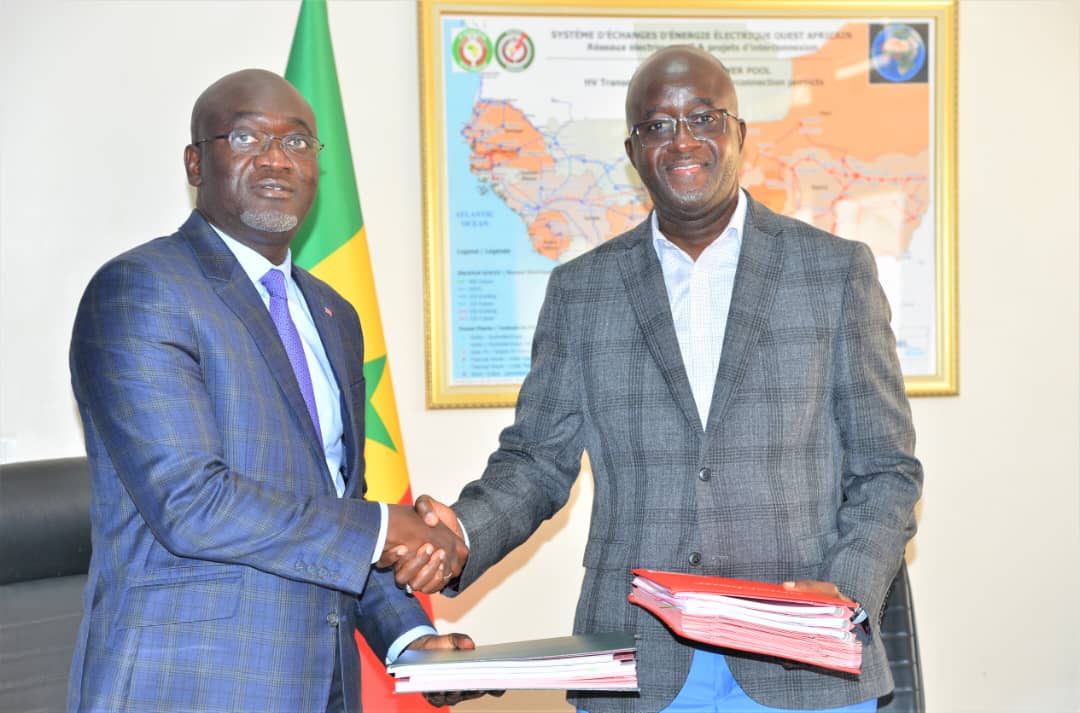

Infinity Power inks 20-year BESS contract in Senegal: Egypt-based renewable energy developer Infinity Power — a joint venture between our friends at Infinity and UAE renewables player Masdar — has signed a 20-year Capacity Change Agreement agreement with Senegalese national utility Senelec to supply 40 MW of clean energy to the country’s grid through a battery energy storage system (BESS), according to a statement (pdf). The BESS system will help Senelec stabilize the country’s electrical grid. The expected investment ticket for the project was not disclosed.

More details: The company will break ground on its planned BESS system in 2024 with the aim to bring it online in 2025. The facility will be operated by Infinity’s 158.7 MW Taiba N’Diaye wind farm in Thies — the country’s first and largest utility-scale wind power project — which has increased the country’s generation capacity by 15%.

Big emissions cuts and savings: The project will offset an estimated 37k tons of emissions annually once operational, and increase national energy storage capacity in preparation for the country’s planned clean energy projects, the statement notes. Over its 20-year lifecycle, the project is expected to accrue USD 165 mn in power savings by reducing the network’s reliance on reserve capacity derived from thermal plants.

Infinity recently upped its renewables targets: Last month, the company said it is looking to expand its renewable energy portfolio to 10 GW by 2030 and said its target will likely garner some USD 5 bn in direct investments.

And already has a considerable foothold in Africa: Infinity Power, Masdar and Hassan Allam Utilities signed back in June a land allocation agreement with the Egyptian government for their USD 10 bn, 10 GW wind farm in Sohag. Infinity is also among seven consortiums that have bought the tender and conditions booklet for several planned renewables-powered desalination projects on Egypt’s North Coast, and is among companies interested in acquiring a stake in the 580 MW Gabal El Zeit wind farm.

Exports on the horizon: The company signed back in May an agreement with Greece-based Copelouzos Group to explore the feasibility of jointly developing renewable energy projects to export energy to Europe via its 3 GW Greece-Egypt Interconnector (GREGY).

RENEWABLES

Desert Technologies and Elsewedy Electric to boost Saudi exports in renewables

Desert Technologies + Elsewedy Electric partner on PV exports: KSA-based renewable energy solutions company Desert Technologies has inked an MoU with Elsewedy Electric to boost its exports of renewable energy products to African markets, according to a statement. Desert Technologies also plans to raise its production capacity to 4 GW yearly and increase the share of locally made solar panels for renewable energy projects implemented by Elsewedy in the kingdom.

About Desert Technologies: Desert Technologies is a solar PV and smart infrastructure holding company focused on manufacturing and sustainable investments. The Saudi-based company operates in more than 25 countries, according to the statement.

The company is expanding in the region: The company signed an agreement with Oman's Colossal Engineering and Construction in February to launch solar projects in Oman. It was also among the companies to sign an MoU with Indian companies last month to invest in the region’s renewables sector.

CAPITAL MARKETS

DP World lists its USD 1.5 bn green sukuk issuance on Nasdaq Dubai

DP World has listed a debut USD 1.5 bn green sukuk on Nasdaq Dubai, according to a press release. The 10-year sukuk issuance debuted in September garnering high demand with the order book reaching USD 3.4 bn, making it c.2.3x oversubscribed. The green sukuk were priced at 119 bps above the US treasuries with a 5.5% coupon rate. The issuance was listed on the London Stock Exchange in October, according to a separate statement. This issuance has brought DP World’s listed sukuk value to USD 4 bn under its USD 5 bn Trust Certificate Issuance Program, the release noted.

Use of proceeds: DP World plans to use the proceeds in eligible green projects in line with its Sustainable Finance Framework (pdf) which includes renewable energy, energy efficiency, electrification, and clean transportation.

Advisors: Citi, Deutsche Bank, Dubai Islamic Bank, Emirates NBD Capital, First Abu Dhabi Bank, HSBC, JPMorgan, and Standard Chartered Bank are acting as the bookrunners for the debt sale, while HSBS is serving as the sole ESG structurer.

EARNINGS WATCH

UAE’s Taqa’s net income drops 30% in 3Q

An unfavorable quarter for UAE’s Taqa: The Abu Dhabi National Energy Company (Taqa) reported a 30% decrease in its net income y-o-y to AED 1.6 bn in 3Q, according to an ADX filing (pdf). The energy giant's revenues also dropped 9.8% y-o-y to AED 12.6 bn.

The results fared no better compared to last quarter: Taqa's bottomline dropped 19% q-o-q, down from AED 1.92 bn. The company’s topline also saw a 7% drop from AED 13.7 bn in 2Q.

A lot of changes so far in 2023: The company attributed the drop in its net income this year to lower contributions from the oil and gas sectors on the back of “lower realized oil and gas prices and reduced production,” the filing notes. Oil and gas average production volumes decreased 10% y-t-d compared to the same time period last year due to the shutdown of operations in Iraq and the decline in production of depreciating UK assets, the statement added.

AROUND THE WORLD

South Pole CEO resigns after greenwashing allegations and US + Indonesia explore minerals cooperation

South Pole CEO steps down after greenwashing allegations: South Pole, the world’s biggest carbon offsets seller, says its CEO and cofounder Renat Heuberger is stepping down following allegations of greenwashing by the company, Bloomberg reports. This comes after South Pole announced it was terminating operations in Zimbabwe’s Kariba REDD+ projects — one of the world’s largest forest conservation and carbon credit schemes — aimed to prevent deforestation around Lake Kariba. South Pole has said that the project failed to meet the standards it expected from its partners.

REMEMBER- Independent experts and South Pole’s own analysis found that the firm vastly overestimated the extent of the preservation by Kariba. South Pole said at the time that the credits were legitimate and would still benefit the climate despite the studies concluding that the project failed to generate enough atmospheric benefit.

The US and Indonesia explore partnering on minerals: The US and Indonesia will discuss a potential partnership on minerals to give a push to the trade in nickel — a critical metal needed for the production of EV batteries, Reuters reports, citing sources with knowledge of the matter. The talks will focus on reducing the environmental impact of nickel supply from Indonesia, which has one of the world's biggest nickel ore reserves. This also comes as the only nickel mine in the US is expected to close in a few years, posing a risk to EV production in the country, the newswire added.

Hyundai is building an EV-dedicated plant in South Korea: South Korean automaker Hyundai broke ground on a domestic EV manufacturing facility in Ulsan which will have an annual 200k production capacity, according to a statement. The company says it will shell out KRW 2 tn (c. USD 1.53 bn) to build the plant and full-scale construction will begin in Q4 2023, with mass production commencing in Q1 2026. Hyundai Motor Group had said in September will invest USD 12 bn in EV manufacturing and battery production.

The company is also eying MENA for EV production: KSA’s Public Investment Fund (PIF) and Hyundai Motor signed a JV agreement last month to establish a USD 500 mn highly automated vehicle manufacturing plant in the kingdom. Automaker Hyundai Kefico — a subsidiary of Hyundai — also signed a KRW 250 bn (c. USD 196 mn) agreement in July to supply spare parts to Saudi Arabia’s first EV manufacturing company Ceer.

OTHER STORIES WORTH KNOWING ABOUT THIS MORNING-

- AirFrance-KLM invests in DG Fuels' SAF plant: French-Dutch airline AirFrance-KLM invested USD 4.7 mn in Dg Fuel's sustainable aviation fuel (SAF) production plant in the US. The airline will be able to buy up to 70k tons SAF annually starting 2029. (Reuters)

CLIMATE IN THE NEWS

Greenland’s glaciers are melting faster than 20 years ago: The melting rate of Greenland’s glaciers — which hold enough water to raise sea levels by at least 6 meters if they melt — have accelerated fivefold over the last 20 years, Reuters reported, citing a recent study by researchers at the University of Copenhagen. Glaciers are retreating annually by 25 meters on average, compared with the 5-6 meters recorded around two decades ago, the study found. The scientists used satellite imagery and hundreds of thousands of archive photography to track and analyze the development of 1k glaciers over a 130-year period.

Glacier loss signals ice sheets will soon follow: “If we start to see glaciers losing mass several times faster than in the last century, it can make us expect that the ice sheet will follow the same path just on a slower and longer time scale,” senior researcher at the Geological Survey of Denmark and Greenland William Colgan said, according to the newswire. The world’s two main ice sheets are in Greenland — which has an ice sheet about three times the size of Texas — and Antarctica contributed 17.3% of the sea level rise between 2006 and 2018, according to Reuters.

France is paying attention: Amid the rapidly rising concern over the world’s melting ice caps and glaciers, France has pledged to spend EUR 1 bn on polar research by 2030, The Guardian reports. As part of the initiative, France is calling for a moratorium on the exploitation of the seabed in polar regions, to which the UK, Canada, Brazil and 19 other countries have agreed. The announcement came during a high-level meeting called by French President Emmanuel Macron in Paris, bringing together high-level officials from countries with polar territory or glaciers, and leading scientists.

REMEMBER- The impact of melting glaciers is not to be underestimated: Many studies around the world have pointed to an unprecedented rapid decline in glaciers, including Indonesia, Switzerland, China, Nepal, and Bhutan. Their impacts have included endangerment of species, loss of freshwater resources, floods, a further rise in global temperatures, and an increased eating away at coastal cities. UN Secretary-General Antonio Guterres visited Nepal’s Everest region last month to highlight the urgency of the melting glaciers. Alexandria in Egypt and Basra in Iraq are amongst the cities primed to bear the brunt of climate-induced sea level shifts.

CALENDAR

NOVEMBER 2023

9-15 November (Thursday-Wednesday): Intra-African Trade Fair 2023, Cairo, Egypt.

11-13 November (Saturday-Monday): GCC-Türkiye Economic Forum, Istanbul, Turkey.

15-17 November (Wednesday-Friday): WETEX and Dubai Solar Show, Dubai, UAE.

15-18 November (Wednesday-Saturday): DEWA’s First MENA Solar Conference, Dubai, UAE.

20-24 November (Monday-Friday) Aviation and Alternative Fuels conference, Dubai, UAE.

27-30 November (Monday-Thursday) Abu Dhabi Finance Week (ADFW), Abu Dhabi, UAE.

28-29 November (Tuesday-Wednesday): World Green Economy Summit (WGES), Dubai, UAE.

30 November – 12 December (Thursday-Tuesday): Conference of the Parties (COP 28), Dubai, UAE.

DECEMBER 2023

1-10 December (Friday-Saturday): Abu Dhabi Sustainability Week COP28 Special Edition, Dubai, UAE.

4 December (Monday): Saudi Green Initiative Forum, Dubai, UAE.

4 December (Monday): Abu Dhabi Sustainability Week (ADSW) summit, Dubai, UAE.

4-7 December (Monday-Thursday): International Conference on Global Warming, Ras Al Khaimah, UAE.

6-7 December (Wednesday-Thursday): Reuters’ Energy Transition MENA conference, Dubai, UAE.

7-8 December (Thursday-Friday): Future Investment Initiative (FII) Priority, Hong Kong.

8 December (Friday): Youth for Sustainability Forum (Y4S), Dubai, UAE.

12-14 December (Tuesday-Thursday): Green Hydrogen Summit Oman, Oman Convention and Exhibition Center, Muscat, Oman.

18-20 December (Monday-Wednesday): Saudi Arabia Smart Grid Conference, Hilton Riyadh Hotel & Residences, Riyadh, Saudi Arabia.

JANUARY 2024

9-11 January (Tuesday-Thursday): Future Minerals Forum, Riyadh, Saudi Arabia.

FEBRUARY 2024

26-28 February (Monday-Wednesday): Management and Sustainability of Water Resources, Dubai, UAE.

MARCH 2024

4-6 March (Monday-Wednesday): International Conference on Sand and Dust Storms in the Arabian Peninsula, Riyadh, Saudi Arabia.

APRIL 2024

16-18 April (Tuesday-Thursday): World Future Energy Summit, Abu Dhabi, UAE.

23-25 April (Tuesday-Thursday): Connecting Green Hydrogen MENA, Dubai, UAE.

MAY 2024

19-21 May (Sunday-Tuesday): Saudi Energy Convention, Riyadh, KSA.

JUNE 2024

5 June (Wednesday): World Environment Day, Saudi Arabia.

OCTOBER 2024

10-12 October (Tuesday-Thursday): Autonomous E-Mobility Forum, Doha, Qatar.

DECEMBER 2024

2-13 December (Monday-Friday): Conference of the Parties (COP16) to the United Nation Convention to Combat Desertification, Riyadh, KSA.

EVENTS WITH NO SET DATE

2024

Early 2024: The 2023 US Algeria Energy Forum, Washington DC, USA.

12-14 February (Monday-Wednesday): Sustainable Aviation Futures MENA Congress, Dubai, UAE.

End-2024: Emirati Masdar’s 500 MW wind farm in Uzbekistan to begin commercial operations.

QatarEnergy’s industrial cities solar power project will start electricity production.

2025

International Union for Conservation of Nature World Conservation Congress, Abu Dhabi, UAE.

UAE to have over 1k EV charging stations installed.

2026

UITP Global Public Transport Summit, Dubai, UAE.

Annual Meetings of the World Bank and the International Monetary Fund, Bangkok, Thailand.

1Q 2026: QatarEnergy’s USD 1 bn blue ammonia plant to be completed.

End-2026: HSBC Bahrain to eliminate single-use PVC plastic cards.

2027

MENA’s district cooling market is expected to reach USD 15 bn.

2030

UAE’s Abu Dhabi Commercial Bank (ADCB) wants to provide AED 35 bn in green financing.

UAE targets 14 GW in clean energy capacity.

Tunisia targets 30% of renewables in its energy mix.

Qatar wants to generate USD 17 bn from its circular economy, creating 9k-19k jobs.

Morocco’s Xlinks solar and wind energy project to generate 10.5 GW of energy.

2035

Qatar to capture up to 11 mn tons of CO2 annually.

2045

Qatar’s Public Works Authority’s (Ashghal) USD 1.5 bn sewage treatment facility to reach 600k cm/d capacity.

2050

Tunisia’s carbon neutrality target.

2060

Nigeria aims to achieve its net-zero emissions target.

Enterprise Climate is available without charge thanks to the generous support of HSBC (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; and Infinity Power (tax ID: 305-170-682), the leading generator and distributor of renewable energy in Africa and the Middle East. Enterprise Climate is delivered Mon-Thurs before 4 am UAE time. Were you forwarded this copy? Sign up for your own delivery at climate.enterprise.press. Contact us on climate@enterprisemea.com.